Stock Analysis

- Taiwan

- /

- Tech Hardware

- /

- TPEX:3324

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to experience mixed performances, with major U.S. indexes like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 sees a decline, investors are closely watching growth stocks that have recently outperformed value stocks by significant margins. In this environment, identifying high-growth tech stocks becomes crucial, as these companies often thrive on innovation and adaptability—qualities that can be particularly advantageous amid economic shifts and evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

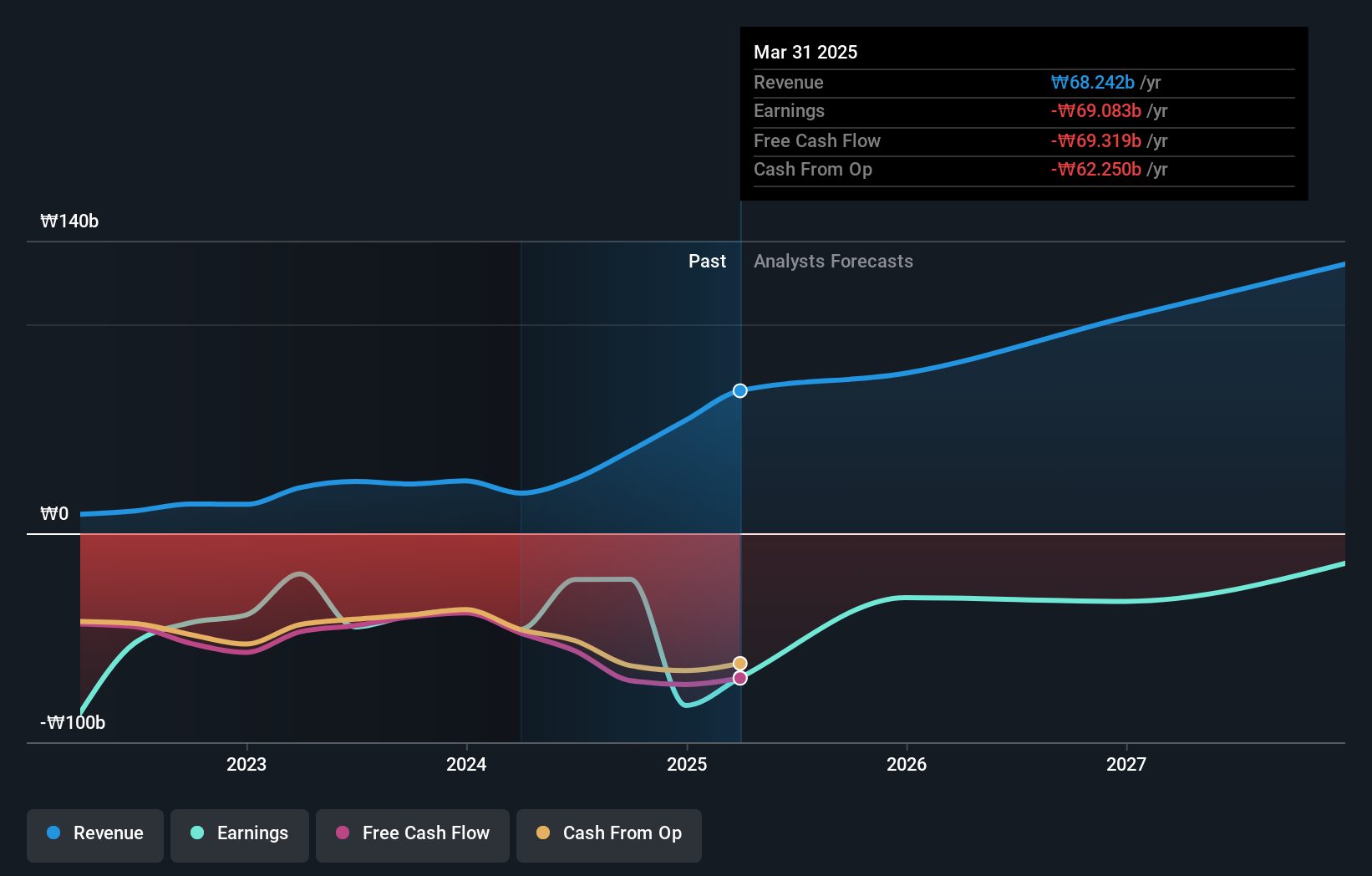

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. specializes in developing AI-based software solutions for cancer screening, diagnosis, and treatment with a market capitalization of ₩1.89 trillion.

Operations: The core revenue stream for Lunit Inc. comes from its healthcare software segment, generating ₩39.54 billion. The company focuses on AI-driven solutions in the medical field, particularly targeting cancer-related applications.

Lunit's recent strides in AI-driven cancer detection and care, particularly at the RSNA 2024 Annual Meeting, underscore its commitment to revolutionizing healthcare. The company unveiled advancements like the Autonomous AI Chest X-ray Report Generation prototype and collaborations enhancing early cancer detection ecosystems. These innovations are supported by substantial R&D investments, aligning with a forecasted revenue growth of 49.9% per year and an earnings growth of 78.2% annually. Such developments not only highlight Lunit’s role in shaping future medical practices but also position it well within the high-growth tech space despite current unprofitability.

- Take a closer look at Lunit's potential here in our health report.

Evaluate Lunit's historical performance by accessing our past performance report.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. is engaged in the production and sale of smart sensors and optoelectronic instrument products, with a market capitalization of CN¥4.08 billion.

Operations: Beijing Beetech focuses on producing and selling smart sensors and optoelectronic instruments. The company's operations are supported by a market capitalization of CN¥4.08 billion, indicating its significant presence in the industry.

Beijing Beetech's recent financial performance reflects challenges, with a revenue drop to CNY 518.63 million from CNY 565.08 million last year and a shift to a net loss of CNY 3.76 million from a prior net income of CNY 15.3 million. Despite this downturn, the company's future looks promising with an expected revenue growth rate of 19.3% per year, outpacing the Chinese market's average of 13.8%. Additionally, earnings are projected to surge by an impressive 55.3% annually, supported by strategic R&D investments which have consistently aligned with industry demands and innovation trends—evident in their substantial commitment to research and development expenses that bolster long-term growth prospects in high-tech sectors.

- Get an in-depth perspective on Beijing Beetech's performance by reading our health report here.

Assess Beijing Beetech's past performance with our detailed historical performance reports.

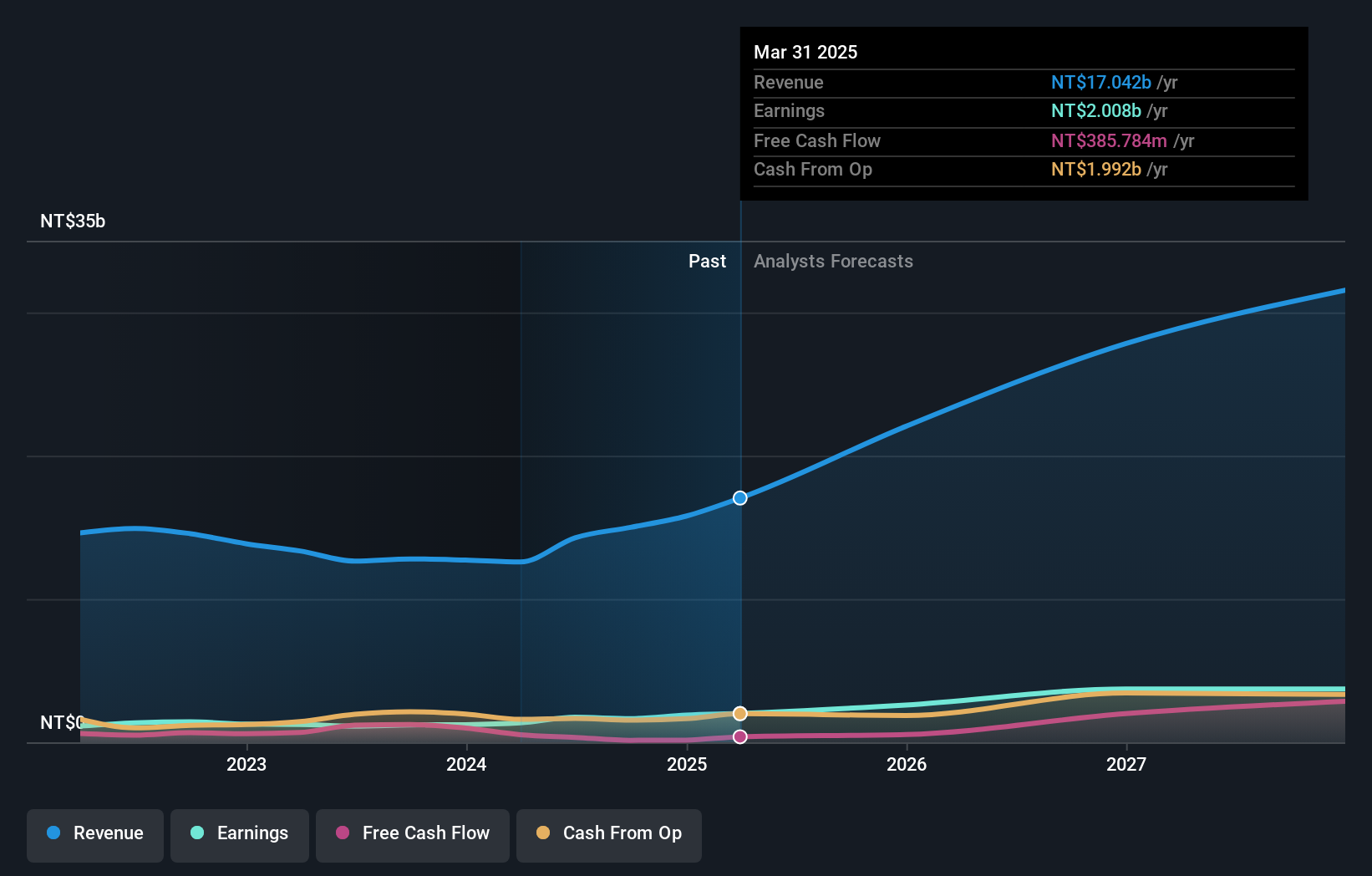

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across various international markets including China, Taiwan, Ireland, Singapore, and the United States with a market cap of NT$64.34 billion.

Operations: Auras Technology focuses on producing and selling electronic components and computer cooling modules, generating NT$14.99 billion in revenue from these segments. The company operates across multiple international markets, leveraging its manufacturing and retail capabilities to serve a diverse customer base.

Auras Technology has demonstrated robust financial dynamics, notably with a 28.6% annual revenue growth forecast, surpassing the broader Taiwanese market's average. This growth is complemented by an aggressive R&D strategy where expenses have surged to support innovation—critical in maintaining competitive advantage in the tech sector. Furthermore, earnings are expected to climb by 43.1% annually, reflecting both effective capital management and strategic market positioning that could significantly influence its industry standing. These figures underscore Auras’s commitment to leveraging technological advancements and market opportunities to sustain its upward trajectory.

- Click to explore a detailed breakdown of our findings in Auras Technology's health report.

Explore historical data to track Auras Technology's performance over time in our Past section.

Make It Happen

- Access the full spectrum of 1287 High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3324

Auras Technology

Engages in the manufacturing, processing, and retailing of electronic materials and computer cooling modules in China, Taiwan, Ireland, Singapore, the United States, and internationally.