Pixels to Profits: The Changing Economics of Gaming in 2024

Reviewed by Bailey Pemberton, Michael Paige

“Education should learn from the positive side of gaming - reward, accomplishment and fun” - Sebastian Thrun

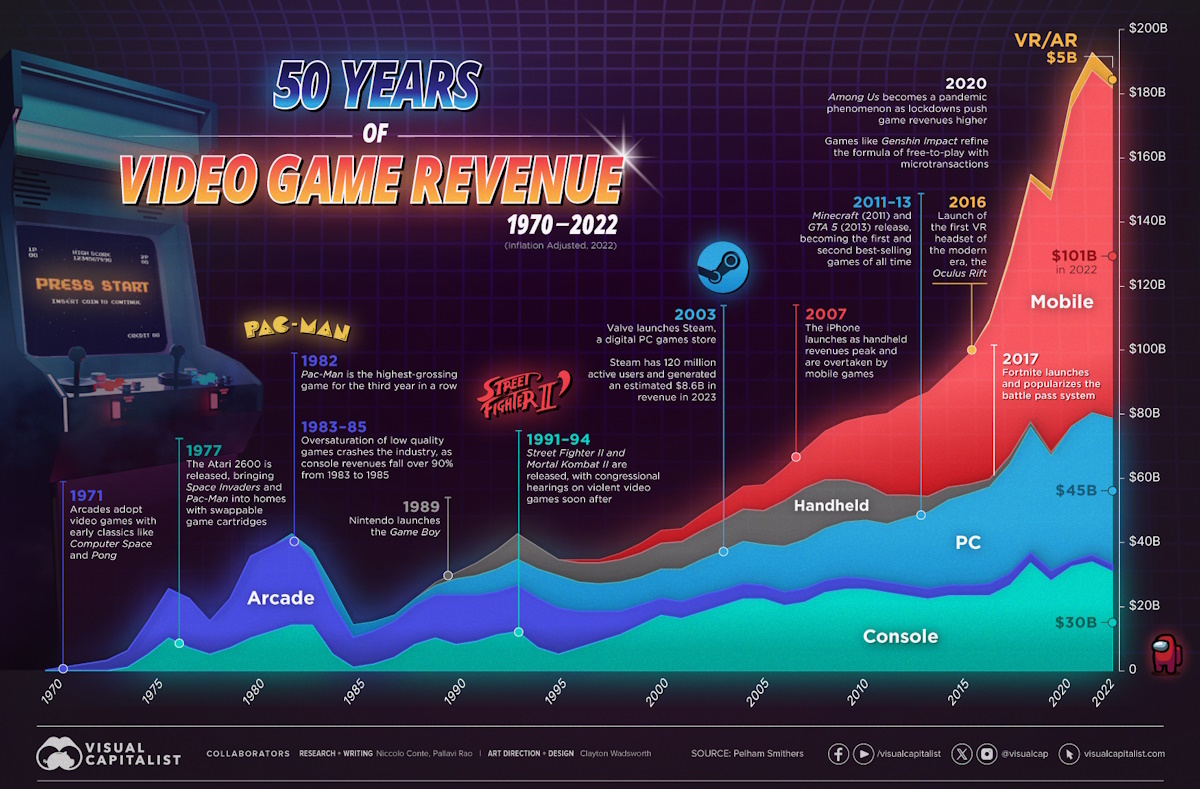

Do you remember that industry we talked about a while back that’s in the entertainment space, but bigger than Hollywood and the music industry, combined ? You know? The one with $180bn in revenue in 2022 (depending on who you include).

Yep, you guessed it (we assume) , it’s the video gaming industry. Given its colossal rise from $20bn in 1995 revenues to $180bn two years ago, it’s increasingly getting investor and mainstream attention.

So this week we are checking in on the industry again after we did a deep dive in September. This time though, we are looking at the key themes and trends to look out for in 2024, how to get exposure if you’re enticed by the opportunities, and how to find gems in the industry.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

What Happened in Markets This Week?

Here’s a quick summary of what’s been going on:

- 🏢🇨🇳 Evergrande ordered to liquidate by Hong Kong court ( Axios )

- Our take : Considering the liquidation order was issued by a Hong Kong court, not a jurisdiction in Mainland China, where most of its operations are, this will likely be a messy process. Evergrande has liabilities of $300 billion, owed to both local and foreign creditors. Complicating matters further is the fact that China has millions of empty and unsold apartments, so the liquidators can’t simply sell assets to pay off creditors. Not exactly a recipe for investor confidence, and a poor outcome for investors here will likely increase the outflow of foreign investor capital.

- 🇪🇺🧥 Europe’s luxury giant LVMH ’s market cap jumped by $46.8 billion on record revenue ( CNBC )

- Our take: LVMH Bernard Arnault chairman is now on top of the world rich list, ahead of Elon Musk. Fortunes are usually made by investing in new technologies and innovation, but clearly there are also opportunities in timeless classics like the brands owned by LVMH. Remember when we talked about the powers of luxury brands ?

- 🇬🇧 UK profit warnings in 2023 exceeded the GFC High ( Bloomberg )

- Our take: The positive side of that stat is that profit warnings actually fell in the third and fourth quarter. If it's darkest before the dawn, maybe the UK is the place to be bargain hunting.

- Meta will pay its first ever quarterly dividend of $0.50 per share ( The Guardian )

- Our Take: The dividend (for those on record by 22nd Feb) alongside the $50bn buyback program signals that the company has excess cash to distribute to shareholders after its “year of efficiency”. Joining the likes of Microsoft and Apple, it appears Meta is in a stage where it can still reinvest heavily for future growth, and reward shareholders along the way.

And some of the key economic data released recently:

-

🏦 The US Fed kept rates steady as expected, but also dashed hopes of imminent rate cuts.

- The latest statement from the Federal Open Market Committee removed language that had indicated a willingness to keep raising interest rates until inflation had been brought under control .

- However, the committee also stated that it won’t be appropriate to lower rates until it had confidence that inflation is moving towards 2%.

-

👷 US Job openings rose to 9.02 million in December, higher than the 8.75 million expected .

- The implication is that the job market is slightly hotter than expected. The ADP employment report reflected 107k new jobs (vs 125k expected), with wages up 5.2%.

-

🇦🇺 Australia’s inflation rate fell to 4.1%.

- That’s a big drop from the prior 5.4% and lower than the 4.3% expected by economists. Good news for anyone hoping for a rate cut, but perhaps not as soon as next week.

Food for Thought

Analysts at Datatrek Research made an interesting observation about S&P 500 EPS estimates, saying:

“ No one believes Wall Street analysts’ 2024/2025 S&P 500 earnings estimates, and that’s OK. Their long history of overestimating results allows markets to haircut those numbers down to realistic expectations. This year’s S&P earnings should be about $236/share, 45% higher than 2019. The S&P is up 51% since then. Stocks discount earnings, and little else.”

✨ A great reminder that over longer periods of time, and on average, earnings drive share prices.

Now, let’s dive into the video game industry!

👾 Recap: The Video Game Industry Entering 2024

The video games industry flourished during the pandemic, and it’s easy to see why. Everyone was at home without much to do other than play video games for weeks on end. But fortunes turned and the industry then experienced a reality check in 2022.

Since then, it's experienced a recovery, although that seems to be stalling for quite a few companies. There are a few reasons for caution - but a correction could also set up some nice opportunities to ride the next wave.

This week we are going to discuss some of the key differences between the various types of gaming companies and some of the latest industry trends.

Before we start, the Visual Capitalist recently updated this great infographic illustrating the industry's evolution over the last 50 years. Check out that mobile gaming revenue 👀

7 Types of Companies Involved in Gaming

The first thing to point out is that the video game industry is very diverse. Stock prices tend to correlate at times, but over longer periods of time they diverge as companies have very different business models. So here’s a rough breakdown of the types of companies.

📱 Big Tech

Just about all the largest US and Asian tech companies have significant exposure to the gaming industry - in fact, they own some of the best gaming assets. Think Meta with their Quest VR line-up, or Microsoft with Xbox.

Gaming is just a part of these businesses. Video games are another reason to consider these stocks, but they don’t offer pure play exposure.

💾 Semiconductors

Gamers are an important market for several semiconductor manufacturers, and specifically Nvidia and AMD . In fact, Nvidia’s meteoric rise all began thanks to their PC gaming hardware! However, like big tech, gaming is just one of several segments, and right now it's not the most important segment, which is AI.

If you want to see how gaming fits into these businesses, take a look at some investors’ narratives for Nvidia and AMD .

🕹 Game Publishers and Distributors

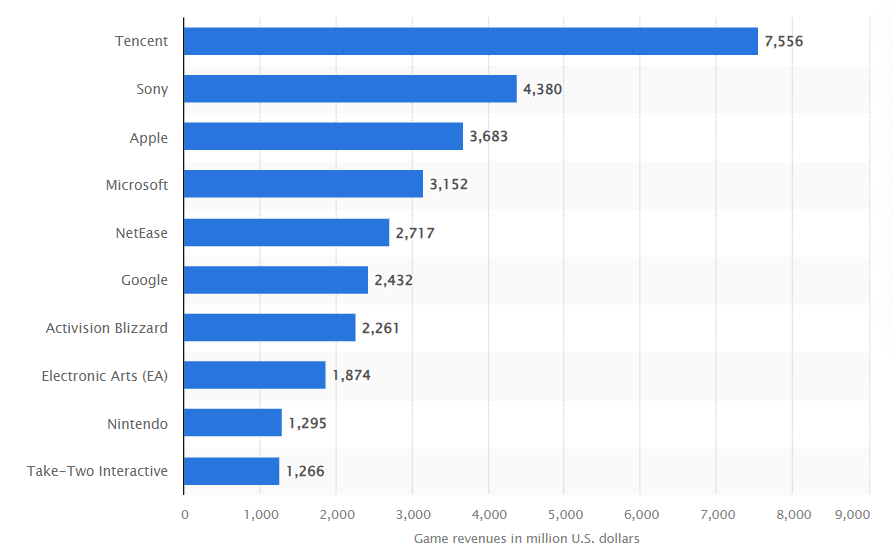

Now that Microsoft has acquired Activision Blizzard, the pure play video game segment is smaller, but there are still quite a few companies spread out across the globe.

These are the companies that own and distribute games played on PCs and consoles, and are the cash cows of the industry. The bigger companies like Take-Two Interactive own a large portfolio of games, which give their cash flows more predictability. Smaller companies like CD Projekt own one or two titles, meaning they are high risk/reward plays.

This segment also includes stalwarts Nintendo and Sony that sell both consoles and games.

👾 Platforms and Game Engines

One of the really exciting parts of the industry is the companies that provide the tools and platforms used to develop and run games.

These companies include Unity Software and Roblox , as well as Epic Games (which owns Fortnite and Unreal Engine). Epic Games is privately owned, but Tencent has a 40% stake.

These are the companies at the leading edge of innovation, and if or when we enter the metaverse they will provide the picks and shovels. However, they also need to make massive investments and profitability might be some time away.

🧑💻 Hardware and Peripherals

Often overlooked are the companies like Corsair Gaming and Logitech that manufacture gaming hardware from joysticks to keyboards.

These businesses may not seem as exciting - but because they are slower growing and often overlooked, they do trade at more attractive valuations from time to time.

🏆 Esports

Competitive video gaming is a new and rapidly growing industry. But from an investor's point of view, the listed companies in this space are tiny and should be treated as highly speculative.

🎰 Sports Betting and Casinos

Sports betting platforms like DraftKings , and even casino owners like Las Vegas Sands are often lumped in with video gaming stocks. Clearly, these companies have completely different business models and industry dynamics, and need to be assessed as such.

Take a look at our Video Games Collection for some more ideas.

🎮 Video Game Outlook for 2024

Sales Growth Has Slowed But Margins Have Improved

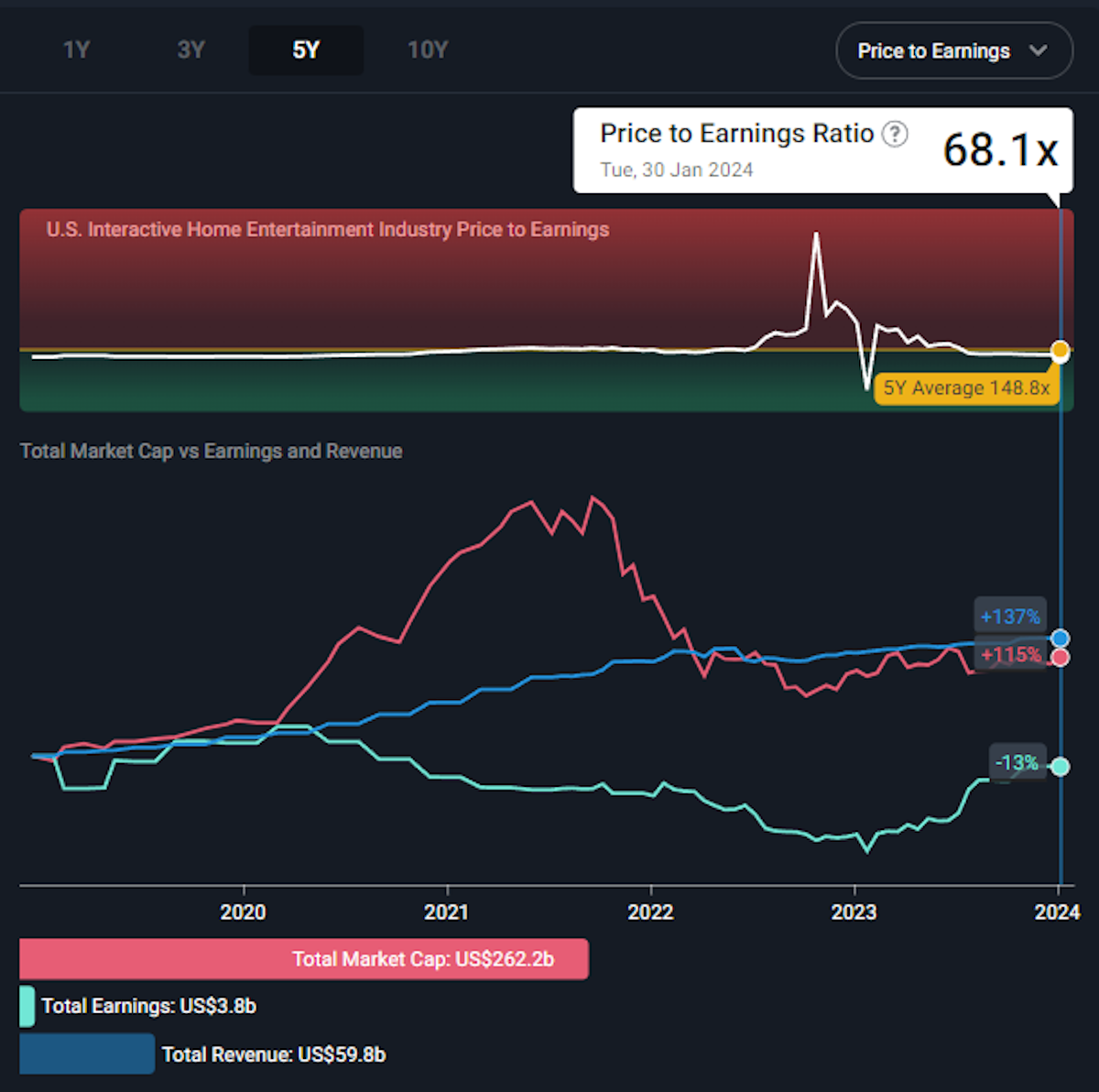

The chart below reflects the market cap, revenue and earnings for the US Interactive Home Entertainment Sector, which includes many of the pure play gaming companies.

Interestingly, while revenue growth has slowed since early 2022, earnings growth has accelerated over the last 12 months.

✨ So margins and earnings shot up - likely due to cost cutting - and valuations now appear to be below average. But, for earnings to grow from here, revenue needs to increase, or margins need to get even better.

That might only be likely for a select few companies, so the key is to find those with good future prospects, solid balance sheets and high returns on invested capital.

Our Screener tool can help you narrrow down the list of companies that meet that criteria!

US Interactive Home Entertainment Sector Market Cap, Revenue and Earnings - Image Credit: Simply Wall St

PC and Console Games Might Be Weaker

Some analysts think PC and Console Games are likely to have a weaker year. This is both a function of the high bar set by a strong 2023 and the fact that there are fewer big games scheduled for release.

One exception could be Nintendo, which is rumored to be launching a new Switch console.

Ads Could Play a Bigger Role in Games Monetization

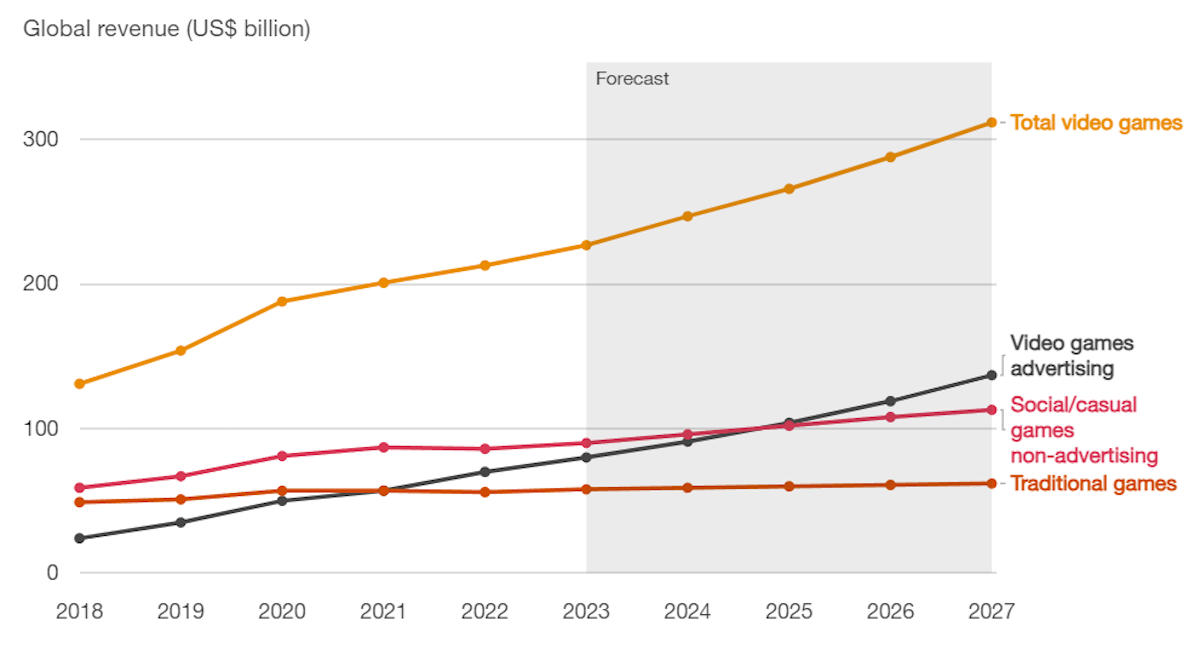

PWC’s media and entertainment report from June last year includes an interesting forecast.

✨ They reckon most of the industry growth over the next few years will be in advertising rather than traditional game purchases.

If they are right, this will favor platforms like Meta, Tencent etc. rather than traditional game publishers. However, PWC goes on to say that there is scope for publishers to explore in-game advertising technology, which could serve ads to gamers while making the ads look and feel similar to game content, making it less intrusive.

PWC’s forecast puts total industry revenue in 2027 at $312 billion, up from $262 billion in 2023. That’s an annual growth rate of 4.6%, which is lower than it's been in the past decade. Obviously, some companies will be way ahead and others way behind.

If advertising is the main growth driver, it's likely to depend on how well ads can be targeted, and that would lean heavily on AI and ad-tech capabilities.

Virtual Reality and the Metaverse Aren’t Coming Tomorrow

Meta has slowed its metaverse investments, and Apple’s first version of the Vision Pro has clearly been aimed at developers. This is probably a sign that mainstream virtual reality gaming is still some way off.

That doesn’t mean there aren’t a lot of companies investing in the technology to make this a reality. But it does mean that monetization could be quite a few years away, and that needs to be incorporated in valuations.

Video Gaming ETFs Vary Widely

As is often the case, ETFs with exposure to video gaming stocks have varying interpretations of what constitutes a video gaming stock.

If you look at the ones that have performed best recently, they are probably very heavily weighted to semiconductor and big tech. The VanEck Video Gaming and Esports ETF is one of the most popular ones in this space - but if you look at its top holdings, it could just as easily be an AI fund.

Others, like the Amplify Video Game Tech ETF and Global X Video Games & Esports ETF are more focussed pure play video gaming stocks, but have very different portfolios.

These ETFs are a great way to find interesting and obscure gaming stocks listed all over the world.

Check the fund fact sheet for a full list of holdings, or ETFDB.com, which listed the 15 largest stocks in each fund.

💡 The Insight: How To Find The Next Gem In Gaming

Gaming covers such a breadth of industries, it could be hard to figure out where to look as an investor if you want to get exposure.

The tried and tested principles of investing still ring true: Look for businesses that have a durable competitive advantage, minimal leverage and are run by competent and aligned people.

But for those of you who aren’t too familiar with video games, here are a few insights specific to the gaming industry to help navigate your way around!

- 💰 Consider the valuable Intellectual Properties

- The value of intellectual property in the gaming world can’t be overstated. Massive game series like Call of Duty, EA Sports FC (FIFA) and NBA 2K all bring in millions of dollars in game sales and microtransactions a year, despite their annual game releases being very similar.

- Franchises with loyal fan bases should see consistent sales, even while other games may see a brief moment in the spotlight. Famously, the release of Call of Duty: Warzone in 2020 lead to a $1.2 Billion boost to Activision Blizzard’s earnings from microtransactions in just 3 months!

- 🤺 Find out who builds the foundations of the entire industry

- Every console generation release comes with the age-old debate: PlayStation or Xbox. However, if you’re an AMD investor, the answer is both! Both the PlayStation 5 and the Xbox Series X use custom RDNA 2 GPUs from AMD to power their latest consoles.

- As an investor, it’s useful to delve deeper into the supply chain and see who manufactures the hardware that powers the gaming industry. Companies like Nvidia, AMD, Arm Holdings and TSM build and license the chips that run the entire video game market.

- 👀 Be on the lookout for acquisitions

- Like a lot of the tech industry, acquisitions are an easy way for large conglomerates to keep generating growth. We’ve touched on Microsoft’s acquisition of Activision Blizzard before, but it’s only now we’re beginning to see the impact of the deal as Microsoft have just reported a 49% increase in Xbox gaming revenue for Q2 2024 .

- The two most important things in video game publishing are intellectual property and talent, so it’s handy to follow the flow of acquisitions to see if any industry cash cows (be it a gaming franchise or a team of developers) make their way to a new parent company.

Key Events During the Next Week

This week is all about balance of trade data, starting with Australia on Monday, where the trade balance is expected to fall to $7.9 billion from the previous $11.4 billion.

Germany’s trade balance is also out on Monday. It’s expected to be $19.8 billion, down from $20.4 billion.

On Tuesday, the Reserve Bank of Australia is expected to keep rates at 4.35%.

Canada’s trade balance is out on Wednesday, and expected to fall slightly to $1.7 billion.

Wrapping up the week, Canada’s unemployment rate is out on Friday and is expected to tick up to 6% from 5.8%

Earnings season is broadening out to industrials, pharma, consumer, and other sectors. The biggest names reporting this week include:

- McDonald’s

- Caterpillar

- NXPI

- Verterx Pharma

- Eli Lilly

- Toyota

- BP

- Alibaba

- Disney

- Uber

- S&P Global

- Unilever

- Pepsico

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.