Key Takeaways

- New leadership in Integrated Logistics aims to renew contracts and expand client services, enhancing revenue through diversification and client engagement.

- Automotive sector growth and tariff adjustments in Automotive Logistics are expected to drive revenue growth and increase market share.

- Tegma Gestão Logística faces profitability and margin pressures due to declining market share, higher costs, unsustainable revenue streams, and potential dividend payout limitations.

Catalysts

About Tegma Gestão Logística- Provides logistics management, transportation, and storage services in Brazil.

- The introduction of Paulo Franceschini to oversee the Integrated Logistics division is set to improve operational and commercial management, focusing on renewing anchor contracts and expanding client services. This is anticipated to enhance revenue through service diversification and better client engagement.

- The recent positive developments in the Brazilian automotive market, including a 14% increase in domestic sales and significant vehicle production and export growth, are expected to drive top-line revenue growth for Tegma due to higher logistics demands.

- With a 41% increase in the Automotive Logistics division's net revenue in Q4 '24, spurred by a transportation tariff adjustment and robust demand, continued tariff adjustments and service mix improvements are projected to further boost revenue growth.

- Expansion plans, such as adding new distribution centers and increasing yard capacities, are intended to meet growing demands for bonded warehousing and distribution services, suggesting potential revenue increases and operational efficiencies.

- Expected sustained growth in GDL's automotive line, fueled by increased imports of electrified vehicles and the expansion of service capacities for multiple brands, indicates potential significant revenue growth and increased market share.

Tegma Gestão Logística Future Earnings and Revenue Growth

Assumptions

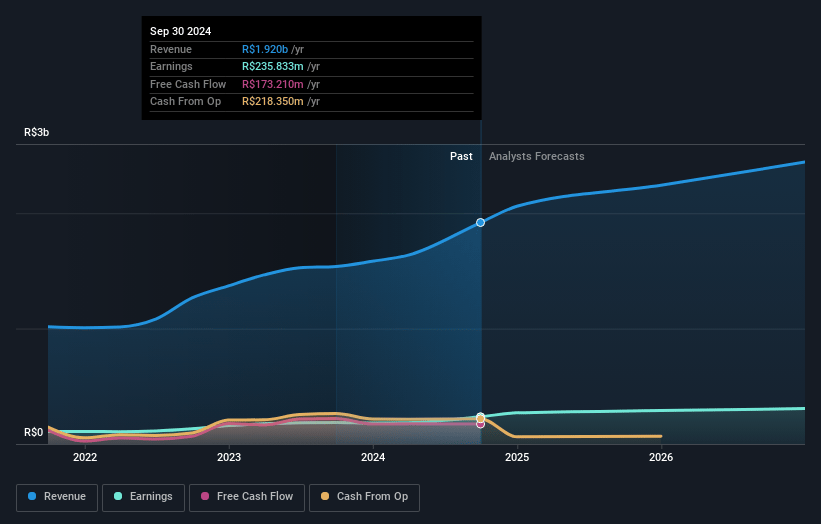

How have these above catalysts been quantified?- Analysts are assuming Tegma Gestão Logística's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.9% today to 11.2% in 3 years time.

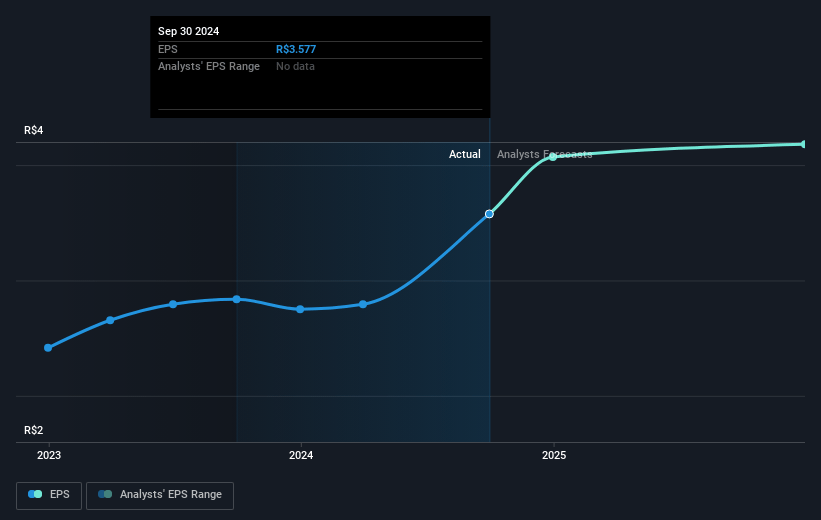

- Analysts expect earnings to reach R$315.0 million (and earnings per share of R$4.79) by about July 2028, up from R$276.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from 8.1x today. This future PE is greater than the current PE for the BR Transportation industry at 7.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.34%, as per the Simply Wall St company report.

Tegma Gestão Logística Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's market share contracted by 0.3 percentage points due to lower-than-average performance of the automakers it is significantly exposed to, which could negatively impact revenue and market position.

- The EBITDA margin for the Integrated Logistics division fell from 29% to 21.8% due to reduced volumes in the chemicals operation and a lag in passing increased freight costs to clients, potentially impacting profitability and earnings.

- The company's expenses rose by 10% above inflation, driven by higher attorney and consultant fees related to various issues including competition and tax contingencies, which could pressure margins and net income.

- The growth of certain revenue streams, such as vehicle transfers between yards and factories, may not be sustainable given their dependency on client demand, creating uncertainty around future revenue and earnings consistency.

- An unfavorable adjustment in spending to increase CapEx and potential involvement in M&A could limit dividend payouts to shareholders, which might affect investor sentiment and the attractiveness of Tegma’s stock.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$39.85 for Tegma Gestão Logística based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$44.0, and the most bearish reporting a price target of just R$35.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$2.8 billion, earnings will come to R$315.0 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 19.3%.

- Given the current share price of R$34.01, the analyst price target of R$39.85 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.