What Happened in the Market This Week?

Q2 Earnings Season in the U.S. started last week, with major global companies reporting quarterly results. Despite that, equity markets have been struggling to find direction this week, with headline indices not making any substantial movements in the last seven days.

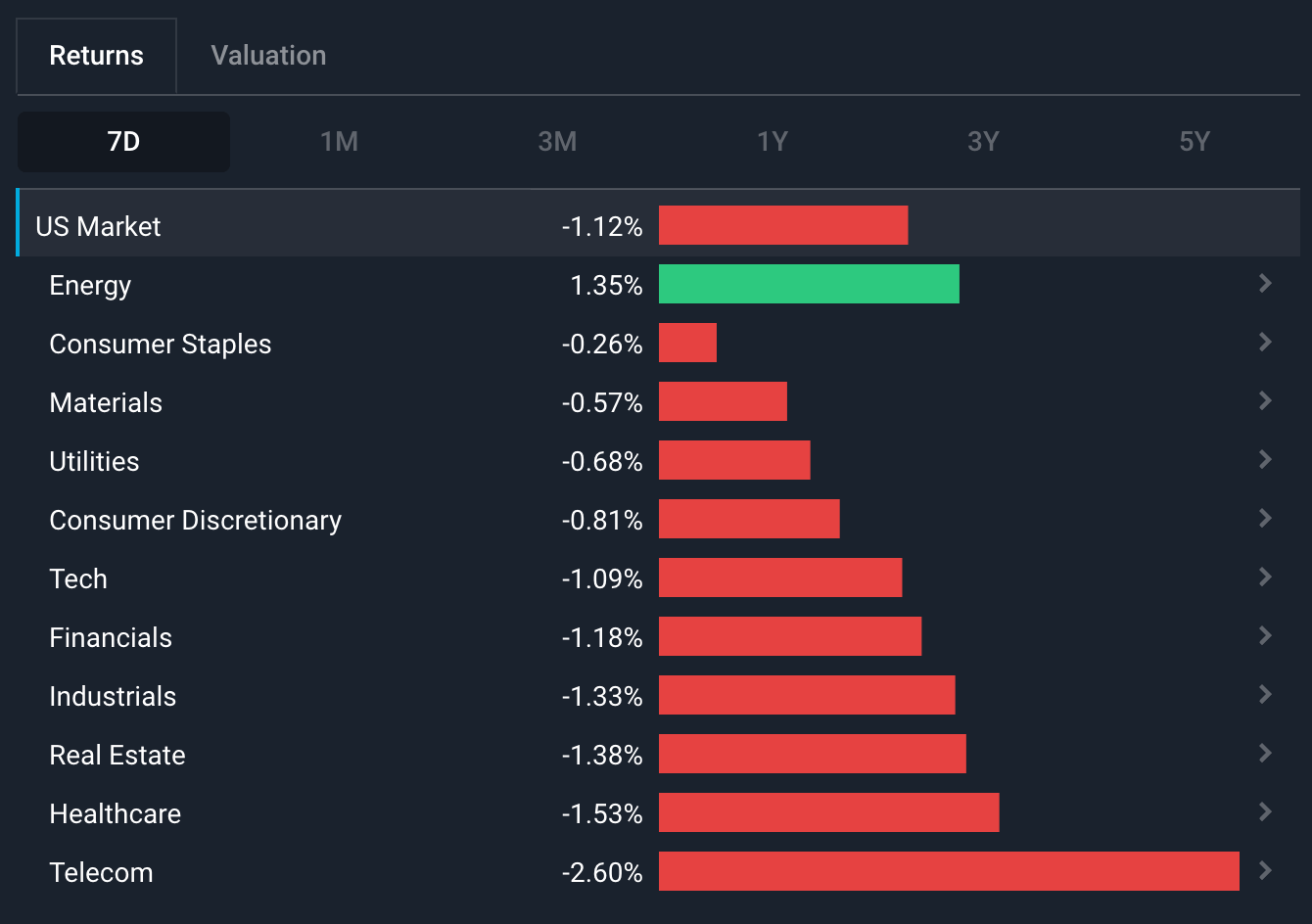

In the U.S., the previous week’s over-performers had switched to becoming under-performers. The telecom and healthcare sectors saw the biggest drops after leading the market the previous week, while the energy sector outperformed after lagging previously. You can find last week’s market report here .

Some of the developments we are watching over the last week include:

- The EUR and the USD are once again trading at the same level , 20 years after it last did so.

- Q2 Earnings Season is underway and all eyes are on the large companies reporting over the next two weeks.

The Euro and the Greenback are back in Parity after 20 Years

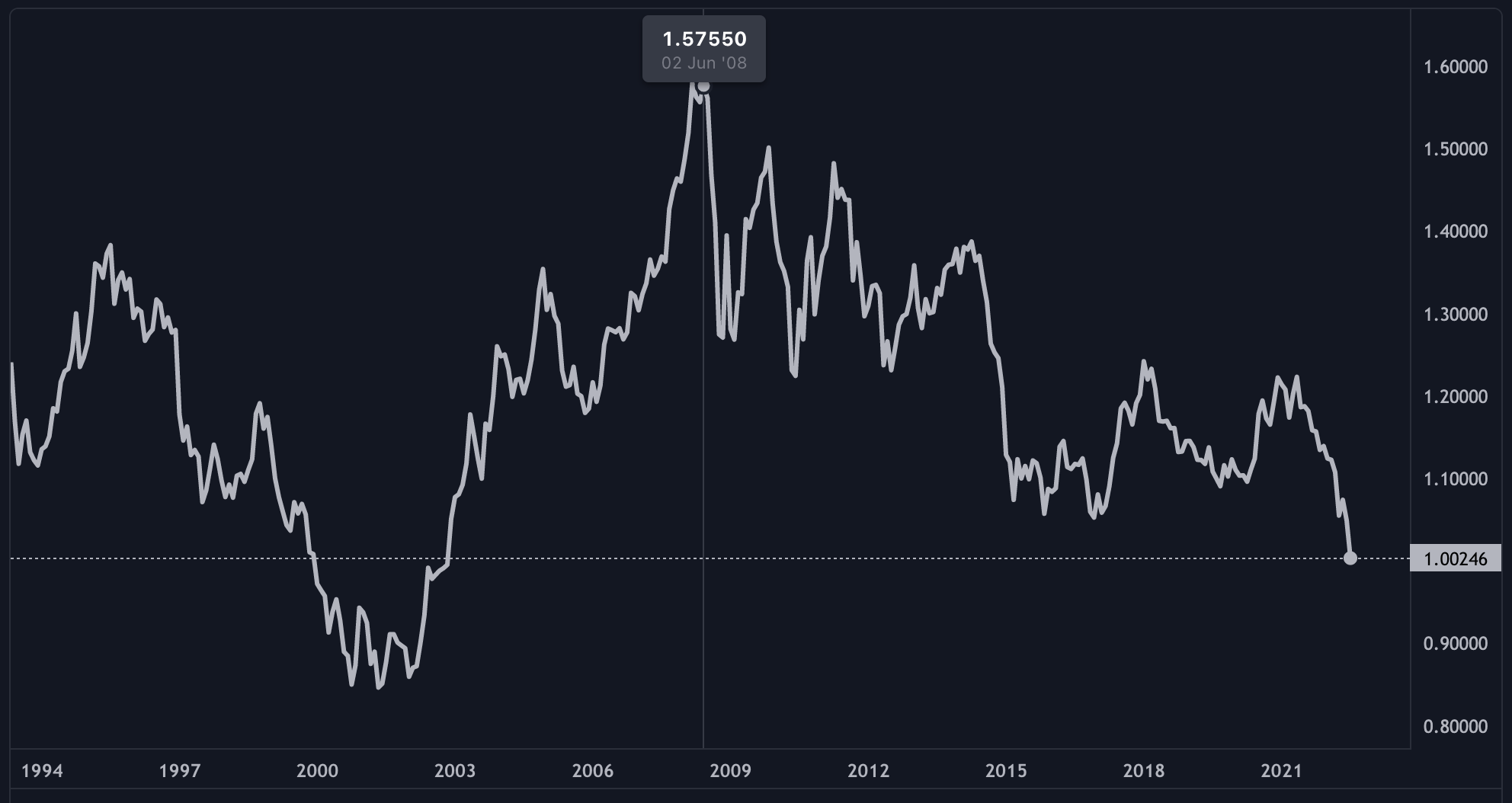

Last week, the Euro fell to trade at parity with the U.S. Dollar (i.e. 1 EUR = 1 USD) for the first time since November 2002. The European currency traded at its lowest level of US$0.84 in 2001, after which it strengthened to nearly US$1.60 in 2008. Since then, it has weakened steadily, losing 12% so far this year.

Why is the Euro so weak?

This is both a case of Dollar strength and Euro weakness. Europe’s economy has been negatively affected by the Russia-Ukraine war and the European Central Bank (ECB) has also been slower than the U.S. Fed to raise rates to combat inflation. This makes the USD a more attractive currency to hold given that interest rates for USD-denominated investments provide a higher return.

Why has the USD been so strong?

The main reason that the USD has remained relatively valuable is due to the U.S. Fed’s tightening policy overtaking all other central banks. As mentioned above, a higher interest rate provides for more attractive investments - and with the U.S. leading in rate hikes, more investors globally have geared towards U.S. investments.

The USD has also benefited this year as it has become just about the only ‘ safe haven ’ asset that has held up while equity and bond markets declined. The U.S. is less affected by the war and its resulting effects on inflation and supply chain issues, making it an attractive market to investors.

Until there is change in the dynamics that had caused the Euro to weaken, the Euro is likely to remain in a slump .

The Insight: How does a weak Euro impact investing?

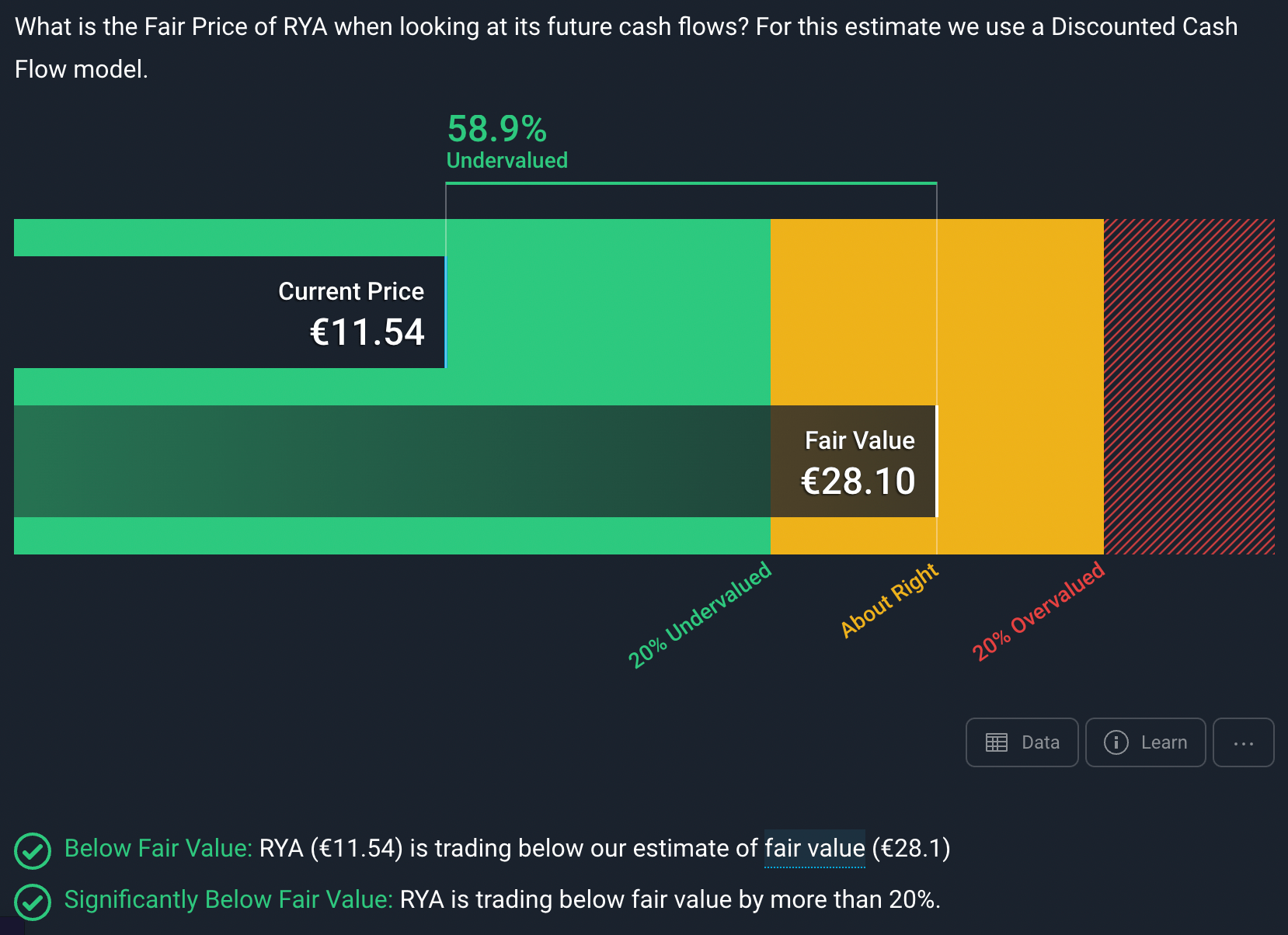

Investors should remember that a weak Euro is a challenge for importers and consumers in Europe. But there are some companies that stand to benefit. European exporters of vehicles like Volkswagen ( XTRA:VOW ) and BMW ( XTRA:BMW ), and luxury goods brands like LVMH ( ENXTPA:MC ) may benefit from higher sales as their products become cheaper for U.S. consumers. Likewise, European holidays are now cheaper for tourists from countries with relatively strong currencies. This could benefit companies like Ryanair ( ISE:RYA ), provided local travel within Europe doesn’t slow.

👉 When analyzing European companies, or companies with exposure to the Euro, there are two things investors should take note of. Firstly, you should check the regions the company operates in and specifically consider where sales actually come from. Some companies are globally diversified while others aren’t. Typically it’s the smaller companies that are less diversified and therefore more vulnerable.

The second factor to take note of is currency hedging. Some companies hedge their currency exposure while others don’t. This could mean that some European importers won’t be affected as much as we might assume — at least in the near term. To help with your analysis, we have written a list of the best stocks to invest in as the U.S. Dollar rises .

Second Quarter (Q2) Earnings Season is Underway

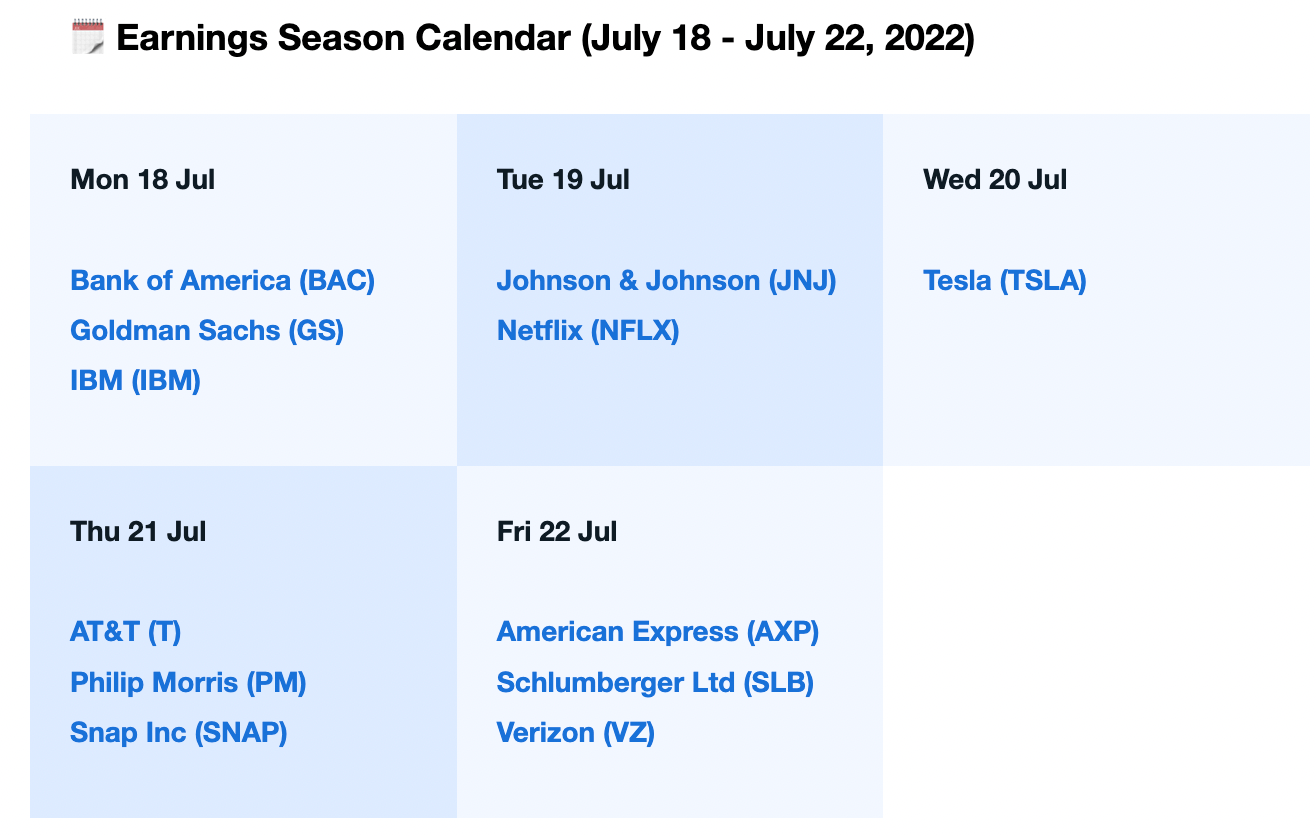

Second quarter earnings season started last week, with mostly financial service companies reporting. This week, companies in other sectors will start reporting, which will give us an idea of how those sectors are performing.

Some of the notable companies reporting this week are:

The Insight: Investors must take note that the macroeconomic environment for many companies have changed over this quarter, most notably with interest rate hikes . Earnings reports provide valuable information that may give you an early indication of what could be in store for companies you own.

👉 Investors would do well to study the reports, as requirements on transparency would have companies reporting whether they would be adversely impacted by any economic conditions.

Aside from that, company reports also generally influence the consensus for other companies in its industry. If a company misses consensus estimates, analysts may preempt the results for similar companies, leading to downward earnings revisions. While the EPS and revenue numbers are important, forward guidance often moves the market even more as it suggests the trend for the next few quarters.

Stock Market This Week

With earnings season well under way, the focus may shift from the economy to the performance of companies.

Nevertheless, some key economic data to keep an eye out for this week:

- July 19, 2022 (Tuesday):

- RBA Release of Interest Rate Minutes ( Australia )

- Unemployment Rate for May 2022 ( United Kingdom )

- Housing Starts and Building Permits Data ( United States )

- July 20, 2022 (Wednesday):

- Inflation Rates - YoY and MoM for June (United Kingdom & Canada )

- July 21, 2022 (Thursday):

- Trade Data & Bank of Japan’s (BOJ) Interest Rate Decision ( Japan )

- European Central Bank’s (ECB) Interest Rate Decision

- July 22, 2022 (Friday):

- Retail Sales Data (United Kingdom)

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.