Luxury Brand Stocks Show Their Long-Term Resilience

Reviewed by Bailey Pemberton, Michael Paige

“Know what you own, and why you own it. Understand the nature of the companies you own and the specific reasons for holding the stock. (“It is really going up!” doesn’t count.)” — Peter Lynch

The best luxury goods are typically “better quality” than their cheaper counterparts in the sense that they are more durable. In the same vein, the stocks of those luxury goods makers also tend to act in a similar manner when market conditions get tough.

When volatility picked up last week it was the luxury goods segment that stumbled the most - which is something we haven't seen for a while. Today, we are taking a look at luxury goods stocks, some of which have managed to outperform in every market environment of the last 10 years.

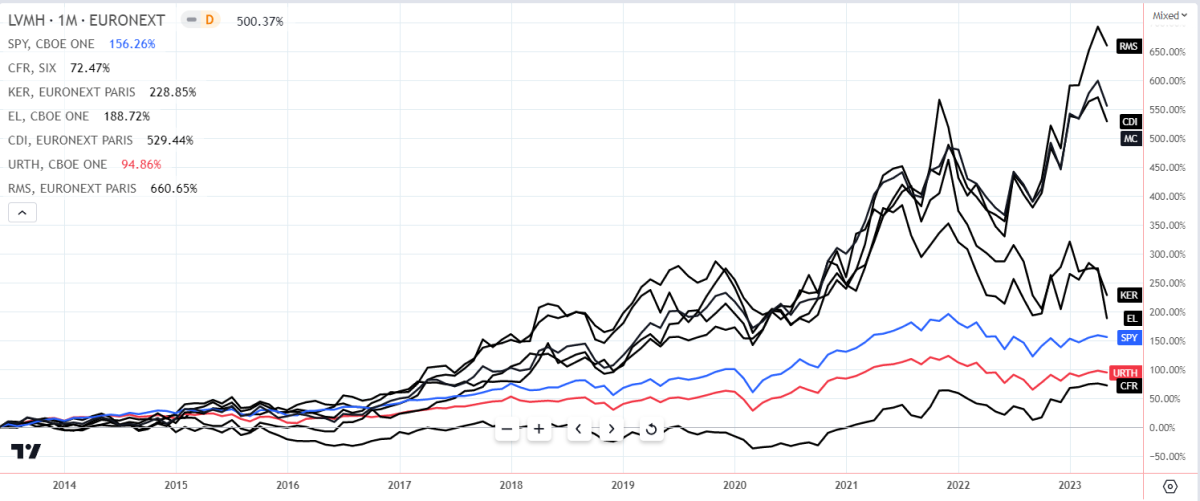

Below is the share price performance for Hermes, Christian Dior, LVMH, Kering, Estee Lauder and Richemont vs the S&P 500 (blue) and the MSCI World index (red) over the last 10 years.

Luxurious Profits From Luxury Goods

Bernard Arnault, who owns 48% of LVMH , rose to the top of the Forbes list of billionaires in December when he took the crown from Elon Musk. Arnault isn’t the only member of the list whose fortune comes from luxury goods. Five members of the Forbes top 50 can attribute their wealth to luxury brands like L’Oreal and Chanel. That number goes up to eight if we count Nike, Tesla and Zara ( Inditex ) as luxury brands. Clearly there is a lot of money to be made selling things to people with money.

The traditional luxury brands, most of which are based in Europe, belong to the market for jewelry and watches, fragrance and cosmetics, clothing, wine and spirits. These days, automakers like Ferrari and Porsche are routinely included, and so are some newer brands like Apple, and Tesla (though price cuts aren’t typical among luxury brands, so maybe that excludes TSLA).

The six stocks below are the most valuable ‘old school’ luxury goods companies that are publicly listed - along with their 12 month price returns. For a more comprehensive list of luxury goods companies, have a look at this portfolio .

The Luxury Premium, And Why It Rarely Drops

Brands are important for most companies, but when it comes to luxury products the brand is often the main feature.

The product quality might be superior, but the brand represents heritage, prestige and most importantly, scarcity. Many of the most valuable luxury brands are more than a hundred years old, and that history can’t be replicated.

From an investor’s point of view, luxury goods companies have a few unique attributes:

- Wide profit margins - which is typically rare in the retail and consumer goods industries and is a result of high price mark-ups. This gives them plenty of breathing room and means they don’t have to rely on higher sales volumes.

- Durability and resilience - luxury brands aim for timeless appeal, so their fortunes don’t rise and fall with each new fashion trend, and they aren’t at risk of being left behind when a new competitor arrives on the scene.

- Lower sensitivity to economic cycles - luxury spending is more closely tied to status than income.

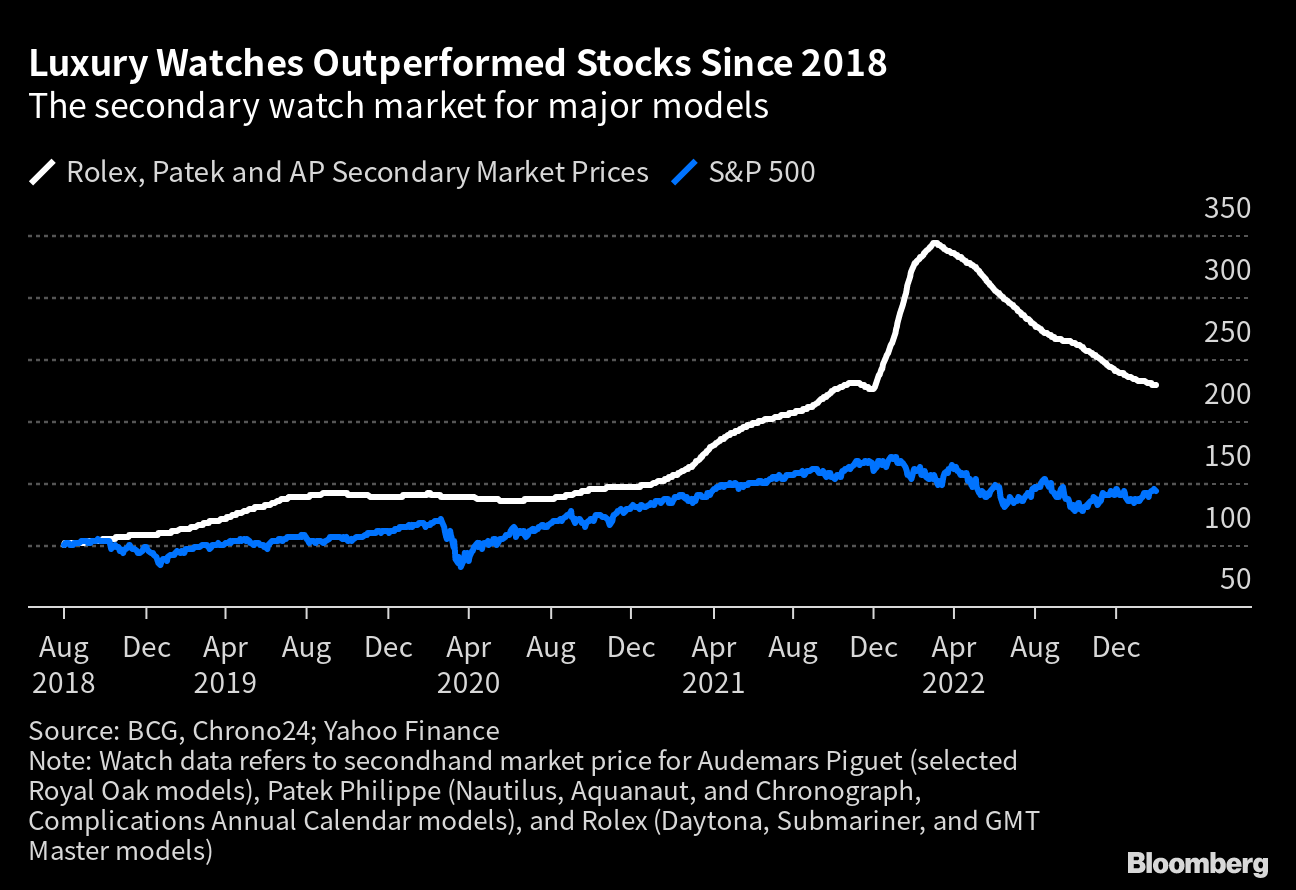

- The goods can be investments themselves - Some luxury products (watches in particular) are regarded as investments, and demand in the secondary market can increase the resale value of new products. The value of Rolex watches (unlisted) has supposedly outperformed every major asset class since 2011 .

- We must mention that investing in luxury goods is a lot like investing in the market. Buying a bunch of Rolex watches is not a good substitute for a well-researched stock portfolio. There are good and bad investments to be found, and a lot of effort goes into determining which products will appreciate. Scarcity and demand are important value drivers but not the sole arbiter of price appreciation.

- We must mention that investing in luxury goods is a lot like investing in the market. Buying a bunch of Rolex watches is not a good substitute for a well-researched stock portfolio. There are good and bad investments to be found, and a lot of effort goes into determining which products will appreciate. Scarcity and demand are important value drivers but not the sole arbiter of price appreciation.

The long term focus of luxury brands is good news for long term investors. By most measures, many of the companies mentioned are now trading somewhere between fair value and overpriced, (though you may disagree) but these companies have been around for a long time and they aren’t going anywhere anytime soon.

If you want to invest in the stocks of these luxury goods brands, it’s important to be prepared.

Because as they say, luck is when preparation meets opportunity. With that in mind, we as investors can:

- Research these luxury brands and focus on the high quality businesses (those with durable brands that thrive regardless of current trends, good growth prospects, high profit margins, high returns on invested capital, etc) that are within our circle of competence.

- It also helps to have an eye for all things fashion and luxury! Luxury goods are quite a fickle business and strong financial stewardship is only one side of the equation. Brands can emerge or disappear overnight off the back of choices in creative direction, emerging trends or through ill-disciplined product decisions.

- Once you feel comfortable with the underlying business and its future prospects, estimate your own intrinsic value for the stock and then determine a price that you’d be willing to pay for it (a “margin of safety” price that is BELOW your value estimate)

- Have dry powder (cash) on the sidelines, and be ready to act decisively when an opportunity arises. As Buffett has said: “If you want to shoot rare, fast-moving pink elephants, you should always carry a loaded gun.”

Since these luxury brand stocks rarely trade at a deep discount to their intrinsic value, we need to practice patience, and discipline. In reality, the same can be said for all investing.

The Berkshire of Luxury

Luxury goods are nothing new, but LVMH is the company that put them on the map as a stock market investing theme. Starting in the 1980s when Bernard Arnault orchestrated the merger of Louis Vuitton and Moët Hennessy, the company has grown into Europe’s most valuable company.

The group now owns 75 prestigious brands including Tiffany and Co, Dior, TAG Heuer and Bulgari. The companies are managed independently, while the holding company allocates capital wherever it sees the highest prospective returns. In this way LVMH is very similar to Warren Buffett’s Berkshire Hathaway.

Kering which owns Gucci and Yves Saint Laurent, amongst other brands, and Richemont which owns Cartier, Montblanc and other brands follow a similar pattern.

The Future of Luxury

The types of brands owned by LVMH and Richemont can easily be classified as luxury goods. It’s less clear when it comes to brands like Apple, Nike and Tesla. Maybe these are better described as “premium” or “prestige” brands. Nevertheless, these companies earn margins that are much higher than their respective industries, and also have the advantage of much bigger markets.

Large luxury conglomerates face an uncertain future, as the number of brands with long histories and good reputations are becoming fewer and further between through industry consolidation. In the coming years, we could see luxury conglomerates branching out into acquiring those “premium” brands as they’re more plentiful than their luxurious counterparts and more applicable to consumers.

In the past, department stores were an important part of the luxury goods industry. Their place is increasingly being taken by online retailers and marketplaces like Watches of Switzerland in the UK and RealReal and Farfetch in the US. RealReal specializes in second hand goods and handled $1.8 billion in 2022, with a commission rate of nearly 30%.

The Risks (and Traps to Avoid)

As mentioned, many of the top luxury stocks are potentially trading on elevated valuations at the moment. Besides valuation, here are a few things to watch out for when assessing stocks in the sector:

- Avoid fads: True luxury brands are timeless. Every now and then a new brand catches a trend and manages to earn lucrative profits - for a while. Crocs currently has one of the highest operating margins in the US footwear industry which is a nice little bonus for the footwear item that used to be the laughing stock of the fashion world. We’re not sure they have the timeless appeal to keep that margin, but they’re certainly trying to enhance their brand presence and longevity with collaborations with high fashion brands like Balenciaga and a very successful collaboration with American designer Salehe Bembury.

- Keep an eye on global wealth accumulation: The luxury sector has been riding the wave of wealth created via economic growth in Asia as well as super low interest rates in the West. Some of this effect has been paused in the last year. This pause is probably temporary, but if the world stops making millionaires, luxury spending is unlikely to grow like it has in the past.

- Succession: Some of Europe's luxury houses are owned and run by families - which can (and has) led to turmoil when it comes to succession.

- Brand Dilution: When management becomes too focussed on short term performance, they may be tempted to expand their market with lower price points. This results in profits in the short term, but dilutes the appeal of the brand in the long term.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇬🇧 The UK’s inflation rate fell sharply, but core inflation rose to a 30 year high. CPI rose 8.7% from a year earlier in April, down from 10.1% in March, while the c ore rate rose to 6.8% , higher than all 36 economists surveyed expected.

- 🇳🇿 New Zealand’s central bank raised the lending rate to 5.5%, a 14 year high, as expected. The RBNZ also said that rate hikes are now on hold, which wasn’t expected . New Zealand now has one the highest interest rates amongst developed economies.

- 🇺🇸 The US Fed released the minutes from the last monetary policy committee meeting. The minutes revealed that committee members are now divided on whether more rate hikes are needed …

And then, a few news items that we thought were worth noting…

- 🎬 Netflix recently reported that its ad supported tier now has 5 million subscribers. Ads on streaming platforms can be very effectively targeted which makes them attractive to advertisers. The key is to have enough subscribers to make it worthwhile, so this is a good start.

- This was one of the key bullish catalysts we identified when we recently looked at the bullish and bearish narratives for Netflix .

- 🛢 Exxon has bought drilling rights to extract lithium in Arkansas. Most of the big oil companies have now begun to diversify away from oil, some by joining the ‘lithium rush’, and others by looking to solar and wind.

- By Exxon’s own projections, fossil fuel powered light vehicle sales will peak in the next few years.

- 👕 It’s been a mixed bag for US footwear and apparel retailers. Urban Outfitters and Abercrombie & Fitch both reported very strong results sending their share prices up 31% and 17% respectively. Meanwhile American Eagle Outfitters and Foot Locker reported declining sales and saw their stock prices fall by double digits.

- This is a very tough industry. So be careful when looking at these stocks, and make sure you firstly have a solid narrative and, secondly are disciplined and conservative with your valuation approach.

Key Events During the Next Week

This week is all about employment data. On Wednesday and Thursday we will see employment data (and some inflation data) from Europe.

And then to the US with the JOLTs job opening report on Wednesday, the ADP employment report on Thursday and non-farm payrolls on Friday.

It’s the last big week of earnings season and a particularly big week for the cloud data and software companies:

- HP

- HP Enterprise

- Box

- CrowdStrike

- CRM

- Okta

- Netapp

- Veeva Systems

- Dollar General

- Lululemon

- MongoDB

- ChargePoint

- Broadcom

- Zscaler

- Dell

- SentinelOne

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.