Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:GTHX

G1 Therapeutics (NASDAQ:GTHX shareholders incur further losses as stock declines 10% this week, taking five-year losses to 82%

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held G1 Therapeutics, Inc. (NASDAQ:GTHX) for five whole years - as the share price tanked 82%. More recently, the share price has dropped a further 13% in a month. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for G1 Therapeutics

Given that G1 Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

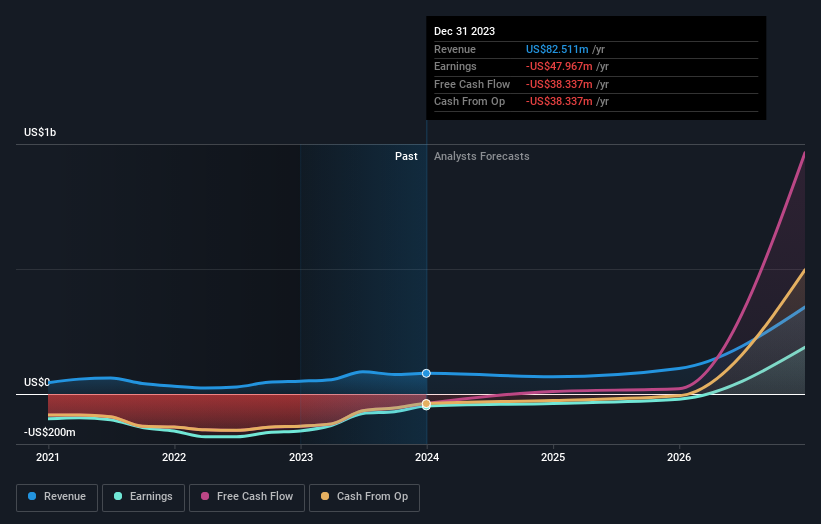

Over five years, G1 Therapeutics grew its revenue at 48% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 13% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at G1 Therapeutics' financial health with this free report on its balance sheet.

A Different Perspective

G1 Therapeutics' TSR for the year was broadly in line with the market average, at 27%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 13%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for G1 Therapeutics. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for G1 Therapeutics that you should be aware of before investing here.

We will like G1 Therapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether G1 Therapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTHX

G1 Therapeutics

A commercial-stage biopharmaceutical company, engages in the discovery, development, and commercialization of small molecule therapeutics for the treatment of patients with cancer in the United States.

Undervalued with high growth potential.