Stock Analysis

- United States

- /

- Life Sciences

- /

- NasdaqGS:LAB

Standard BioTools (NASDAQ:LAB shareholders incur further losses as stock declines 6.3% this week, taking five-year losses to 82%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Standard BioTools Inc. (NASDAQ:LAB) during the five years that saw its share price drop a whopping 82%. And the share price decline continued over the last week, dropping some 6.3%. However, this move may have been influenced by the broader market, which fell 3.2% in that time. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since Standard BioTools has shed US$65m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Standard BioTools

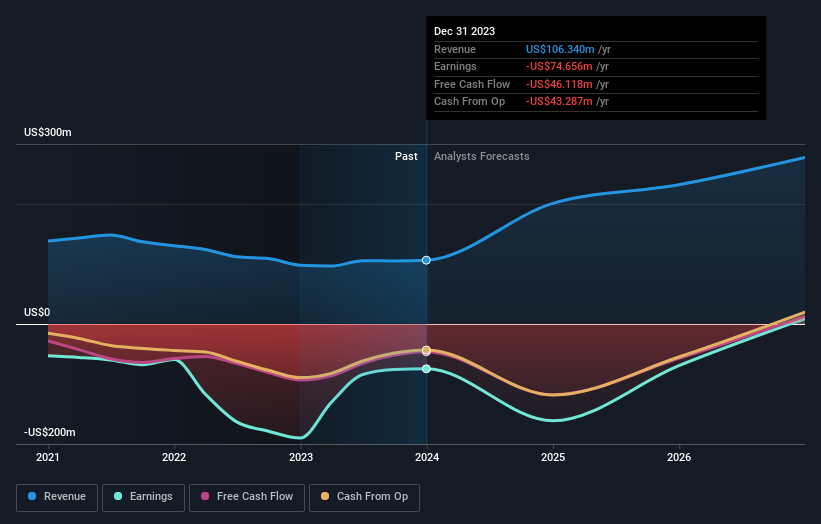

Because Standard BioTools made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Standard BioTools reduced its trailing twelve month revenue by 2.7% for each year. While far from catastrophic that is not good. The share price fall of 13% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Standard BioTools shareholders have received a total shareholder return of 53% over the last year. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Standard BioTools has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Standard BioTools is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LAB

Standard BioTools

Standard BioTools Inc., together with its subsidiaries, provides instruments, consumables, reagents, and software services for researchers and clinical laboratories in the Americas, Europe, the Middle East, Africa, and the Asia pacific.

High growth potential with excellent balance sheet.