Investing In Weight-loss And Diabetes Treatments

Reviewed by Bailey Pemberton, Michael Paige

“A 10% decline in the market is fairly common — it happens about once a year. Investors who realize this are less likely to sell in a panic, and more likely to remain invested, benefitting from the wealth-building power of stocks.” - Christopher Davis

Eli Lilly and Novo Nordisk shareholders must be pretty chuffed with the last few years of performance.

The latest generation of GLP-1 medications have resulted in massive gains for these two pharmaceutical giants. But the revolution may only just be getting started, as a pipeline of similar treatments are going through clinical trials.

These drugs could offer similar results to patients suffering from other conditions, and have far-reaching effects on other sectors and the economy.

We’re going to spend the next two weeks covering the investment opportunity and risks for these companies, as well as some of the industries that could be disrupted by these drugs.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

📉 Investors Dump Snowflake on Weak Outlook ( Barrons )

- What’s our take?

- Investors care about the future, not past performance. Snowflake actually beat estimates, but billings and the sales outlook disappointed. This added to negative sentiment that has been building for some time.

- Last week, Berkshire Hathaway disclosed that it had sold its entire stake. Buffett acquired the stake before the IPO, which attracted attention because Berkshire makes very few tech investments - or pre-IPO investments. The company made a small profit on the investment, unlike many of the investors that invested after the IPO.

- Investors are also beginning to wonder how much of a moat the company really has, and whether AI is an opportunity or a threat to the business.

- Lastly, have a look at the difference between Snowflake’s cash flow and GAAP earnings on the company report . The massive level of stock-based compensation turns a reasonable cash flow margin into a -30% profit margin!

- What’s our take?

-

🤝 OpenAI Signs Multi-year Content Partnership with Condé Nast ( BBC )

- What’s our take?

- If you can’t beat them, join them. The deal will allow OpenAI to train its models on content from titles including Vogue, Vanity Fair and GQ. Content from these publications will also be featured within OpenAI’s products.

- While some publishers are suing OpenAI for using their content, others are lining up to sign deals with the AI startup. Time magazine and IAC’s Dotdash-Meredith have also signed deals with OpenAI.

- Clearly, the disruption of the media industry is an ongoing phenomenon, and publishers are going to have to keep reinventing themselves to stay in business.

- What’s our take?

-

🛜 AMD Acquires Server Builder ZT Systems for $5bn to Enhance its Data Center AI Capabilities ( Reuters )

- What’s our take?

- Data centers are becoming more complex as compute power increases. AMD hopes that by combining its technology with ZT Systems' expertise in server and system design, it can offer data centers more comprehensive solutions.

- This will help AMD differentiate itself from Nvidia, and will also allow it to compete for market share with the other companies that supply products to datacenters.

- What’s our take?

-

🇺🇸 US Payrolls for 12 months to April Revised Down by 818k ( CNBC )

- What’s our take?

- The labour market might be weakening faster than previously thought. This was the largest revision by the National Bureau of Economic Research since 2009. However, it was widely expected and came in more or less in the middle of the range of estimates. It means that the US economy created 30% fewer jobs in the year to April than previously estimated.

- Whether the estimates were too high at the beginning or end of that period isn’t clear - and would make a big difference to the trend. This means the Fed’s actions, and statements, will be more closely watched than ever. Some argue that the Fed has more of a case to cut in September by 0.5% rather than just 0.25%.

- What’s our take?

-

🇨🇳 China’s $70bn Property Rescue Plan is Getting Off to a Slow Start ( FT )

- What’s our take?

- These stimulus policies may not be as effective as first thought. The People’s Bank of China and state banks are providing up to $70bn in funding to local governments to start buying up the country’s huge inventory of unsold homes and apartments. These would then be leased to citizens.

- Only about 5% of that amount has been lent out, as lenders and borrowers struggle to agree on valuations. Furthermore, potential borrowers aren’t sure they can lease the homes at rates that cover the interest.

- Rates on these loans may have to be lowered to close to zero - in which case, China may be entering its own ZIRP era.

- What’s our take?

-

🚀 New ETFs are Being Launched at a Record Pace in the US ( Reuters )

- What’s our take?

- Investors still love their ETFs. This year, an average of 50 new exchange traded funds have been launched each month. That’s only a little higher than last year, but substantially higher than the 38 launched each month in 2022.

- The universe for ETFs has grown with the addition of cryptocurrency ETFs, so perhaps the number isn’t surprising

- However, it’s worth remembering that new funds are launched when there is demand for them - not when the upside for the strategy is optimal. Earlier in the year, we covered some of the pros and cons of ETFs and how to make sure you know what you are getting into.

- What’s our take?

The GLP-1 Revolution

Over the last 2 years, and almost in parallel with the Generative AI boom, a revolution has begun in the treatment of diabetes and weight loss. Surging sales of Ozempic and Wegovy have helped Novo Nordisk overtake LVMH to become Europe’s most valuable company.

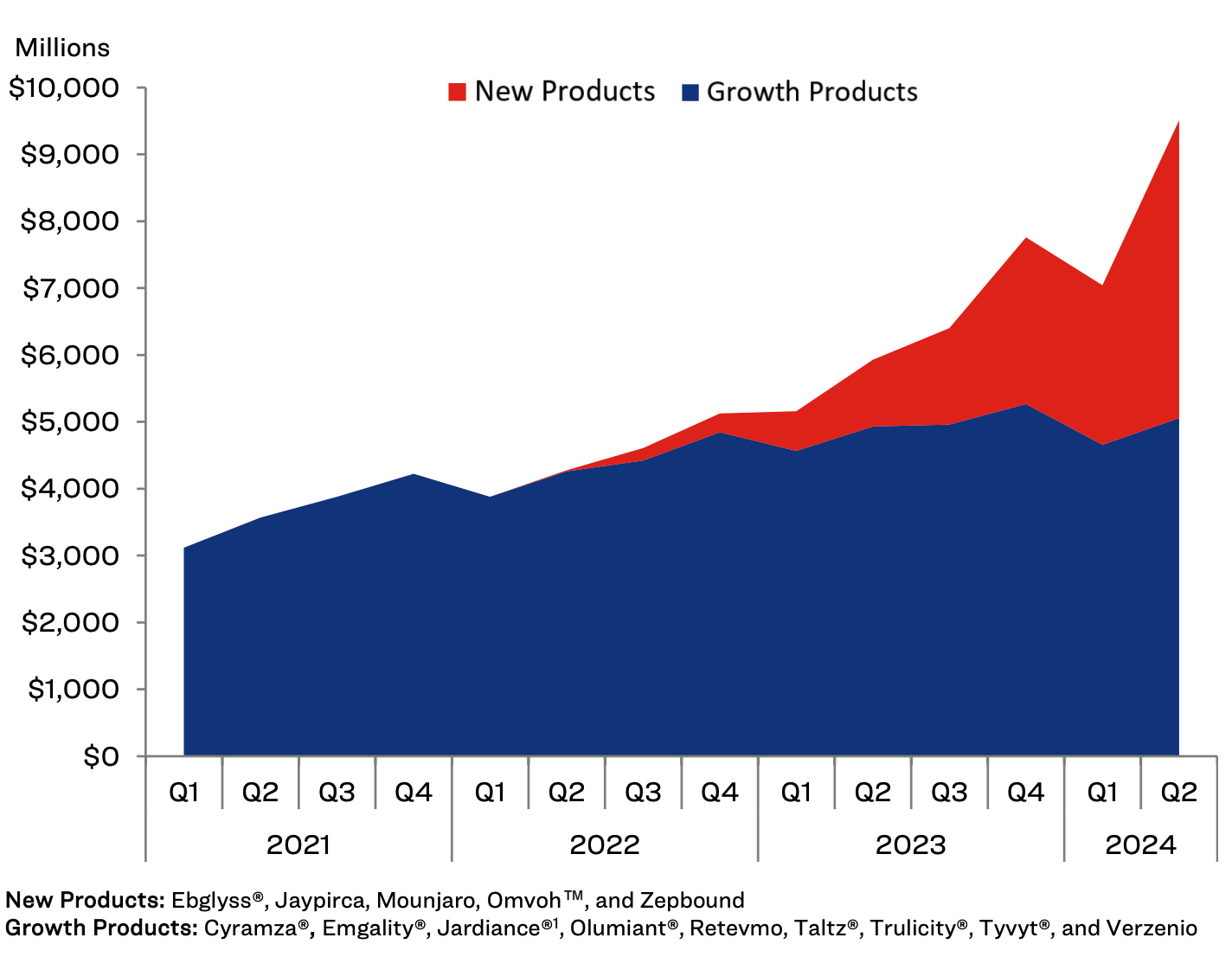

Eli Lilly followed with its own versions, Mounjaro and Zepbound . This chart illustrates the effect on sales of its growth product portfolio, and brings the term blockbuster drug to mind:

GLP-1 (glucagon-like peptide-1 agonists) drugs stimulate the body to create more insulin, which helps lower blood sugar levels. The first GLP-1 drug was approved for the treatment of type 2 diabetes nearly 20 years ago. Patients found that the drug also reduced their appetite and food intake, resulting in weight loss. In 2014 a newer variant was approved for weight management.

✨ The game changer was Novo Nordisk’s Semaglutide, which only needed to be injected once a week, rather than once or even twice each day.

Semaglutide was originally approved for type-2 diabetes under the brand name Ozempic . Rybelsus , the version that can be taken orally, was approved in 2019. In 2021, it was approved for weight management under the brand name Wegovy .

Tirzepatide , Ely Lilly’s own GLP-1 was approved for diabetes in 2022 under the brand name Mounjaro . It followed up with Zepbound for weight loss, which was approved in 2023.

💰 The $100 Billion Opportunity

Although Ozempic and Mounjaro were indicated for diabetes, they were both being prescribed ‘off-label’ for weight loss before the weight loss brands were approved. The positive results meant demand was already there long before Wegovy was approved.

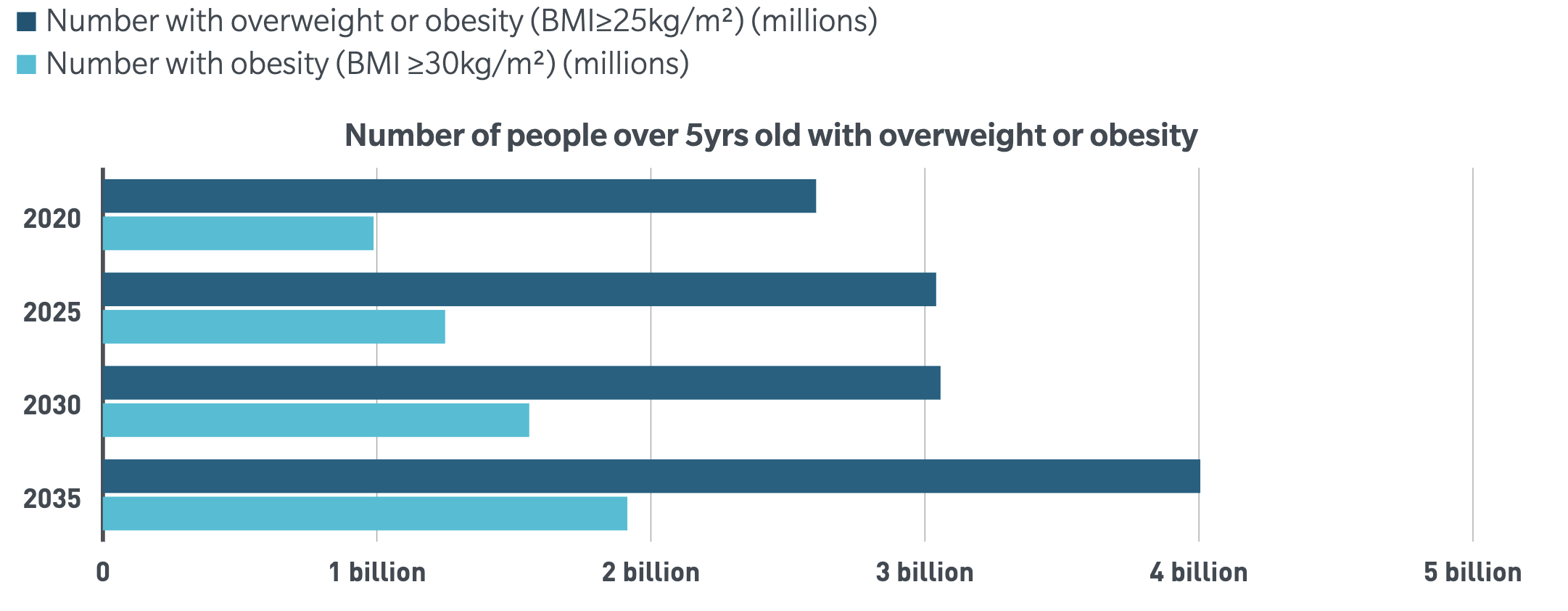

Type-2 diabetes affects over 500 million people worldwide. While the newer GLP-1s are very effective for diabetes, there are other ways to manage it. The impact on weight management was more pronounced because few treatments have had widespread success.

Obesity is more prevalent and a leading cause of type-2 diabetes, cardiovascular disease and other conditions. Weight management is therefore preventative and reduces the risk of numerous other conditions. It is therefore crucial to reducing overall healthcare costs - and can also lead to higher productivity for individuals and economies.

GLP-1 drugs are currently being developed and tested for a long list of other conditions , including sleep apnea, heart failure, chronic kidney disease, peripheral arterial disease, osteoarthritis, Alzheimer’s, and cancers. Most of the major pharmaceutical companies as well as lots of small research firms are developing treatments targeting these conditions.

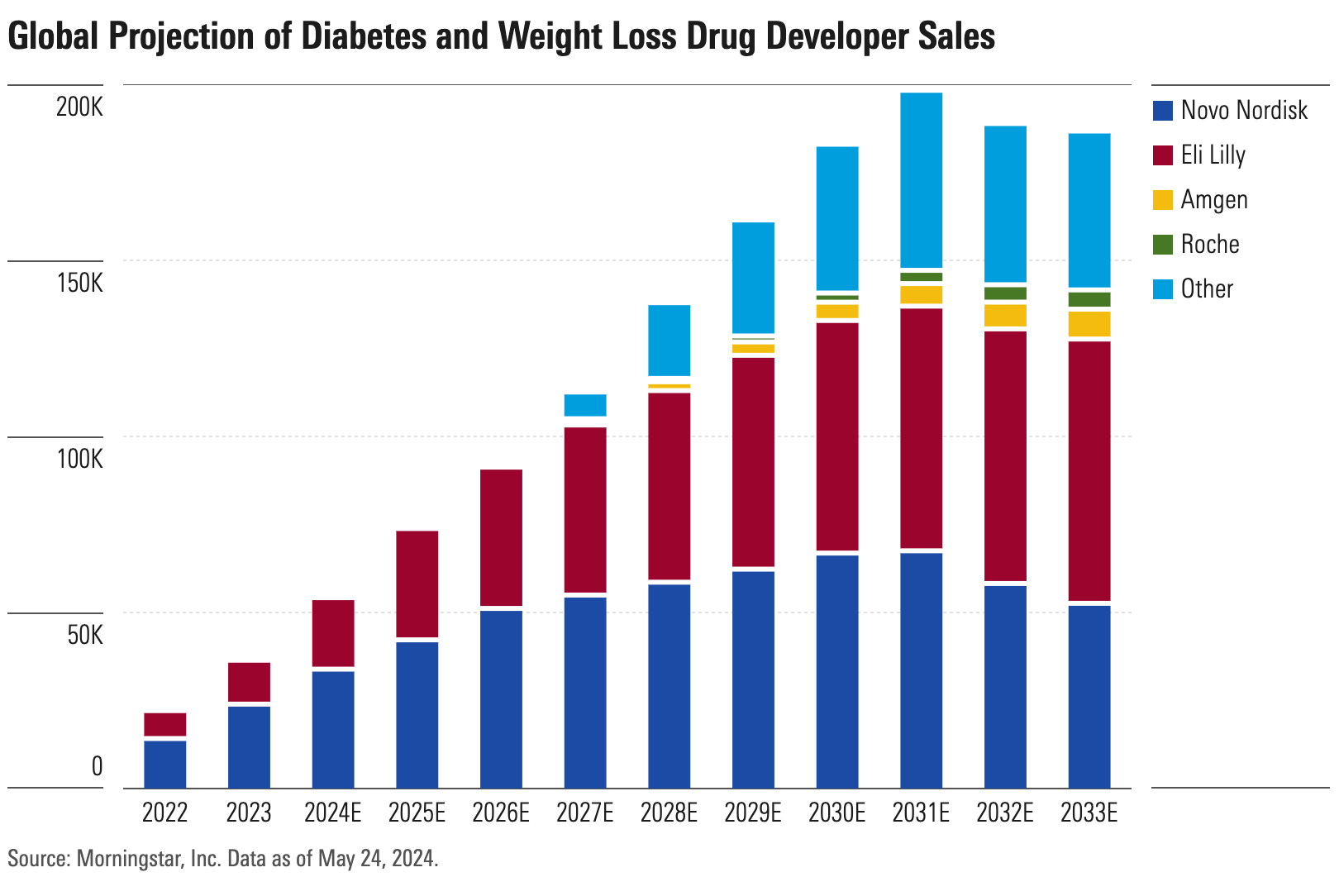

✨ Estimates of the potential GLP-1 market size vary widely, and range from around $70 billion to over $150 billion in the next decade. Most analysts also expect Novo Nordisk and Eli Lilly to continue to dominate the market for the next decade.

The projection below, from Morningstar, includes GLP-1 drugs as well as other diabetes and weight-loss treatments.

The reality could look quite different from this chart, as there are a few hurdles and limitations to growth. How and when these hurdles are overcome will shape the outcome for the overall market and for individual companies.

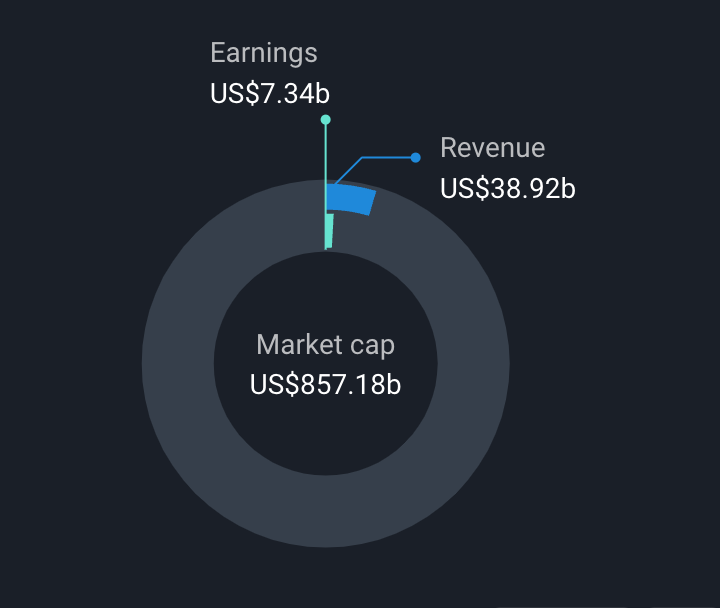

✨ Novo Nordisk is currently trading at around 47x EPS for the last 12 months and 32x estimated EPS for the next 12 months. Eli Lilly is trading at 118x historical EPS and 43x forward EPS. Those elevated valuations imply that investors believe consistent EPS growth will occur for quite a few years.

In the short term, the only constraint to sales growth is the ability of these companies to keep up with demand. Both companies are ramping up capacity at an impressive rate, and at some point supply will catch up with demand. The question then becomes about demand.

Potential Limitations To Growth And Demand

💰 Price

One of the most important factors in the global pharmaceutical industry is the price of medication in the US compared to elsewhere. In the case of drugs like Ozempic, a month’s supply in the US costs as much as $1,300, while it can cost less than 10% of that in Europe and elsewhere.

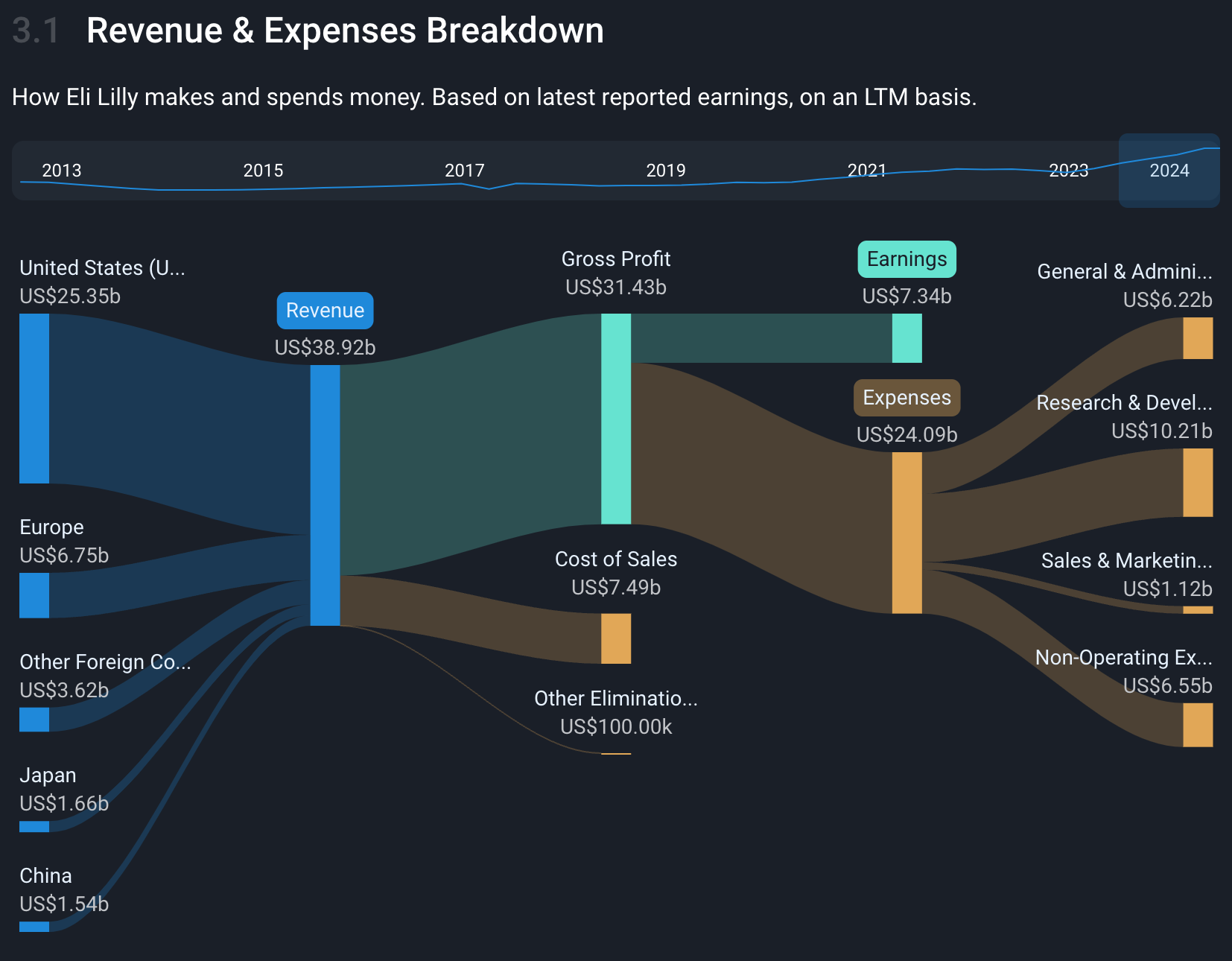

This isn’t unique to GLP-1s. For many pharmaceutical companies, the US accounts for most of the revenue and even more of the operating income. Here’s where Eli Lilly earns its revenue:

✨ In the last quarter both companies earned over 65% of their revenue from GLP-1s in the US, and with such a wide price differential, most of their profit too. This means further penetration of the US market is crucial to earnings growth.

Many of the current forecasts assume 10’s of millions of US citizens will be taking GLP-1 drugs in the next few years. Whether or not that can happen at the current price is the question.

Novo Nordisk’s CEO is due to testify before a Senate committee in September to justify the current pricing. Regardless of the outcome of that hearing, the number of patients that can afford the treatments may be limited. Employers have reported that GLP-1 drugs have led to much higher health costs, and healthcare premiums are expected to rise sharply.

Only so many people can afford to pay the ‘out of pocket’ expenses if insurers don’t cover the cost.

😰 Side Effects and Persistence

The second limitation on demand concerns side effects and how likely patients are to continue with injections long enough to be effective. Recent reports have shown:

- 🤢 Nausea is a very common side effect and causes some patients to stop the injections.

- 💪📉 Many patients experience muscle loss unless they increase protein intake and exercise.

- ⛔ Some studies showed that the majority of patients stopped the injections before the full benefit was achieved.

- The reasons for stopping included side effects, cost, and difficulty sticking to the schedule of injections.

New versions of the drugs are expected to address the common side effects. But, until they do, employers and health insurers may be reluctant to keep paying for treatment. There may be a long-term benefit to employers and insurers, but only if the treatment is effective.

✨ The bottom line is that the addressable market may be very big, but it might not be at the current price point. It’s typical for the price of a new product to come down as volume increases - but it may need to come down quite quickly for demand to keep rising.

Ultimately, there will be new competitors in the market too - so competitive forces will also lead to lower prices. But that’s likely to be a few years away, until then affordability and efficacy may play a bigger role.

💡 The Insight: Develop Your Narrative On GLP-1 Stocks Before Investing

The market for GLP-1 treatments is evolving and each company's earnings potential will depend on capacity, prices, volume and competition.

Creating an investment narrative will help you determine the price you are prepared to pay for a share and expect to earn a return - AKA a fair value estimate . It will also help you monitor the company’s progress and decide if or when it’s time to exit.

An investment narrative helps you tie the story behind a company to a fair value estimate. You can create a narrative on the Simply Wall St platform, and the fair value will show up on your watchlists alongside the current price.

A narrative consists of catalysts, assumptions, risks, and a calculation of fair value. We can use the example of the GLP-1 makers to illustrate these elements:

📈 Catalysts

The catalysts within the narrative are the primary drivers of a company’s revenue and earnings growth (or decline).

Industry catalysts concern the market for a company’s products and the competitive landscape. For GLP-1 manufacturers:

- The market is immense and while there are competitors, their products are still going through clinical trials.

- One of the two companies may have a better product, which could matter when supply matches demand.

- Demand is strong, but may be limited at the current price.

Company catalysts concern the company itself and its products. These catalysts could include:

- The entire product portfolio

- Capacity

- The pipeline of new drugs being developed.

📊 Assumptions

Your assumptions express the catalysts in terms of sales revenue and margins over the next five to ten years.

- You will also need to make assumptions about other factors like capital expenditure, share buybacks and the tax rate.

- You can then calculate an estimated net income figure for a given year in the future.

- Finally, you will need to estimate a P/E ratio that you think the market would pay for the share at that point in the future. This would depend on the growth rates leading up to that point, and the likely outlook at that point.

❗️ Risks

There are always risks to a narrative. These are events that may occur and could derail your narrative. For GLP-1 companies, the risks to your narrative could include:

- The emergence of long-term adverse side effects from a drug.

- A competing company could develop a breakthrough drug that shows far better results.

- Major changes to the US healthcare system.

Finally, you can put it all together by calculating your estimate of fair value. Don’t worry - the narrative builder will do this for you - just plug your assumptions into the calculator, and you’ll have your estimate.

If you develop a narrative and decide the share price is too high, your time hasn’t been wasted. The share price could fall, or the narrative might change, and imply a higher fair value. The work you put in now might help you spot a great opportunity in two or three years time.

Next week we’ll cover some of the companies with GLP-1 drugs in late-stage trials, some of the smaller companies developing other variants for a range of conditions. We’re also going to look at some of the other industries that could be disrupted by GLP-1’s, most notably food producers and other healthcare companies.

Key Events During the Next Week

The main event this week will be Nvidia’s second-quarter earnings, due out after the close on Wednesday.

Monday

- 🇺🇸 US Durable Goods Orders for July are due. The index is forecast to be down 0.3% for the month, after a big 6.6% decline in June.

Wednesday

- 🇦🇺 Australia’s consumer price index for July is expected to be 3.7%, down slightly from 3.8% in June.

Thursday

- 🇺🇸 US GDP data for the second quarter will be published. This is the second estimate, and is forecast to be 2.8%, up from 1.8% in the first quarter.

- 🇺🇸 US Initial Jobless Claims are forecast to be 242K, up from 232K earlier in August.

Friday

- 🇪🇺 Euro Area inflation data will be published. The previous estimate was 2.6%.

- 🇺🇸 US Personal income and spending and the PCE Price Index will be published. Spending is expected to show a slight decline, with incomes remaining flat. The core PCE price index is forecast to be up 0.2% MoM.

Besides Nvidia, there are quite a few prominent cloud software companies reporting, and a few retailers:

- NVIDIA Corporation

- Salesforce

- CrowdStrike

- PDD Holdings

- BHP Group

- SentinelOne

- Veeva Systems

- Dollar General

- Lululemon

- MongoDB

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.