The Singapore stock market has been buzzing with activity, driven by advancements in artificial intelligence and its adoption by major financial firms like Goldman Sachs and Nomura. In this dynamic environment, identifying strong dividend stocks can provide a stable income stream while potentially benefiting from technological innovations.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.08% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.56% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.16% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.22% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.34% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.73% | ★★★★★☆ |

| Delfi (SGX:P34) | 7.02% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.10% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited (SGX:MR7) is an investment holding company providing global solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering with a market cap of SGD137.69 million.

Operations: Nordic Group Limited's revenue segments include Project Services generating SGD69.93 million and Maintenance Services contributing SGD83.13 million.

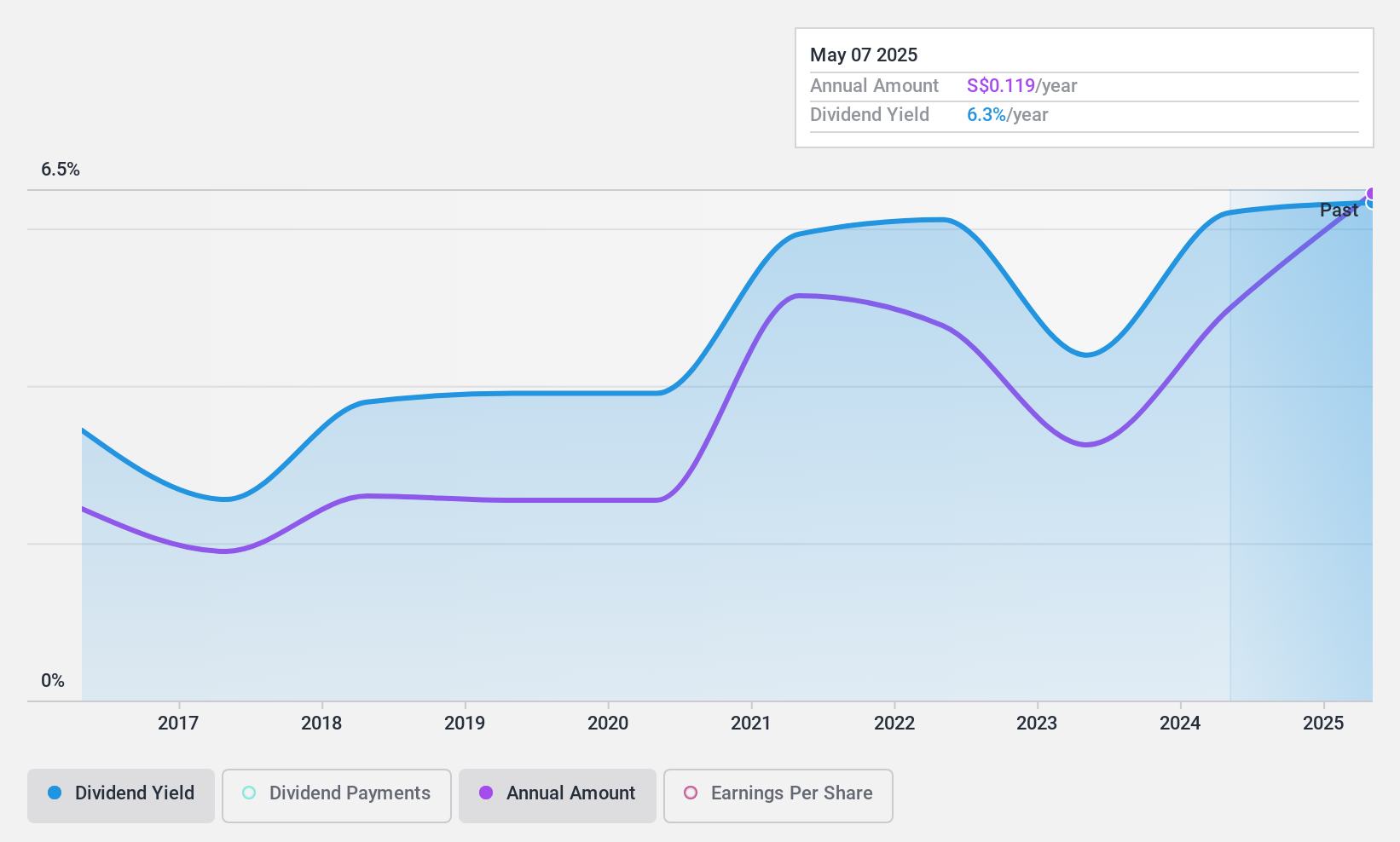

Dividend Yield: 4.6%

Nordic Group's recent earnings report for H1 2024 showed a decline in sales to S$76.16 million and net income to S$8.53 million, impacting its dividend sustainability. Despite a volatile dividend history, the company maintains a low payout ratio of 40%, ensuring dividends are well-covered by earnings and cash flows. However, the current yield of 4.61% is below Singapore's top-tier dividend payers at 6.13%.

- Click here and access our complete dividend analysis report to understand the dynamics of Nordic Group.

- Our valuation report here indicates Nordic Group may be overvalued.

QAF (SGX:Q01)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QAF Limited is an investment holding company that manufactures and distributes bread, bakery, and confectionery products in Singapore, Australia, the Philippines, Malaysia, and internationally with a market cap of SGD474.60 million.

Operations: QAF Limited's revenue segments include Bakery (SGD460.50 million) and Distribution & Warehousing (SGD164.22 million).

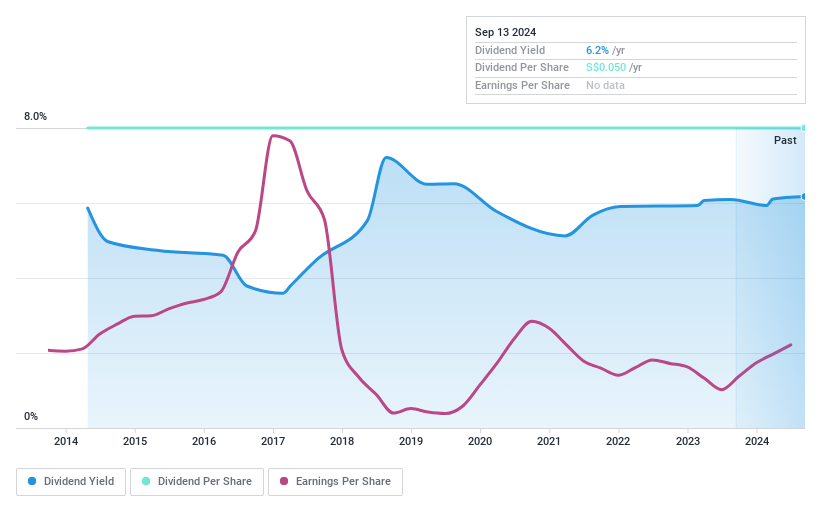

Dividend Yield: 6.1%

QAF Limited reported H1 2024 earnings of S$12.48 million on sales of S$309.23 million, showing significant growth from the previous year. The company announced an interim dividend of S$0.01 per share, payable on 26 September 2024, with a payout ratio of 82%, indicating dividends are covered by both earnings and cash flows. However, QAF's dividend history has been unreliable over the past decade and its yield is slightly below Singapore’s top-tier payers at 6.06%.

- Take a closer look at QAF's potential here in our dividend report.

- According our valuation report, there's an indication that QAF's share price might be on the expensive side.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company that offers stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services in Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market cap of SGD1.36 billion.

Operations: UOB-Kay Hian Holdings Limited generated SGD581.07 million from its Securities and Futures Broking and Other Related Services segment.

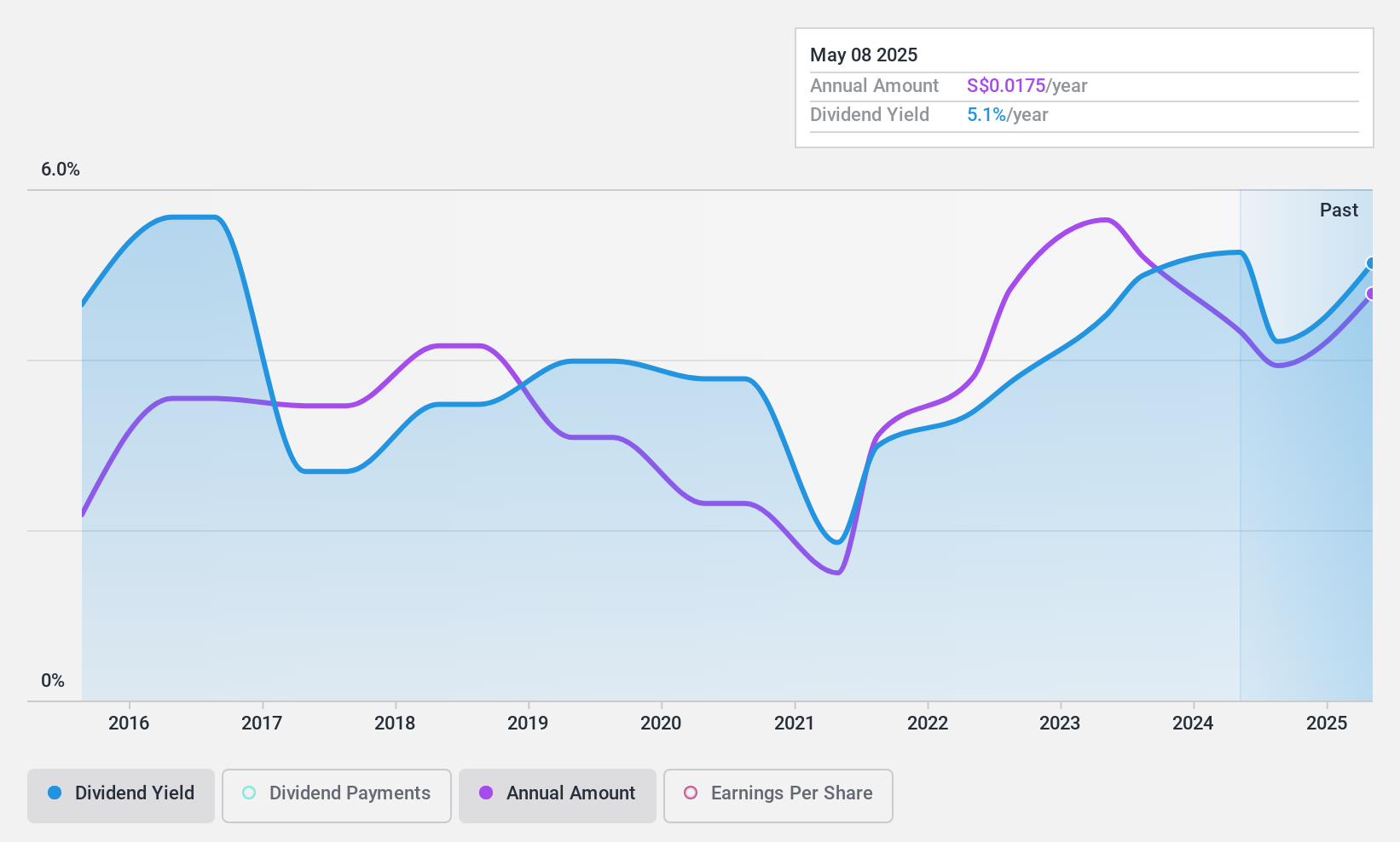

Dividend Yield: 6.3%

UOB-Kay Hian Holdings reported net income of S$113.91 million for H1 2024, up from S$69.32 million a year ago, with basic earnings per share rising to S$0.1264 from S$0.0783. While its dividend yield is among the top 25% in Singapore at 6.34%, the payments have been volatile and are not well covered by free cash flows despite a low payout ratio of 38.6%. Shareholders have also faced dilution over the past year.

- Dive into the specifics of UOB-Kay Hian Holdings here with our thorough dividend report.

- According our valuation report, there's an indication that UOB-Kay Hian Holdings' share price might be on the cheaper side.

Taking Advantage

- Dive into all 20 of the Top SGX Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QAF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Q01

QAF

An investment holding company, engages in the manufacture and distribution of bread, bakery, and confectionery products in Singapore, Australia, the Philippines, Malaysia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.