Key Takeaways

- OMV's diversified gas portfolio and strategic investments in growth projects enhance resilience, stability, and long-term revenue diversification.

- Polyolefin sales growth and operational efficiencies from new plants and potential joint ventures boost earnings and margins.

- Potential revenue and margin declines due to challenges in circular chemicals, energy production, refining, gas supply diversification, and competitive pressures in the polyolefin market.

Catalysts

About OMV- Operates as an energy and chemicals company in Austria, Germany, Romania, Norway, Belgium, New Zealand, the United Arab Emirates, the rest of Central and Eastern Europe, the rest of Europe, and internationally.

- OMV's diversification of its gas supply portfolio, including sources from Norway, the U.S., and Italy, strengthens its resilience and ability to meet customer demands without interruption. This diversification reduces risk and is expected to provide a more stable cash flow from operations, positively impacting revenue and earnings.

- The ramp-up of the new Baystar polyethylene plant in the U.S. and record-high production and sales volumes at Borouge are set to drive growth in polyolefin sales volumes. This is projected to substantially enhance revenue in the Chemicals segment, improving overall earnings through increased sales and operational efficiencies.

- The planned efficiency program aims to generate an additional €0.5 billion of annual operating cash flow by the end of 2027, which could positively impact margins and cash flows by reducing costs and improving operational efficiencies, ultimately enhancing net income.

- Investments in future growth projects such as the Neptun Deep gas field in Romania, renewable energy projects, and the SAF/HVO plant in Romania demonstrate a strategic focus on sustainable energy solutions which are anticipated to increase production capacity and diversify revenue streams, positively affecting long-term earnings.

- The potential joint venture with ADNOC and potential acquisition of Nova Chemicals could create a global polyolefin business with improved feedstock positions and synergies. This expansion could drive higher revenues and improved economies of scale, enhancing margins and earnings potential.

OMV Future Earnings and Revenue Growth

Assumptions

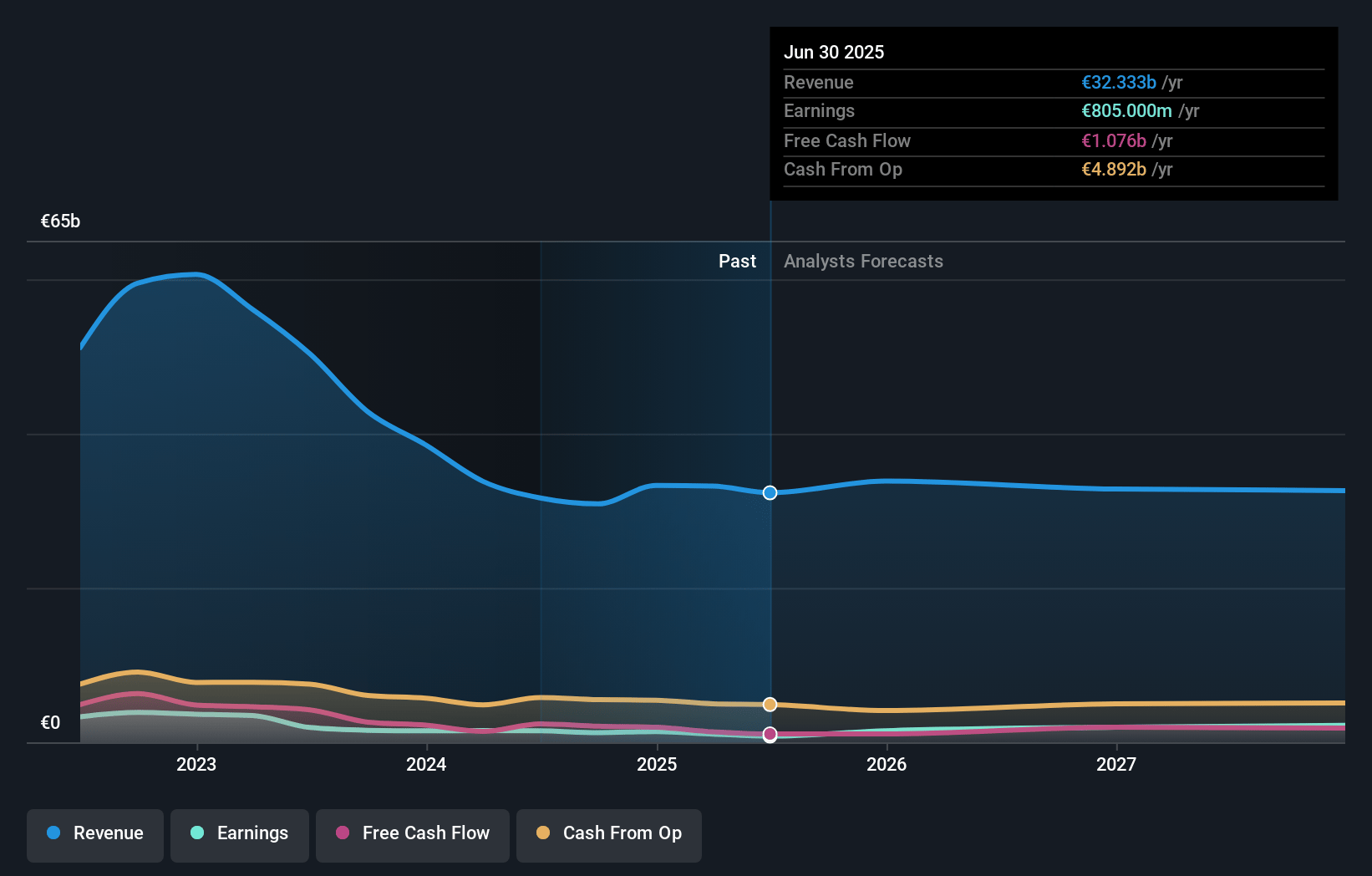

How have these above catalysts been quantified?- Analysts are assuming OMV's revenue will decrease by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 7.0% in 3 years time.

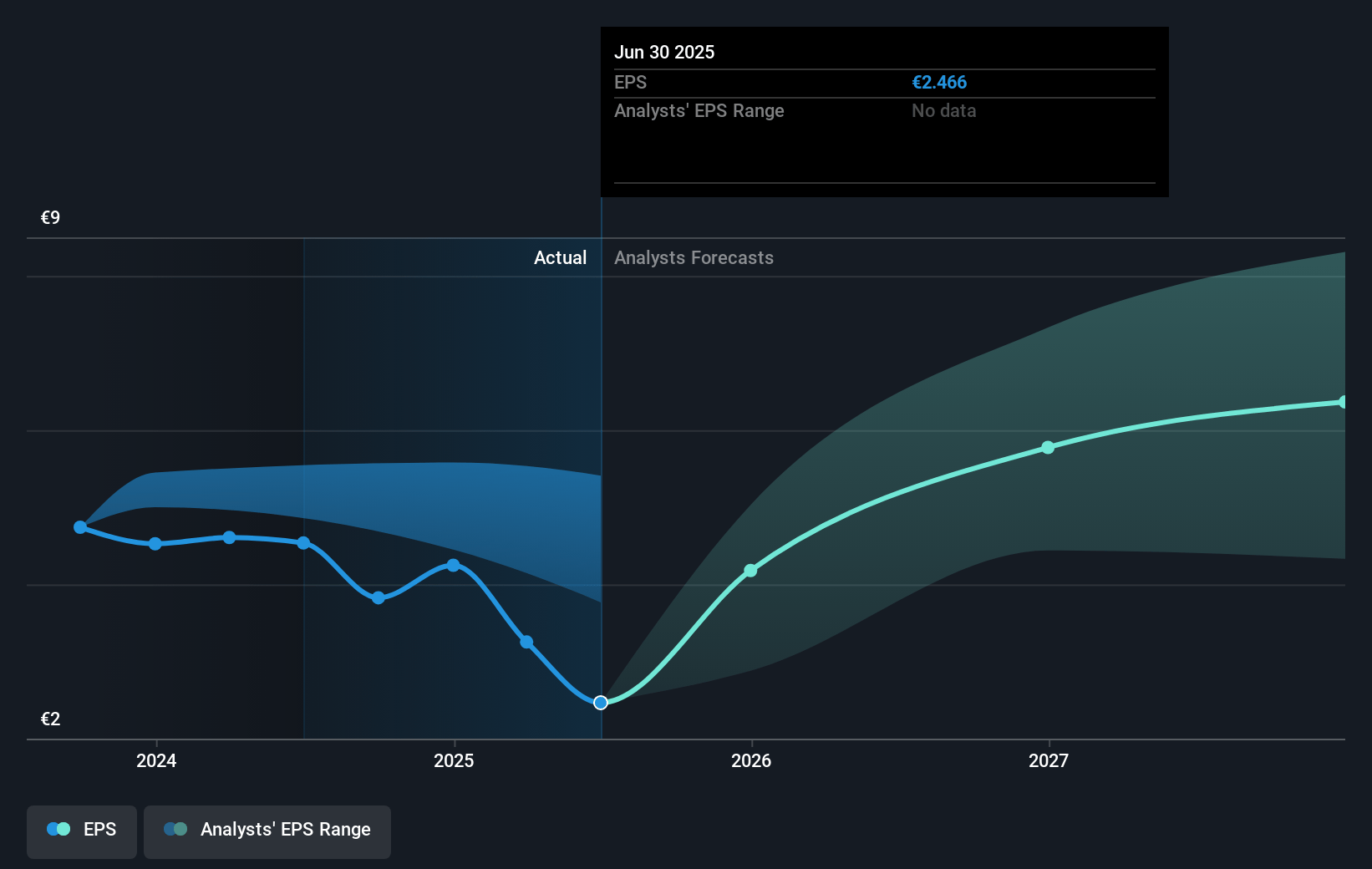

- Analysts expect earnings to reach €2.1 billion (and earnings per share of €6.37) by about May 2028, up from €1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €2.7 billion in earnings, and the most bearish expecting €1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.3x on those 2028 earnings, down from 10.7x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

OMV Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential slowdown in circular chemicals due to weaker regulation and less certain market environments in Europe could lead to reduced growth and profitability in this segment, impacting future revenues and margins.

- The company's oil and gas production is expected to decline, with a reduction in production volumes leading to increased unit production costs in the Energy segment, which could negatively affect net margins.

- The refining segment's performance was negatively impacted by much lower refining indicator margins and a weaker contribution from ADNOC refining and trading, which may continue to pressure earnings.

- The termination of the Gazprom contract and subsequent need to diversify gas supplies could lead to higher costs compared to previous contracts, affecting the company's cash flows and earnings from the gas segment.

- Challenges in the polyolefin market, such as increased competition and potential supply-side pressures from new projects in regions like China, could negatively impact margins and earnings in the Chemicals segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €48.3 for OMV based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €62.5, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €29.7 billion, earnings will come to €2.1 billion, and it would be trading on a PE ratio of 9.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of €45.56, the analyst price target of €48.3 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.