- United Kingdom

- /

- Airlines

- /

- LSE:WIZZ

August 2024's Top Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As global markets react positively to the Federal Reserve's announcement of upcoming interest rate cuts, small-cap stocks have notably outperformed their larger counterparts, with indices like the S&P 600 showing strong gains. This environment provides a fertile ground for identifying undervalued small-cap stocks that exhibit insider buying activity, which can be an indicator of potential growth and confidence from those closest to the company. In this context, a good stock is often characterized by solid fundamentals, attractive valuations, and positive insider actions—all elements that align well with current market optimism and economic indicators.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.0x | 0.9x | 42.66% | ★★★★★★ |

| Calfrac Well Services | 2.6x | 0.2x | 34.40% | ★★★★★★ |

| Hanover Bancorp | 8.9x | 2.0x | 49.93% | ★★★★★☆ |

| Trican Well Service | 8.1x | 1.0x | 5.93% | ★★★★☆☆ |

| German American Bancorp | 14.3x | 4.8x | 44.90% | ★★★☆☆☆ |

| MYR Group | 33.3x | 0.5x | 43.71% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Titan Machinery | 3.4x | 0.1x | -25.79% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -88.95% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | -269.24% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

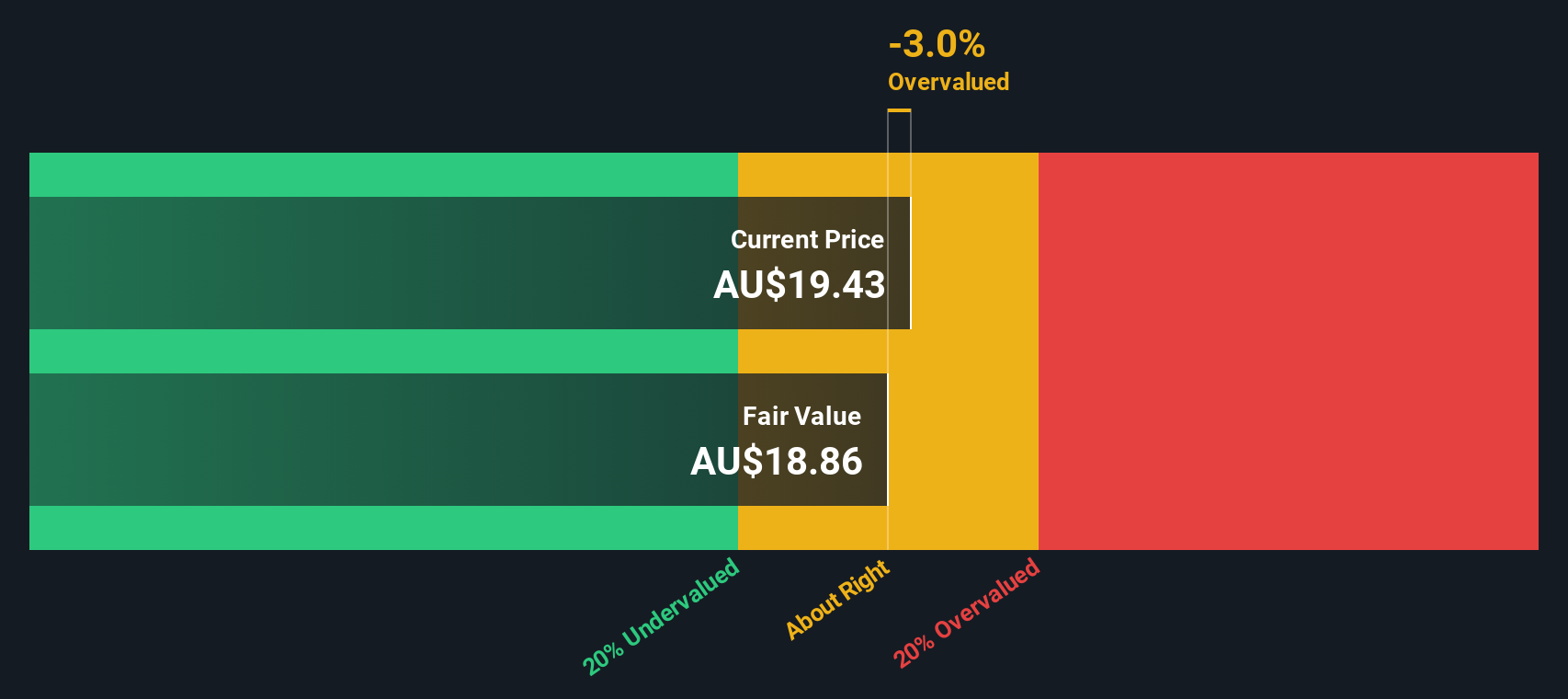

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Codan is a technology company specializing in communications and metal detection solutions, with a market cap of A$1.2 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with recent figures showing A$326.91 million and A$219.85 million respectively. The company's gross profit margin has shown variability, most recently recorded at 54.55% for the quarter ending March 31, 2024. Operating expenses are significant, including notable expenditures in sales & marketing and R&D, which were A$102.23 million and A$34.65 million respectively for the same period.

PE: 33.4x

Codan, a small cap stock, recently reported full-year earnings for 2024 with sales of A$550.46 million and net income of A$81.39 million, reflecting significant growth from the previous year. Basic earnings per share rose to A$0.45 from A$0.375 last year. They also announced an increased dividend of A$0.12 per share for the six months ending June 30, 2024, indicating strong insider confidence in their financial health and future prospects despite relying solely on external borrowing for funding.

- Click here to discover the nuances of Codan with our detailed analytical valuation report.

Review our historical performance report to gain insights into Codan's's past performance.

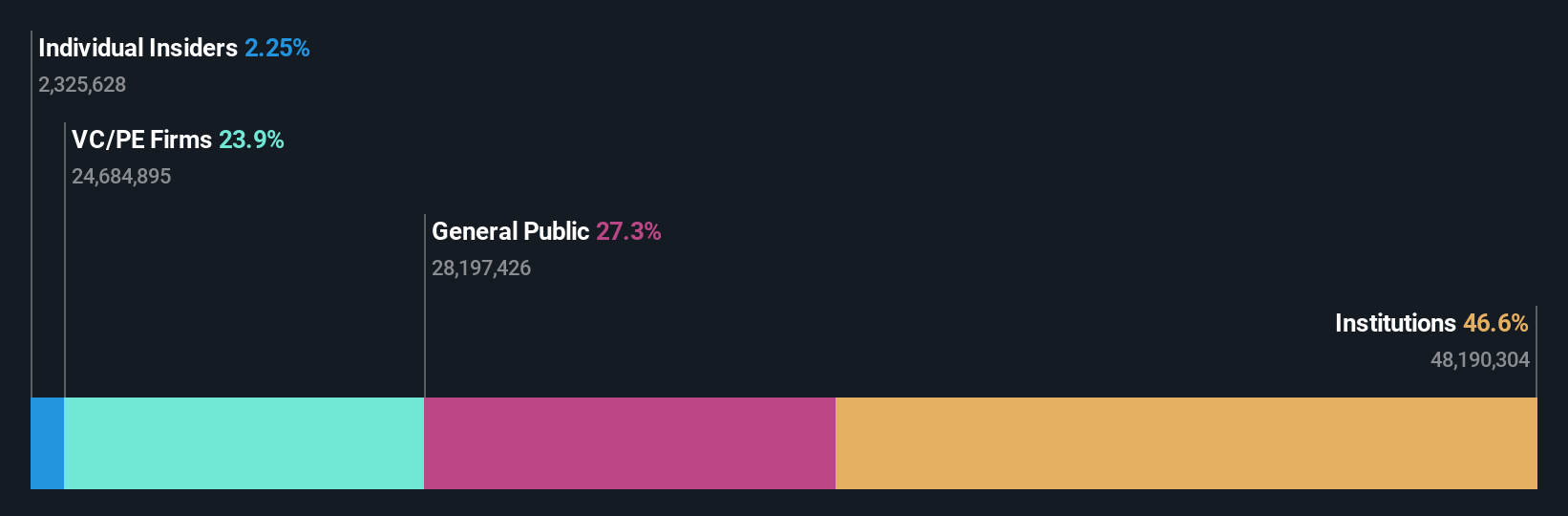

Wizz Air Holdings (LSE:WIZZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wizz Air Holdings operates as a low-cost airline providing passenger air transportation services across its entire route network, with a market cap of approximately £2.50 billion.

Operations: Wizz Air Holdings generates revenue primarily from its entire route network, with recent figures showing €5095.8 million. The company's cost of goods sold (COGS) for the same period was €3949.8 million, resulting in a gross profit of €1146.0 million and a gross profit margin of 22.49%.

PE: 5.1x

Wizz Air Holdings, a smaller aviation player, appears undervalued given its recent financial and operational metrics. Despite a volatile share price over the past three months and interest payments not well covered by earnings, the company forecasts 20.78% annual earnings growth. Recent results show stable passenger numbers with a load factor of 90%. Insider confidence is evident with significant share purchases in July 2024. Future guidance suggests improved load factors and net income between €350 million and €450 million for fiscal year 2025.

- Take a closer look at Wizz Air Holdings' potential here in our valuation report.

Explore historical data to track Wizz Air Holdings' performance over time in our Past section.

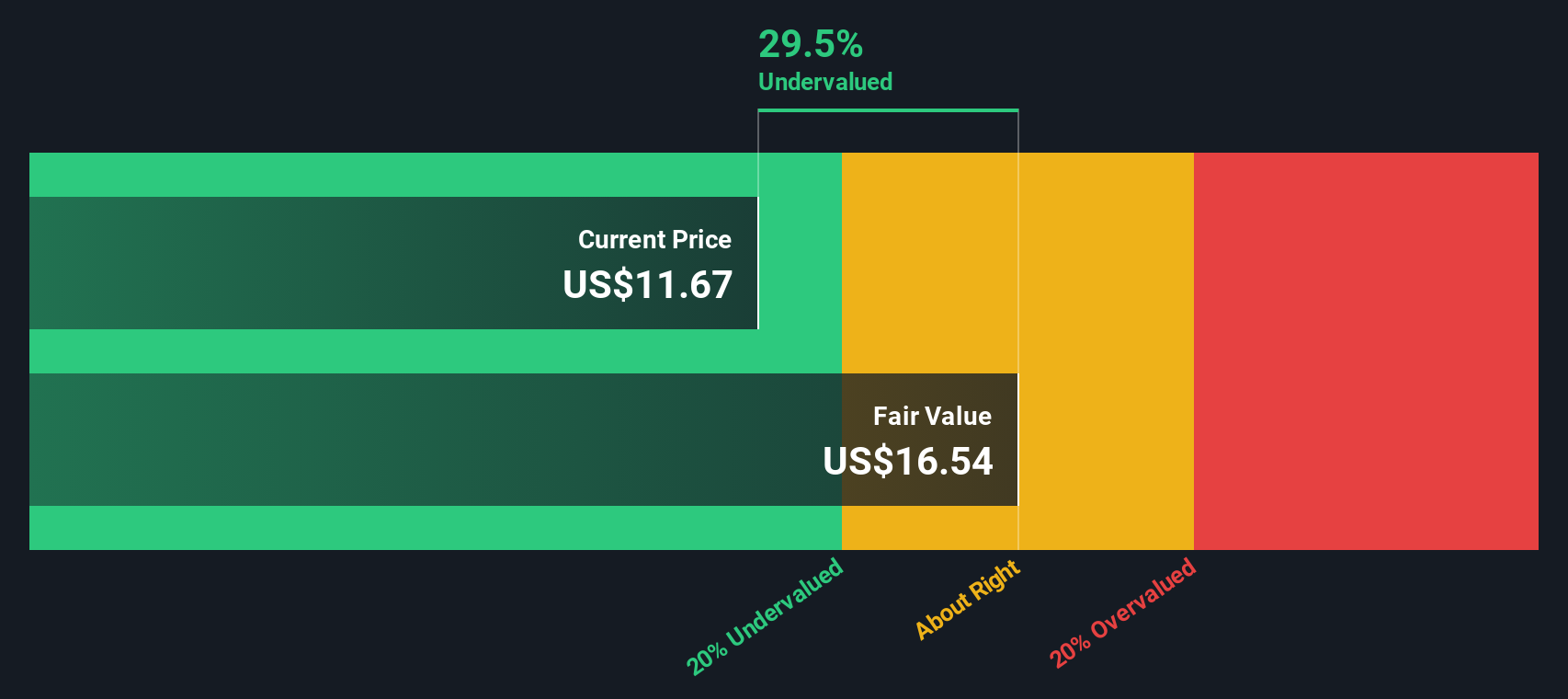

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates expedition cruises and adventure travel experiences, with a market cap of approximately $0.55 billion.

Operations: The company generates revenue primarily from Lindblad and Land Experiences segments, amounting to $405.86 million and $185.61 million respectively. For the most recent period ending 2024-06-30, it reported a gross profit margin of 44.10%.

PE: -10.5x

Lindblad Expeditions Holdings, a small-cap company in the expedition cruise industry, recently reported second-quarter sales of US$136.5 million, up from US$124.8 million a year ago. Despite this growth, net losses increased slightly to US$24.67 million from US$24.47 million last year. The company has closed a shelf registration worth nearly US$6 million and insiders have shown confidence through recent share purchases in August 2024. With new Galápagos vessels joining their fleet and earnings projected to grow by over 100% annually, Lindblad appears positioned for potential future growth despite current financial challenges.

- Click to explore a detailed breakdown of our findings in Lindblad Expeditions Holdings' valuation report.

Understand Lindblad Expeditions Holdings' track record by examining our Past report.

Summing It All Up

- Click through to start exploring the rest of the 214 Undervalued Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wizz Air Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIZZ

Wizz Air Holdings

Engages in the provision of passenger air transportation services.

High growth potential and fair value.