Stock Analysis

- China

- /

- Communications

- /

- SZSE:301191

High Growth Tech And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

Amid rising U.S. Treasury yields and a cautious economic outlook, global markets have experienced mixed performances, with large-cap stocks faring better than small-caps and growth stocks slightly outperforming value. In this environment, identifying promising investments involves looking for companies with strong growth potential and resilience in the face of macroeconomic challenges, as highlighted by the high-growth tech sector and other emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. specializes in the research, development, production, and sale of new display device testing equipment in China and has a market cap of CN¥6.37 billion.

Operations: SEICHI Technologies focuses on the production and sale of innovative testing equipment for display devices. The company operates primarily in China, leveraging its R&D capabilities to enhance product offerings in this niche market.

Shenzhen SEICHI Technologies has demonstrated a robust trajectory with its revenue surging by 29.1% annually, outpacing the broader Chinese market's growth rate of 13.9%. This performance is underpinned by significant R&D investments, which are not just a cost but a cornerstone of its strategy to stay ahead in technology innovation. Despite recent earnings showing a slight dip with net income at CNY 51.38 million down from CNY 54.85 million, the firm's commitment to reinvesting in itself is evident from its share repurchase program, completing buybacks worth CNY 44.76 million this year alone. With projected annual earnings growth at an impressive rate of 35.8%, Shenzhen SEICHI is positioning itself as a resilient contender in the tech sector, even as it navigates market fluctuations and competitive pressures.

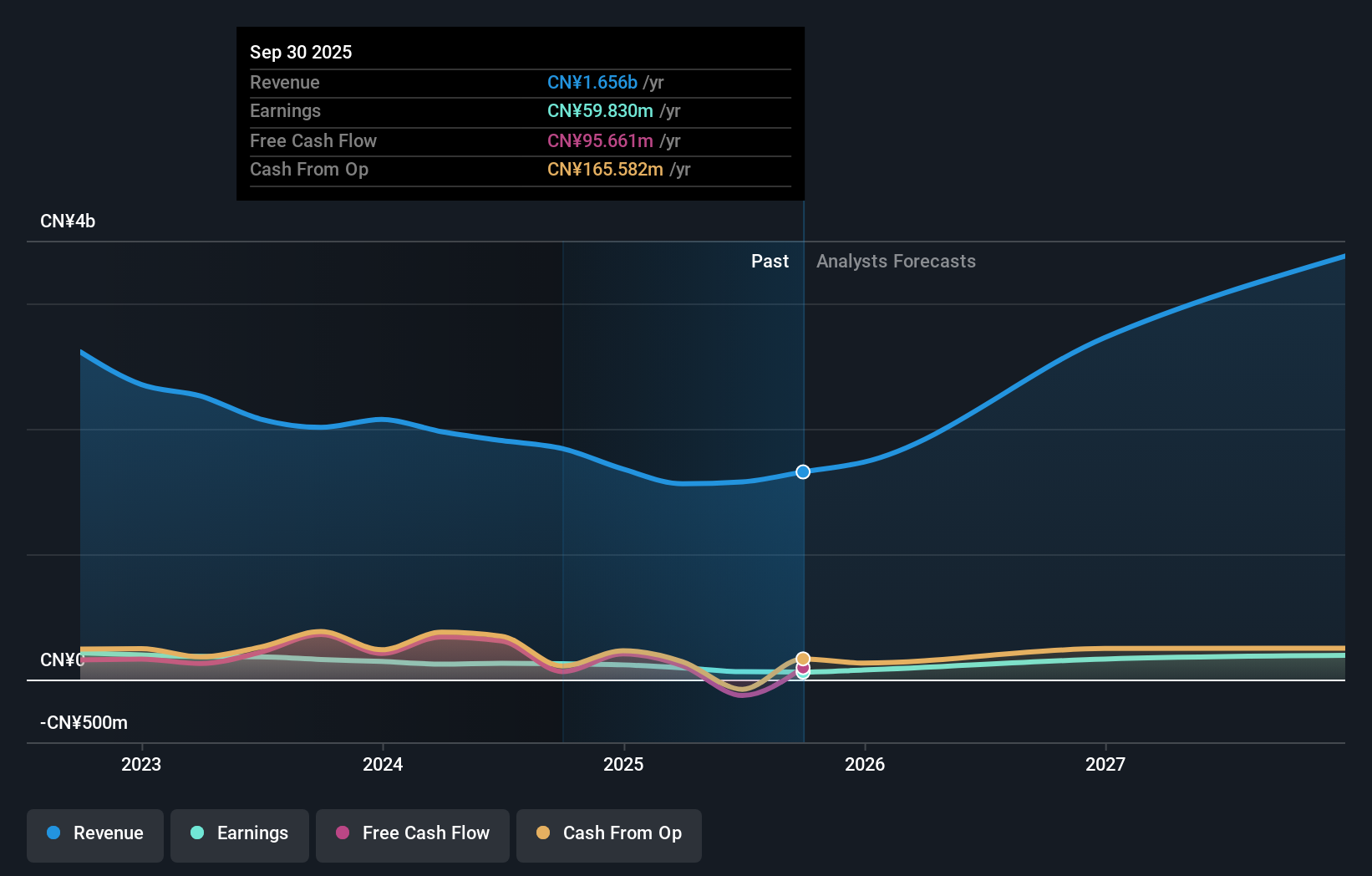

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. operates in the telecommunications technology sector with a market capitalization of CN¥5.44 billion.

Operations: Phoenix Telecom focuses on the telecommunications technology sector, generating revenue through various segments within this industry. The company's financial performance includes a net profit margin that reflects its operational efficiency and cost management strategies.

Shenzhen Phoenix Telecom TechnologyLtd. has been navigating a challenging landscape with its recent earnings revealing a decrease, yet the firm's commitment to innovation remains robust, reflected in its R&D expenditures which are crucial for maintaining competitive edge in the fast-evolving telecom sector. With revenue growth at 29.8% annually, surpassing the broader market's 13.9%, and projected earnings growth of 38.8% per year, the company is poised for significant advancements. Additionally, inclusion in the S&P Global BMI Index underscores its growing relevance in the global market despite short-term fluctuations in net income and sales figures from previous periods.

- Navigate through the intricacies of Shenzhen Phoenix Telecom TechnologyLtd with our comprehensive health report here.

Learn about Shenzhen Phoenix Telecom TechnologyLtd's historical performance.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. is a global leader in the research, development, manufacturing, and sale of electronic paper display panels, with a market capitalization of NT$350.34 billion.

Operations: The company generates revenue primarily through the sale of electronic components and parts, amounting to NT$25.95 billion. It focuses on the development and manufacturing of electronic paper display panels for a global market.

E Ink Holdings is capitalizing on robust demand in the ePaper market, underscored by its innovative T2000 timing controller ASIC, which enhances color ePaper displays with faster refresh rates and lower power consumption. This technological advancement aligns with a 30.9% annual revenue growth forecast, outpacing the Taiwan market's 12.1%. Furthermore, E Ink's R&D commitment is evident as it plans substantial investments in new production facilities, ensuring sustained innovation and competitiveness in high-efficiency display solutions. With earnings expected to surge by 36.6% annually, the company is strategically positioned to leverage emerging digital reading trends while enhancing environmental sustainability through reduced power usage in consumer electronics.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' health report.

Assess E Ink Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Unlock our comprehensive list of 1279 High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301191

Shenzhen Phoenix Telecom TechnologyLtd

Shenzhen Phoenix Telecom Technology Co., Ltd.