The Singapore market has shown resilience amidst global economic uncertainties, with the Straits Times Index reflecting steady performance. In this environment, dividend stocks can offer a reliable income stream and stability to your portfolio.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.37% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.53% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.76% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.60% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.38% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.67% | ★★★★★☆ |

| DBS Group Holdings (SGX:D05) | 6.43% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 8.16% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multi-Chem Limited, with a market cap of SGD254.97 million, is an investment holding company that distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Operations: Multi-Chem Limited generates revenue by distributing information technology products across Singapore, Greater China, Australia, India, and various international markets.

Dividend Yield: 8.6%

Multi-Chem Limited reported strong earnings growth, with net income rising to SGD 16.42 million for the half year ended June 30, 2024. Despite a high dividend yield of 8.59%, the company's dividends have been volatile and are not well covered by free cash flows or earnings, indicating potential sustainability issues. Trading at a significant discount to its estimated fair value, Multi-Chem's dividends have increased over the past decade but remain unreliable due to inconsistent payments and high payout ratios.

- Delve into the full analysis dividend report here for a deeper understanding of Multi-Chem.

- According our valuation report, there's an indication that Multi-Chem's share price might be on the cheaper side.

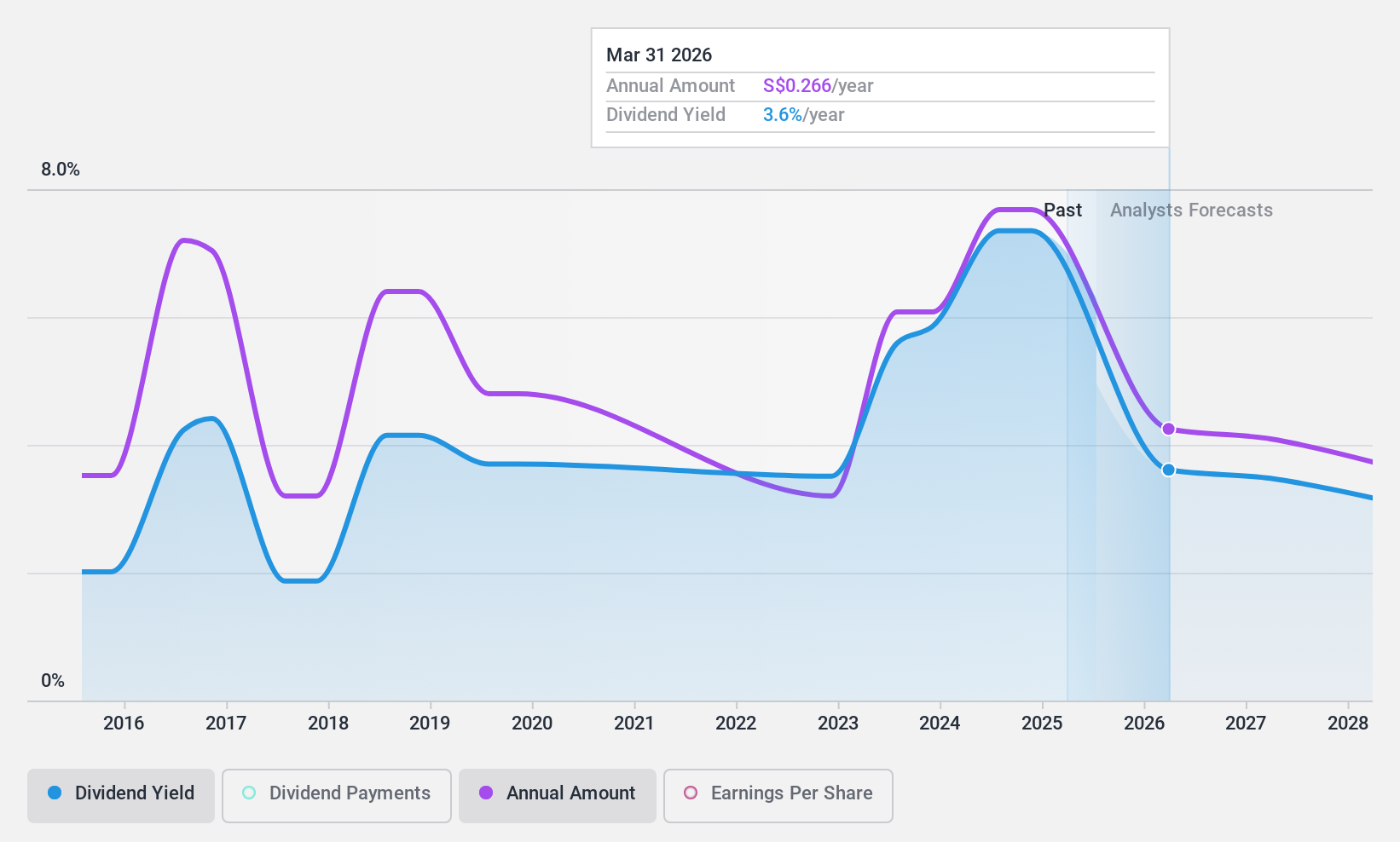

Singapore Airlines (SGX:C6L)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited, along with its subsidiaries, offers passenger and cargo air transportation services under the Singapore Airlines and Scoot brands across East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa with a market cap of SGD20.97 billion.

Operations: Singapore Airlines Limited generates revenue from three main segments: Full Service Carrier (SGD16.18 billion), Low-Cost Carrier (SGD2.45 billion), and Engineering Services (SGD1.09 billion).

Dividend Yield: 8.2%

Singapore Airlines' dividend yield of 8.16% ranks in the top 25% of Singapore's market, but its dividend history has been volatile over the past decade. The company's payout ratio stands at 75.9%, indicating dividends are covered by earnings, and a cash payout ratio of 45.9% suggests good coverage by cash flows. Recent share buybacks could potentially enhance shareholder value, yet forecasted earnings decline raises concerns about future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Singapore Airlines.

- The valuation report we've compiled suggests that Singapore Airlines' current price could be quite moderate.

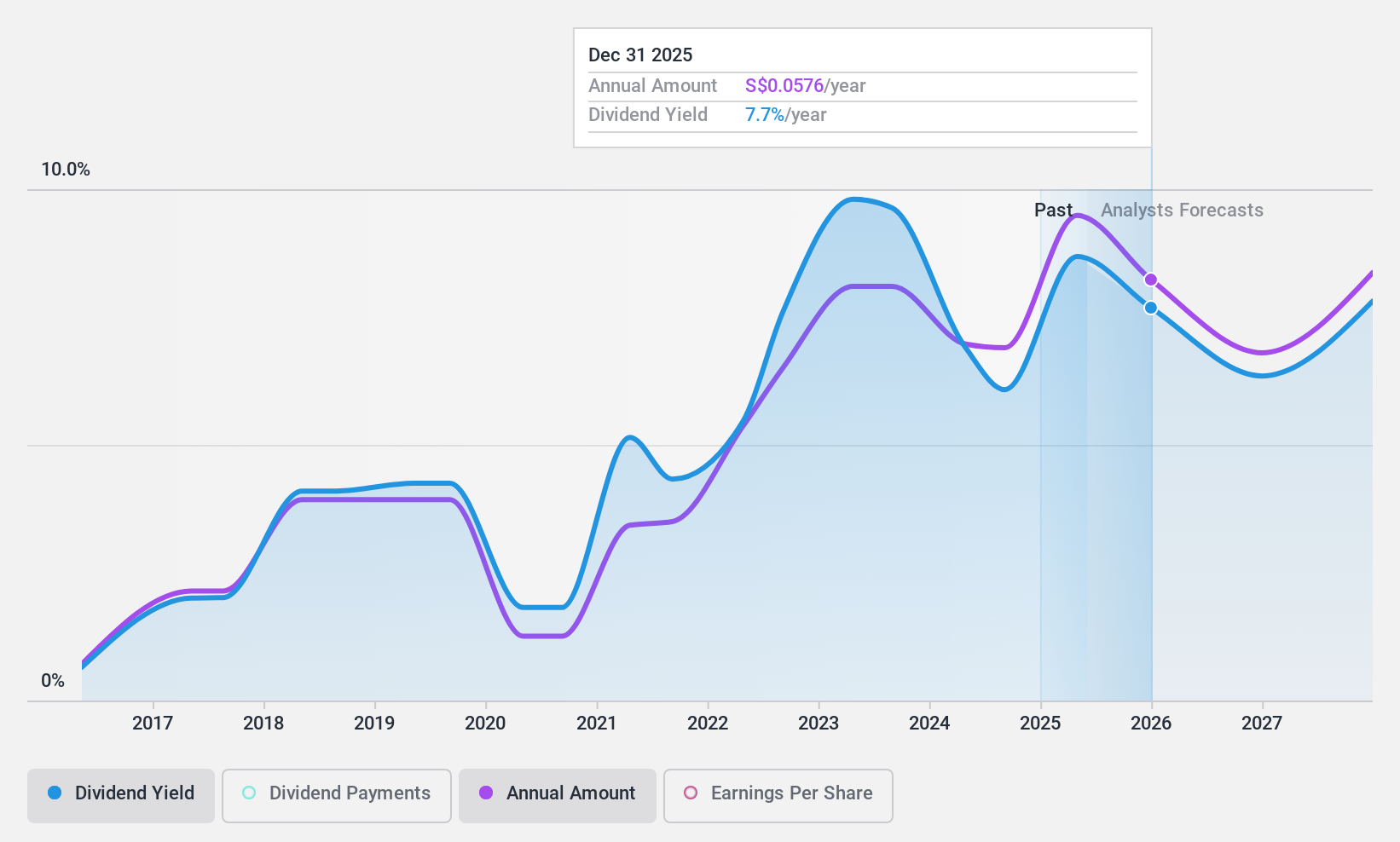

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd., an investment holding company with a market cap of SGD1.24 billion, engages in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia.

Operations: The company's revenue primarily comes from its Plantations and Palm Oil Mills segment, which generated IDR15.44 billion.

Dividend Yield: 6.6%

Bumitama Agri's dividend yield of 6.6% places it in the top 25% of payers in Singapore, though its dividend history has been volatile over the past decade. The company's payout ratio is 40.4%, indicating dividends are well covered by earnings, and a cash payout ratio of 60.8% suggests reasonable coverage by cash flows. Trading at a significant discount to its estimated fair value, Bumitama Agri offers good relative value despite an unstable dividend track record.

- Get an in-depth perspective on Bumitama Agri's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Bumitama Agri is trading behind its estimated value.

Taking Advantage

- Click through to start exploring the rest of the 16 Top SGX Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa.

Excellent balance sheet established dividend payer.