Stock Analysis

- Singapore

- /

- Other Utilities

- /

- SGX:U96

Should You Buy Sembcorp Industries Ltd (SGX:U96) For Its Upcoming Dividend?

It looks like Sembcorp Industries Ltd (SGX:U96) is about to go ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Sembcorp Industries' shares on or after the 29th of April, you won't be eligible to receive the dividend, when it is paid on the 9th of May.

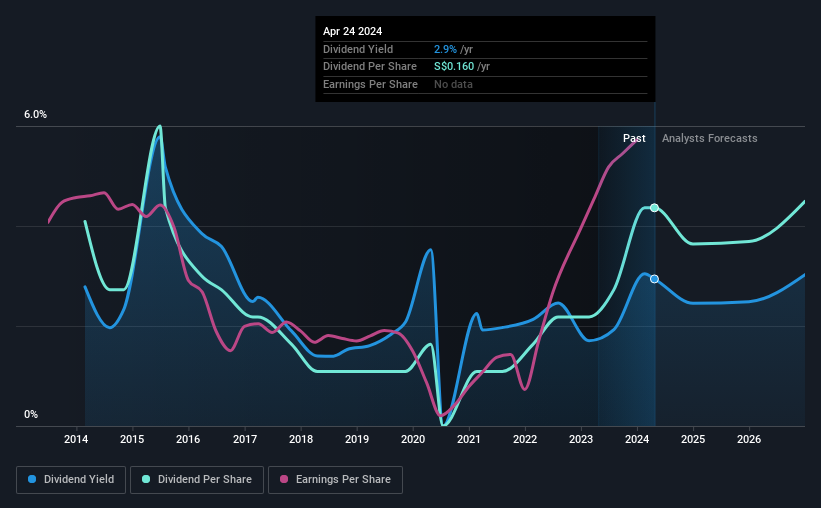

The company's next dividend payment will be S$0.08 per share, and in the last 12 months, the company paid a total of S$0.16 per share. Calculating the last year's worth of payments shows that Sembcorp Industries has a trailing yield of 2.9% on the current share price of S$5.44. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Sembcorp Industries

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Sembcorp Industries paid out just 23% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 25% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Sembcorp Industries has grown its earnings rapidly, up 27% a year for the past five years. Sembcorp Industries earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Sembcorp Industries has delivered an average of 0.6% per year annual increase in its dividend, based on the past 10 years of dividend payments. It's good to see both earnings and the dividend have improved - although the former has been rising much quicker than the latter, possibly due to the company reinvesting more of its profits in growth.

The Bottom Line

Is Sembcorp Industries worth buying for its dividend? Sembcorp Industries has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. Sembcorp Industries looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

So while Sembcorp Industries looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For example, Sembcorp Industries has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Sembcorp Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:U96

Sembcorp Industries

Sembcorp Industries Ltd, an investment holding company, engages in the production and supply of utilities services, and terminalling and storage of petroleum products and chemicals in Singapore, the United Kingdom, China, India, rest of Asia, the Middle East, and internationally.

Solid track record average dividend payer.