SGX Seatrium And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The Singapore market has been experiencing significant developments, with digital platforms like Primary Portal transforming equity capital market processes for greater efficiency. In this evolving landscape, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on discrepancies between a company's market price and its intrinsic value.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LHN (SGX:41O) | SGD0.33 | SGD0.37 | 11% |

| Singapore Technologies Engineering (SGX:S63) | SGD4.39 | SGD7.43 | 40.9% |

| 17LIVE Group (SGX:LVR) | SGD0.84 | SGD1.53 | 45% |

| Hongkong Land Holdings (SGX:H78) | US$3.28 | US$5.68 | 42.2% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.985 | SGD1.66 | 40.7% |

| Winking Studios (Catalist:WKS) | SGD0.31 | SGD0.51 | 39.2% |

| Digital Core REIT (SGX:DCRU) | US$0.58 | US$0.75 | 22.7% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.85 | SGD1.46 | 41.8% |

| Seatrium (SGX:5E2) | SGD1.61 | SGD2.69 | 40% |

We're going to check out a few of the best picks from our screener tool.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries and has a market cap of SGD5.48 billion.

Operations: Seatrium Limited generates its revenue primarily from Rigs & Floaters, Repairs & Upgrades, Offshore Platforms and Specialised Shipbuilding (SGD7.26 billion), along with Ship Chartering (SGD31.63 million).

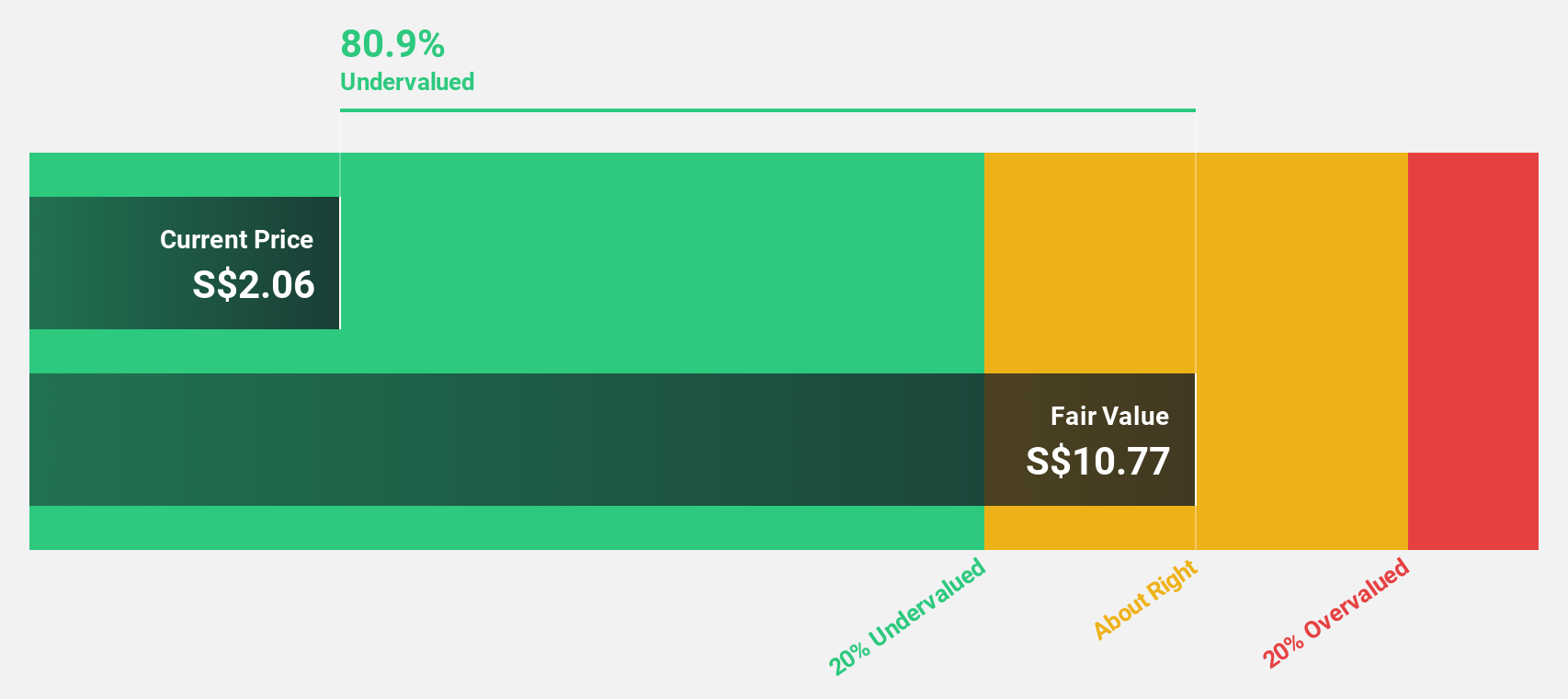

Estimated Discount To Fair Value: 40%

Seatrium Limited is trading 40% below its estimated fair value of S$2.69, with analysts forecasting significant revenue growth at 8.7% annually, outpacing the Singapore market's 3.6%. Despite a low forecasted return on equity (8.2%), Seatrium is expected to become profitable within three years, driven by substantial contracts like the S$11 billion Petrobras FPSO platforms and a third HVDC project for TenneT in the Netherlands worth approximately €2 billion each.

- Our expertly prepared growth report on Seatrium implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Seatrium with our detailed financial health report.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust with a portfolio of 107 industrial and commercial properties worth approximately S$6.4 billion, diversified across Australia, Germany, Singapore, the United Kingdom and the Netherlands, with a market cap of around S$3.70 billion.

Operations: FLCT generates revenue primarily from its portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, spread across Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

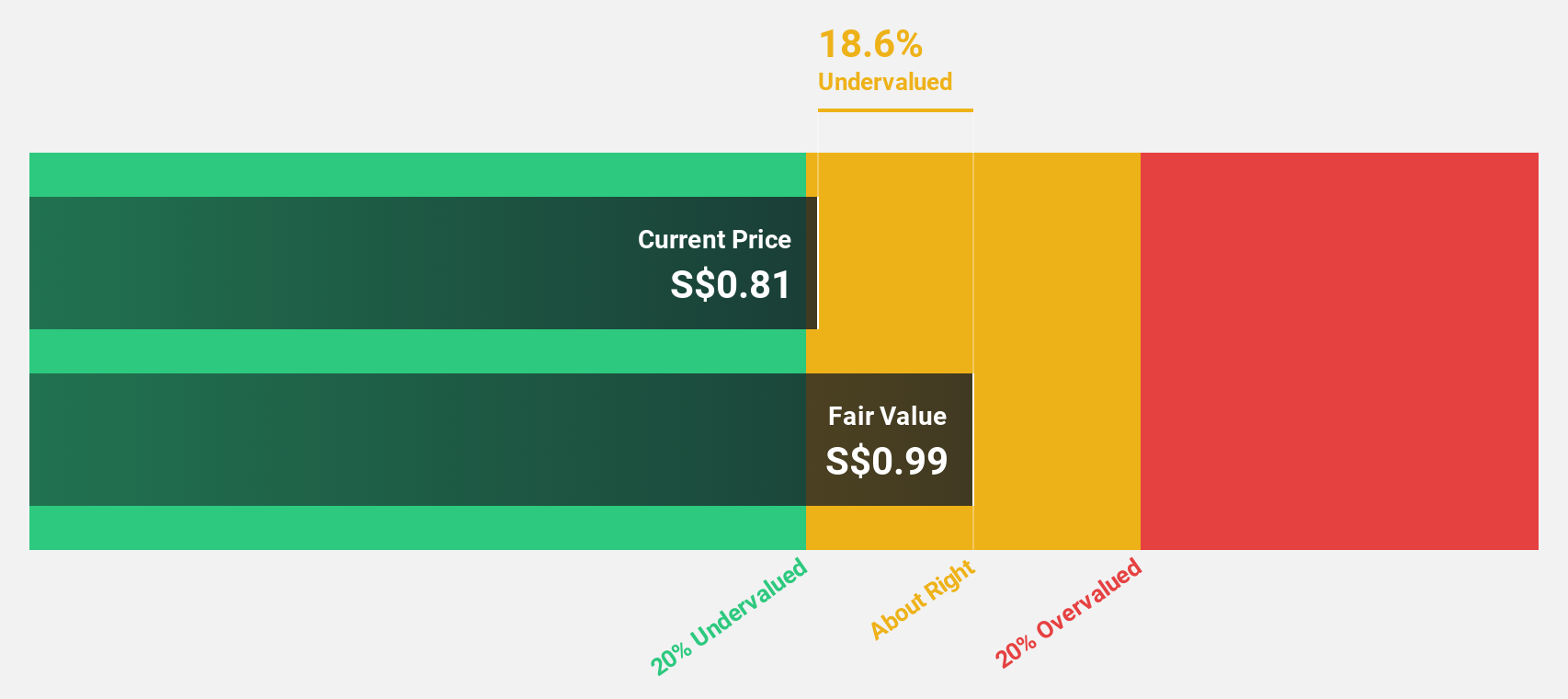

Estimated Discount To Fair Value: 40.7%

Frasers Logistics & Commercial Trust is trading 40.7% below its estimated fair value of S$1.66, with forecasted revenue growth of 6.2% annually, surpassing the Singapore market's 3.6%. Though it has an unstable dividend track record and debt not well covered by operating cash flow, earnings are projected to grow at 41.17% per year, becoming profitable within three years. Recent earnings showed sales of S$216 million and net income of S$93.59 million for H1 2024.

- The analysis detailed in our Frasers Logistics & Commercial Trust growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Frasers Logistics & Commercial Trust.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD553.36 million, provides nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: Nanofilm Technologies International Limited generates revenue from four main segments: Sydrogen (SGD1.05 million), Nanofabrication (SGD16.05 million), Advanced Materials (SGD141.54 million), and Industrial Equipment (SGD37.17 million).

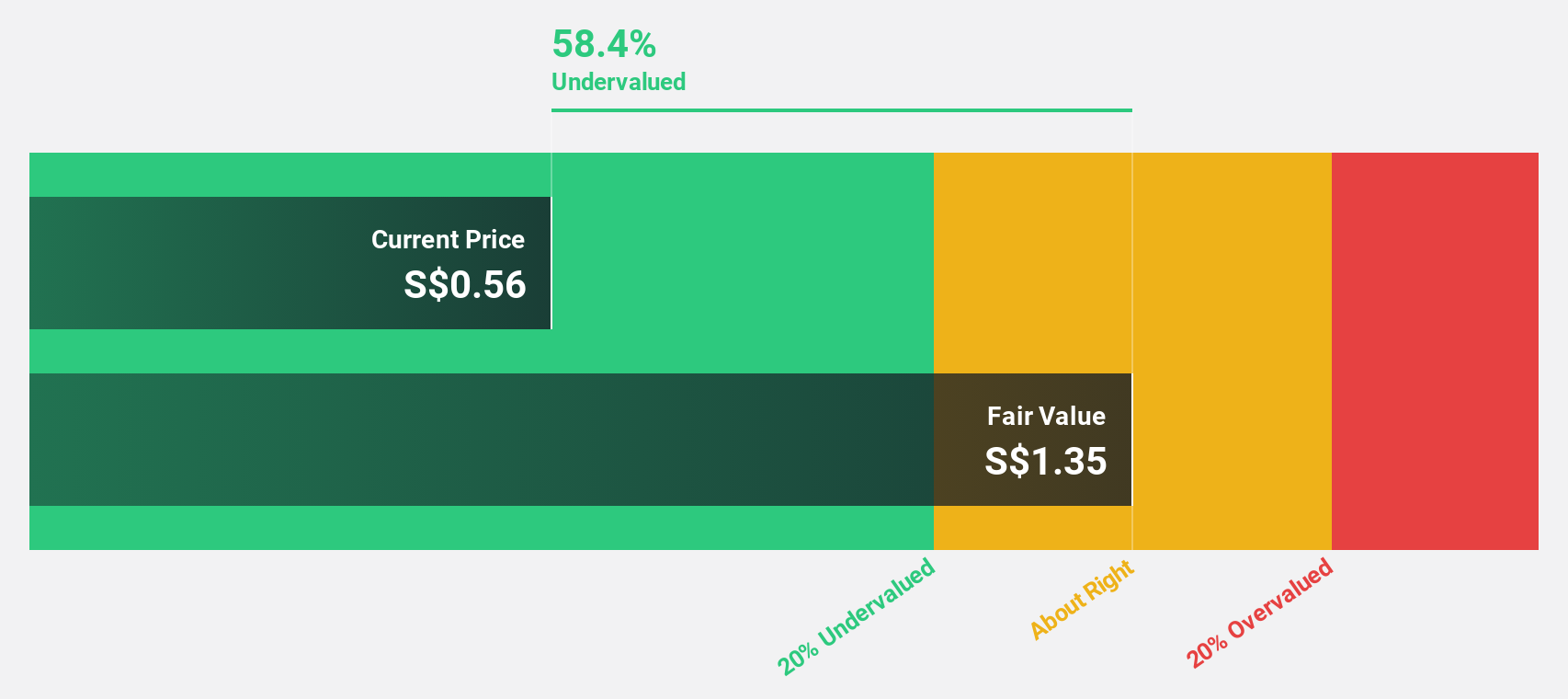

Estimated Discount To Fair Value: 41.8%

Nanofilm Technologies International is trading at S$0.85, significantly below its estimated fair value of S$1.46, indicating it may be undervalued based on cash flows. Earnings are projected to grow 50.66% annually over the next three years, outpacing the Singapore market's 9.2%. Despite lower profit margins this year (1.8%) compared to last year (18.5%), revenue growth is forecasted at 15.1% per year, higher than the market average of 3.6%. Recent leadership changes include Mr. Cho Form Po as joint Company Secretary from July 2024.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Dive into the specifics of Nanofilm Technologies International here with our thorough financial health report.

Summing It All Up

- Delve into our full catalog of 9 Undervalued SGX Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanofilm Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MZH

Nanofilm Technologies International

Provides nanotechnology solutions in Singapore, China, Japan, and Vietnam.

Flawless balance sheet with reasonable growth potential.