Stock Analysis

Risks To Shareholder Returns Are Elevated At These Prices For Corticeira Amorim, S.G.P.S., S.A. (ELI:COR)

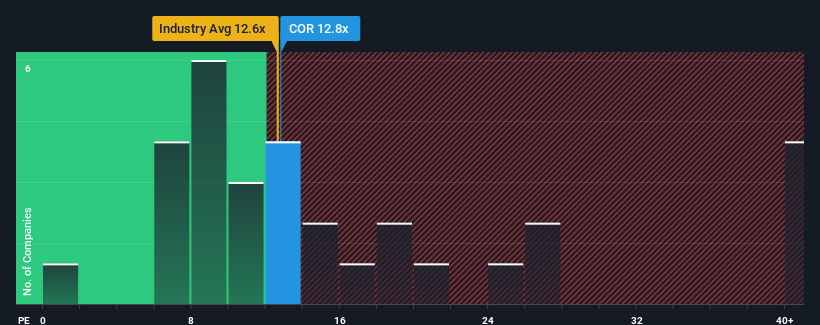

With a median price-to-earnings (or "P/E") ratio of close to 12x in Portugal, you could be forgiven for feeling indifferent about Corticeira Amorim, S.G.P.S., S.A.'s (ELI:COR) P/E ratio of 12.8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Corticeira Amorim S.G.P.S certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Corticeira Amorim S.G.P.S

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Corticeira Amorim S.G.P.S would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. Pleasingly, EPS has also lifted 47% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 2.6% each year as estimated by the seven analysts watching the company. With the market predicted to deliver 5.8% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Corticeira Amorim S.G.P.S is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Corticeira Amorim S.G.P.S currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Corticeira Amorim S.G.P.S with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Corticeira Amorim S.G.P.S' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Corticeira Amorim S.G.P.S is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:COR

Corticeira Amorim S.G.P.S

Corticeira Amorim, S.G.P.S., S.A. manufactures and sells cork and cork related products worldwide.

Good value with adequate balance sheet.