Stock Analysis

- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Three Undiscovered Gems in the United States with Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 1.2%, driven by gains of 1.0% in the Information Technology sector. Over the past 12 months, the market is up 26%, with earnings forecast to grow by 15% annually. In this favorable environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hamilton Beach Brands Holding | 34.31% | 1.65% | 4.46% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| San Juan Basin Royalty Trust | NA | 39.20% | 40.92% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Oil-Dri Corporation of America | 20.63% | 10.47% | 20.87% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

XPEL (NasdaqCM:XPEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: XPEL, Inc. operates globally in the sale, distribution, and installation of protective films and coatings with a market cap of $1.25 billion (NasdaqCM:XPEL).

Operations: XPEL generates its revenue primarily from the Auto Parts & Accessories segment, which accounted for $408.24 million. The company’s cost structure and profit margins are not specified in the provided data.

Trading at 28.4% below its estimated fair value, XPEL has seen its debt to equity ratio rise from 4.6% to 5.6% over the past five years and boasts a robust EBIT coverage of interest payments (48.1x). Despite a recent earnings dip (-3.1%), it remains profitable with high-quality earnings and positive free cash flow. Recent legal challenges, including class action lawsuits, have emerged, yet Q2 revenue grew to US$109.92 million from US$102.24 million last year while net income slightly decreased to US$15.03 million from US$15.74 million in the same period.

- Take a closer look at XPEL's potential here in our health report.

Gain insights into XPEL's historical performance by reviewing our past performance report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hovnanian Enterprises, Inc., with a market cap of $1.38 billion, designs, constructs, markets, and sells residential homes in the United States through its subsidiaries.

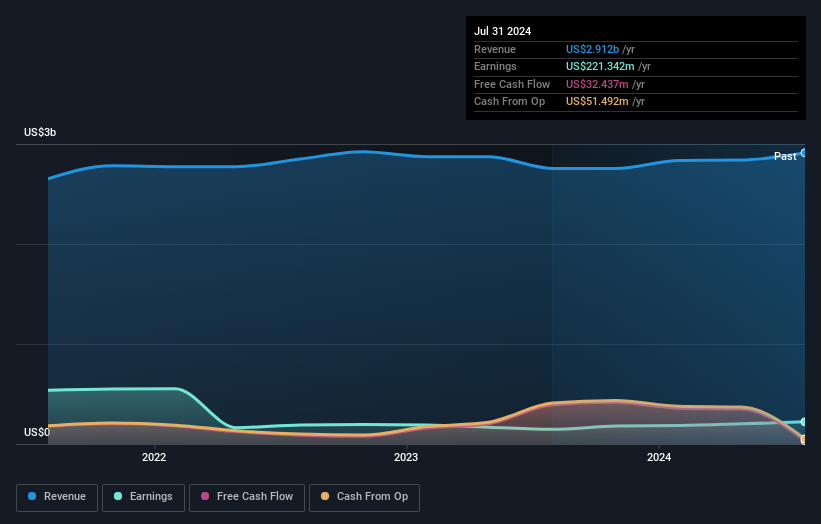

Operations: Hovnanian Enterprises generates revenue primarily from its residential home construction and sales, with a notable contribution of $70.40 million from financial services. The company also reports a segment adjustment of $2.84 billion.

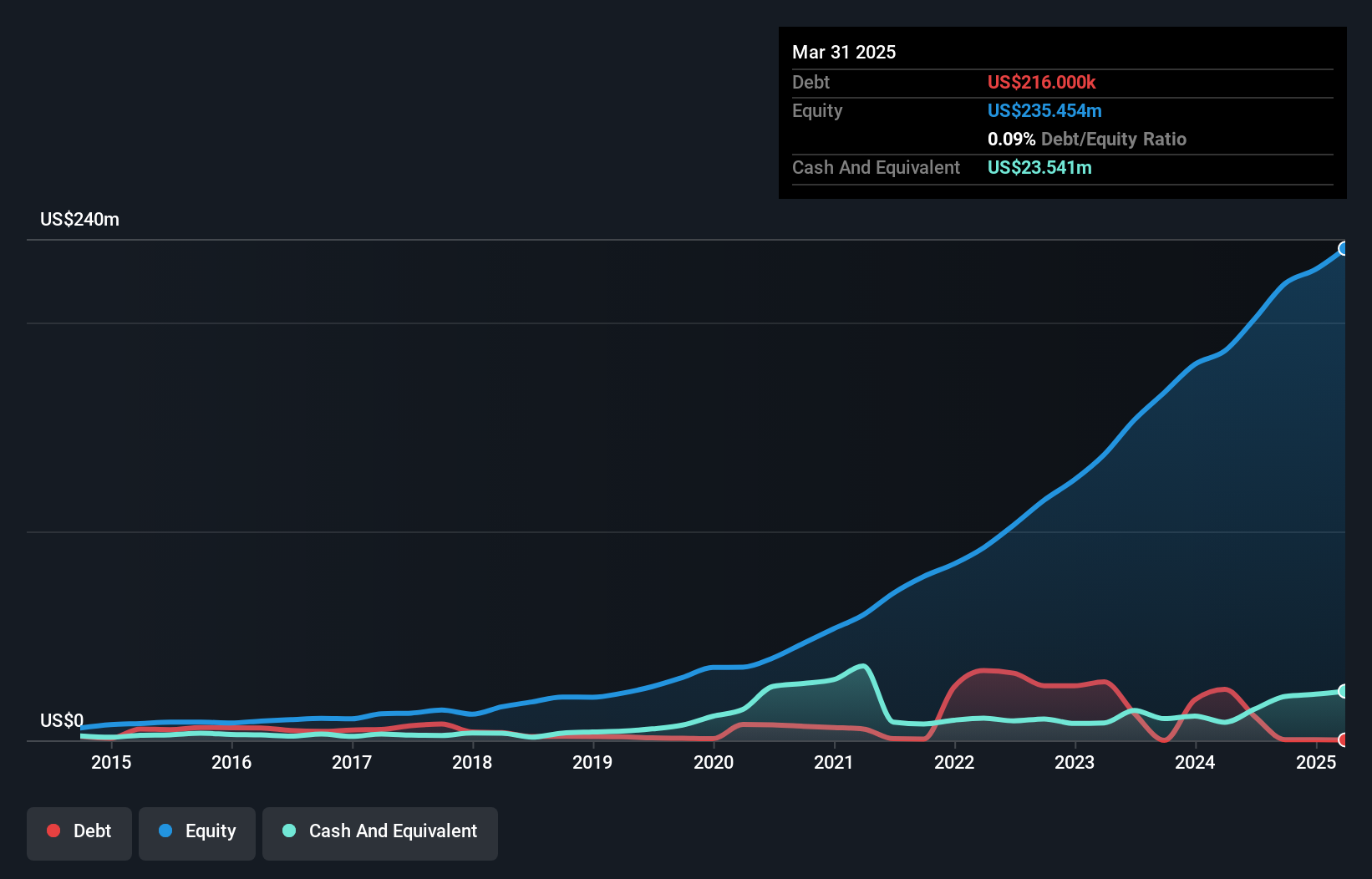

Hovnanian Enterprises, a notable player in the homebuilding sector, has shown impressive growth with earnings up 49.2% over the past year, outpacing the Consumer Durables industry’s -2.1%. Recently added to multiple Russell indices and S&P Homebuilders Select Industry Index, HOV reported Q3 revenue of US$722.7 million and net income of US$72.92 million. The company repurchased 655,471 shares for US$36.82 million in 2024 and increased its full-year earnings guidance to between US$29-$31 per share.

- Click here to discover the nuances of Hovnanian Enterprises with our detailed analytical health report.

Assess Hovnanian Enterprises' past performance with our detailed historical performance reports.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $841.49 million.

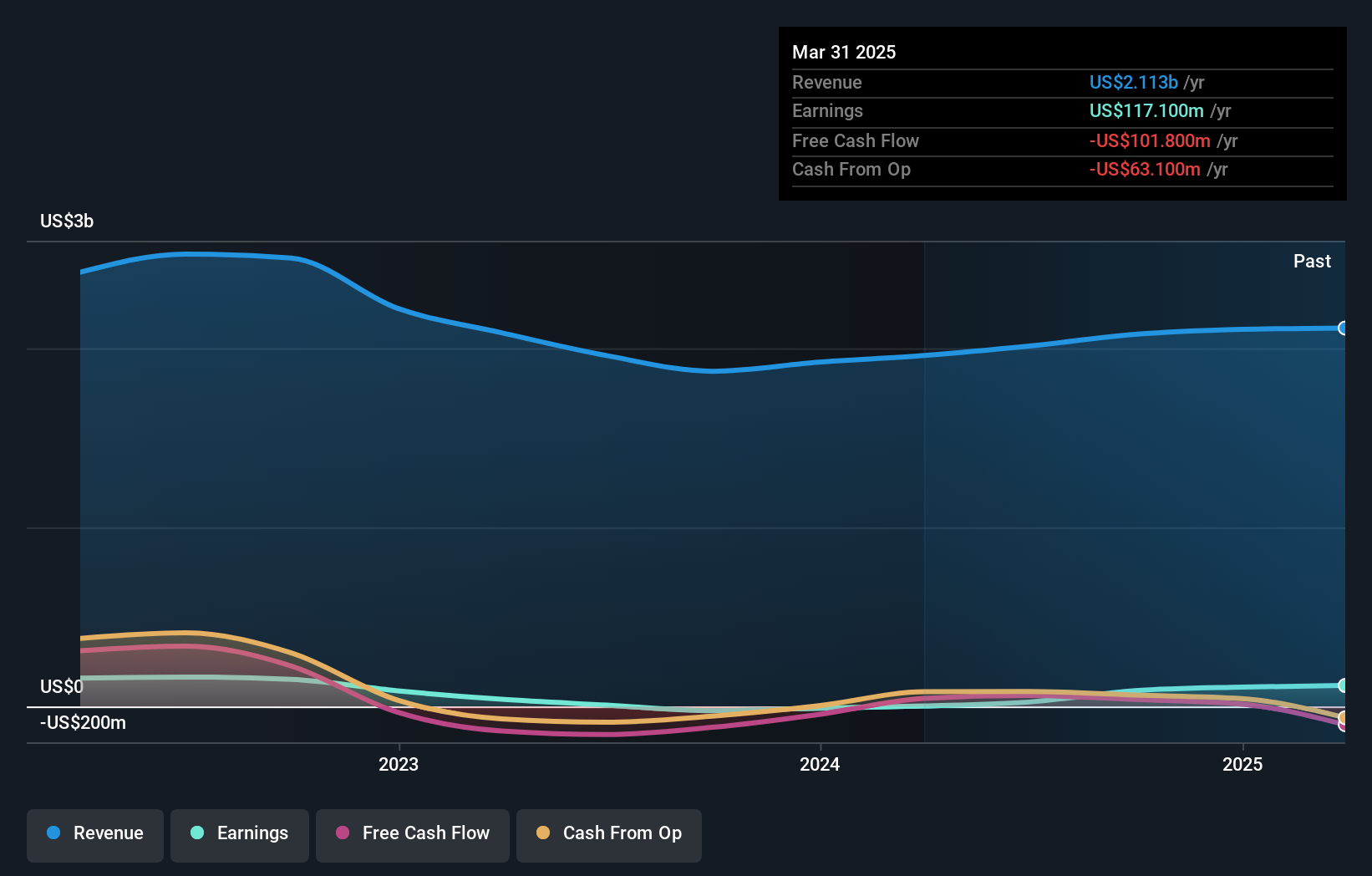

Operations: Valhi, Inc. generates revenues primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million). The company's net profit margin is a key metric to consider in evaluating its overall financial health.

Valhi's net debt to equity ratio of 8.6% is satisfactory, and its earnings surged by 215.4% over the past year, outpacing the Chemicals industry. The company's debt to equity ratio improved from 78% to 38.7% in five years, reflecting better financial health. Recent earnings for Q2 showed US$559.7 million in sales and US$19.9 million net income compared to a loss last year, with diluted EPS at US$0.70 up from a loss of $0.11 per share previously.

- Click here and access our complete health analysis report to understand the dynamics of Valhi.

Review our historical performance report to gain insights into Valhi's's past performance.

Seize The Opportunity

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 214 more companies for you to explore.Click here to unveil our expertly curated list of 217 US Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.