Key Takeaways

- Integration with global partners and a focus on emerging markets position Borouge for growth, expanding scale, market presence, and earnings opportunities.

- Emphasis on premium product mixes, operational excellence, and active shareholder returns supports margin resilience and a robust free cash flow outlook.

- Growing regulatory, operational, and market pressures threaten Borouge’s margins and sales outlook, while expansion and regional reliance heighten execution, cost, and geopolitical risks.

Catalysts

About Borouge- Through its subsidiaries, provides polymer solutions in the People’s Republic of China, India, the United Arab Emirates, Austria, Egypt, Pakistan, Vietnam, Saudi Arabia, Bangladesh, Japan, and internationally.

- The proposed creation of Borouge Group International—integrating Borouge, Borealis, and Nova Chemicals—will create a larger, globally diversified platform with enhanced access to feedstock and technology, supporting global expansion and scale that is set to accelerate revenue and drive future earnings growth.

- Strong volume growth in key emerging markets—especially Asia and the Middle East, which benefit from accelerating urbanization and infrastructure investments—indicates Borouge is well positioned to capitalize on rising polyolefin demand, supporting high asset utilization and topline expansion.

- Optimizing the product mix toward high-value infrastructure, advanced packaging, and specialty solutions allows Borouge to maintain strong premium pricing and margin resilience, with a focus on end-markets favored by the push for lightweight and sustainable materials, enhancing net margins.

- Continued operational reliability, demonstrated by record-high production and high utilization rates, coupled with strategic efficiency and value enhancement programs, structurally lowers the company’s cost base—translating into robust EBITDA margins and higher-quality earnings.

- The commitment to elevated dividend payouts, active share buybacks, and disciplined capital management underscores Borouge’s strong free cash flow profile; this shareholder return policy, underpinned by tangible growth drivers, is likely undervalued given the company’s future earnings potential.

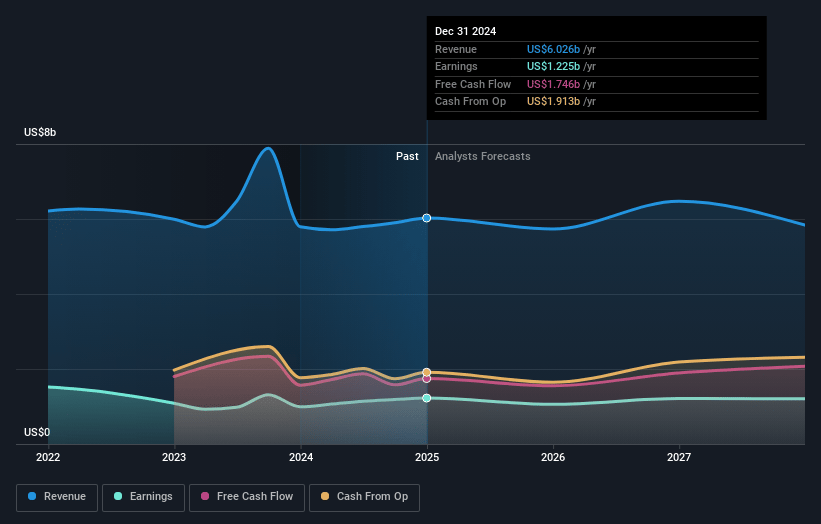

Borouge Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Borouge's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 20.3% in 3 years time.

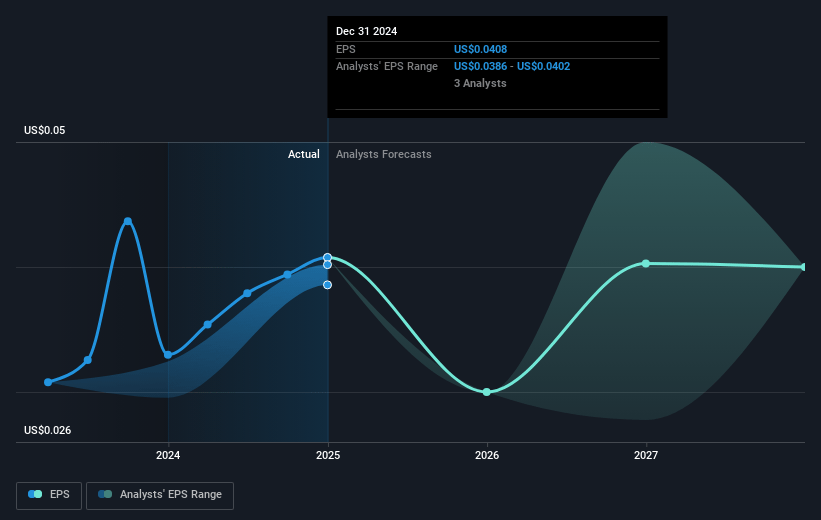

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $0.04) by about May 2028, up from $1.2 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.1x on those 2028 earnings, up from 16.8x today. This future PE is lower than the current PE for the AE Chemicals industry at 32.7x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.83%, as per the Simply Wall St company report.

Borouge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global regulatory scrutiny and growing restrictions on single-use plastics may structurally reduce long-term demand for Borouge’s core polyolefin products, particularly polyethylene and polypropylene, which could pressure future revenue growth and volume utilization rates.

- Heavy reliance on hydrocarbons as feedstock (mainly ethane, linked to a long-term contract with ADNOC) exposes Borouge to potential input cost volatility as decarbonization initiatives, carbon taxes, and global energy transition policies could increase operational costs, negatively impacting future net margins and profitability.

- Large-scale capacity expansions (e.g., Borouge 4, debottlenecking projects, and integration into Borouge Group International) carry significant execution risk, with potential for project delays or cost overruns that could depress free cash flow, lengthen payback periods, and reduce returns to shareholders.

- Increasing global polyolefin supply, combined with risks of overcapacity (especially from new entrants and expansions in Asia and the Middle East), may drive product prices lower and compress Borouge’s margins and earnings, especially if demand growth lags capacity additions.

- The company’s export-heavy sales strategy, with concentration in Asia Pacific and Middle Eastern markets, exposes Borouge to heightened geopolitical, trade policy, and tariff risks—any escalation could trigger sudden revenue drops or impair long-term sales growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED2.753 for Borouge based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED2.95, and the most bearish reporting a price target of just AED2.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.5 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 29.1x, assuming you use a discount rate of 19.8%.

- Given the current share price of AED2.54, the analyst price target of AED2.75 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.