Stock Analysis

- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (NASDAQ:WVE) shareholders are up 12% this past week, but still in the red over the last five years

It is doubtless a positive to see that the Wave Life Sciences Ltd. (NASDAQ:WVE) share price has gained some 55% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 75% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Wave Life Sciences

Because Wave Life Sciences made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Wave Life Sciences saw its revenue increase by 40% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 12% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

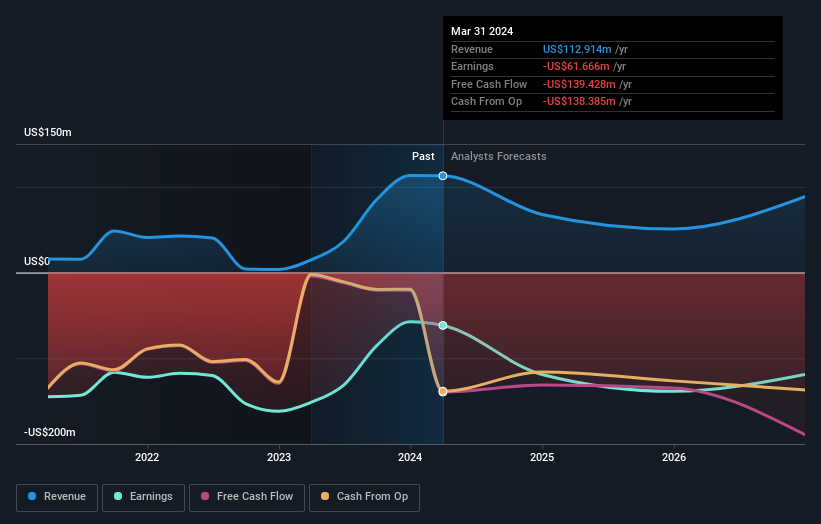

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Wave Life Sciences stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Wave Life Sciences shareholders have received a total shareholder return of 72% over one year. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Wave Life Sciences better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Wave Life Sciences , and understanding them should be part of your investment process.

But note: Wave Life Sciences may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Wave Life Sciences is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Flawless balance sheet with limited growth.