Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics (NASDAQ:IOVA) pulls back 3.5% this week, but still delivers shareholders solid 141% return over 1 year

It might be of some concern to shareholders to see the Iovance Biotherapeutics, Inc. (NASDAQ:IOVA) share price down 15% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 141% in that time. So we think most shareholders won't be too upset about the recent fall. Only time will tell if there is still too much optimism currently reflected in the share price.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Iovance Biotherapeutics

With just US$1,189,000 worth of revenue in twelve months, we don't think the market considers Iovance Biotherapeutics to have proven its business plan. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Iovance Biotherapeutics has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Iovance Biotherapeutics has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

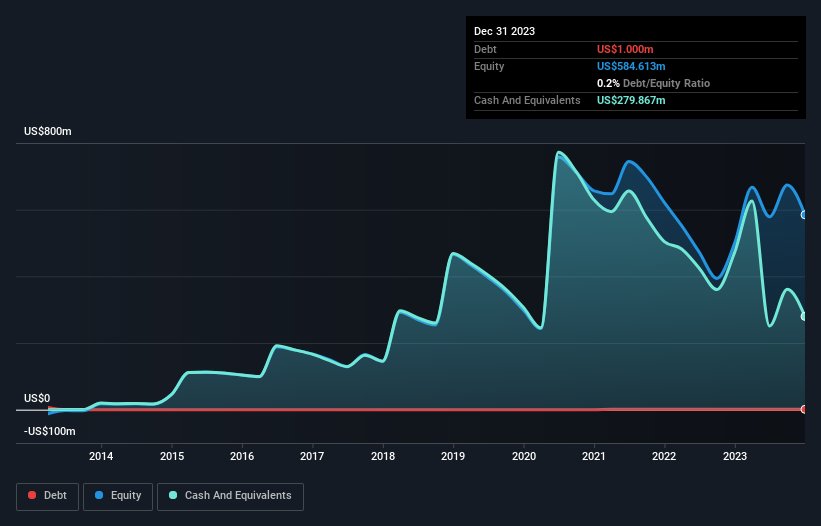

Iovance Biotherapeutics only just had cash in excess of all liabilities when it last reported. So it's prudent that the management team has already moved to replenish reserves through the recent capital raising event. It's a testament to the popularity of the business plan that the share price gained 87% in the last year , despite the recent dilution. You can click on the image below to see (in greater detail) how Iovance Biotherapeutics' cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

It's nice to see that Iovance Biotherapeutics shareholders have received a total shareholder return of 141% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Iovance Biotherapeutics that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Iovance Biotherapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biotechnology company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

High growth potential with adequate balance sheet.