Key Takeaways

- Interest rate cuts and strategic partnerships are expected to boost revenue in the UAE, enhancing market share in real estate and retail sectors.

- Expansion in production capacity and local manufacturing initiatives are poised to improve margins amid competitive challenges in Saudi Arabia and European markets.

- Geopolitical tensions, inflation, and competitive pressures threaten R.A.K. Ceramics' margins and profitability, while tax changes and market-specific challenges further risk financial performance.

Catalysts

About R.A.K. Ceramics P.J.S.C- Engages in manufacture and sale of various ceramic products in the Middle East, Europe, Asian countries, and internationally.

- The recent cut in interest rates, along with expected future reductions, is anticipated to improve liquidity and ease credit conditions. This could stimulate the real estate sector, particularly in the UAE, which is RAK Ceramics' largest revenue contributor. Improved real estate activity is expected to drive revenue growth.

- In Saudi Arabia, the government's exemption of custom duties on exports has improved competitiveness by reducing costs. This, along with a focus on premium and differentiated product offerings, is expected to enhance margins and revenue in a market affected by oversupply and high transportation costs.

- RAK Ceramics is investing in expanding its production facilities in key markets such as the UAE and Saudi Arabia, with particular emphasis on premium product lines and cutting-edge technology. These investments are expected to enhance capacity and operational efficiencies, positively impacting earnings and net margins.

- The strategic partnerships with reputable developers in the UAE and strong retail presence improvements in India might drive revenue by tapping into new projects and enhancing customer engagement, thus increasing market share and revenue in these regions.

- The rationalization of KLUDI Europe's operations and the shift to local manufacturing in the UAE are anticipated to reduce costs and support margin improvements for the faucets division, as the company overcomes challenges from higher logistics costs and geopolitical tensions in European markets.

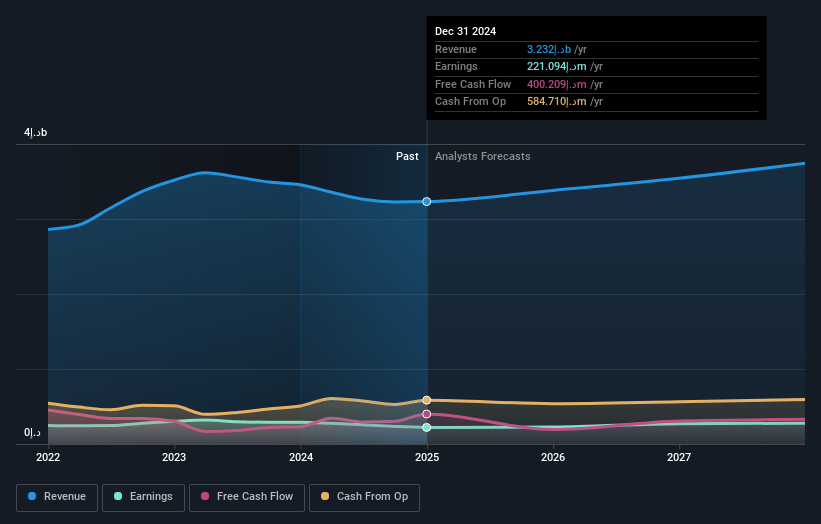

R.A.K. Ceramics P.J.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming R.A.K. Ceramics P.J.S.C's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 8.5% in 3 years time.

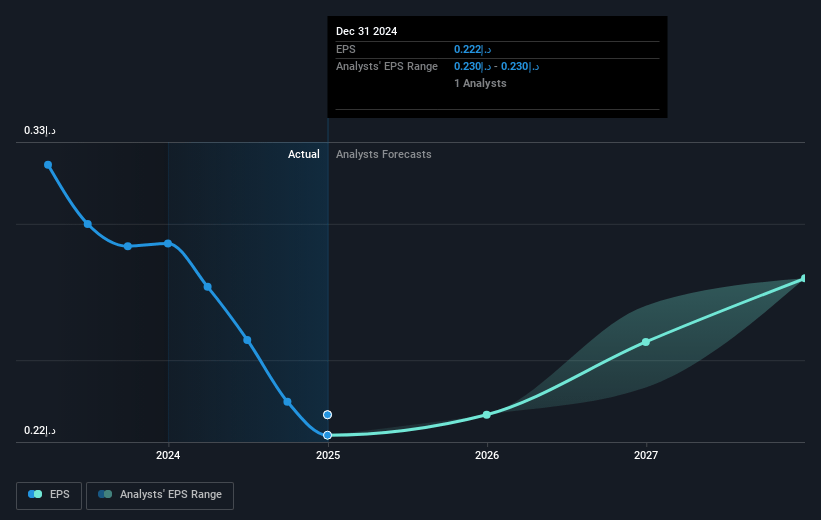

- Analysts expect earnings to reach AED 320.3 million (and earnings per share of AED 0.28) by about May 2028, up from AED 221.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting AED364 million in earnings, and the most bearish expecting AED276.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the AE Building industry at 11.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 22.4%, as per the Simply Wall St company report.

R.A.K. Ceramics P.J.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical tensions and inflationary pressures, particularly in the Red Sea and Europe, have led to higher logistic costs, impacting the company's margins in key export markets. This could further strain net margins and earnings.

- Competitive pressures in Saudi Arabia due to oversupply from local manufacturers and lower-cost imports supported by free trade agreements in the UAE add challenges, potentially impacting revenue and profitability in these markets.

- Political instability, gas shortages, and currency devaluation in Bangladesh have severely affected production efficiency and revenues, posing a risk to financial performance in this region.

- The slowdown in Europe's demand driven by inflation, recessionary pressures, and currency fluctuations, along with tableware division's decline due to supply chain disruptions, could negatively affect overall revenue and earnings.

- Corporate tax implementation at 9% in the UAE and potential further increases to 15% as a multinational, along with reduced net profits from higher logistical and freight costs, diminish profit margins and could affect long-term growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED3.238 for R.A.K. Ceramics P.J.S.C based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED3.8 billion, earnings will come to AED320.3 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 22.4%.

- Given the current share price of AED2.49, the analyst price target of AED3.24 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.