Stock Analysis

- Taiwan

- /

- Infrastructure

- /

- TWSE:2607

Evergreen International Storage & Transport Corporation (TWSE:2607) Could Be Riskier Than It Looks

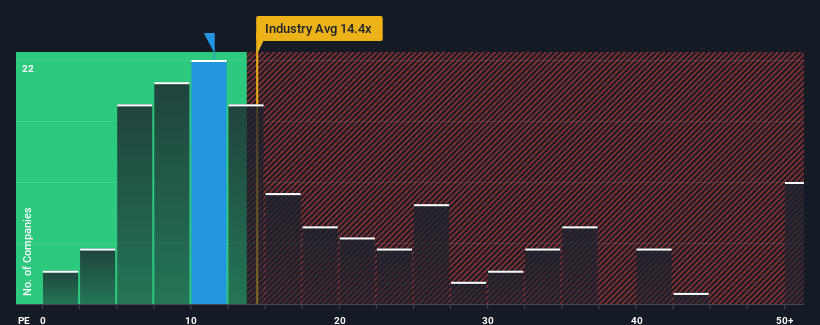

Evergreen International Storage & Transport Corporation's (TWSE:2607) price-to-earnings (or "P/E") ratio of 11.5x might make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 23x and even P/E's above 38x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Evergreen International Storage & Transport over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Evergreen International Storage & Transport

How Is Evergreen International Storage & Transport's Growth Trending?

Evergreen International Storage & Transport's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 283% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Evergreen International Storage & Transport is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Evergreen International Storage & Transport revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Evergreen International Storage & Transport with six simple checks on some of these key factors.

If you're unsure about the strength of Evergreen International Storage & Transport's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Evergreen International Storage & Transport is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2607

Evergreen International Storage & Transport

Evergreen International Storage & Transport Corporation provides inland haulage, marine terminal stevedoring and chartering, and passenger transportation services.

Flawless balance sheet established dividend payer.