Key Takeaways

- Restructured executive team and asset optimization are expected to boost operational efficiency and improve net margins through cost reductions.

- Investment in infrastructure and energy trading positions Copel for revenue growth by enhancing service quality and market penetration.

- Operational challenges and financial pressures from leverage and litigation could impact Copel's short-term margins and earnings sustainability.

Catalysts

About Companhia Paranaense de Energia - COPEL- Engages in the generation, transformation, distribution, and sale of electricity to industrial, residential, commercial, rural, and other customers in Brazil.

- The company has restructured its executive team, bringing in experienced personnel, which could lead to improved operational efficiency and asset management. This strategic enhancement could positively impact the company's net margins by optimizing operations and reducing costs.

- Copel has initiated significant asset swaps and sales, such as the consolidation of assets with Eletrobras, which is designed to optimize its asset portfolio and simplify its operational structure, ultimately improving cash predictability. This strategy could lead to improved net income due to increased synergies and reduced tax losses.

- The company is focusing on completing a major investment program for Copel Distribuição, aiming to enhance service quality and efficiency ahead of the next tariff review. Successful implementation could result in increased revenue through improved infrastructure and customer satisfaction, and higher regulatory EBITDA efficiency levels.

- Copel has begun a share buyback program, which could support earnings per share growth by reducing the share count and enhancing shareholder value. This demonstrates management's focus on capital allocation efficiency and returning value to shareholders.

- The company is targeting opportunities in energy trading to capitalize on favorable market conditions, which could lead to increased revenue from optimized trading strategies. By tapping into market price volatility, Copel aims to extract more value from its assets over the coming years.

Companhia Paranaense de Energia - COPEL Future Earnings and Revenue Growth

Assumptions

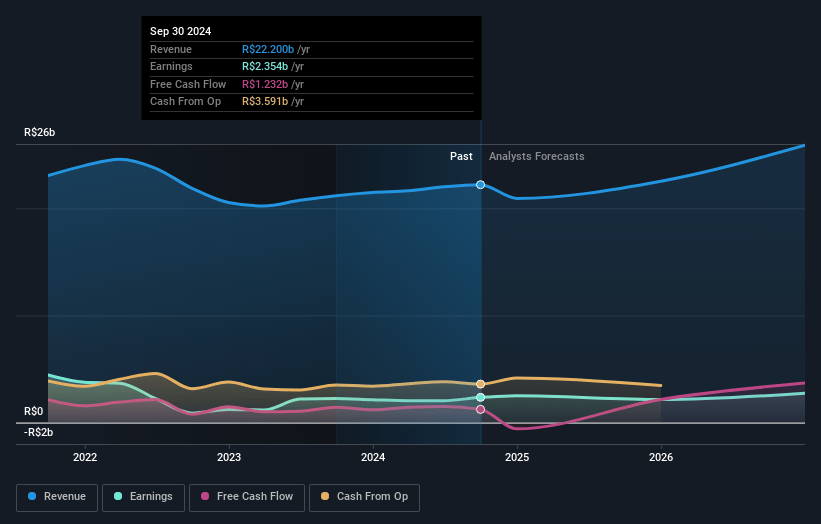

How have these above catalysts been quantified?- Analysts are assuming Companhia Paranaense de Energia - COPEL's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 14.0% in 3 years time.

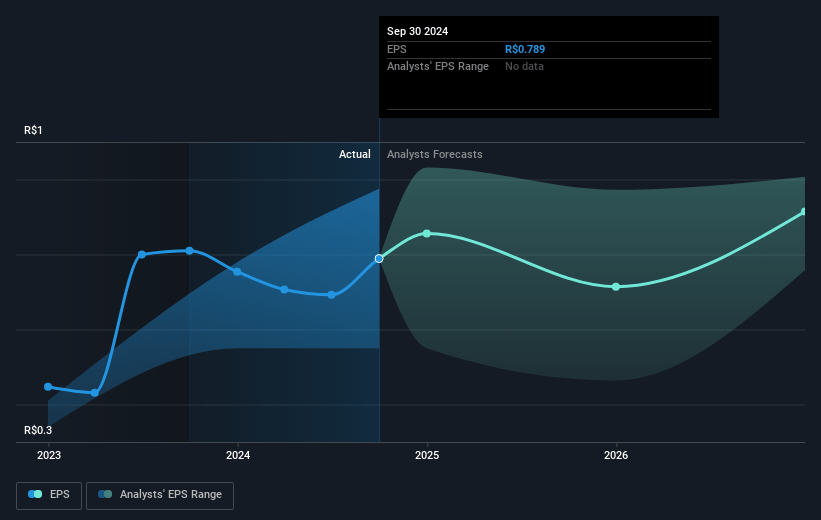

- Analysts expect earnings to reach R$3.4 billion (and earnings per share of R$1.16) by about May 2028, up from R$2.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as R$3.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 14.6x today. This future PE is greater than the current PE for the US Electric Utilities industry at 7.4x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.92%, as per the Simply Wall St company report.

Companhia Paranaense de Energia - COPEL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced challenges with its wind parks due to curtailment, lower than expected wind volumes, and turbine unavailability, which could impact revenue and net margins in the short term.

- Copel's leverage increased due to the payment of a grant bonus, potentially affecting its ability to invest in growth opportunities and impacting future earnings.

- The volatility in energy prices and curtailment issues continue to affect the company's energy trading operations, which could lead to fluctuating revenues and earnings.

- Significant investments in distribution may not yield immediate returns, leading to a short-term impact on cash flow and net margins.

- Copel's exposure to litigation, as indicated by additional provisions for civil lawsuits, could result in unpredictable expenses and liabilities, impacting net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$12.874 for Companhia Paranaense de Energia - COPEL based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$15.0, and the most bearish reporting a price target of just R$11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$24.1 billion, earnings will come to R$3.4 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 16.9%.

- Given the current share price of R$11.34, the analyst price target of R$12.87 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.