🎢 Opportunities In The Turbulent Transition To Greener Energy

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: “The history of energy use is a sequence of transitions to sources that are cheaper, cleaner, and more flexible.” Vaclav Smil

The bear market in renewable energy stocks is now in its fifth year. It started with sky-high valuations, but the fundamentals have since deteriorated. Stock prices peak when expectations are at their highest, and they usually make lows when expectations are at their lowest.

It’s time for an update on renewable energy stocks, as well as nuclear stocks, which have continued to gain momentum. Specifically, we are having a look at the state of the clean energy transition, what it means for the sector, and how to find opportunities.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 🤝 Meta signs nuclear power deal with Constellation Energy ( CNBC )

- Meta signed a 20-year deal to buy 1.1 GW of nuclear power from Constellation’s Clinton plant, securing clean energy for its AI-driven data center growth.

- The agreement will keep the plant from shutting down and potentially expand its output, marking Meta’s first formal nuclear power purchase.

- This deal signals growing institutional confidence in nuclear as a scalable, low-carbon energy solution for AI infrastructure.

- Meta’s nuclear deal shows where AI energy demand is heading. Expect increased investor interest in nuclear utilities like Constellation and SMR developers that are aligned with Big Tech’s power demand.

- 🚘 Toyota to buy out key supplier in $26bn take-private deal ( CNBC )

- Toyota is helping take one of its key suppliers, Toyota Industries, private in a $26B deal led by a company tied to Toyota’s chairman.

- The offer price is lower than expected, surprising investors who thought the deal would be much bigger.

- This move is part of a trend in Japan where big companies are cleaning up complicated ownership structures. It could lead to more deals and changes at other Japanese firms.

- Investors should watch Japanese conglomerates with cross-shareholdings. More buyouts like Toyota’s could unlock value in overlooked group companies.

- 💥Trump threatens Musk's government deals as feud explodes over tax-cut bill ( Reuters )

- Trump and Musk’s feud over a tax-and-spending bill escalated into open warfare, with Trump threatening to cut off billions in federal contracts to Musk’s companies.

- Tesla shares sank 14.3% as investors reacted to the political blowback and Musk's pledge to decommission SpaceX’s Dragon spacecraft.

- Political risk just became a real threat for Musk-backed stocks. Investors in Tesla, SpaceX-related suppliers, and Starlink partners should brace for volatility as Musk’s Washington ties unravel and get repriced accordingly.

- If you're exposed to Musk-led ventures, now’s the time to reassess those political risks.

- 🚀 Musk says SpaceX revenue will near $16 billion in 2025 ( WSJ )

- Elon Musk says SpaceX will hit $15.5B in revenue in 2025, led by booming demand for rocket launches and Starlink internet. Starlink alone could bring in $12.3B, thanks to contracts with households, governments, and corporate clients like United Airlines.

- But as mentioned above, Trump now threatens to cut off government contracts with Musk’s companies after the public falling-out, putting key NASA and defense revenues at risk. With SpaceX earning over $1B from NASA alone, investors need to weigh the political blowback.

- While SpaceX’s growth is still stellar, U.S. government contracts, which reportedly accounted for 25% of SpaceX’s 2024 revenue , risk slowing down that growth.

- 🇺🇸 Wise to move primary listing to the U.S. in blow to London stock exchange ( CNBC )

- Wise plans to shift its primary listing to the U.S., keeping only a secondary presence in London, delivering another hit to the struggling UK exchange.

- The move follows growing concerns that London lacks the investor base and analyst coverage to support major tech listings.

- This adds to the momentum of high-growth firms leaving London for deeper capital markets. Investors looking for exposure to international tech should watch for more UK-listed firms moving to U.S. exchanges, where valuation upside and liquidity are stronger.

- If you think there are more UK-listed tech firms who might follow Wise’s lead, early positioning in these names could offer upside as they tap into deeper U.S. capital markets.

- 🪨 China's rare earth export curbs hit the auto industry worldwide ( Reuters )

- China’s rare earth export curbs are disrupting Europe’s auto supply chains, with parts shortages already halting production at some plants.

- BMW and Mercedes are exploring stockpiles and alternatives, but approvals for export licenses remain slow, with only 25% granted so far.

- European automakers face rising costs and supply chain risk. Watch for margin pressure, delayed EV rollouts, and a push toward rare-earth-free tech. Suppliers with diversified sourcing or magnet-free motor tech could outperform.

- Since China just tightened the screws on Europe’s EV engine room, investors should brace for supply shocks and a fast-track hunt for alternatives.

⚡️ The Green Energy Transition: Crisis, Crossroads, or Catalyst? 🌍

A year ago, Vaclav Smil published an essay titled Halfway Between Kyoto and 2050: Zero Carbon Is a Highly Unlikely Outcome .

The paper presents a gloomy view of the green energy transition and the odds of reaching net zero in the next 25 years.

Vaclav Smil is one of the foremost authorities on the global energy big picture , as well as other important topics. So it’s worth paying attention to what he has to say - and reading his books.

Since he wrote that essay, the renewable energy industry has faced more bad news:

- 🇺🇸 Donald Trump won the US presidential election.

- That means no more incentives for renewables AND tariffs on imports of solar panels from China.

- ☢️ Some European nations have begun to hedge their bets.

- They’re reconsidering nuclear power .

- 💰 Interest rates have remained higher than expected

- That makes funding renewable projects more expensive.

Yet, the outlook for some renewable stocks doesn’t look too bad.

Some are performing very well financially, while others are trading at their lowest valuations in years despite reasonable growth outlooks.

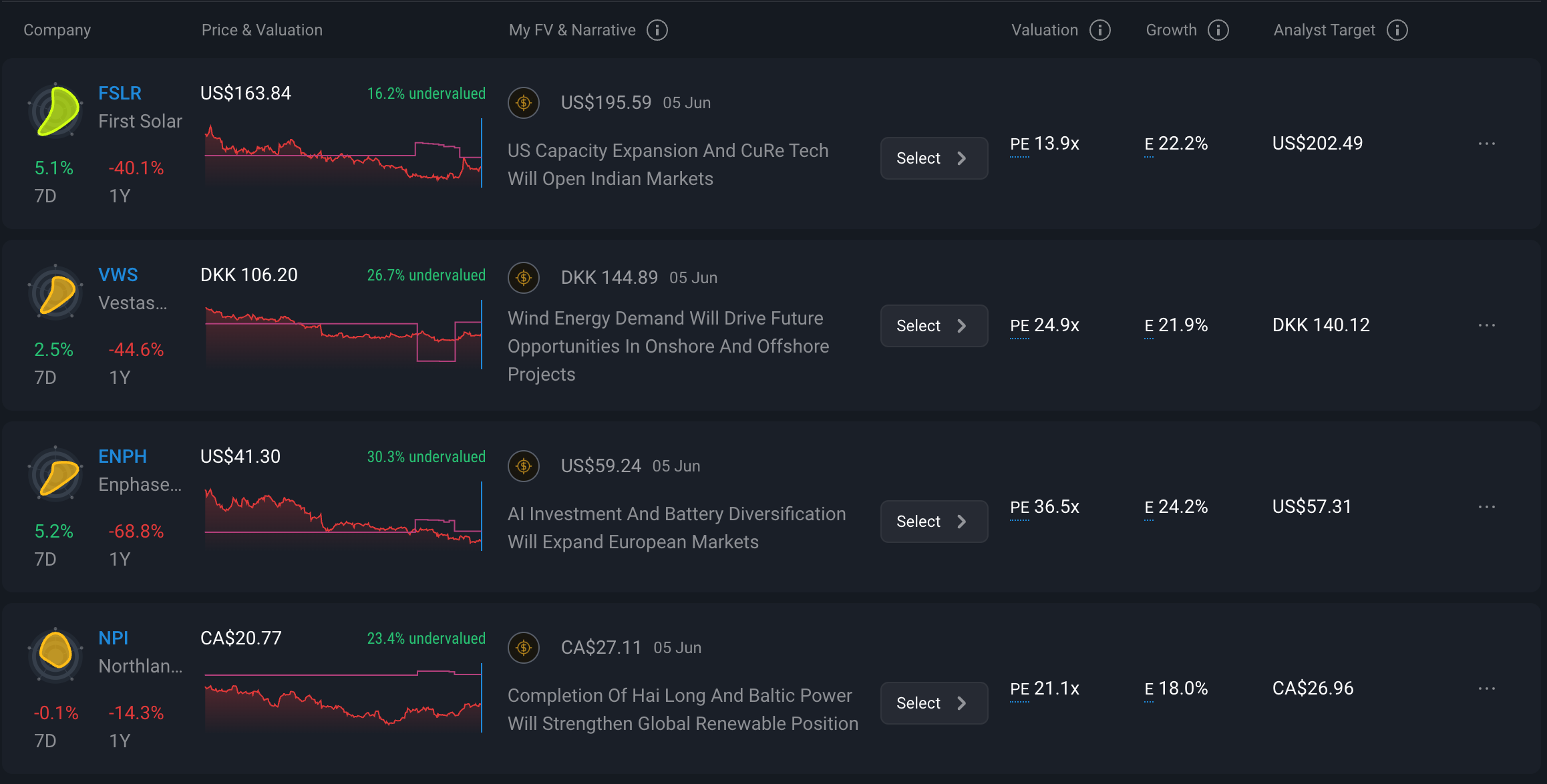

Leading Renewable Energy Companies - Simply Wall St

Global investment in renewable energy, infrastructure, nuclear, and ‘clean’ transport is still expected to reach a record $3.3 trillion in 2025.

Last year, it was around $2.1 trillion, so the increase is more modest than the previous 5 years. But it’s worth noting that the amount is double the expected investments in fossil fuel energy.

So, does this mean there are still opportunities in renewables for investors? Let’s take a look at the bullish and bearish catalysts.

We’ll start with the bearish take…

🤷♂️ The Bearish Barrage: Why Pessimism Lingers for Renewables

Vaclav Smil’s essay takes a look at the big picture goal of reducing carbon emissions to ‘net zero’ by 2050.

The Kyoto Protocol for decarbonization was agreed to in 1997, so we are looking at a 53-year period, and we’re roughly halfway there.

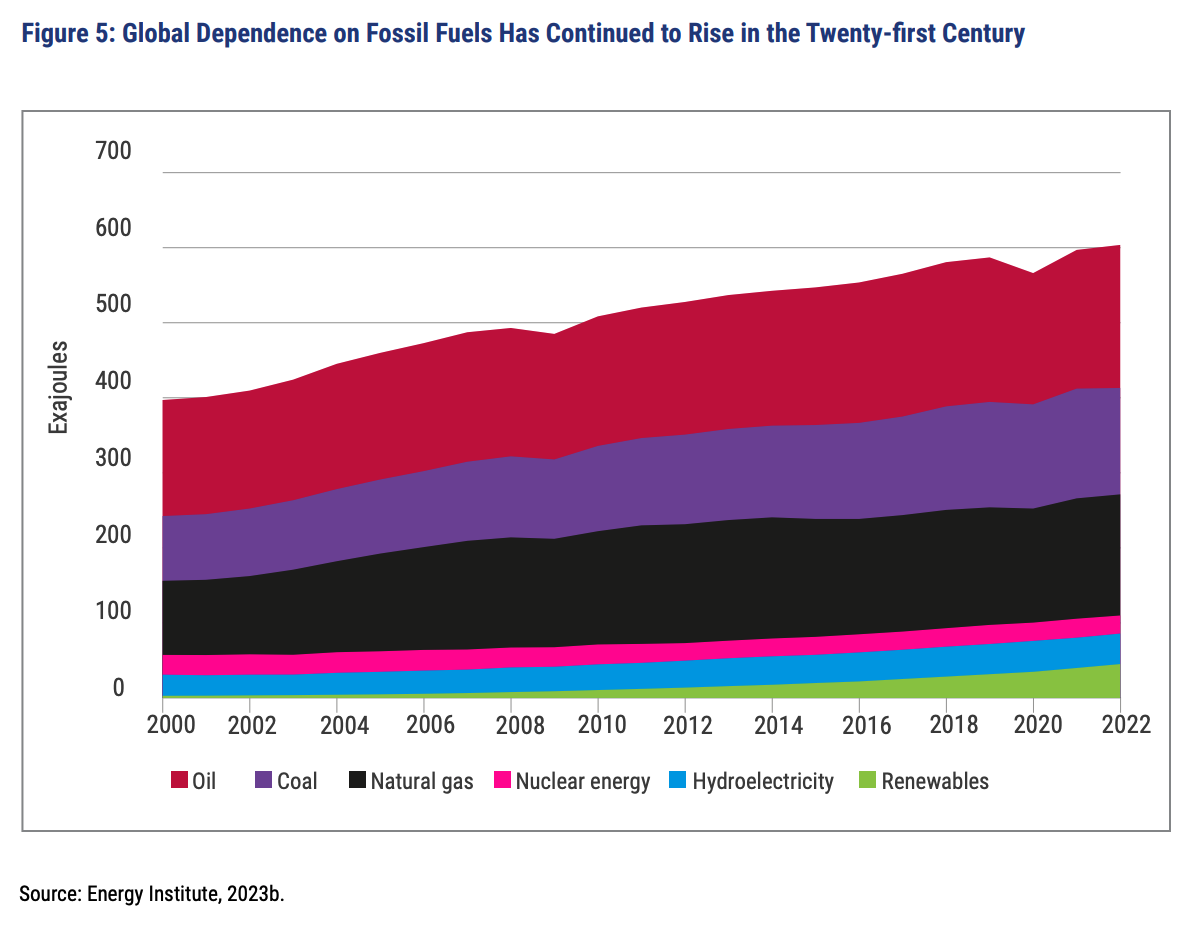

✨ Smil points out that global CO2 emissions increased by 54% between 1997 and 2022. While it's difficult to estimate how much the increase would have been without implementing green energy, it's clear that our reliance on oil, coal, and gas has continued to rise.

Global Energy Consumption - Vaclav Smil

Smil’s dose of reality is based on the magnitude of the task.

Decarbonization will require the global energy infrastructure to be replaced in the next 25 years. This will require immense investments and resources.

Here are just a few of the examples he cites:

- 🚗 EVs require about five times as much copper as gas vehicles.

- That means replacing the world’s light vehicle fleet would consume 150 million tons of additional copper.

- That’s seven times the total amount currently extracted each year.

- ⚡ Electricity grids will need 80 million kilometers of additions or refurbishments.

- 🌎 Affluent countries would need to spend around 20% of their annual GDP to make the transition happen.

In addition, there are other minerals like cobalt, lithium, and rare earth minerals to find and extract, with considerable environmental impact. As mentioned in the news section, China’s curbs on rare earth exports are already hitting the auto industry.

Smil also pointed out that energy transitions are slow.

The first, from wood to coal and then oil, began over 200 years ago, and there are many communities still dependent on wood for fuel.

His conclusion isn’t that the transition won’t happen - it just won’t happen by 2050.

There are other challenges in the medium term:

- 💰 Funding

- Renewable energy is generated from resources that cost nothing.

- But two-thirds of the lifetime cost is incurred up front. Coal and gas plants incur ongoing fuel costs, but less is incurred upfront.

- So, renewable projects are more sensitive to interest rates.

- 🌐 Global unity

- The fracturing of global alliances makes policy co-ordination next to impossible.

- Transitions to cleaner energy sources can help smaller communities from a local pollution point of view. However, some countries might view spending billions on renewable energy tech simply to contribute towards the global net-zero goal less appealing if other countries actions are negating their efforts.

- 📋 Priorities

- Europe and China have led the way with renewable investments.

- Both now face economic challenges, a trade war, and in Europe, defense has now become a priority.

- Most countries are also having to come to terms with rising deficits.

Besides these challenges, oil and gas production has exceeded expectations, largely due to shale production in the US.

The idea of ‘peak oil’ used to refer to peak supply . It’s now a question of when demand will peak!

🤷♂️ The Bullish Perspective: Pockets of Strength

So, the transition to a decarbonized global economy is behind schedule and possibly losing momentum. But there are some bullish catalysts to consider, particularly for certain companies.

💪 Stronger Companies Remain

The downturn of the last few years has stopped many of the more speculative companies in their tracks.

But those that remain are stronger, and they’ve been forced to become more efficient and conservative with debt.

📊 Expectations are Low

First Solar’s P/E ratio has fallen from a peak of nearly 600x to just 13.5x . Even if we ignore the spike in 2023, the 5-year average is about 50x:

FirstSolar PE Ratio - Simply Wall St

Meanwhile, the trajectory is about as good as it’s been…

FirstSolar Revenue and Earnings: Historical and Future Estimates - Simply Wall St

✨ Forecasts have fallen, and may well fall further, but for now, expectations are clearly very low. Investors earn excess returns when the market underestimates the future.

🔋Energy Independence

For governments, energy independence is more important than ever.

For countries that don’t have their own fossil fuel reserves, renewables are still a viable solution. Renewable projects are also quicker to build.

More countries are turning to nuclear, but upfront funding is even more of a challenge for nuclear projects, which take longer to build.

All of this means many countries still have energy policies that support clean energy.

🧑🔬 Innovation Continues

Innovation continues to drive efficiency and cost declines for solar panels, wind turbines, and battery storage.

For battery storage (and green hydrogen for that matter), the technology is still a bit of an unknown quantity, but any major breakthroughs would improve the outlook for the whole sector.

🎰 Hedging Your Bets

The fact that the clean energy transition isn’t happening at the required pace doesn’t mean some companies won’t prosper. But investors will need to make sure companies have a proven and profitable business model.

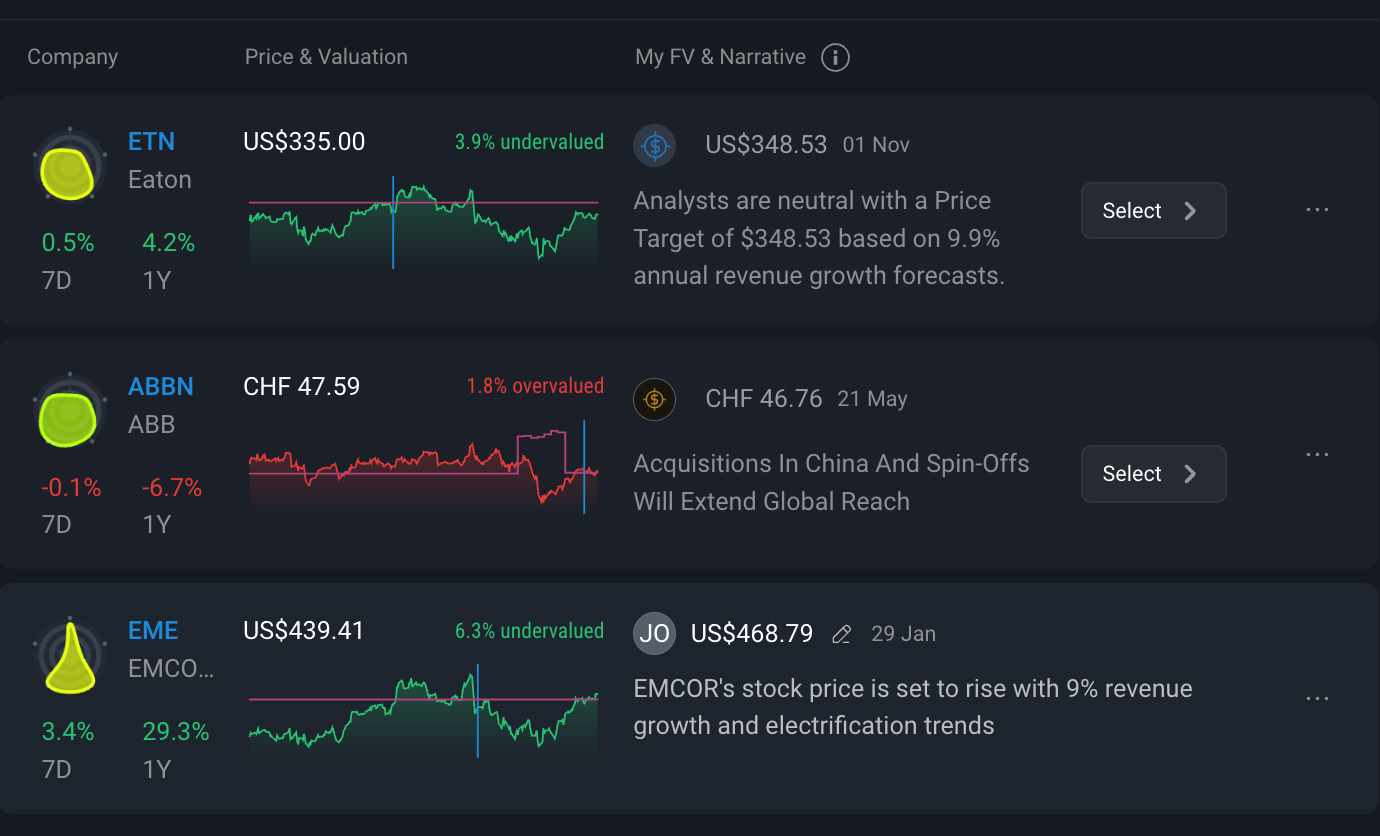

There are also a few industries driving electrification regardless of the bigger picture:

- 🏢 Data centers need a lot of power, and they need it soon.

- Regardless of where it comes from transmission infrastructure to get it to those datacenters.

- 🔋 Automation generally requires electricity and battery storage.

- Robotaxis, drones, and humanoid robots are unlikely to be diesel-powered.

So, the companies that build transmission infrastructure and battery storage solutions should benefit from tailwinds regardless of how quickly the rest of the economy becomes electrified.

Leading Electrification Stocks - Simply Wall St

☢️ Nuclear Energy is Making a Comeback

We wrote about the resurgence of interest in nuclear power in November. Since then, the momentum has continued:

- 🇪🇺 Several European countries are reconsidering their aversion to nuclear power .

- Denmark is reviewing a 40 year ban on nuclear, and Germany and Spain may be reversing course after shutting nuclear plants as recently as 2023. All three countries have significant renewable capacity, but nuclear power would balance that with more reliability.

- 🇺🇸 Donald Trump signed an executive order to overhaul the Nuclear Regulatory Commission to speed up approvals.

- His order also gives the green light to new builds on federal land.

- 🤝 Meta has signed a 20-year deal to buy nuclear power from Constellation Energy (As mentioned in our news stories at the top).

It’s clear that nuclear power has more momentum than it’s had in decades.

The question now is whether reactors can be built within budget and on time. The track record on reactor builds has been terrible over the last few decades, but maybe the increased investments and interest will change that.

Meanwhile, the world is also waiting to see if SMRs (small modular reactors) will be the game changers they promise to be. There are dozens of SMRs in various stages of development and planning, but only two are actually in production, in China and Russia.

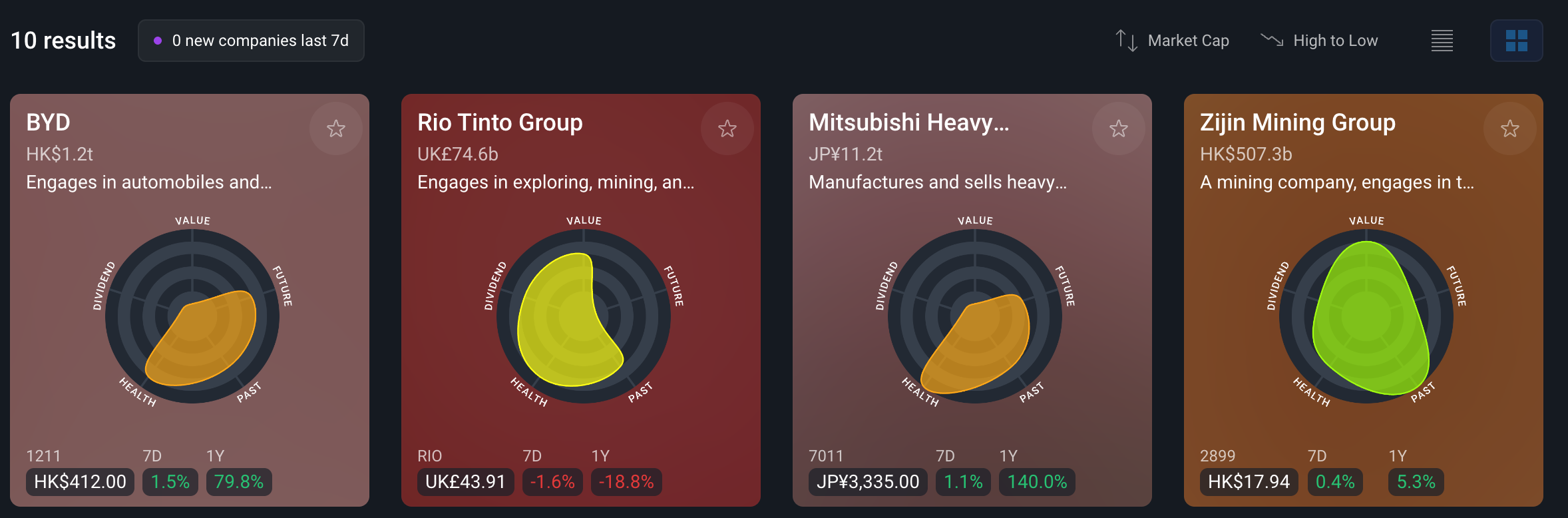

🔍 Where to Look for Potential Opportunities

Companies that operate in the renewables and nuclear space don’t have their own industry classification. Some are classified under “energy”, some as “utilities”, some are in the “industrial” sector, and others are within the “semiconductor” industry.

This can make finding potential investments tricky. As always, looking at the holdings of ETFs is one way to find companies.

The Simply Wall St Stock Screener’s keyword search function is also handy for this. You can search for very specific terms, and if they are mentioned in the company profile, they’ll come up.

Here are a few of the terms you can try:

- Solar and wind: microinverter, battery management systems (BMS) to

- Electrification: HVAC, transmission

- Battery storage : LFP, lithium iron phosphate, NMC, nickel manganese cobalt, solid-state,

- Nuclear: modular reactors, SMR, fission, fusion

Screener Keyword Search: “Lithium Iron” - Simply Wall St

🎯The Insight: Due Diligence is as Crucial as Ever

The challenges that the clean energy transition is facing don’t mean it’s over.

Fossil fuels will probably be around for a while, but renewables and nuclear will also be a part of the energy mix.

For investors, returns will need to come from companies actually making a profit, rather than positive sentiment ‘lifting all boats’ like it did a few years ago.

Here are a few things to consider when assessing potential investments:

- 🔋 Financial Endurance

- Prioritize companies with strong balance sheets and operational efficiency.

- 🏗️ Critical Backbone & New Demand

- Look for opportunities in essential infrastructure, like grid modernization, energy storage, and sustainable resource management.

- Look for companies that can win regardless of the overall energy mix.

- 💎 Value Matters

- Most companies in the renewables space are unlikely to grow at the rates usually seen in the tech sector.

- Valuations need to be based on realistic growth rates and profit margins.

- 📜 Policy can Work Both Ways

- Energy policy is country-specific, and it can act as a headwind or a tailwind.

- Investors need to stay up to date on relevant energy policies.

- ✨ Be conservative when it comes to unproven technologies

- Innovation can solve big problems for the world’s energy needs. But a lot of experiments don’t work out.

- Making wildly optimistic claims is a great way for companies to raise capital from investors with a dose of FOMO.

Key Events During the Next Week

Here are some of the important figures coming out next week that have the biggest forecasted differences from prior reported figures:

Monday, June 9th

- 🇨🇳 China Inflation Rate YoY (May)

- 📉 Forecast: -0.2%, Previous: -0.1%

- ➡️ Why it matters: Persistently low inflation or deflation could signal weak domestic demand, potentially leading to further economic stimulus measures.

- 🇨🇳 China Balance of Trade (May)

- 📉 Forecast: $70.0B, Previous: $96.18B

- ➡️ Why it matters: A smaller trade surplus might suggest weakening export strength or a rise in imports, impacting currency and global trade sentiment.

- 🇨🇳 China Exports YoY (May)

- 📉 Forecast: -4.0%, Previous: 8.1%

- ➡️ Why it matters: A significant drop in export growth would be a strong indicator of cooling global demand.

- 🇨🇳 China Imports YoY (May)

- 📉 Forecast: -3.0%, Previous: -0.2%

- ➡️ Why it matters: Declining imports suggest sluggish domestic demand, which can impact companies reliant on Chinese consumer and business spending.

Wednesday, June 11th

- 🇺🇸 US Federal Budget Statement (May)

- 📊 Forecast: -$312bn, Previous: +$258bn

- ➡️ Why it matters: Reflects the government's fiscal health; significant deficits can have long-term implications for borrowing costs and currency.

Thursday, June 12th

- 🇮🇳 India Inflation Rate CPI YoY (May)

- 📉 Forecast: 3.16%, Previous: 3.72%

- ➡️ Why it matters: Inflation is a key focus for the Reserve Bank of India; a significant deviation could impact rate expectations.

Friday, June 13th

- 🇪🇺 Eurozone Industrial Production MoM (April)

- 📈 Forecast: 2.6%, Previous: -0.2%

- ➡️ Why it matters: Indicates the health of the manufacturing sector across the Eurozone, impacting growth forecasts and business sentiment.

Stocks reporting this week

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.