Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Investors in Incyte (NASDAQ:INCY) have unfortunately lost 30% over the last three years

Incyte Corporation (NASDAQ:INCY) shareholders should be happy to see the share price up 14% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 30% in the last three years, significantly under-performing the market.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Incyte

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Incyte became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 12% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Incyte further; while we may be missing something on this analysis, there might also be an opportunity.

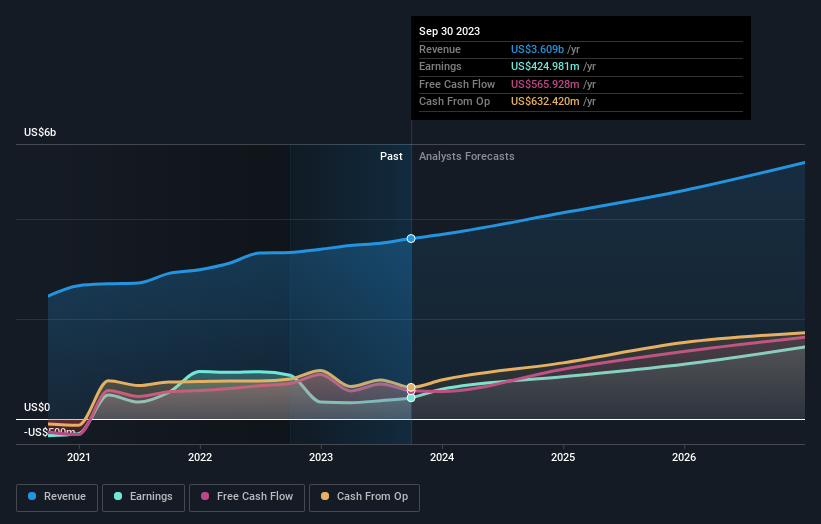

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Incyte is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Incyte in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 20% in the last year, Incyte shareholders lost 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Incyte that you should be aware of.

We will like Incyte better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Incyte is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INCY

Incyte

Incyte Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for hematology/oncology, and inflammation and autoimmunity areas in the United States and internationally.

Flawless balance sheet and undervalued.