Key Takeaways

- Strategic toll gate expansion and partnerships are expected to bolster revenue growth and net profit margins over time.

- Favorable macroeconomic trends in Dubai support increased toll usage, driving future earnings and revenue growth.

- New corporate tax and increased concession fees may pressure Salik's profit margins, while emerging revenue streams and competitive transport pose uncertainty for future growth.

Catalysts

About Salik Company P.J.S.C- Designs, constructs, operates, and maintains the toll gates in Dubai.

- Salik Company P.J.S.C. is expected to benefit from the introduction of two new toll gates and variable pricing, anticipated to contribute additional annual revenue between AED 60 million and AED 110 million, which is likely to have a positive impact on overall revenue growth.

- The company is ramping up its ancillary revenue streams through strategic partnerships in parking and insurance solutions, indicating potential for increased revenue contribution from these streams in the medium to long term, impacting both revenue and net profit margins.

- Dubai's macroeconomic environment, with significant infrastructure investment and population growth, provides a favorable backdrop for increased toll usage, which is expected to drive future revenue and earnings growth.

- The successful implementation of variable pricing aims to enhance traffic management and is expected to optimize revenue generation during peak traffic periods, thereby improving revenue and potentially net margins.

- Strong financial fundamentals, including a high EBITDA margin of 68.9% in 2024 and robust investment-grade credit ratings, position Salik for continued growth and ability to leverage opportunities in the capital markets, affecting earnings and shareholder returns.

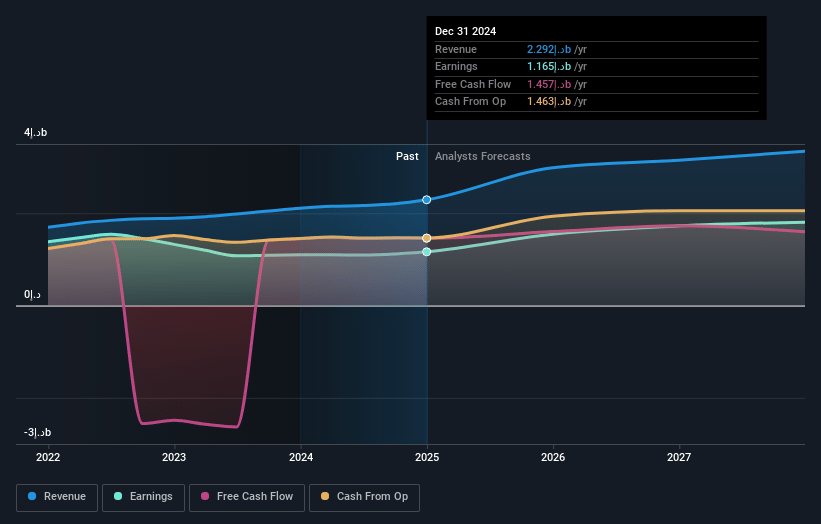

Salik Company P.J.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Salik Company P.J.S.C's revenue will grow by 13.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 50.8% today to 54.0% in 3 years time.

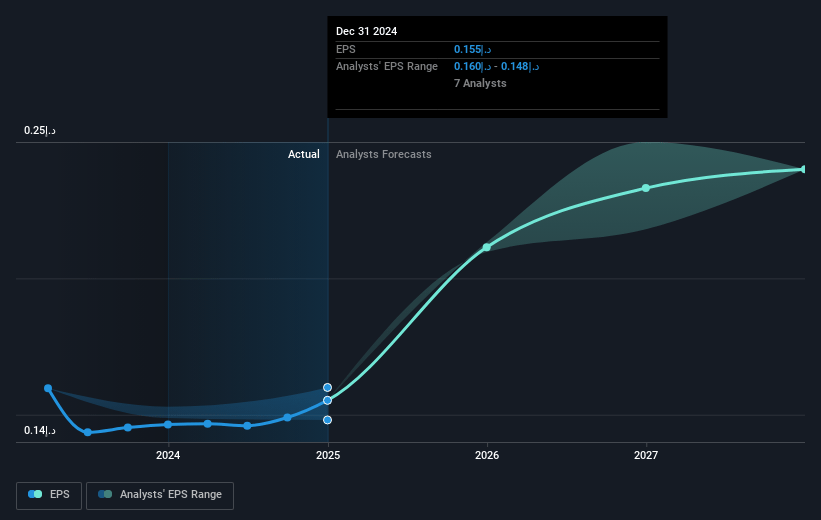

- Analysts expect earnings to reach AED 1.8 billion (and earnings per share of AED 0.24) by about March 2028, up from AED 1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.3x on those 2028 earnings, up from 32.3x today. This future PE is greater than the current PE for the AE Infrastructure industry at 24.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.17%, as per the Simply Wall St company report.

Salik Company P.J.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The introduction of a new corporate tax in the UAE may impact Salik's profit margins, as it resulted in a net profit increase of only 6.1% year-on-year for the full year 2024, despite a 16.6% increase in profit before tax. This could pressure net earnings in future years.

- The reliance on ancillary revenue streams such as parking and insurance solutions, which are still in early stages, poses uncertainty regarding their medium-term revenue potential. This could lead to variability in revenue growth projections if these streams underperform.

- The implementation of a variable pricing model is expected to generate additional revenue, but there is uncertainty regarding the impact on traffic patterns and driver behavior, which may affect the predictability of revenue from core toll operations.

- The increase in concession fee, now at 22.5% of toll usage revenue, and potential future adjustments related to inflation protection mechanisms could exert pressure on net margins if toll revenue does not increase proportionally.

- The introduction of competitive public transportation options like Etihad Rail could potentially alter commuter behavior in the long term, affecting the number of revenue-generating trips and ultimately impacting revenue from their core tolling business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED5.59 for Salik Company P.J.S.C based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED6.75, and the most bearish reporting a price target of just AED4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED3.3 billion, earnings will come to AED1.8 billion, and it would be trading on a PE ratio of 41.3x, assuming you use a discount rate of 21.2%.

- Given the current share price of AED5.02, the analyst price target of AED5.59 is 10.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives