Stock Analysis

- Singapore

- /

- Capital Markets

- /

- SGX:U10

3 High Yield Dividend Stocks On SGX With Yields Up To 8.2%

Reviewed by Simply Wall St

As Singapore continues to embrace technological advancements, the recent unveiling of a Web3 digital banking platform by Alchemy Pay highlights the market's progressive adaptation to the evolving landscape of digital finance. In this dynamic environment, high-yield dividend stocks on the SGX offer investors potential stability and consistent returns, qualities that are particularly appealing amid the rapid changes in financial technology and payment systems.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 6.21% | ★★★★★★ |

| Singapore Exchange (SGX:S68) | 3.60% | ★★★★★☆ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.67% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.58% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.58% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.84% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.10% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.09% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. specializes in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets with a market capitalization of approximately SGD 748.79 million.

Operations: Aztech Global Ltd. generates revenue through the sale of IoT devices, data-communication products, and LED lighting across various global markets.

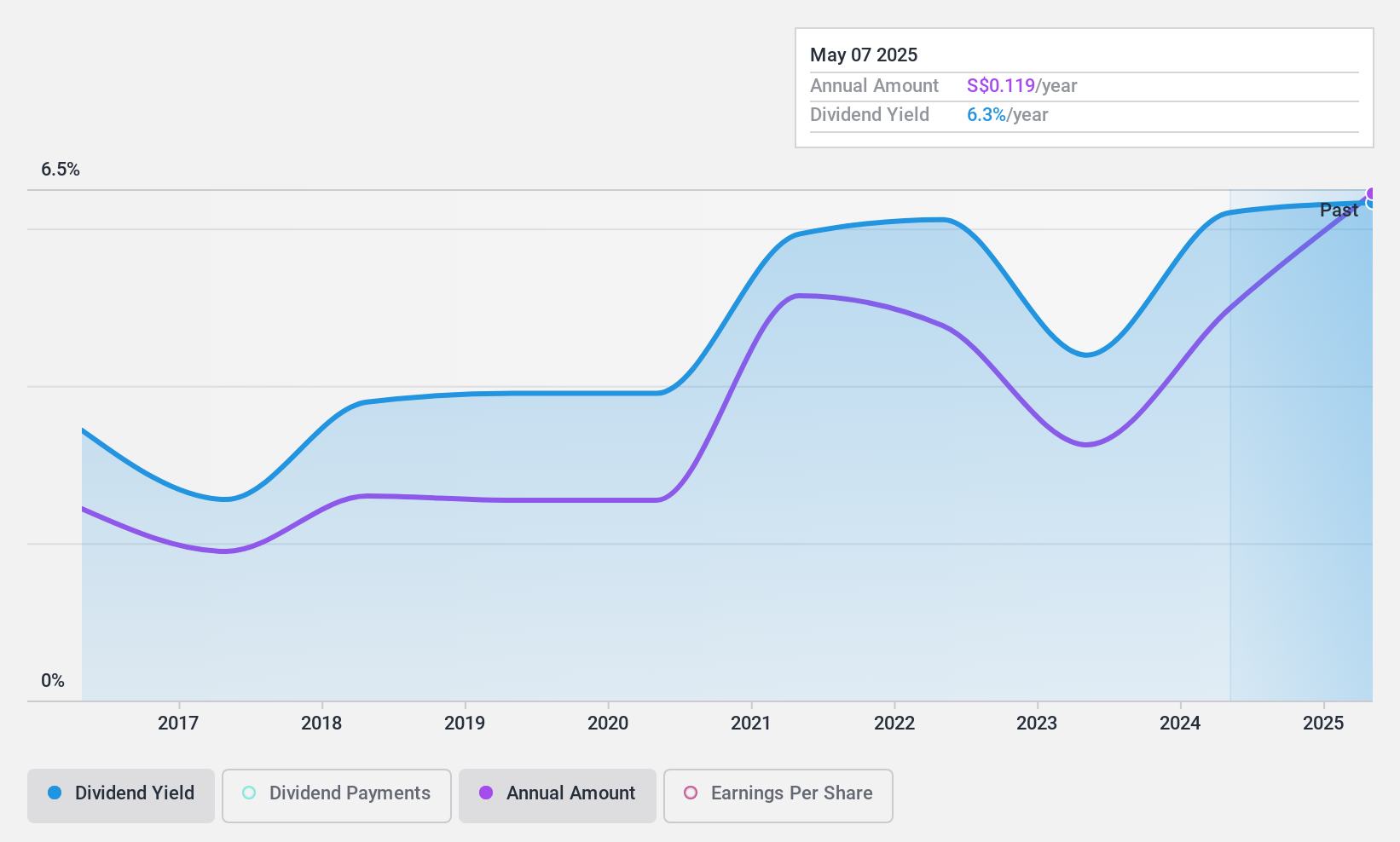

Dividend Yield: 8.2%

Aztech Global offers a high dividend yield of 8.25%, above the Singapore market average, supported by a payout ratio of 61.7% and cash payout ratio of 77.9%, indicating earnings and cash flows sufficiently cover dividends despite its short three-year history of payments and some volatility in amounts distributed. Recent financials show positive trends with net income rising to SGD 15.9 million from SGD 13.4 million year-over-year, alongside an approved increase in dividends to SGD 0.05 per share for FY2023, reflecting potential stability and growth in shareholder returns amidst management changes with the CFO's resignation.

- Delve into the full analysis dividend report here for a deeper understanding of Aztech Global.

- Upon reviewing our latest valuation report, Aztech Global's share price might be too pessimistic.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited operates as an investment holding company that distributes automotive and industrial products across regions including Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand, and other international markets; it has a market capitalization of approximately SGD 138.56 million.

Operations: YHI International Limited generates revenue through its distribution activities in ASEAN, Oceania, and North East Asia totaling SGD 275.36 million, alongside manufacturing operations in ASEAN and North East Asia (excluding rental) which contribute SGD 105.58 million.

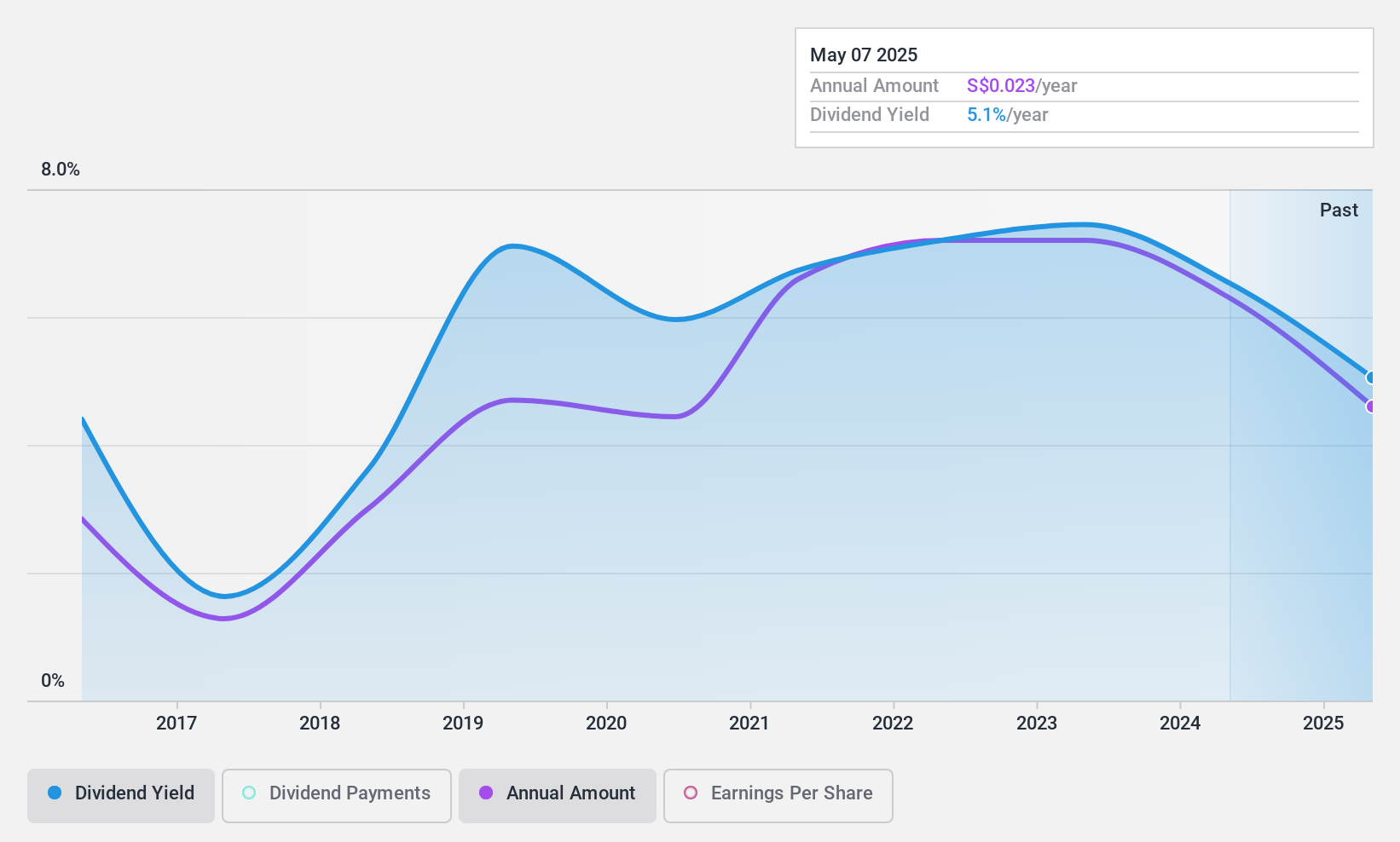

Dividend Yield: 6.6%

YHI International Limited, with a recent dividend of 3.15 Singapore cents per share for FY2023, demonstrates a cautious approach in shareholder returns amid declining sales and net income from SGD 430.89 million and SGD 20.72 million in FY2022 to SGD 376.94 million and SGD 13.05 million respectively in FY2023. Despite this downturn, dividends are supported by a low cash payout ratio of 26.6% and an earnings coverage ratio of 70.1%, suggesting reasonable sustainability albeit with historical volatility in dividend consistency over the past decade.

- Navigate through the intricacies of YHI International with our comprehensive dividend report here.

- The analysis detailed in our YHI International valuation report hints at an deflated share price compared to its estimated value.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited operates as an investment holding company offering services like stockbroking, futures broking, and more across Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market capitalization of approximately SGD 1.20 billion.

Operations: UOB-Kay Hian Holdings Limited generates its revenue primarily through securities and futures broking and related services, amounting to SGD 539.01 million.

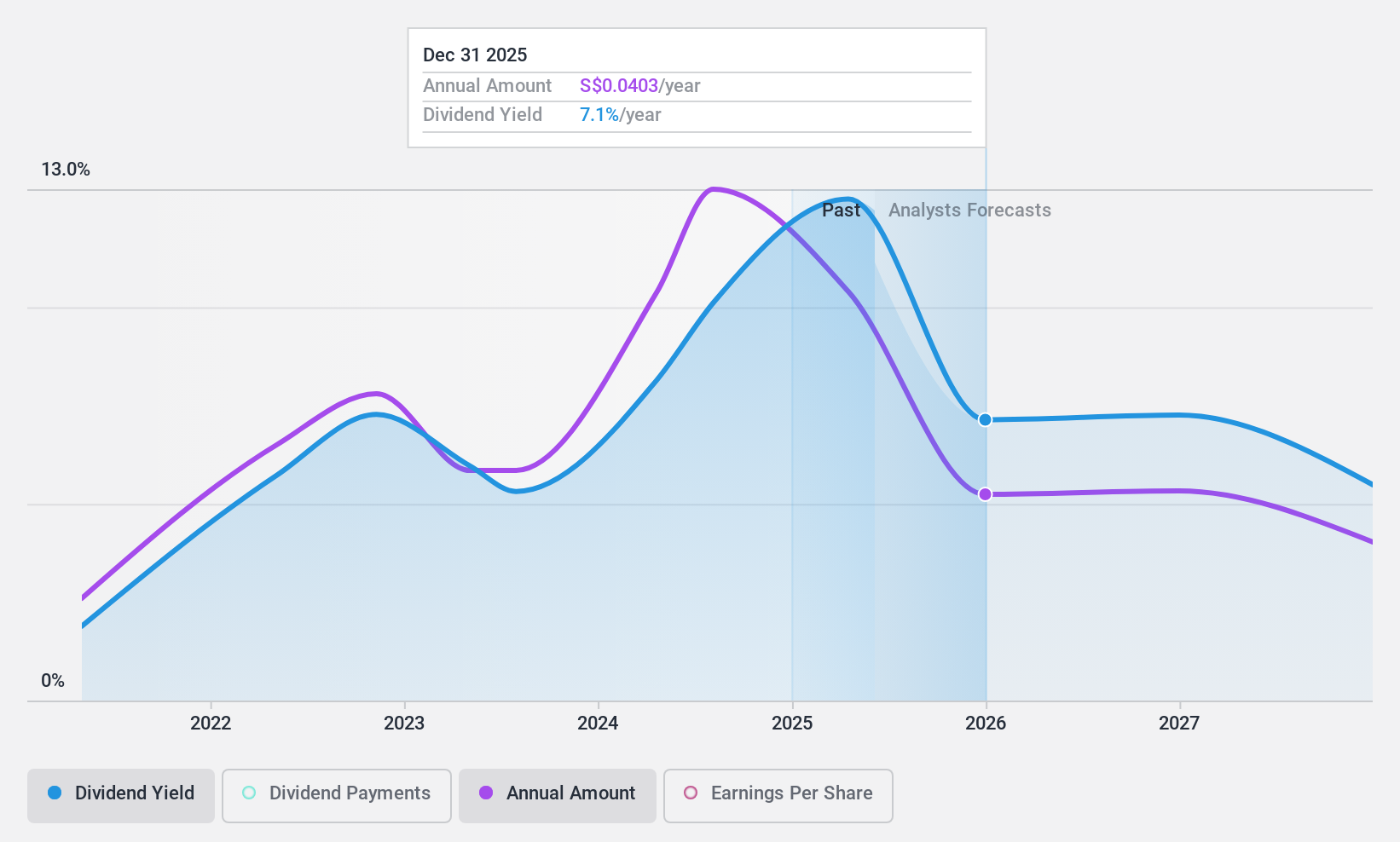

Dividend Yield: 6.9%

UOB-Kay Hian Holdings, with a dividend yield of 6.92%, stands above the Singapore market average. Despite a volatile dividend history over the past decade, recent financials show strong support for ongoing payouts: a low cash payout ratio at 21.8% and an earnings coverage reflected by a 48.2% payout ratio underscore sustainability. The firm recently declared an increased annual dividend of S$0.092 per share, set for payment on June 26, following shareholder approval at the April AGM where new board appointments were also confirmed.

- Dive into the specifics of UOB-Kay Hian Holdings here with our thorough dividend report.

- Our valuation report here indicates UOB-Kay Hian Holdings may be undervalued.

Seize The Opportunity

- Discover the full array of 21 Top SGX Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether UOB-Kay Hian Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services in Singapore, Hong Kong, Thailand, Malaysia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.