Stock Analysis

Unveiling 3 Top Dividend Stocks In Singapore With Yields Up To 8.5%

Reviewed by Kshitija Bhandaru

As the Singapore market continues to navigate through global economic challenges, including inflation and interest rate adjustments, investors are increasingly looking for stable returns. Dividend stocks, known for their potential to provide regular income, become particularly appealing in such uncertain times.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 6.31% | ★★★★★★ |

| Singapore Exchange (SGX:S68) | 3.67% | ★★★★★☆ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.77% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 8.25% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.43% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.51% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.98% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 8.51% | ★★★★☆☆ |

| Sing Investments & Finance (SGX:S35) | 6.19% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. operates in the design, development, and manufacturing of IoT devices, data-communication products, and LED lighting across various regions including Singapore, North America, China, and Europe with a market capitalization of approximately SGD 0.73 billion.

Operations: Aztech Global Ltd. generates revenue through the design and manufacturing of IoT devices, data-communication products, and LED lighting in regions such as Singapore, North America, China, and Europe.

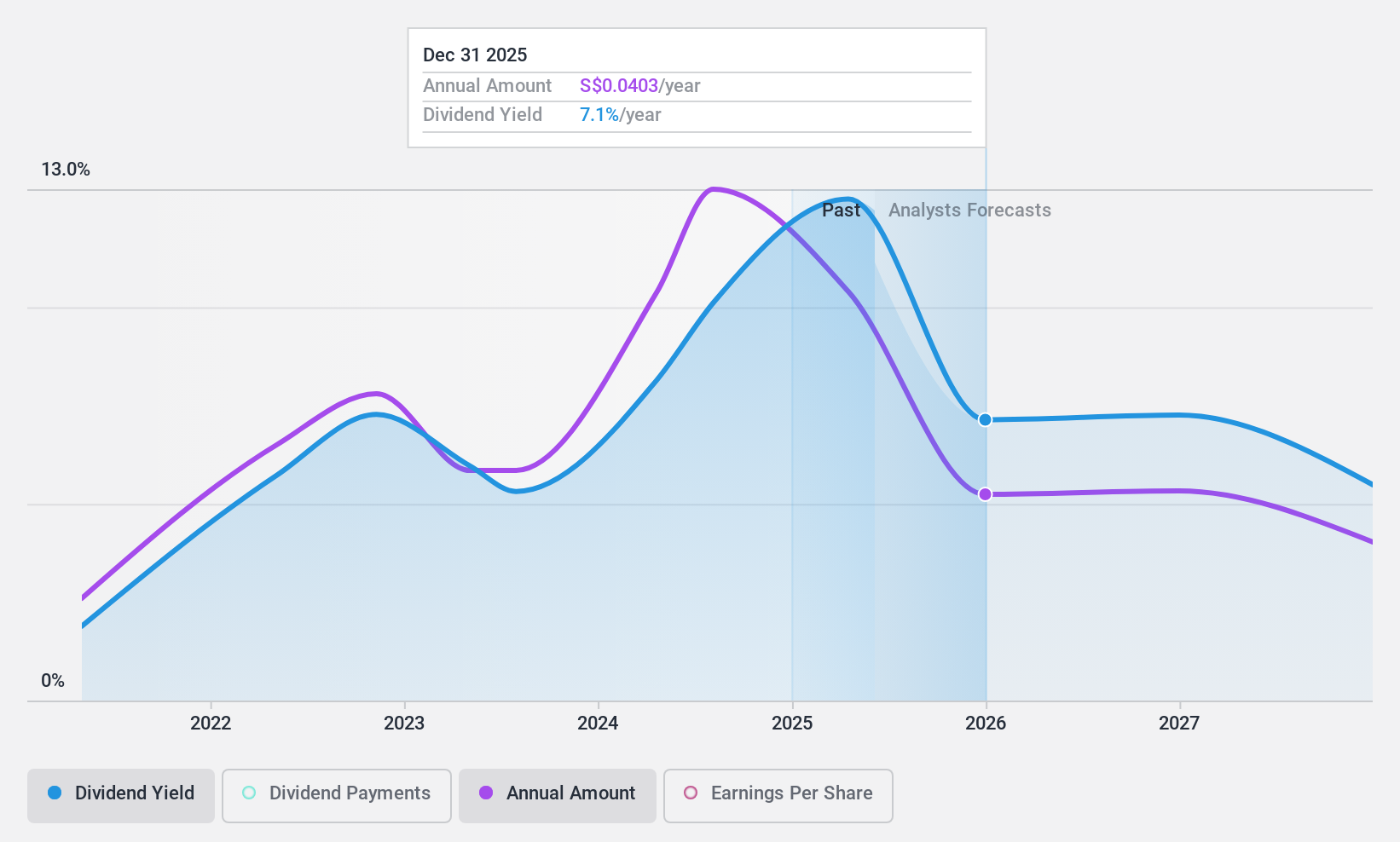

Dividend Yield: 8.5%

Aztech Global Ltd. reported a solid financial performance in Q1 2024 with sales of SGD 128.6 million and net income rising to SGD 15.9 million, reflecting an increase from the previous year. The company declared a final dividend of SGD 0.05 per share for FY2023 during its April AGM, aligning with its recent practice despite a history of volatile dividends over the last three years. While Aztech's dividends are covered by earnings and cash flows, with payout ratios at 61.7% and 77.9% respectively, the fluctuating nature of past payments suggests cautious optimism for dividend stability moving forward.

- Click here to discover the nuances of Aztech Global with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Aztech Global's share price might be too pessimistic.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited operates as an investment holding company that distributes automotive and industrial products across regions including Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand, and other international markets; it has a market capitalization of approximately SGD 144.40 million.

Operations: YHI International Limited generates revenue through various segments, with SGD 120.10 million from Distribution in ASEAN, SGD 47.72 million from Manufacturing in ASEAN, SGD 136.97 million from Distribution in Oceania, and SGD 57.87 million from Manufacturing in North East Asia (excluding rental).

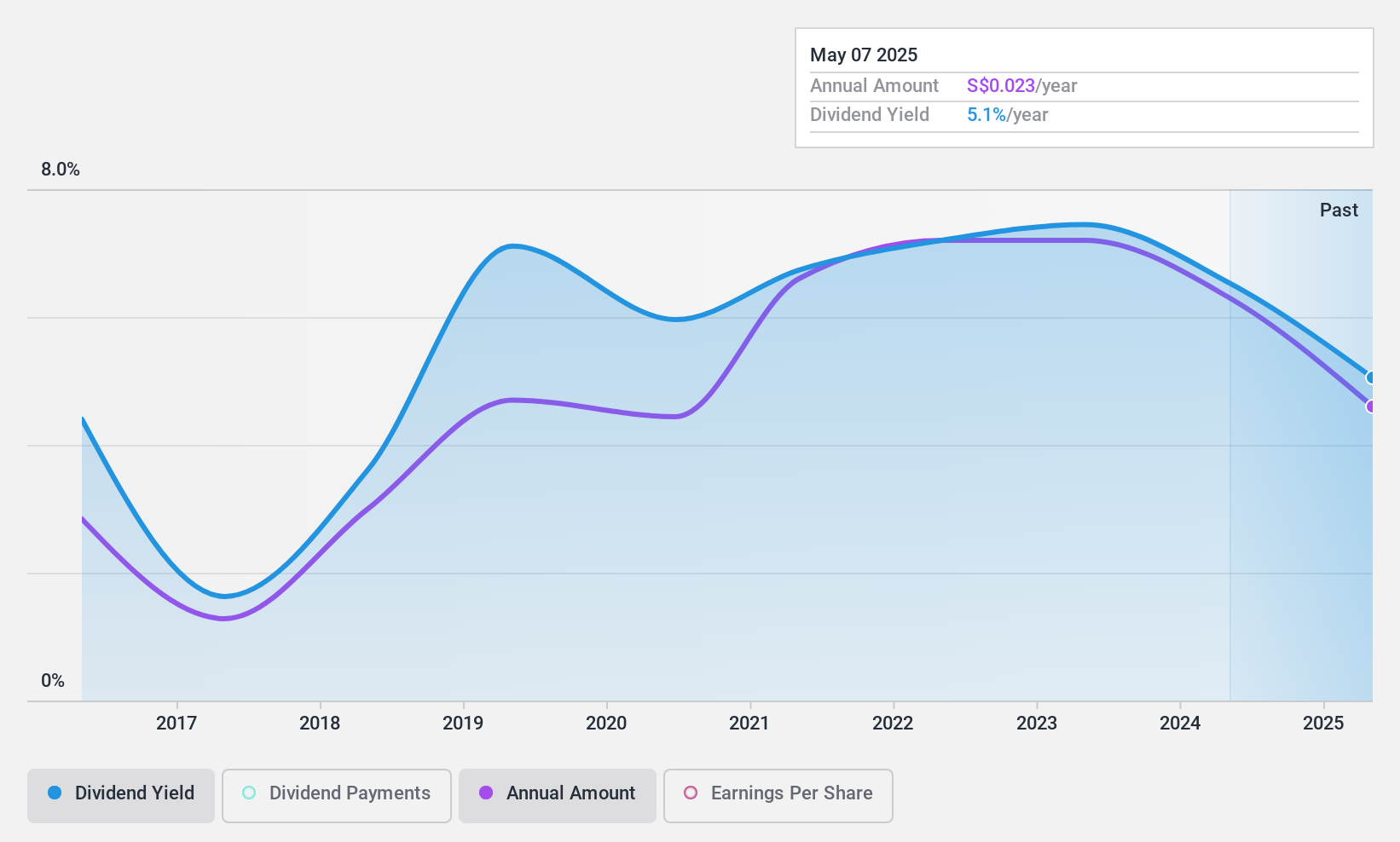

Dividend Yield: 6.4%

YHI International Limited declared a tax-exempt dividend of S$0.0315 per share for FY2023, consistent with its recent announcement and payment schedule. Despite a revenue drop to S$376.94 million and reduced net income of S$13.05 million from the previous year, the company maintains a payout ratio of 70.1%, suggesting earnings sufficiently cover the dividend. However, YHI's historical dividend volatility indicates potential concerns for long-term stability in its dividend policy.

- Navigate through the intricacies of YHI International with our comprehensive dividend report here.

- Our valuation report here indicates YHI International may be undervalued.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited operates as an investment holding company offering services like stockbroking, futures broking, and more across Singapore, Hong Kong, Thailand, Malaysia, and globally, with a market capitalization of approximately SGD 1.29 billion.

Operations: UOB-Kay Hian Holdings Limited generates revenue primarily through securities and futures broking and related services, amounting to SGD 539.01 million.

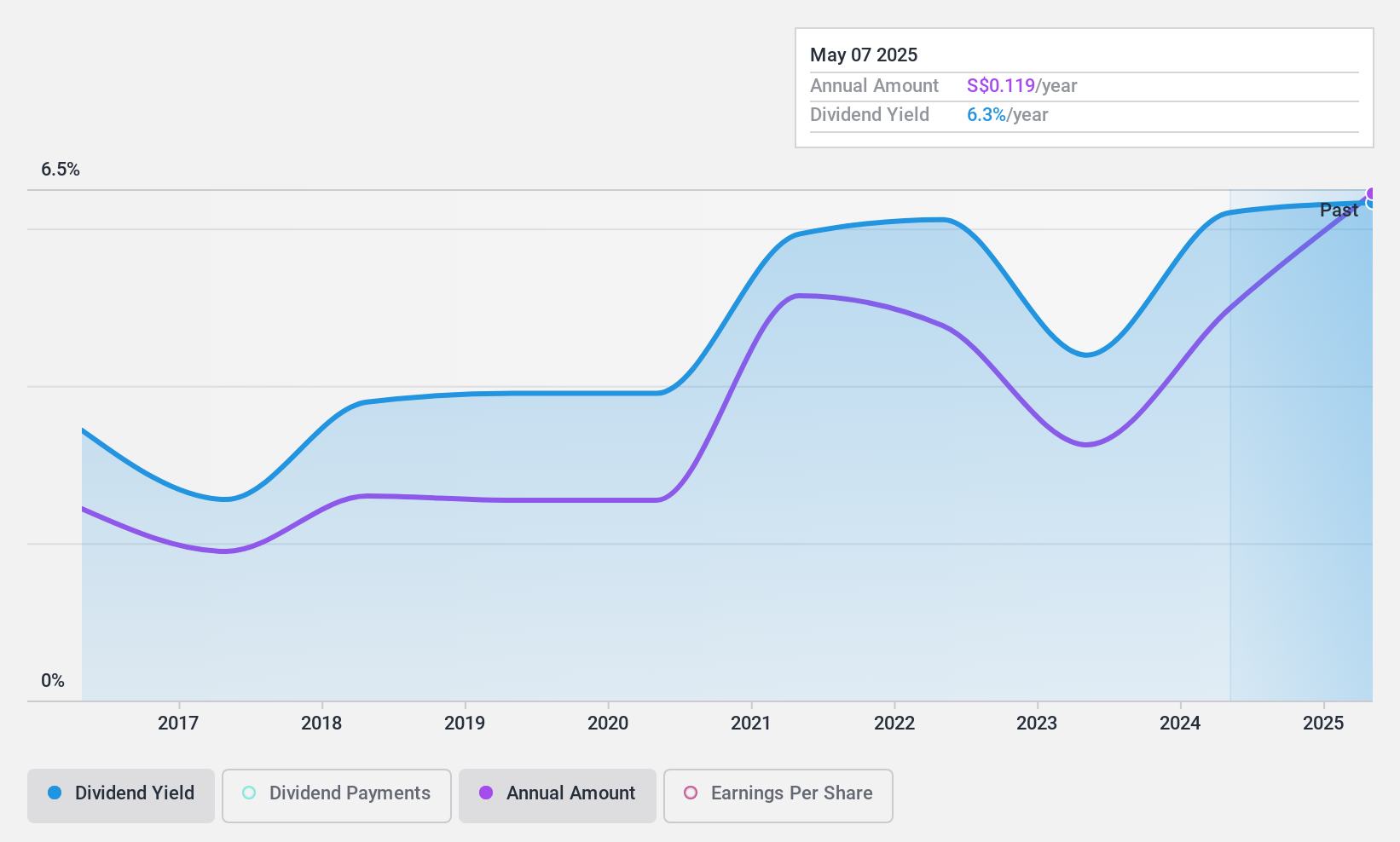

Dividend Yield: 6.4%

UOB-Kay Hian Holdings declared a dividend of S$0.092 per share for FY2023, reflecting a commitment to shareholder returns despite a history of volatile dividends. The company's recent financial performance shows significant improvement, with net income rising to S$165.64 million, up 67.2% from the previous year. This growth supports a sustainable dividend policy with earnings and cash flows covering payouts at ratios of 48.2% and 21.8%, respectively, underscoring stronger financial health and potential reliability in future distributions.

- Click here and access our complete dividend analysis report to understand the dynamics of UOB-Kay Hian Holdings.

- Our comprehensive valuation report raises the possibility that UOB-Kay Hian Holdings is priced lower than what may be justified by its financials.

Summing It All Up

- Investigate our full lineup of 21 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Aztech Global is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:8AZ

Aztech Global

Engages in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products in Singapore, North America, China, Europe, and internationally.

Very undervalued with outstanding track record and pays a dividend.