Stock Analysis

- Saudi Arabia

- /

- Software

- /

- SASE:7201

Arab Sea Information Systems (TADAWUL:7201) shareholders are still up 525% over 5 years despite pulling back 12% in the past week

It's been a soft week for Arab Sea Information Systems Company (TADAWUL:7201) shares, which are down 12%. But that does not change the realty that the stock's performance has been terrific, over five years. In that time, the share price has soared some 525% higher! Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 31% decline over the last three years: that's a long time to wait for profits. It really delights us to see such great share price performance for investors.

In light of the stock dropping 12% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Arab Sea Information Systems

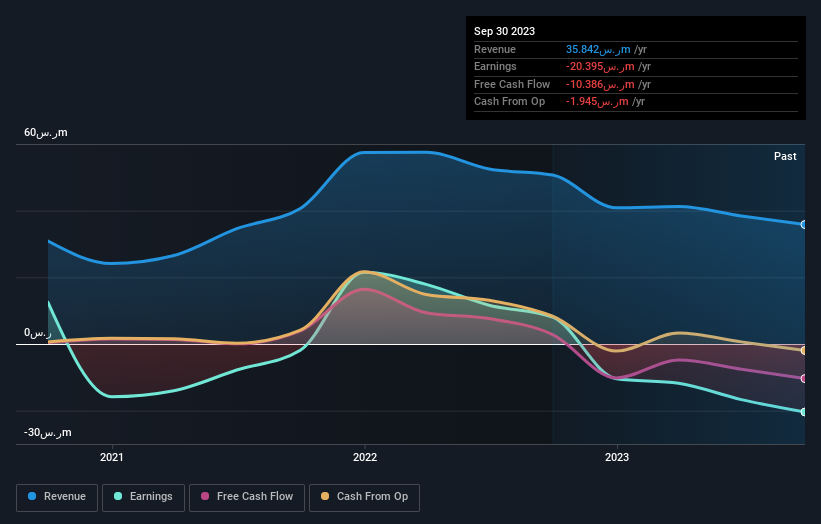

Because Arab Sea Information Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Arab Sea Information Systems can boast revenue growth at a rate of 3.2% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 44% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Arab Sea Information Systems' financial health with this free report on its balance sheet.

A Different Perspective

Investors in Arab Sea Information Systems had a tough year, with a total loss of 11%, against a market gain of about 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 44%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Arab Sea Information Systems you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Arab Sea Information Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:7201

Arab Sea Information Systems

Arab Sea Information Systems Company, together with its subsidiaries, engages in the development and sale of integrated software solutions for commercial and government customers in the Kingdom of Saudi Arabia.

Excellent balance sheet with weak fundamentals.