How to Invest Like the Best - Part 1: Narrative Based Investing, and Your Circle of Competence

Key Takeaways

- Narrative-based investing is a systematized and repeatable framework used by the best investors for investing in any environment.

- Your circle of competence is any area where you have in-depth knowledge from personal experience.

- Starting with products or services within your circle of competence is the perfect way to learn how to invest in stocks using a narrative-based investing approach.

Why narrative based investing?

Narrative based investing is essentially a systematized, repeatable, method to investing in any environment.

The process is as follows:

- Discover a business that you understand,

- Build your narrative around it as you get to know it further,

- Estimate the fair value of that business,

- Buy it when it is undervalued (or wait patiently until it is)

- Monitor that stock to make sure you only hold it if your narrative unfolds largely as expected.

- Then, when the narrative has either finished unfolding, or is no longer valid, sell the stock and move on to the next idea.

The “narrative” is essentially your assessment of the current business, and your estimates of where it could be in the future. Answering a question like “Where do I think this business is going to be in 5-10 years time, and why?” is the basic premise of a narrative.

A very brief example of a narrative is:

“Based on my research, I believe stock X is going to have 40% market share of the $100bn Y industry by 2032 (i.e $40bn revenue). I believe it will be above its competitors because its current competitive advantage of “Z” will help it maintain its dominance in the future. With this in mind and other assumptions, I think the business could be worth $Xbn in 2032, and since it’s currently priced at half that value, I think it’s undervalued based on its future prospects.”

The entire Simply Wall St platform is built around this process, and throughout this series we’ll show you how it helps you build your narrative.

Now, an important point is, you can only build a narrative around a stock by getting to know the ins and outs of the underlying business.

So, how can you find businesses that you already know a lot about? Start by looking within your circle of competence.

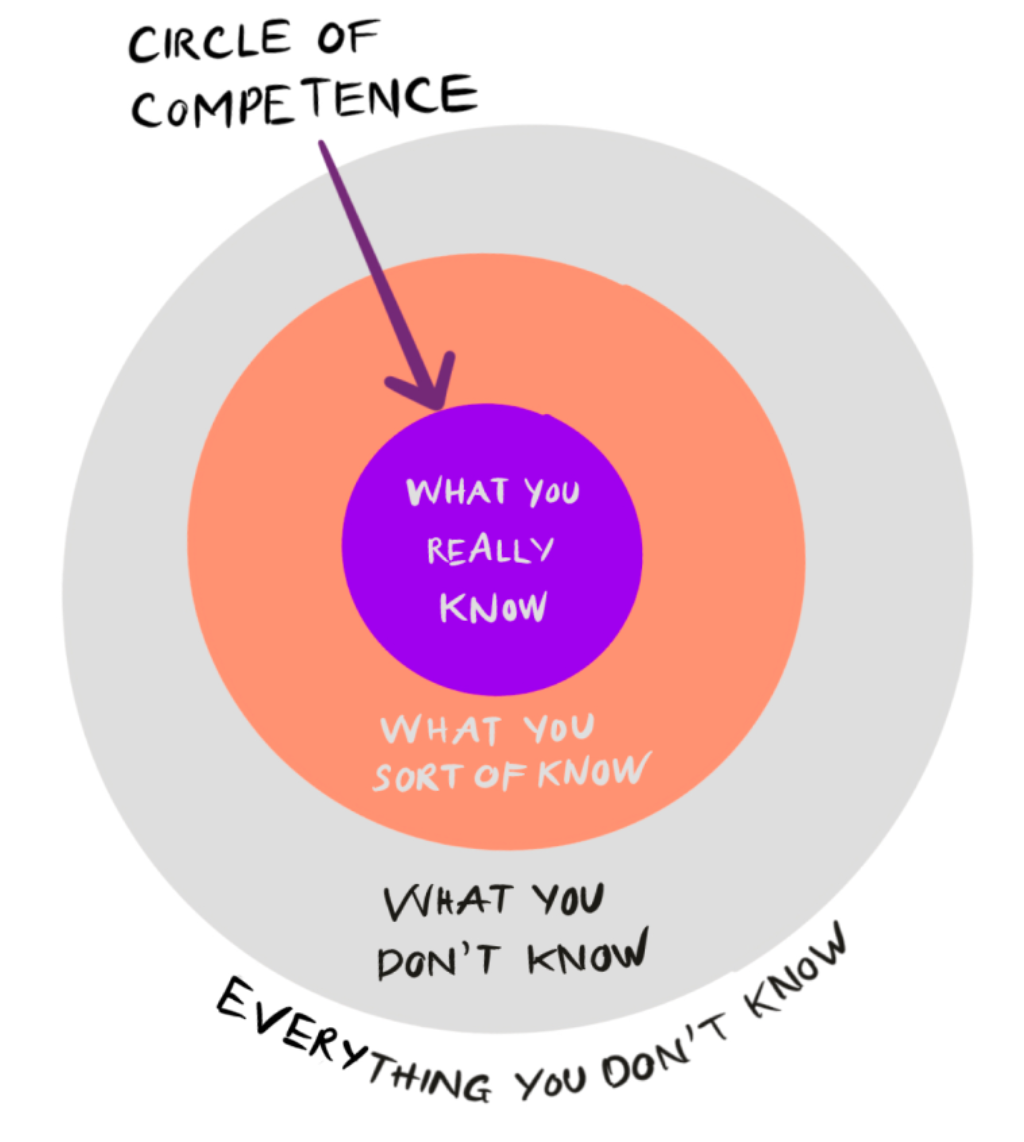

What is your circle of competence?

Your “circle of competence” is any product or service that you have an in-depth understanding of. Think about products or services you already use, and ones where you know what makes them better than others.

- Do you love certain subscriptions over others due to the available content?

- Do you choose certain apparel brands over others because of the quality and brand?

- Did you choose a bank over others because of the user experience?

- Did you choose certain tools at work because they’re more reliable than others?

- Do you shop at some supermarkets because they have the best prices?

- Do you use some social media apps because all your friends are on there?

Why start in our circle of competence?

There are many reasons to only look for investments within your circle of competence (like Buffett does), and here are three:

- It helps you avoid those costly mistakes of investing in things you don’t understand

- You already know what makes one product or service better than others

- Since analyzing a stock is essentially analyzing a business, and you already know the business, you’re halfway there.

So in your own time, fill out this table below to get an idea of where you have some experience already.

| What do I spend my money on? | What am I passionate about? | What is my line of work? |

|

|

|

Now that you’ve answered the questions above, it’s time to list what companies are the owners of those products and services you use or know?

| What do I spend my money on? | What am I passionate about? | What is my line of work? |

|

|

|

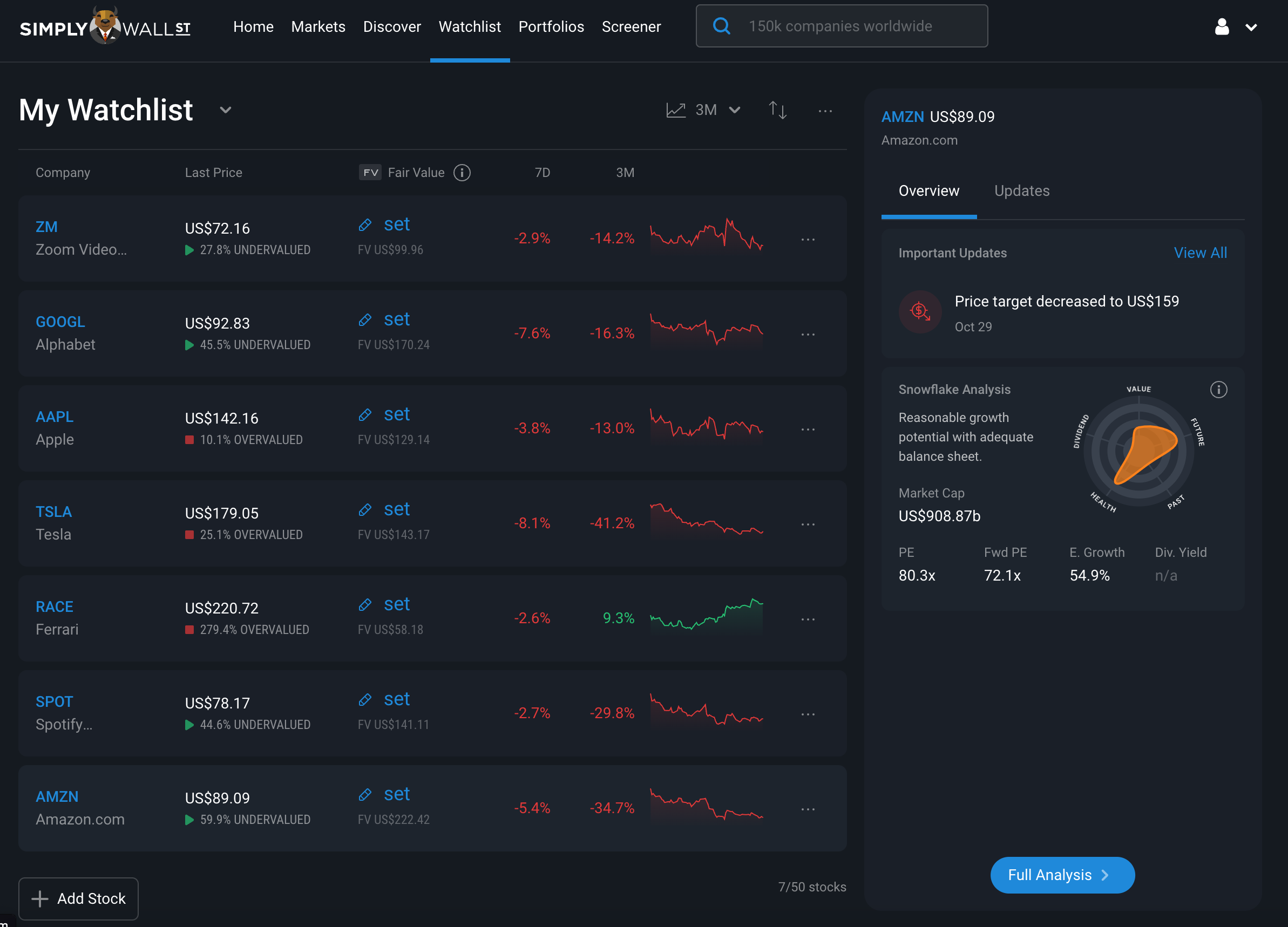

Once you know which companies you use above that are also publicly listed as stocks on the stock market, you can then add them to your Simply Wall St Watchlist!

Now that you have a bunch of stocks on our radar that you’re familiar with, let’s get to know them a little better in Part 2!

In Part 2: Get to know the business , you'll find out exactly where to look to get up to speed on these businesses in your watchlist!

And here's the link to the Simply Wall St Investment Checklist !

Lastly, if you've finished the How to Invest like the Best series, we'd love to hear your feedback!

Simply Wall St analyst Michael Paige holds a long position in AAPL, MA, AMZN and SPOT. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments. We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.