Key Takeaways

- High recycling capabilities and flexible production position AMAG to capitalize on global sustainability trends and shifting regional demand, supporting premium pricing and market resilience.

- Investments in specialty alloys, automation, and operational efficiency enhance cost structure and earnings potential amid rising demand from transportation and industrial end markets.

- U.S. tariffs, weak demand, operational risks from supply chain shifts, slow ESG investments, and intense global competition threaten AMAG’s revenue growth, margins, and market share.

Catalysts

About AMAG Austria Metall- Engages in the production, processing, and sale of aluminum, aluminum semi-finished, and cast products in Austria, Europe, North America, and internationally.

- The accelerating global demand for low-carbon, recycled aluminum—driven by decarbonization initiatives and stricter environmental regulations—positions AMAG (with its high scrap utilization rate and established recycling capabilities) to capture premium pricing and increase market share, likely benefiting both revenue and net margin in the mid-to-long term.

- Continued lightweighting trends across transportation (including EVs, rail, and aerospace) are set to drive sustained demand for aluminum, supporting stable or growing shipment volumes in AMAG’s rolling and specialty divisions, directly impacting top-line growth.

- Expansion in high-value specialty alloys for end markets such as packaging and industrial applications, coupled with investments in automation and operational efficiency, should support higher average selling prices and improved cost structure, boosting AMAG’s operating leverage and net income over time.

- AMAG’s flexible production and sales model allows for rapid shifting of export volumes between North America and Europe in response to tariff or market disruptions, supporting revenue resilience and mitigating downside risk from trade headwinds.

- Rising adoption of circular economy practices by industrial buyers and regional supply chain localization in Europe increase demand for suppliers with robust recycling, ESG, and local production profiles—advantages from which AMAG stands to profit, supporting future revenue stability and potential pricing power.

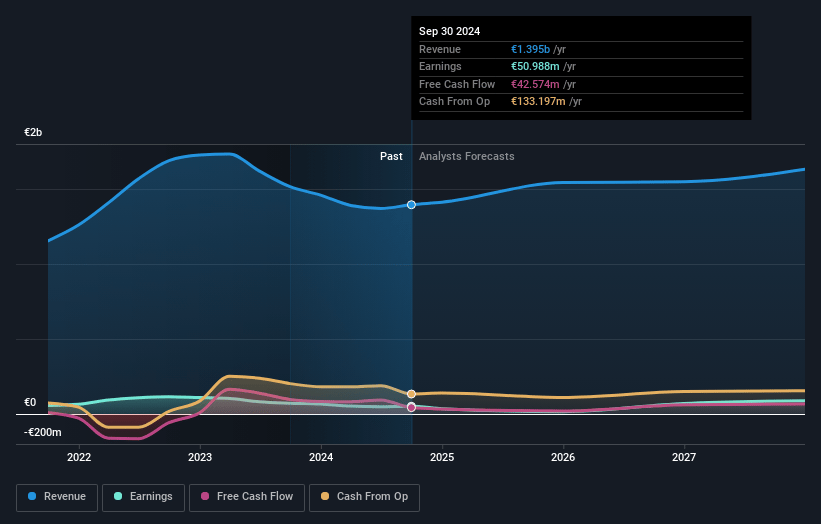

AMAG Austria Metall Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMAG Austria Metall's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.4% in 3 years time.

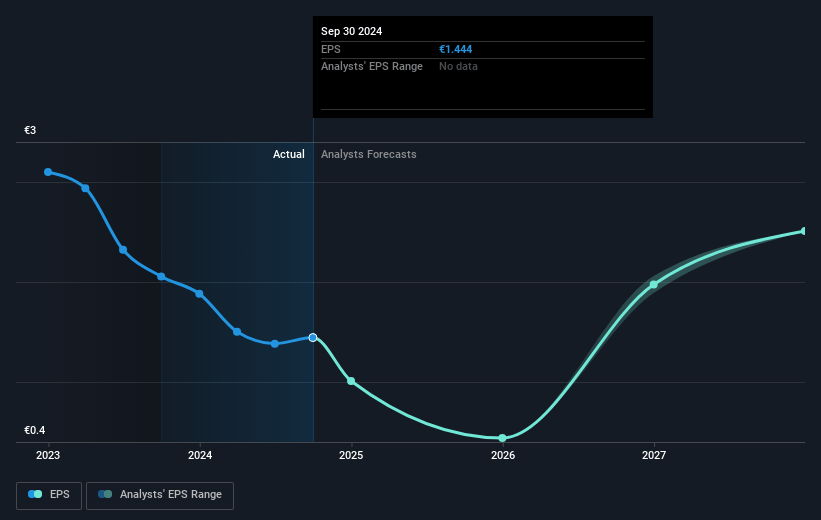

- Analysts expect earnings to reach €50.1 million (and earnings per share of €1.53) by about July 2028, up from €46.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, up from 18.4x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 23.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

AMAG Austria Metall Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The introduction of 25% U.S. import tariffs on aluminum products, which previously exempted Canadian exports like those from AMAG’s Alouette smelter, is likely to cause persistent price pressure and shrinking market share in the strategically significant U.S. market, negatively impacting AMAG’s revenues and net margins in coming quarters and possibly years if trade tensions persist.

- The company is experiencing and anticipates ongoing volatility and depressed demand in core end markets such as the Eurozone and the U.S., with pronounced weakness in automotive, aerospace, and heat exchanger sectors. Shifting of volume to Europe could increase competition and reduce prices further, potentially compressing margins and pressuring earnings stability.

- The shift of supply chains and customer orders due to tariffs, in conjunction with long lead times and a large order backlog, introduces significant forecasting and operational risks. AMAG may be unable to shift volumes smoothly without incurring additional costs, risking underutilized assets or margin sacrifice, threatening net income and effective use of operating cash flow.

- Weakness in customer investment in sustainability projects (linked to uncertainty around the EU’s Green Deal or national industrial stimulus plans) and the postponement of decarbonization initiatives could stall industry demand for premium, low-carbon aluminum, risking lower price premiums and stalling AMAG’s long-term revenue growth from ESG-oriented products.

- Persistent global overcapacity, increasing price competition from both American and international aluminum producers, and the potential for advancements in alternative materials (like composites or plastics) could erode market share and put downward pressure on AMAG’s selling prices, directly impacting future revenues and risking long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €25.6 for AMAG Austria Metall based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.5 billion, earnings will come to €50.1 million, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of €24.1, the analyst price target of €25.6 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.