Key Takeaways

- Strategic expansion and acquisitions increase potential planted area and diversify the land portfolio, driving future revenue growth.

- Increased corn demand and cost-efficient operations could enhance margins and reshape export dynamics, supporting sustained profitability.

- Geopolitical tensions and supply challenges risk depressing revenues and create financial strains, despite expanding production and potentially volatile commodity prices.

Catalysts

About SLC Agrícola- Produces and sells agricultural products in Brazil and internationally.

- The expansion of the planted area by 10.6% for the '24-'25 harvest to 731,000 hectares and the strategic joint ventures and new lease agreements that add a potential planted area increase by 60,000 hectares can potentially drive future revenue growth.

- The acquisition of Sierentz Agro Brasil, which involves the operation of 63,000 hectares, adding approximately 100,000 hectares of planted area including second crops, is expected to strategically diversify the land portfolio and contribute to higher revenue in future seasons.

- An increase in corn demand in Brazil, driven largely by the ethanol industry, could support future revenue due to a potential production deficit and increased domestic use exceeding previous cycles, reshaping global corn export dynamics.

- A projected reduction in input costs per hectare by 5.4% in the '24-'25 harvest relative to '23-'24 due to declines in fertilizer, pesticide, and seed prices could enhance net margins through improved cost efficiency.

- Advances in operational efficiency, such as expanding irrigation capabilities and increasing storage capacity, along with a focus on improving yield through technology and strategic business decisions, are likely to positively impact earnings by optimizing production and operational scalability.

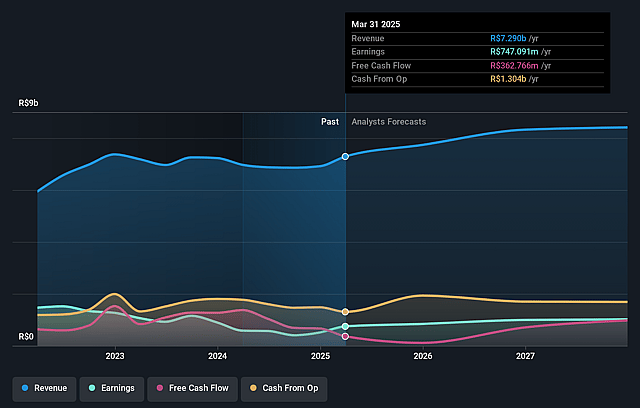

SLC Agrícola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SLC Agrícola's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 12.7% in 3 years time.

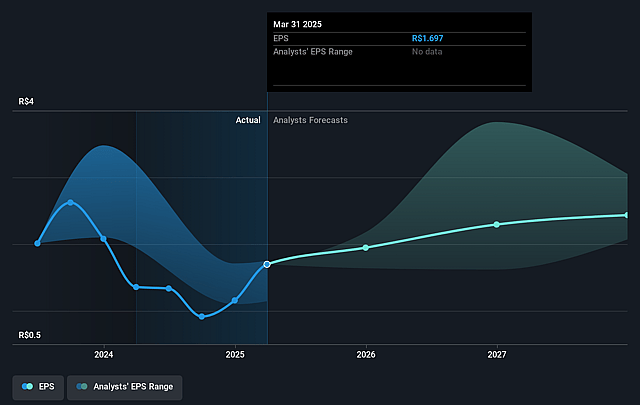

- Analysts expect earnings to reach R$1.1 billion (and earnings per share of R$2.4) by about August 2028, up from R$747.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$1.3 billion in earnings, and the most bearish expecting R$774 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the BR Food industry at 10.2x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.93%, as per the Simply Wall St company report.

SLC Agrícola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global cotton market is experiencing a supply surplus due to increased production in China, which could depress cotton prices and negatively impact SLC Agrícola's revenues derived from cotton.

- Irregular rainfall and high temperatures in Brazil have created uncertainties in soybean production, which could lead to lower-than-expected yields and affect future revenue and net margins.

- A forecasted production deficit in the global corn market, while currently supporting corn prices, could also lead to volatility and uncertainty in future yields and revenues for SLC Agrícola if domestic demand continues to increase, particularly for corn ethanol production.

- Despite expanding planted areas and acquisitions, the company's leverage remains at 1.8x net debt over adjusted EBITDA, indicating that further expansions could pressure financials, potentially affecting earnings and free cash flow.

- Geopolitical factors, such as the trade tensions between the U.S. and China, influence global commodity prices and can create uncertainty in export dynamics, impacting SLC Agrícola's ability to maintain stable revenues from international markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$22.364 for SLC Agrícola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$25.0, and the most bearish reporting a price target of just R$18.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$8.8 billion, earnings will come to R$1.1 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 17.9%.

- Given the current share price of R$17.28, the analyst price target of R$22.36 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.