Stock Analysis

- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Undiscovered Gems In The United States For August 2024

Reviewed by Simply Wall St

The market has been flat over the last week, but it has risen 25% in the past 12 months with earnings forecast to grow by 15% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover some truly promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Planet Image International | 119.30% | 2.39% | 0.80% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Helport AI (NasdaqCM:HPAI)

Simply Wall St Value Rating: ★★★★★☆

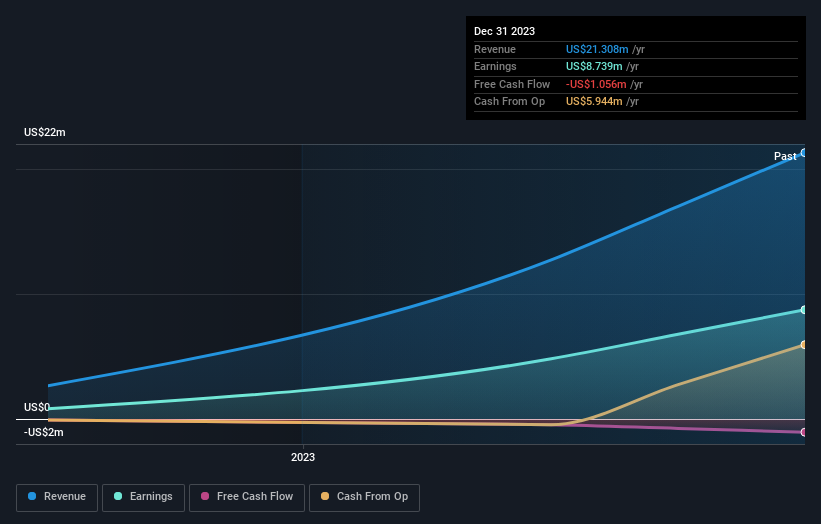

Overview: Helport AI Limited, an AI technology company with a market cap of $255.06 million, offers intelligent products, solutions, and a digital platform designed to enhance communication between businesses and their customers to boost sales performance.

Operations: Helport AI generates revenue primarily from its Software & Programming segment, amounting to $21.31 million.

Helport AI, a small cap stock, recently joined the NASDAQ Composite Index on August 6, 2024. The company’s earnings surged by 208% over the past year, outpacing the software industry’s growth of 23%. Trading at nearly 90% below its estimated fair value, Helport AI's net debt to equity ratio stands at a satisfactory 4.5%, and its EBIT covers interest payments by an impressive 403 times. However, it is not free cash flow positive.

- Navigate through the intricacies of Helport AI with our comprehensive health report here.

Explore historical data to track Helport AI's performance over time in our Past section.

Jiayin Group (NasdaqGM:JFIN)

Simply Wall St Value Rating: ★★★★★★

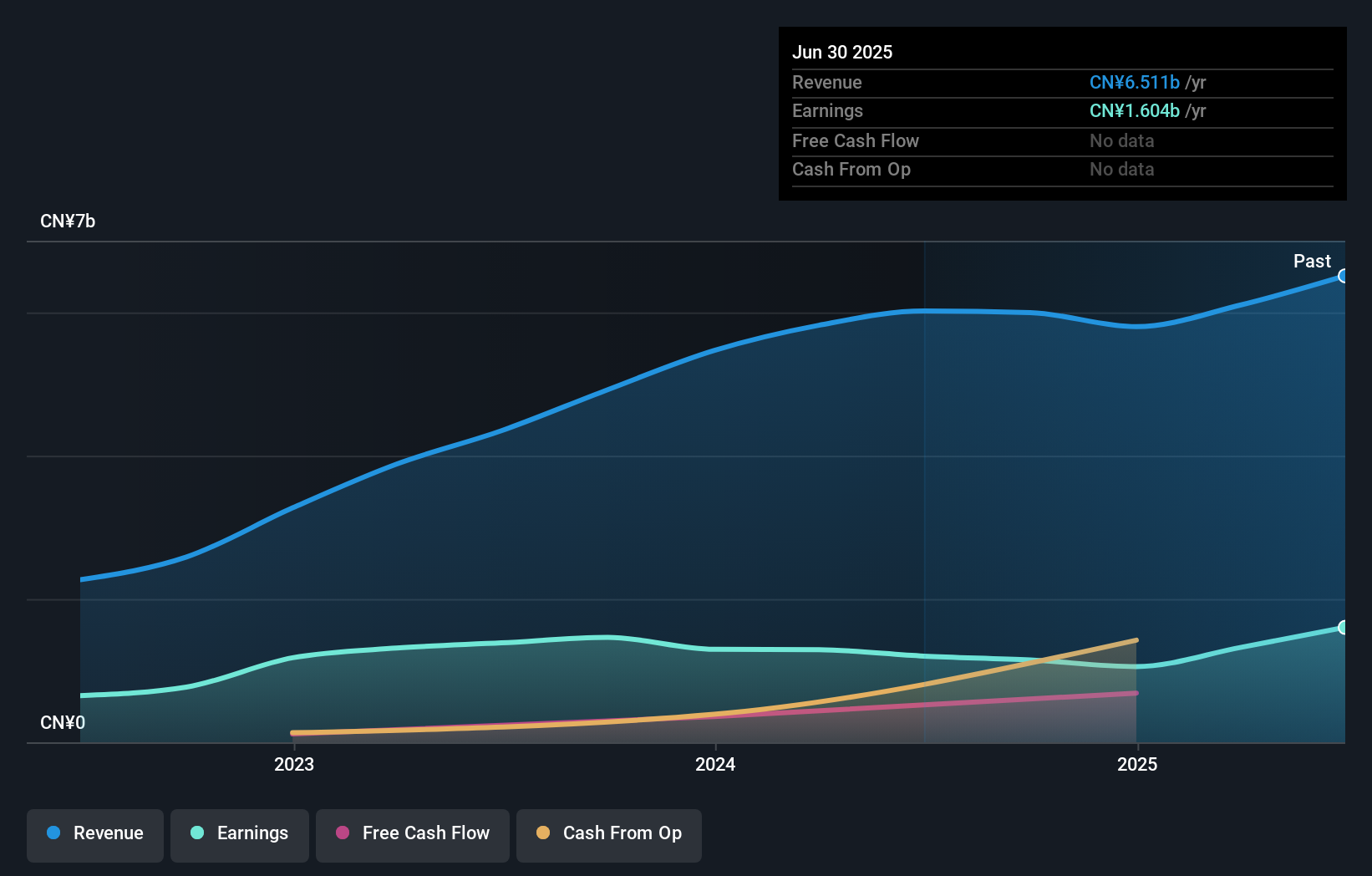

Overview: Jiayin Group Inc., along with its subsidiaries, offers online consumer finance services in the People’s Republic of China and has a market cap of $322.44 million.

Operations: Jiayin Group generates revenue primarily from its online consumer finance services, amounting to CN¥5820.05 million. The company has a market cap of $322.44 million.

Jiayin Group, a relatively small player in the consumer finance sector, is trading at 85.3% below its estimated fair value and carries no debt. Despite a net profit margin drop from 33.9% to 22.2%, it remains profitable with high-quality earnings and positive free cash flow. Recent developments include board-approved dividends of $0.50 per ADS payable in early September and a shelf registration for $200 million filed in June 2024, indicating potential future capital raises or financial flexibility enhancements.

- Unlock comprehensive insights into our analysis of Jiayin Group stock in this health report.

Gain insights into Jiayin Group's historical performance by reviewing our past performance report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

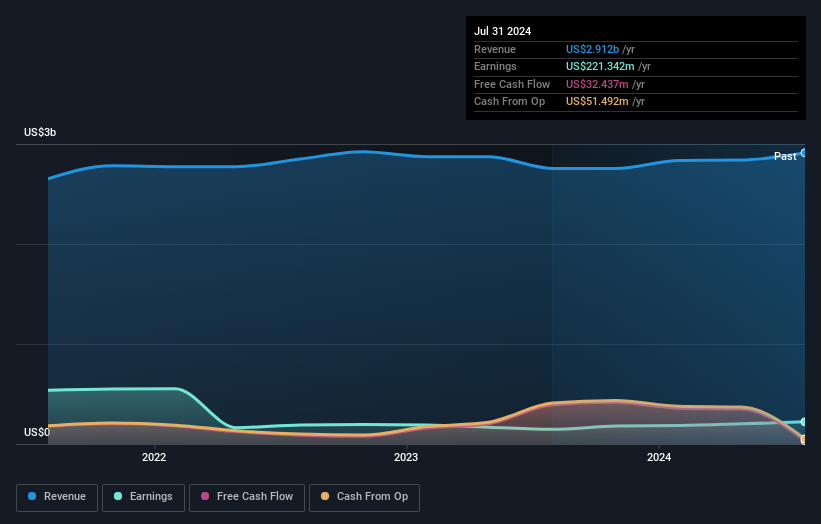

Overview: Hovnanian Enterprises, Inc., with a market cap of $1.24 billion, designs, constructs, markets, and sells residential homes in the United States through its subsidiaries.

Operations: Hovnanian Enterprises generates revenue primarily from its Homebuilding segments, with the West contributing $1.35 billion, Northeast $935.87 million, and Southeast $480.25 million. The Financial Services segment adds $66.16 million to the revenue stream.

Hovnanian Enterprises has been making waves with impressive financials and strategic moves. Notably, the company’s net debt to equity ratio stands at 141.9%, signaling high leverage, yet its interest payments are well covered by EBIT at 6.5x. Earnings grew by 20.3% over the past year, outpacing the Consumer Durables industry average of -2.1%. Recent earnings guidance projects full-year revenues between US$2.90 billion and US$3.05 billion, with EPS expected between US$29 and US$31.

Make It Happen

- Click this link to deep-dive into the 221 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.