- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A204270

High Growth Tech Stocks in South Korea October 2024

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index stumbling by 4.2 percent over three consecutive sessions and currently sitting just above the 2,560-point mark. This decline comes amid broader global market uncertainties and heightened geopolitical tensions affecting oil prices, creating a challenging environment for investors seeking high-growth opportunities in the tech sector. Identifying promising tech stocks in such conditions requires careful consideration of their innovation potential and resilience against economic fluctuations.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd is a company that offers telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market capitalization of ₩1.60 trillion.

Operations: Seojin System Co., Ltd generates revenue primarily through its EMS Division, contributing ₩1.52 billion, and its Semiconductor segment, adding ₩169.98 million. The company has a market capitalization of approximately ₩1.60 trillion.

Seojin SystemLtd, a South Korean tech firm, recently bolstered its financial position through a significant private placement of convertible and subordinate bonds totaling KRW 100 billion. This strategic move not only enhances their capital but also aligns with their aggressive R&D investment strategy, which is crucial for maintaining technological leadership. With an expected revenue growth rate of 33.6% and earnings forecast to surge by 52.1% annually, the company is well-positioned to capitalize on market opportunities despite stiff competition in the tech sector. Their commitment to innovation is further underscored by substantial investments in research and development, ensuring they remain at the forefront of technological advancements and market demands.

- Unlock comprehensive insights into our analysis of Seojin SystemLtd stock in this health report.

Evaluate Seojin SystemLtd's historical performance by accessing our past performance report.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

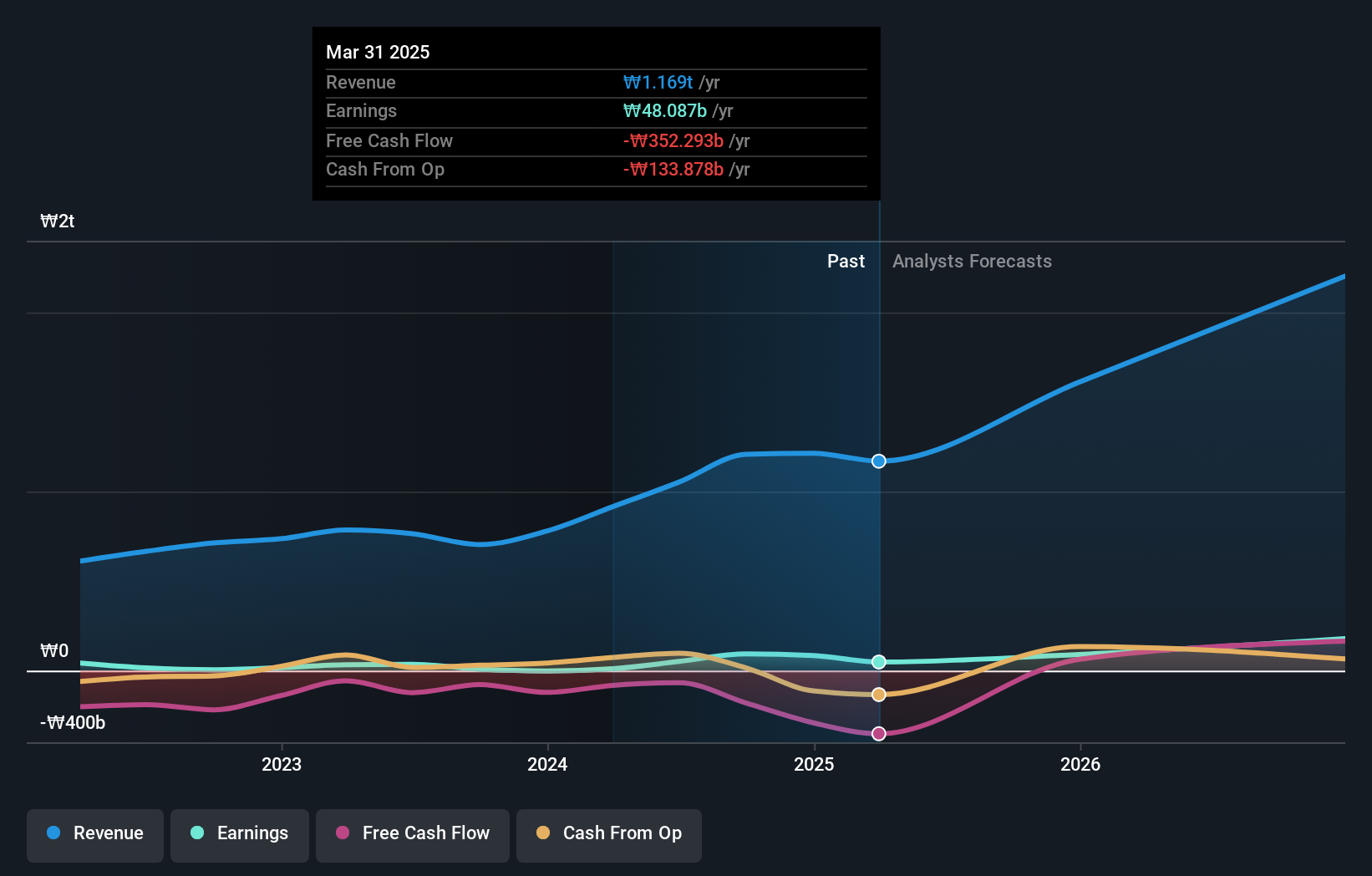

Overview: JNTC Co., Ltd. operates in South Korea, offering products such as connectors, hinges, and tempered glass, with a market capitalization of approximately ₩1.26 trillion.

Operations: The company generates revenue primarily from the manufacturing and sales of mobile parts, amounting to approximately ₩402.99 billion.

JNTC, a South Korean tech firm, recently transitioned to profitability this year, signaling robust operational improvements and strategic positioning within the high-growth sectors of technology. The company is set to expand earnings by an impressive 51.9% annually, outpacing the broader Korean market's growth rate of 29.7%. This financial trajectory is bolstered by JNTC's commitment to research and development, with significant investments aimed at fostering innovation and securing competitive advantages in a rapidly evolving industry landscape. Moreover, despite a volatile share price in recent months, JNTC’s revenue growth forecast at 18.1% annually surpasses the market average of 10.5%, indicating potential resilience and upward momentum in its sector.

- Click here and access our complete health analysis report to understand the dynamics of JNTC.

Gain insights into JNTC's past trends and performance with our Past report.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

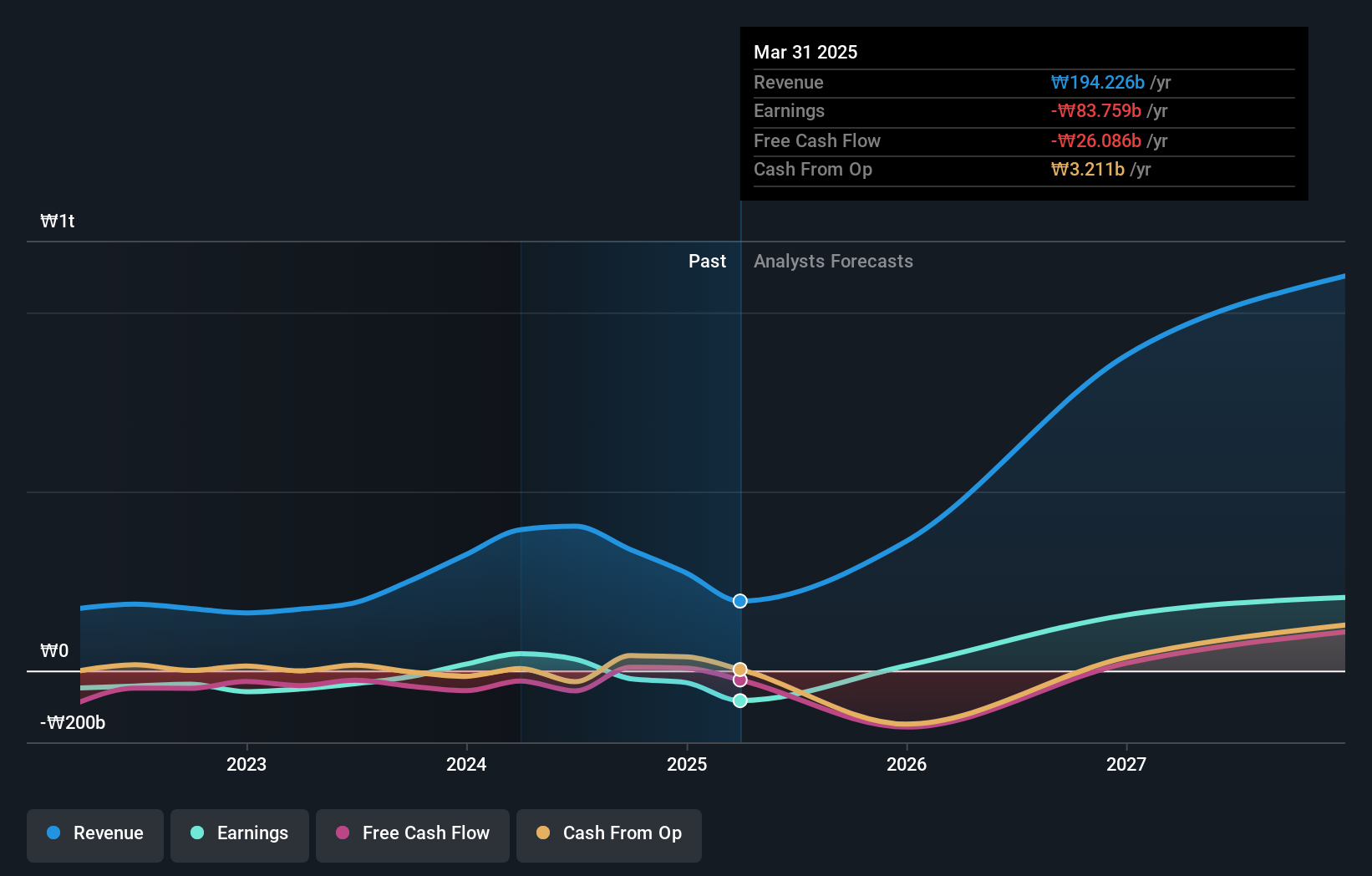

Overview: Pearl Abyss Corp. is involved in software development for games and has a market capitalization of approximately ₩2.42 trillion.

Operations: The company primarily generates revenue through game sales, amounting to approximately ₩330.62 billion.

With an expected annual profit growth of 52.8%, Pearl Abyss stands out in the South Korean tech landscape, significantly outpacing the broader market's growth rate of 29.7%. This robust expansion is underpinned by a strategic emphasis on R&D, with the company channeling substantial resources to fuel innovation—evident from its recent earnings call highlighting these efforts. Furthermore, revenue forecasts project a growth rate of 22.9% per year, dwarfing the market average of 10.5%, which could position Pearl Abyss favorably among its peers in navigating future industry dynamics and enhancing its market share.

- Dive into the specifics of Pearl Abyss here with our thorough health report.

Review our historical performance report to gain insights into Pearl Abyss''s past performance.

Seize The Opportunity

- Get an in-depth perspective on all 48 KRX High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A204270

JNTC

Provides connector, hinge, and tempered glass products in South Korea.

Exceptional growth potential and fair value.