Stock Analysis

- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:ASLE

3 High Insider Ownership US Stocks With Minimum 73% Earnings Growth

Reviewed by Simply Wall St

Amid a turbulent week for major U.S. stock indices, with the S&P 500 and Nasdaq Composite experiencing notable declines, investors are navigating a challenging landscape. In such times, stocks of growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

We're going to check out a few of the best picks from our screener tool.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

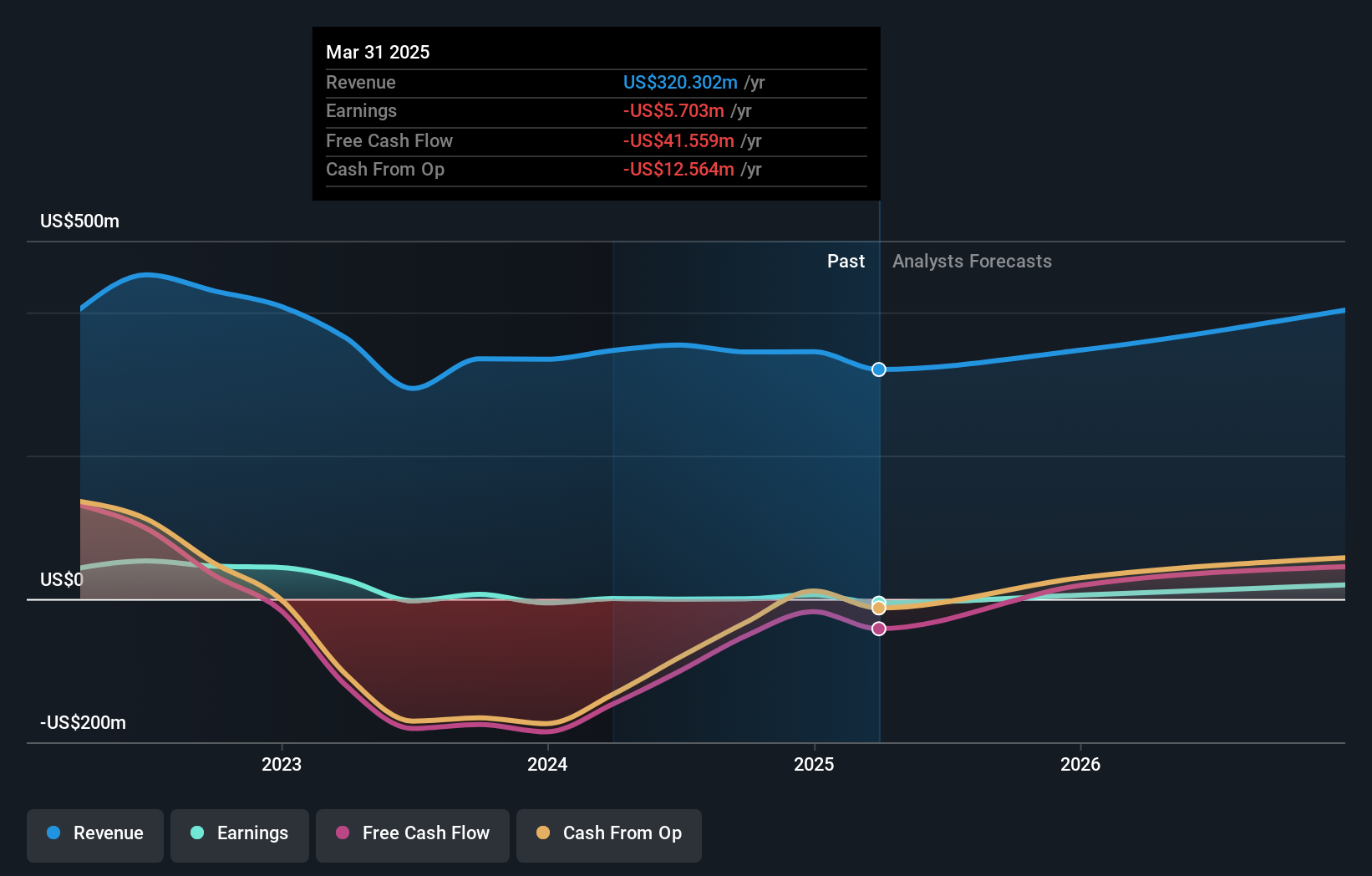

Overview: AerSale Corporation operates globally, offering aftermarket commercial aircraft, engines, and related parts and services to various clients including airlines and MRO providers, with a market capitalization of approximately $376.36 million.

Operations: AerSale's revenue is segmented into Tech Ops - MRO Services generating $101.23 million, Tech Ops - Product Sales at $19.33 million, and Asset Management Solutions divided into Engine and Aircraft segments, which earned $153.68 million and $72.32 million respectively.

Insider Ownership: 24.1%

Earnings Growth Forecast: 105.5% p.a.

AerSale, a company with substantial insider buying in the past three months, is trading at 93.9% below its estimated fair value, indicating potential undervaluation. Despite recent drops from Russell 2000 indices and shareholder dilution over the past year, AerSale's revenue and earnings are expected to grow significantly above market rates at 15.8% and 105.5% per year respectively. The firm also recently expanded its MRO operations by opening a new facility in Tennessee, enhancing its service capabilities in the aviation industry.

- Get an in-depth perspective on AerSale's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility AerSale's shares may be trading at a discount.

GEN Restaurant Group (NasdaqGM:GENK)

Simply Wall St Growth Rating: ★★★★☆☆

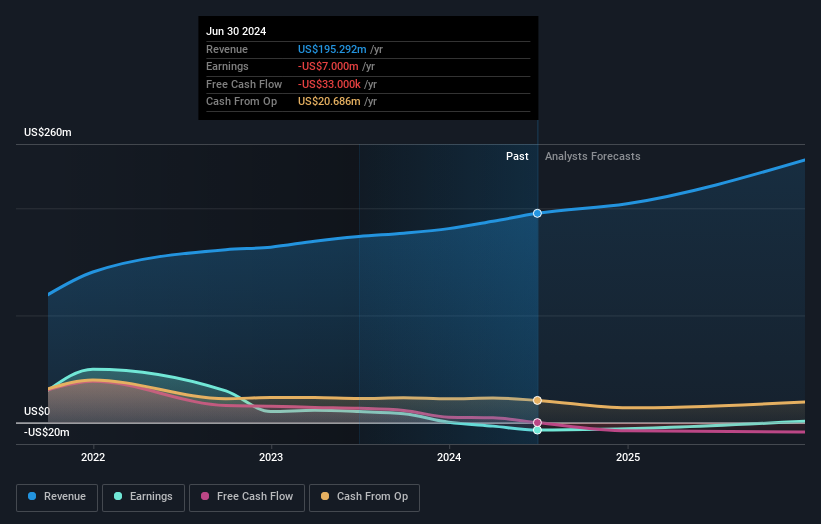

Overview: GEN Restaurant Group, Inc., a restaurant operator with locations in California, Arizona, Hawaii, Nevada, Texas, New York, and Florida, has a market capitalization of approximately $270.21 million.

Operations: The company generates its revenue primarily from its restaurant operations, totaling $187.91 million.

Insider Ownership: 10.8%

Earnings Growth Forecast: 143.2% p.a.

GEN Restaurant Group has recently expanded its offerings with a new Premium Menu, aiming to enhance customer experience and potentially increase revenue streams. Despite a significant drop in net income from US$4.13 million to US$0.496 million in Q1 2024, the company's sales grew to US$50.76 million from US$43.86 million year-over-year, reflecting resilience in operations. With high insider ownership and no major insider sales reported recently, GEN shows promise with expected revenue growth outpacing the market at 14.4% annually and forecasts indicating profitability within three years.

- Dive into the specifics of GEN Restaurant Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that GEN Restaurant Group's current price could be quite moderate.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited, operating as an e-commerce company in China, has a market capitalization of approximately $415.08 million.

Operations: The company generates its revenue primarily from online retailing, amounting to CN¥19.998 billion.

Insider Ownership: 28.7%

Earnings Growth Forecast: 73.6% p.a.

Dingdong (Cayman) Limited, despite a forecasted revenue growth of 6.4% per year, which trails the US market average of 8.6%, has shown promising signs of profitability with earnings expected to grow substantially by 73.61% annually. Recently, the company reported a shift from a net loss to a profit in Q1 2024 and raised its full-year guidance, anticipating strong performance ahead. However, it trades at 79.5% below its estimated fair value and experiences high share price volatility.

- Click to explore a detailed breakdown of our findings in Dingdong (Cayman)'s earnings growth report.

- According our valuation report, there's an indication that Dingdong (Cayman)'s share price might be on the cheaper side.

Seize The Opportunity

- Access the full spectrum of 184 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASLE

AerSale

Provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, and government and defense contractors, as well as maintenance, repair, and overhaul (MRO) service providers worldwide.