Last Update 04 Nov 25

Fair value Increased 5.79%Analysts have increased their price target for Cogna Educação from R$3.61 to R$3.82. They cite an improved profit margin outlook and a lower discount rate, both of which are driving higher fair value estimates.

What's in the News

- Cogna Educação S.A. was added to the Brazil IBRX 50 Index, highlighting its growing relevance in the Brazilian market. (Key Developments)

Valuation Changes

- Fair Value Estimate increased from R$3.61 to R$3.82, reflecting an improved outlook.

- Discount Rate decreased from 21.2% to 20.7%, indicating a modest reduction in perceived risk.

- Revenue Growth expectation remained stable, moving slightly from 7.28% to 7.28%.

- Net Profit Margin rose significantly from 7.35% to 11.54%.

- Future P/E ratio dropped substantially from 17.33x to 11.52x, suggesting improved earnings expectations.

Key Takeaways

- Digital adoption, technology investments, and an asset-light strategy are strengthening margins, scalability, and long-term free cash flow generation.

- Socioeconomic tailwinds, favorable regulation, and financial discipline support enrollment, revenue growth, and increased market share.

- Regulatory uncertainty, demographic shifts, dependence on government contracts, rising competition, and high investment needs collectively threaten revenue growth, margins, and long-term financial resilience.

Catalysts

About Cogna Educação- Operates as a private educational organization in Brazil and internationally.

- The company is demonstrating consistent revenue and profitability growth across all business units, benefiting from ongoing socioeconomic improvements in Brazil, including a rising middle class and increasing demand for quality education-factors likely to support future revenue and enrollment growth.

- Ongoing adoption of digital and hybrid learning models, coupled with investments in AI and technology, are enhancing operating efficiency and scalability, which should drive margin expansion and improved earnings over the long term.

- Regulatory changes in higher education are expected to reduce competition from smaller, less-capitalized players, allowing Cogna to increase average ticket prices and gain market share-positively impacting both top-line revenue and margins.

- Cogna's asset-light transformation-emphasizing growth in franchising, B2B, subscription, and premium educational content-reduces capital intensity and enhances return on invested capital, supporting sustainable free cash flow growth.

- Improved balance sheet strength, evidenced by significant deleveraging and strong free cash generation, not only reduces financial risk but also allows for increased shareholder returns and reinvestment in strategic growth areas, supporting EPS growth and valuation expansion.

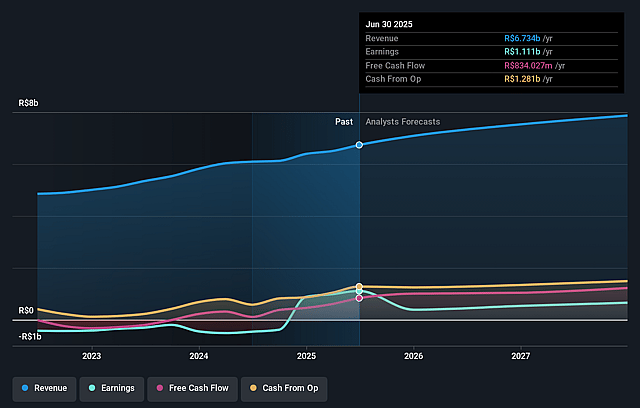

Cogna Educação Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cogna Educação's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.5% today to 6.3% in 3 years time.

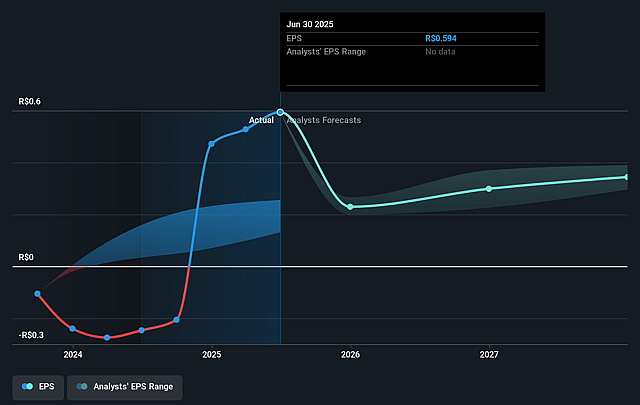

- Analysts expect earnings to reach R$518.6 million (and earnings per share of R$0.37) by about September 2028, down from R$1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from 4.7x today. This future PE is greater than the current PE for the BR Consumer Services industry at 10.2x.

- Analysts expect the number of shares outstanding to decline by 3.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.79%, as per the Simply Wall St company report.

Cogna Educação Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory risk remains a significant concern, as new regulations regarding distance learning and semi-presential models are being implemented and extended; while management sees opportunities, any adverse or unclear regulatory changes could increase costs, reduce enrollment, or restrict market access, impacting revenue growth and net margins.

- Heavy reliance on government contracts for K-12 and B2G segments creates risk of delayed payments and uncertainties in revenue recognition, particularly amid budget delays or changes in public policy, which could lead to cash flow volatility and earnings pressure.

- The current positive trends in enrollment and average ticket are partly buoyed by pent-up demand and regulatory transition periods; demographic headwinds (such as declining birth rates in Brazil) or waning demand for traditional higher education could undermine long-term student growth, limiting future revenues.

- Increased competition, especially from consolidation among well-capitalized players and the entry of EdTech startups leveraging digital technologies, poses risk to Cogna's pricing power and ability to grow market share, potentially compressing operating margins.

- Despite recent deleveraging, there is significant ongoing investment required for digital transformation, regulatory compliance, and innovation; any underperformance in these investments or resurgence in debt levels could strain free cash flow and diminish earnings resilience over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$3.318 for Cogna Educação based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$4.2, and the most bearish reporting a price target of just R$2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$8.2 billion, earnings will come to R$518.6 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 21.8%.

- Given the current share price of R$2.85, the analyst price target of R$3.32 is 14.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.