- Netherlands

- /

- Logistics

- /

- ENXTAM:PNL

3 Euronext Amsterdam Growth Stocks With High Insider Ownership And Up To 108% Earnings Growth

Reviewed by Simply Wall St

The European market has seen a boost in investor sentiment, driven by expectations of interest rate cuts from both the Federal Reserve and the European Central Bank. Amid this optimistic backdrop, identifying growth companies with high insider ownership can be particularly compelling, as it often signals confidence from those closest to the business.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 79.2% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 107.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 78.3% |

| MotorK (ENXTAM:MTRK) | 35.8% | 108.4% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Underneath we present a selection of stocks filtered out by our screen.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines for collecting and processing used beverage containers primarily in the Netherlands, North America, and Europe with a market cap of €302.87 million.

Operations: Envipco Holding generates revenue through the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Earnings Growth Forecast: 79.2% p.a.

Envipco Holding, a Dutch company with high insider ownership, is experiencing significant revenue growth, forecasted at 34.8% per year. Recent earnings show substantial improvement with sales reaching €26.57 million in Q2 2024, up from €16.48 million a year ago, and net loss narrowing to €0.532 million from €1.8 million. Despite highly volatile share prices recently and past shareholder dilution, insider buying has been more prevalent than selling in the last three months.

- Get an in-depth perspective on Envipco Holding's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Envipco Holding is trading behind its estimated value.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

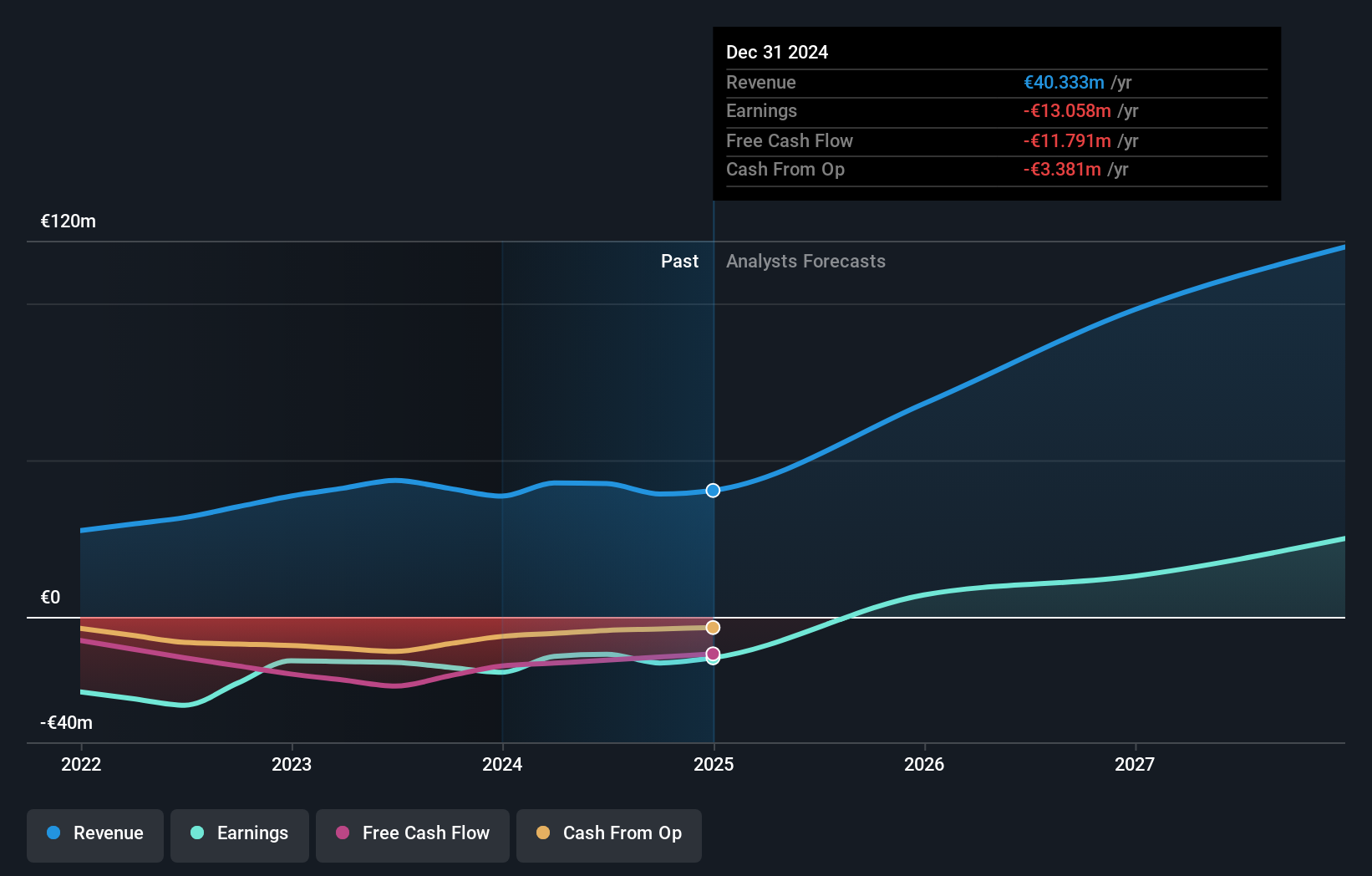

Overview: MotorK plc, with a market cap of €271.79 million, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company's revenue segment is primarily driven by its Software & Programming division, which generates €42.50 million.

Insider Ownership: 35.8%

Earnings Growth Forecast: 108.4% p.a.

MotorK plc, a Dutch company with high insider ownership, is forecasted to achieve significant revenue growth at 22.1% annually, outpacing the Dutch market's 9.7%. The company reported H1 2024 sales of €21.46 million and a reduced net loss of €6.48 million. Despite past shareholder dilution and less than one year of cash runway, MotorK is expected to become profitable within three years, showing above-average market growth in earnings at 108.44% per year.

- Click to explore a detailed breakdown of our findings in MotorK's earnings growth report.

- Our valuation report here indicates MotorK may be overvalued.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

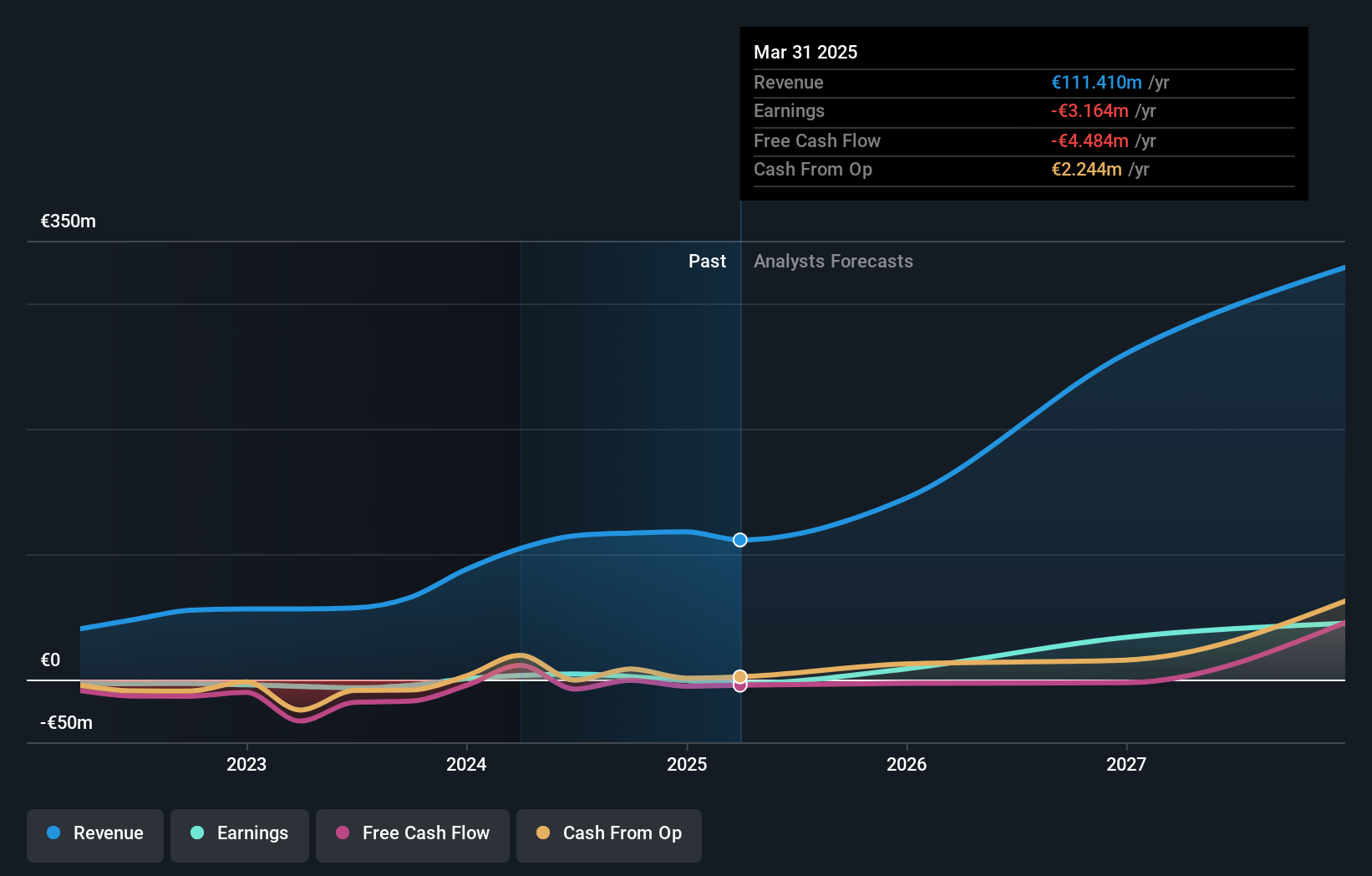

Overview: PostNL N.V. provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally, with a market cap of €621.61 million.

Operations: The company's revenue segments include Parcels (€2.28 billion) and Mail in The Netherlands (€1.35 billion).

Insider Ownership: 35.6%

Earnings Growth Forecast: 36.4% p.a.

PostNL, a Dutch company with high insider ownership, has shown mixed financial performance. Despite reporting Q2 sales of €793 million and a net income of €10 million, its dividend yield of 4.85% is not well covered by earnings. The company's revenue growth forecast (2.6% annually) lags behind the Dutch market (9.7%), though its earnings are expected to grow significantly at 36.4% per year, outpacing market averages. Recent events include completing a €300 million sustainable bond offering in June 2024.

- Take a closer look at PostNL's potential here in our earnings growth report.

- Our valuation report here indicates PostNL may be undervalued.

Next Steps

- Discover the full array of 5 Fast Growing Euronext Amsterdam Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PNL

PostNL

Provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally.

Good value with reasonable growth potential.