- Poland

- /

- Professional Services

- /

- WSE:GPP

Three Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. indices and geopolitical developments influencing market sentiment, investors are closely monitoring potential opportunities amid fluctuating economic signals. As small-cap stocks join their larger peers in reaching new peaks, the search for undervalued stocks becomes particularly pertinent; such stocks might offer value when broader markets appear buoyant, presenting opportunities for those looking to invest wisely amid ongoing market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$633.57 | MX$1257.07 | 49.6% |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR2.39 | 49.7% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.70 | MYR1.39 | 49.5% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹996.65 | ₹1971.74 | 49.5% |

| Equity Bancshares (NYSE:EQBK) | US$48.12 | US$96.15 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Acerinox (BME:ACX) | €9.92 | €19.82 | 49.9% |

| Nidaros Sparebank (OB:NISB) | NOK100.10 | NOK198.62 | 49.6% |

| Marcus & Millichap (NYSE:MMI) | US$40.88 | US$81.13 | 49.6% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.90 | A$3.77 | 49.5% |

Here's a peek at a few of the choices from the screener.

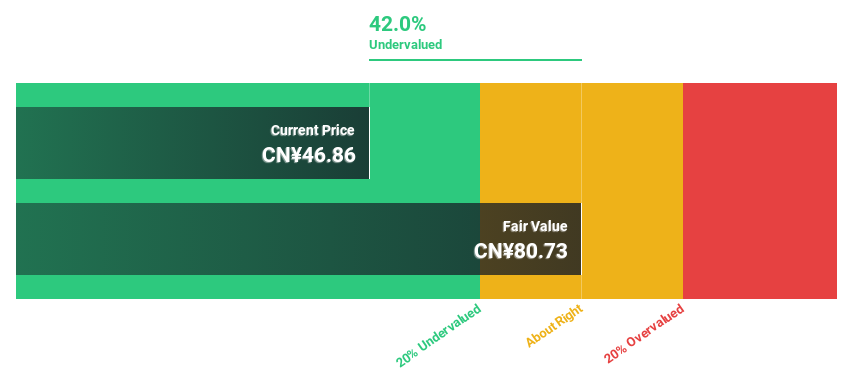

Gambol Pet Group (SZSE:301498)

Overview: Gambol Pet Group Co., Ltd. focuses on the research, development, production, and sale of pet food products in China with a market cap of CN¥26.32 billion.

Operations: The company generates revenue primarily from its Pet Food & Supplies segment, totaling CN¥4.89 billion.

Estimated Discount To Fair Value: 27.7%

Gambol Pet Group is trading 27.7% below its estimated fair value of CNY 91.05, with a current price of CNY 65.8, indicating it may be undervalued based on cash flows. Recent earnings show significant growth, with net income rising to CNY 470.42 million from last year's CNY 314.36 million and revenue increasing to CNY 3.67 billion from CNY 3.11 billion year-on-year, supporting its potential as an attractive investment opportunity in the pet industry sector.

- Our growth report here indicates Gambol Pet Group may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Gambol Pet Group.

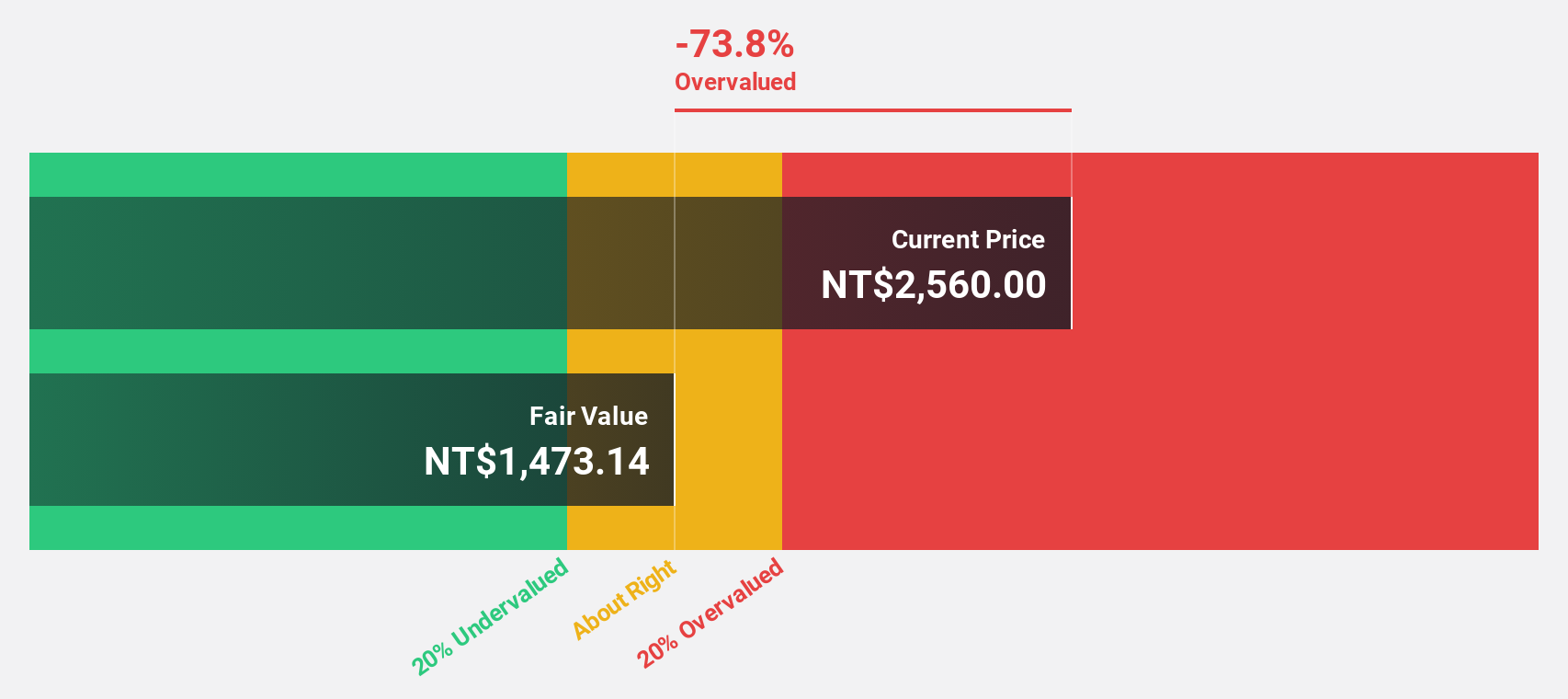

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation manufactures and sells servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$432.08 billion.

Operations: The company's revenue from the computer hardware segment amounts to NT$303.48 billion.

Estimated Discount To Fair Value: 31.8%

Wiwynn is trading 31.8% below its estimated fair value of NT$3,408.27, with a current price of NT$2,325, suggesting potential undervaluation based on cash flows. Recent earnings highlight robust growth; third-quarter sales rose to TWD 97.82 billion from TWD 52.82 billion year-on-year, with net income increasing to TWD 6.33 billion from TWD 2.62 billion last year. Despite high volatility and past shareholder dilution, revenue and earnings are projected to grow significantly faster than the market average.

- Our comprehensive growth report raises the possibility that Wiwynn is poised for substantial financial growth.

- Get an in-depth perspective on Wiwynn's balance sheet by reading our health report here.

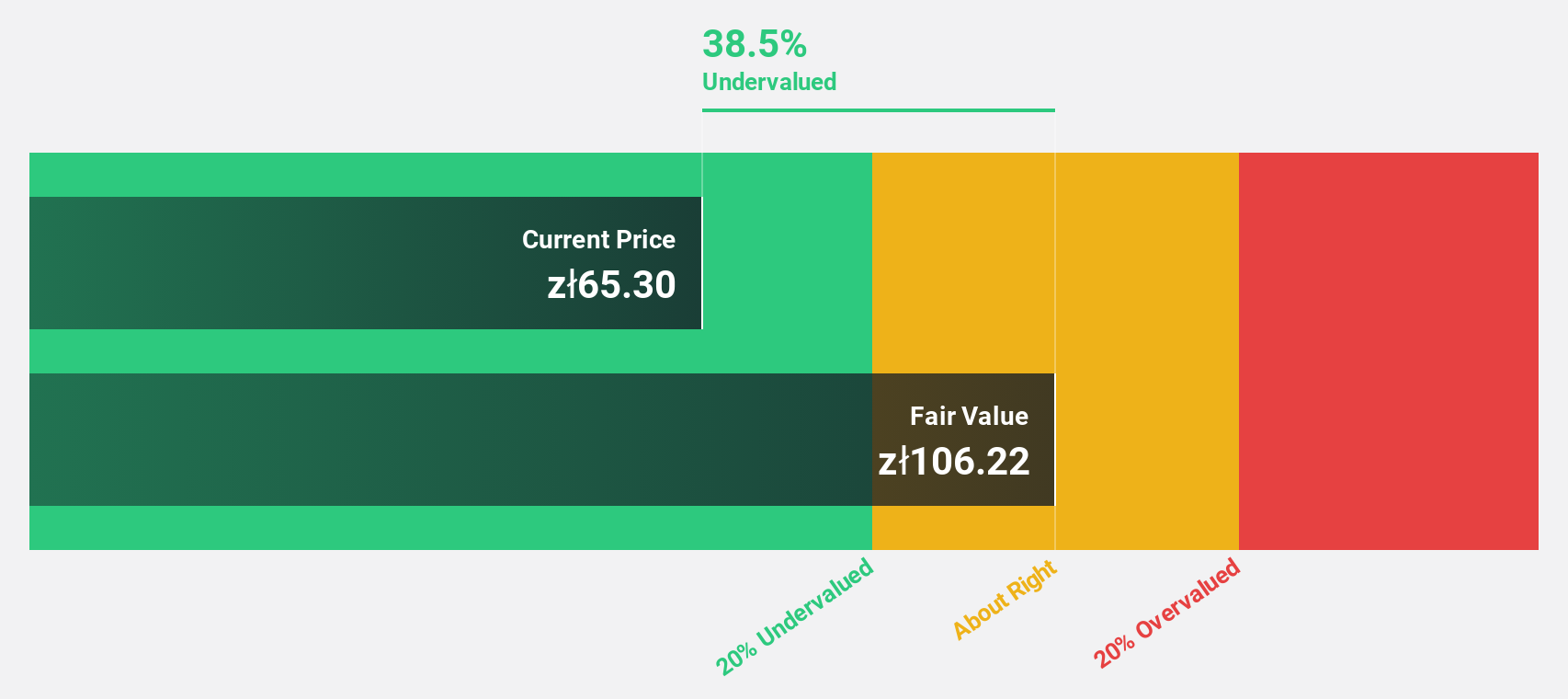

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates in the digital recruitment market in Poland and Ukraine, with a market cap of PLN4.16 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, amounting to PLN756.07 million.

Estimated Discount To Fair Value: 36.7%

Grupa Pracuj is trading at PLN 61, significantly below its estimated fair value of PLN 96.33, highlighting potential undervaluation based on cash flows. Recent earnings show growth, with third-quarter sales rising to PLN 192.95 million from PLN 181.16 million year-on-year and net income increasing to PLN 60.59 million from PLN 49.59 million last year. Despite an unstable dividend track record, revenue and earnings are projected to outpace the Polish market's growth rates.

- Our expertly prepared growth report on Grupa Pracuj implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Grupa Pracuj's balance sheet health report.

Seize The Opportunity

- Discover the full array of 889 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GPP

Grupa Pracuj

Operates in the digital recruitment market in Poland and Ukraine.

Solid track record with reasonable growth potential.