Stock Analysis

- Sweden

- /

- Specialty Stores

- /

- OM:BMAX

Dividend Investors: Don't Be Too Quick To Buy Byggmax Group AB (publ) (STO:BMAX) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Byggmax Group AB (publ) (STO:BMAX) is about to trade ex-dividend in the next 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Byggmax Group's shares before the 7th of May to receive the dividend, which will be paid on the 14th of May.

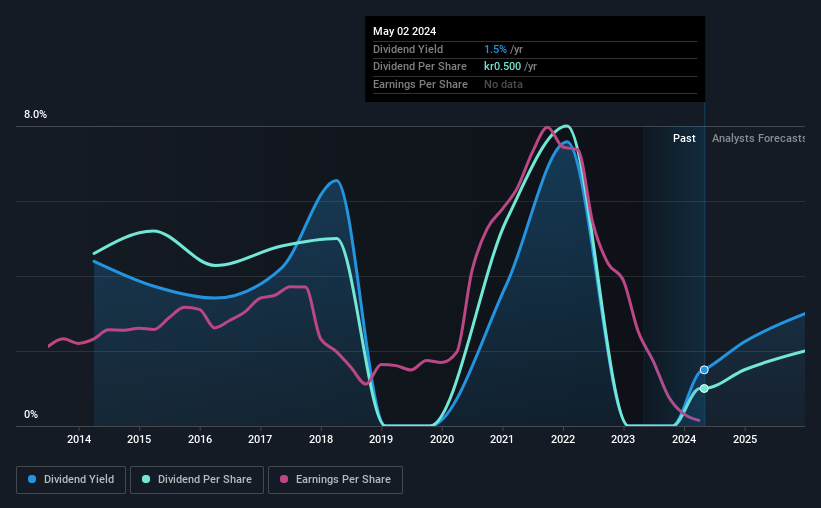

The company's next dividend payment will be kr00.50 per share, and in the last 12 months, the company paid a total of kr0.50 per share. Based on the last year's worth of payments, Byggmax Group has a trailing yield of 1.5% on the current stock price of kr033.38. If you buy this business for its dividend, you should have an idea of whether Byggmax Group's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Byggmax Group

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year, Byggmax Group paid out 244% of its profit to shareholders in the form of dividends. This is not sustainable behaviour and requires a closer look on behalf of the purchaser.

Click here to see how much of its profit Byggmax Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Byggmax Group's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 38% a year over the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Byggmax Group's dividend payments per share have declined at 14% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Is Byggmax Group worth buying for its dividend? Not only are earnings per share shrinking, but Byggmax Group is paying out a disconcertingly high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Byggmax Group. To help with this, we've discovered 3 warning signs for Byggmax Group (1 makes us a bit uncomfortable!) that you ought to be aware of before buying the shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether Byggmax Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BMAX

Byggmax Group

Sells building materials and related products for DIY projects in Sweden, Norway, and internationally.

Reasonable growth potential and fair value.