Key Takeaways

- Organic expansion and new hospital systems are poised to boost operational efficiency and improve net margins.

- Strategic partnerships and synergies, including with SulAmérica, are opening growth opportunities and enhancing earnings.

- Operational challenges and external pressures could affect revenue, margins, and efficiency, with delisting and cost increases being particularly critical concerns.

Catalysts

About Rede D'Or São Luiz- Operates a network of hospitals in Brazil.

- The company's organic expansion with the implementation of new hospital systems is expected to improve process standardization, likely enhancing operational efficiency and potentially boosting net margins.

- The strengthening of the joint venture Atlântica D'Or with the Bradesco Group is seen as a significant growth vector, supporting the revenue uplift through rapid ramp-up of new hospitals.

- Rede D'Or's strong cash generation and disciplined capital allocation provide opportunities for strategic investments, both organic and inorganic, which could enhance future earnings.

- The consolidation and synergies between Rede D'Or and SulAmérica are expected to open substantial growth opportunities and reduce execution risk, likely positively impacting net margins and earnings.

- The concerted effort to combat fraud and launch more sustainable products with SulAmérica is expected to improve the consolidated loss ratio, contributing to better net margins in the insurance operations.

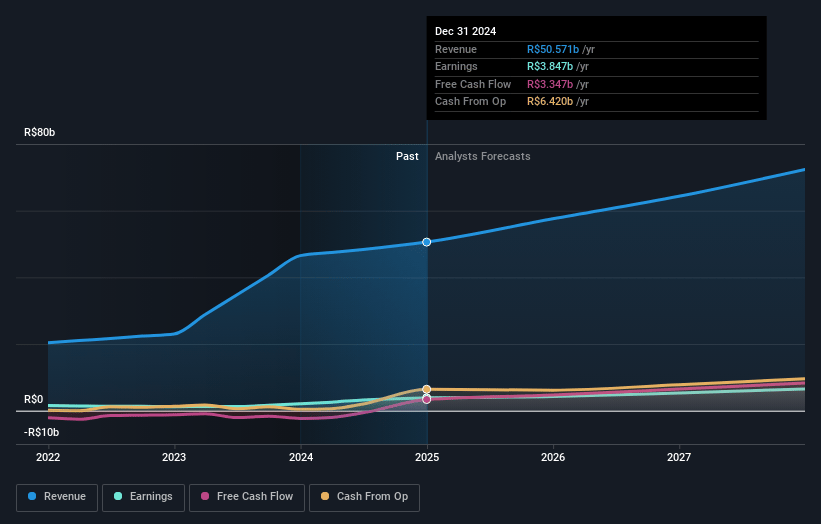

Rede D'Or São Luiz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rede D'Or São Luiz's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 9.0% in 3 years time.

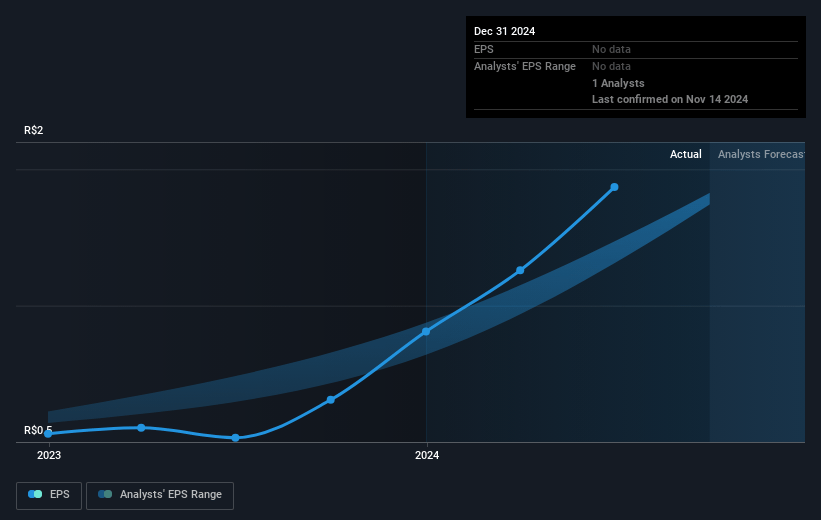

- Analysts expect earnings to reach R$6.5 billion (and earnings per share of R$2.92) by about April 2028, up from R$3.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from 17.1x today. This future PE is greater than the current PE for the BR Healthcare industry at 10.8x.

- Analysts expect the number of shares outstanding to decline by 1.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.53%, as per the Simply Wall St company report.

Rede D'Or São Luiz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent delisting from contracts and resulting loss of bed utilization could impact future revenues and operational efficiency, as seen with the contracted cancellation with a significant client in Rio de Janeiro.

- The company acknowledges the impact of macroeconomic conditions and industry-specific factors that may lead to results differing from its forward-looking statements, posing a risk to revenue and earnings projections.

- Increased operational costs and a notable rise in total costs year-on-year may pressure net margins if not offset by equivalent revenue growth.

- The expectation of further system implementations and standardization processes carries execution risk, which could affect operational efficiency and financial outcomes if not managed effectively.

- The healthcare market remains challenging, and high seasonality, as evidenced by fluctuations in patient demand and occupancy rates, introduces variability that can impact revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$36.0 for Rede D'Or São Luiz based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$40.5, and the most bearish reporting a price target of just R$31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$72.3 billion, earnings will come to R$6.5 billion, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 17.5%.

- Given the current share price of R$29.69, the analyst price target of R$36.0 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.