Stock Analysis

Quonia Socimi Leads The Charge Among 3 European Penny Stocks

Reviewed by Simply Wall St

The European market has shown resilience with the STOXX Europe 600 Index rising for a fourth consecutive week, buoyed by optimism over easing trade tensions between China and the U.S. Amidst this backdrop, investors are increasingly looking at penny stocks as potential opportunities, despite their historical reputation as relics of past market eras. These stocks often represent smaller or newer companies that can offer growth potential at lower price points when supported by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.26 | SEK2.16B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.00 | SEK302.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.62 | SEK271.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.64 | PLN123.37M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.478 | NOK106.21M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 4 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €1.62 | €22.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.999 | €33.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.215 | €305.81M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 439 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Quonia Socimi (BME:YQUO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quonia Socimi, S.A. is a real estate investment fund focused on acquiring and managing properties in Barcelona, with a market cap of €39.88 million.

Operations: The company generates its revenue primarily from its commercial real estate investment trust (REIT) operations, amounting to €4.12 million.

Market Cap: €39.88M

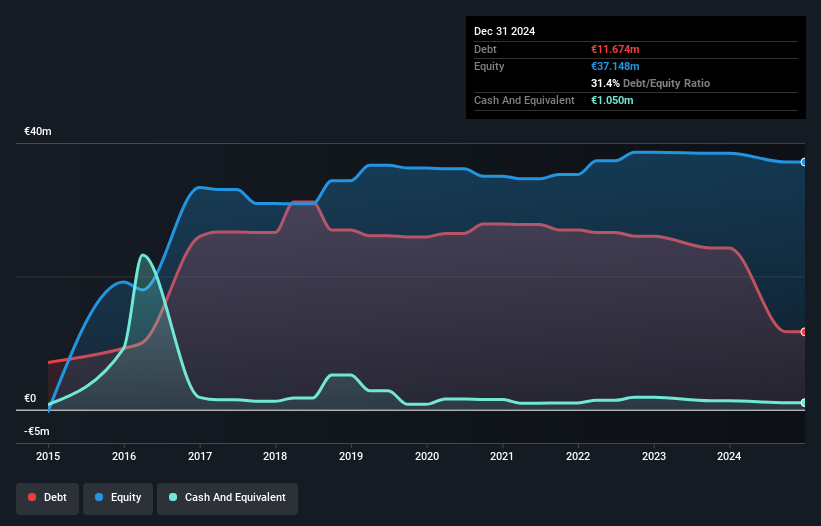

Quonia Socimi, S.A. has shown impressive earnings growth, with a 246.6% increase over the past year, surpassing the REIT industry average. Despite its low revenue of €4.12 million, the company reported a significant net income of €5.89 million for 2024, aided by a large one-off gain of €3.4 million. While its debt to equity ratio has improved to 31.4%, short-term assets do not cover long-term liabilities (€11.3M). The dividend yield is not well covered by earnings and management experience data is insufficient; however, stable weekly volatility suggests consistent performance amidst these challenges.

- Click to explore a detailed breakdown of our findings in Quonia Socimi's financial health report.

- Examine Quonia Socimi's past performance report to understand how it has performed in prior years.

Sinteza (BVB:STZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinteza S.A. is a Romanian company that produces and sells basic organic chemical products, with a market capitalization of RON152.06 million.

Operations: The company's revenue is primarily derived from the manufacture of other organic basic chemicals, totaling RON2.76 million.

Market Cap: RON152.06M

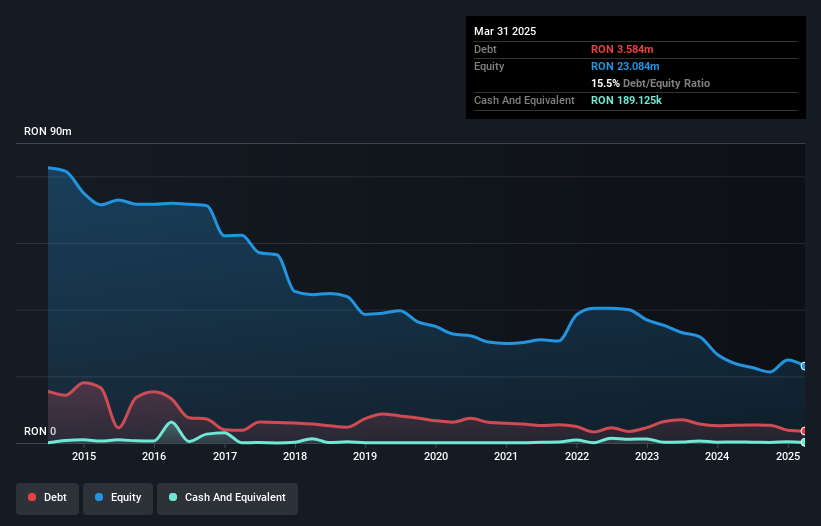

Sinteza S.A., a Romanian chemical producer, faces challenges typical of penny stocks, with revenue dropping significantly to RON2.82 million for 2024 from RON18.54 million the previous year. Despite being pre-revenue by US$ standards and currently unprofitable, it maintains a satisfactory net debt to equity ratio of 13.9% and has not diluted shareholders recently. The company possesses a cash runway exceeding three years due to positive free cash flow growth, although its short-term assets fall short of covering both short- and long-term liabilities. Share price volatility remains high but has decreased over the past year.

- Jump into the full analysis health report here for a deeper understanding of Sinteza.

- Evaluate Sinteza's historical performance by accessing our past performance report.

Kongsberg Automotive (OB:KOA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kongsberg Automotive ASA develops, manufactures, and sells products to the automotive industry worldwide, with a market cap of NOK1.35 billion.

Operations: Kongsberg Automotive ASA has not reported any specific revenue segments.

Market Cap: NOK1.35B

Kongsberg Automotive ASA, with a market cap of NOK1.35 billion, exemplifies the mixed landscape of penny stocks in Europe. Despite being unprofitable, it has successfully reduced losses over the past five years and maintains a positive free cash flow, providing a cash runway exceeding three years. Recent strategic moves include securing significant contracts worth EUR 78 million combined and expanding production capabilities in India to enhance its global footprint. However, challenges persist with high net debt to equity ratio at 61.3% and an inexperienced board averaging 1.7 years tenure, affecting stability perceptions among investors.

- Get an in-depth perspective on Kongsberg Automotive's performance by reading our balance sheet health report here.

- Explore historical data to track Kongsberg Automotive's performance over time in our past results report.

Seize The Opportunity

- Access the full spectrum of 439 European Penny Stocks by clicking on this link.

- Ready For A Different Approach? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quonia Socimi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:YQUO

Quonia Socimi

A real estate investment fund, engages in the acquisition and management of real estate assets in Barcelona.