What Investors Need To Know About Warren Buffett's Letter To Shareholders

Reviewed by Bailey Pemberton

What Happened In The Market Last Week?

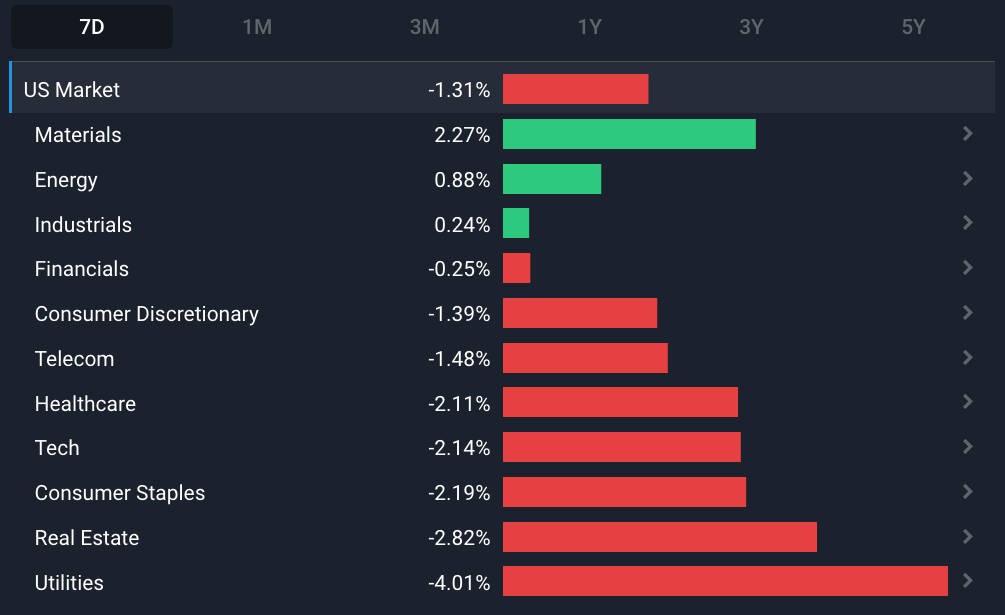

Equity markets remained on the back foot as bond yields continued to climb - the US 2-year Treasury Yield is now at its highest levels since 2007, and hopes for a Fed pivot have evaporated. The only area of strength was commodity prices, leading to gains for the US Materials and US Energy sectors. Defensive sectors were weakest, but cyclical sectors were also in the red.

This week we had a look at Warren Buffett’s annual letter to Berkshire Hathaway’s shareholders, and highlighted three key topics:

- How a handful of great investments contributed to BerkShire Hathaway’s success.

- The pros and cons of GAAP and non-GAAP reporting .

- Why share buybacks can be sensible , and why they can also be harmful when done for the wrong reasons.

Warren Buffett’s annual letter to shareholders was published along with Berkshire Hathaway’s 4th quarter and annual results. The letter is a widely anticipated read for many investors each year, and often imparts a great deal of wisdom and common sense to its many readers. This was the shortest letter in 44 years, and he barely commented on the companies within the portfolio, but he is 92 after all so we will give him a pass.

He also covered several topics he’s talked about repeatedly in the past - but they are probably worth repeating.

The Secret Sauce: A Handful Of Long-Term Winners 📈

Buffett emphasized an important aspect of Berkshire Hathaway’s returns. He said that most of his capital allocation decisions had been ‘no better than so-so’ , and that the results he’s renowned for were the product of a handful of a few ‘truly good decisions’.

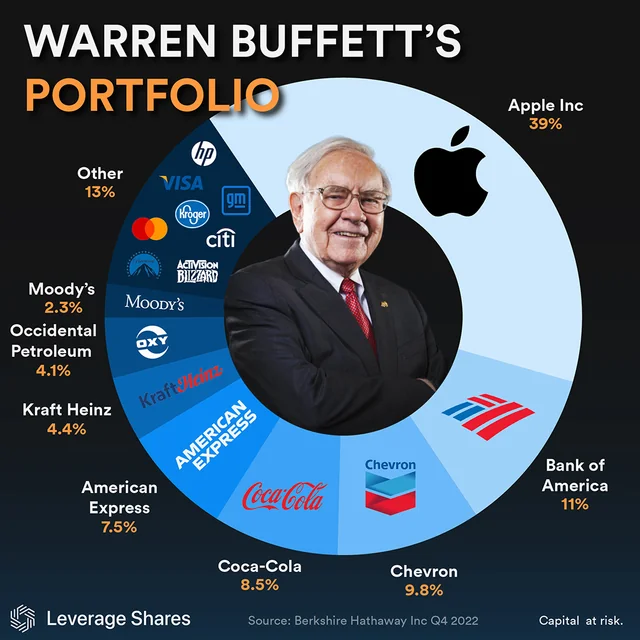

He gave two examples of companies that have grown into Berkshire’s fourth and fifth largest holdings respectively:

- The purchase of 400 million shares of Coca Cola ( NYSE:KO ) was completed in 1994, for a total cost of US$1.3b. That investment is now worth US$23.8b and paid Berkshire a US$704m, dividend in 2022 - ie. 54% of the initial investment.

- The second example was American Express ( NYSE:AXP ). The purchase of AMEX was completed in 1995, also for US$1.3b. It’s now worth US$26b and paid Berkshire a US$300m dividend in 2022.

💡 The Insight: Let Your Portfolio Concentrate Itself

Most investors don’t know which of their investments will be their most successful. Berkshire’s portfolio has concentrated itself over time. In the process, the winners become bigger, while the losers become insignificant. As he put it: “the weeds wither away in significance as the flowers bloom”.

Great long term returns are often the result of letting winning investments run, rather than trying to reallocate profits to the laggers. Indexes like the S&P 500 have also benefited from this self-concentration.

What This Means For Investors

Many of the best long term investors have benefitted from allowing their winners to become very large within their portfolio. Of course there is a trade-off, as this could result in large drawdowns. If you invested in companies like Amazon ( Nasdaq:AMZN ) or Netflix ( Nasdaq:NFLX ) early on, and never sold a share, they would likely have accounted for a massive part of your portfolio at the start of 2022. That would have resulted in a very large draw-down.

Investors must not get carried away with seeing people like Buffett have a large allocation in a select few holdings and think the secret to success is to replicate it. Their success is not because they invested a great deal of capital into a select few investments, rather, the outcome of their success is a great deal of capital in a select few winning stocks .

If one of your investments outperforms the others to the point where it accounts for a big chunk of your portfolio, you will probably wonder if you should reduce its size. This is a personal choice and really depends on how much volatility you can tolerate - both financially and emotionally.

Here are a few things to consider if you are in this position:

- How much volatility will you be able to tolerate , before you panic and sell at an irrationally low price?

- Are you going to need the money in the foreseeable future ? Would a 50% drawdown in that one share have a material impact on your life?

- Is it really a ‘forever share’ ? Warren Buffett invests in companies that he’s happy to own forever. These companies tend to trade on more reasonable valuations and carry less downside risk than faster growing shares like Amazon and Netflix (which often trade on higher earnings multiples). No matter how much you like a company, if it’s in a bubble its price can fall a long way.

GAAP vs Non-GAAP Earnings 🥊💰

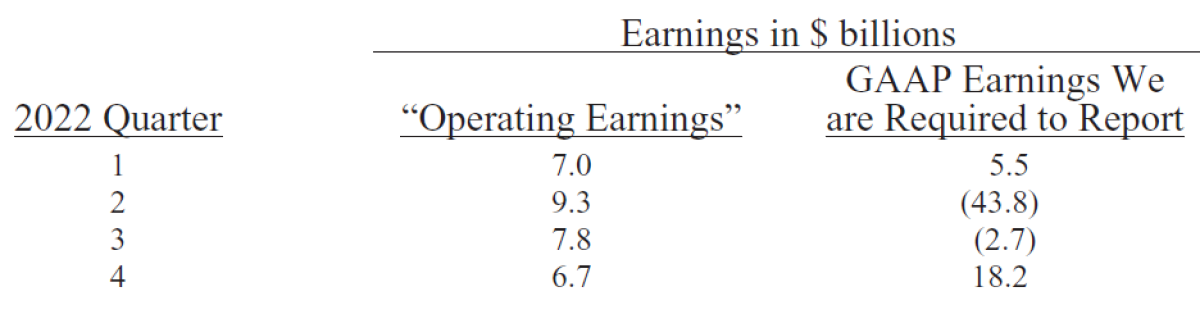

Buffett also pointed out the disparity between GAAP and non-GAAP results. The table below from the letter lists Berkshire Hathaway's quarterly Non-GAAP and GAAP ‘operating earnings’ during 2022.

The first column is the operating earnings for the companies that Berkshire Hathaway owns outright. The second column includes both those earnings and the mark-to-market gains and losses for the financial instruments Berkshires owns, which includes listed shares, bonds and derivatives.

Buffett’s point is that the GAAP losses in the second and third quarter were unrealized losses caused by market volatility. Unrealized gains and losses are very different from operating earnings, and don’t reflect the performance of the underlying business.

But Buffett also pointed out that while the non-GAAP figures he favors can be easily manipulated by managers with ‘a desire to deceive’.

Pro Tip: You can use the Simply Wall St Portfolio Tool to view the underlying fundamentals for your portfolio as a single entity. The tool shows the aggregate valuation, growth forecasts and financial health for all the companies in a portfolio (weighted by holdings), as well as the performance of individual holdings, and diversification across sectors and industries.

💡 The Insight: GAAP And Non-GAAP Measures Both Have Pros And Cons

GAAP stands for Generally Accepted Accounting Principles and provides a set of standards that companies are legally obliged to use when reporting their financial results. The advantage of this system is that the results of several companies can be compared on a like-for-like basis. The disadvantage is that it’s a one size fits all system, and overlooks aspects unique to each company or sector. In particular, the GAAP standard doesn’t always give a true reflection of operational performance that might exclude taxes or non-recurring items.

Companies can also report non-GAAP numbers. These are metrics that the company ‘adjusts’ to reflect aspects of the financials that GAAP reporting misses. In theory, these numbers can give a better reflection of how the underlying business is performing.

The disadvantage is that they can be used to obscure or mislead as they’re unaudited and are calculated at the discretion of the company, meaning they can be adjusted to look favorable. Non-GAAP numbers typically overlook the cost of employee stock options and they can also be used to justify executive compensation.

What This Means For Investors

Both GAAP and non-GAAP accounting have their drawbacks. For a comprehensive reflection of a company’s performance you should look at both - and try to reconcile the difference. Take a look at which elements have been excluded from the non-GAAP figures and ask yourself “why?”. That should be fairly easy to do - and if it isn’t the company might be trying to obscure something.

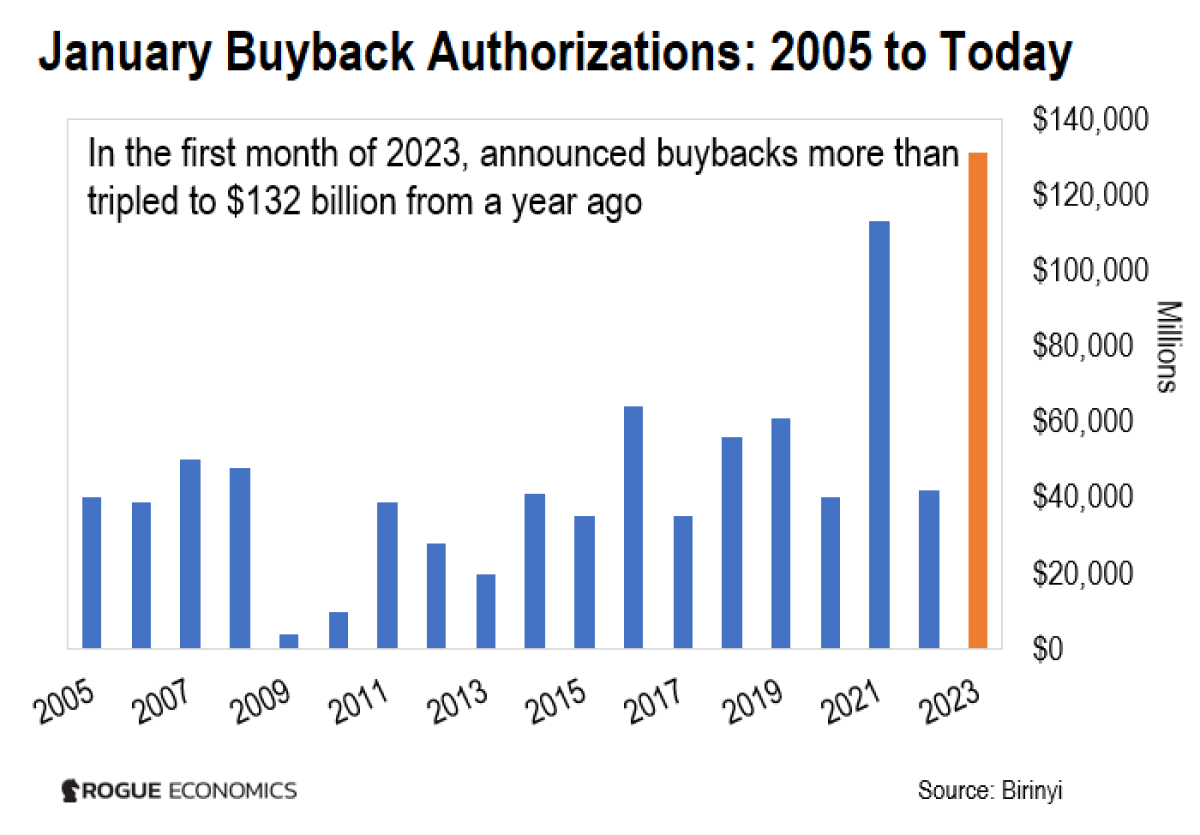

Share Buybacks: A Vote Of Confidence In The Company, But Not Always A Good Thing 💵🤔

Buffett often brings up the topic of share buybacks. Share buybacks are when companies commit excess cash to buying back their own shares from shareholders. Buybacks are an easy target for politicians as they appear to favor the rich and can be difficult to fully understand. As usual Buffett didn’t mince his words on this: ‘‘When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive)".

Berkshire Hathaway bought back 1.2% of its shares in 2022, and shareholders also benefited from buybacks at Apple and Amex, which the company owns.

Share buybacks have become a popular strategy for companies with cash, and no other way to spend it:

💡 The Insight: There’s A Little Difference Between Buybacks And Dividends

When a company buys its own shares, the number of outstanding shares decreases, so your percentage holding in the company increases, provided you were not a participant in the buyback. This means net income is divided amongst few shares, so earnings per share increases relative to net income.

Share buybacks are a useful strategy to increase management control (which could be good or bad depending on how you look at it). In buying back shares, the company reduces the voting power of external shareholders, meaning decision-making could become easier.

Share buybacks, like dividends, are also a way for companies to distribute excess capital to shareholders. In fact, irrespective of if you prefer one over the other, the end result can be the quite similar.

If a company buys back 2% of outstanding shares but doesn’t pay a dividend, each non-participating shareholder’s interest in the company increases by 2%. If you are a shareholder and would prefer a dividend, you can sell 2% of your shares to give yourself a 2% 'dividend', and your proportional interest in the company will be the same as it was before the buyback.

Conversely, if a company pays a 2% dividend but doesn’t buy back any shares, you can use that cash to increase your interest in the company by 2%. But while the outcome is similar, there are some notable differences in how these two strategies are treated.

One difference relates to the way buybacks and dividends are taxed. The argument about which is more tax effective is open to debate and the answer may depend on the tax legislation you have to abide by - as are all matters related to tax.

What This Means For Investors

While buybacks are generally a positive sign that the company is in a comfortable cash position and see their stock is undervalued, buybacks can also be harmful to shareholders if they don’t make sense. If the share price is too high, it's the same as the company overpaying on any other investment.

Using debt to buy shares can also be harmful, particularly if the share price is too high, or if the interest rates are high. That’s very relevant now that interest rates have risen. If a company has debt that needs to be rolled over at higher rates, it could be a better idea to pay down the debt - unless the share price is really attractive.

Another thing investors should be wary of is when executives use unnecessary buybacks to meet the targets outlined in any performance-based compensation scheme. These executives could announce buybacks to support the share price, or to improve EPS and achieve the targets they need, all while operational performance is less than impressive.

At the end of the day, buybacks are generally a good sign but if a company buying its own shares doesn’t make sense, you should probably regard it as a red flag.

Key Events During the Next Week

Things are quietening down on the earnings front, but there are some events that may spark volatility related to inflation and interest rates. Specifically, Fed chair Jerome Powell is testifying on Tuesday and US non-farm payrolls are out on Friday.

Elsewhere, interest rate decisions are being announced in Australia on Tuesday and in Japan on Friday.

We are down to the last few weeks of earnings season and it will wind down to a trickle after this batch of releases out this week:

- CrowdStrike ( Nasdaq:CRWD )

- MongoDB ( Nasdaq:MDB )

- Sea Ltd ( NYSE:SE )

- Dick’s Sporting Goods ( NYSE:DKS )

- Asana ( NYSE:ASAN )

- JD.com ( NYSE:JD )

- Docusign ( Nasdaq:DOCU )

- Gap Inc ( NYSE:GAP )

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.