Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

KRX Growth Companies With High Insider Ownership And Up To 64% Revenue Growth

Reviewed by Simply Wall St

The South Korea stock market has ticked lower in back-to-back sessions, slipping almost 10 points or 0.4 percent along the way. Despite this recent downturn, growth companies with high insider ownership continue to be a focal point for investors looking for robust revenue growth and strong alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 78.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 114.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 37.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's uncover some gems from our specialized screener.

ITM Semiconductor (KOSDAQ:A084850)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITM Semiconductor Co., Ltd. manufactures and sells components for secondary batteries worldwide, with a market cap of ₩400.55 billion.

Operations: The company's revenue segments include the SET Division with ₩140.49 billion and the Parts Division with ₩475.24 billion.

Insider Ownership: 14.9%

Revenue Growth Forecast: 13% p.a.

ITM Semiconductor is trading at 41.8% below its estimated fair value, presenting a good relative value compared to peers and industry. Analysts forecast earnings to grow 59.37% per year, with revenue expected to increase by 13% annually, outpacing the South Korean market's growth rate of 10.7%. Despite low return on equity projections (11.1%), ITM Semiconductor is anticipated to become profitable within three years, driven by substantial insider ownership and recent strategic acquisitions like BJ Ventures Co., Ltd.'s additional stake purchase for KRW 15 billion in June 2024.

- Delve into the full analysis future growth report here for a deeper understanding of ITM Semiconductor.

- The analysis detailed in our ITM Semiconductor valuation report hints at an deflated share price compared to its estimated value.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a bio company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩16.60 billion.

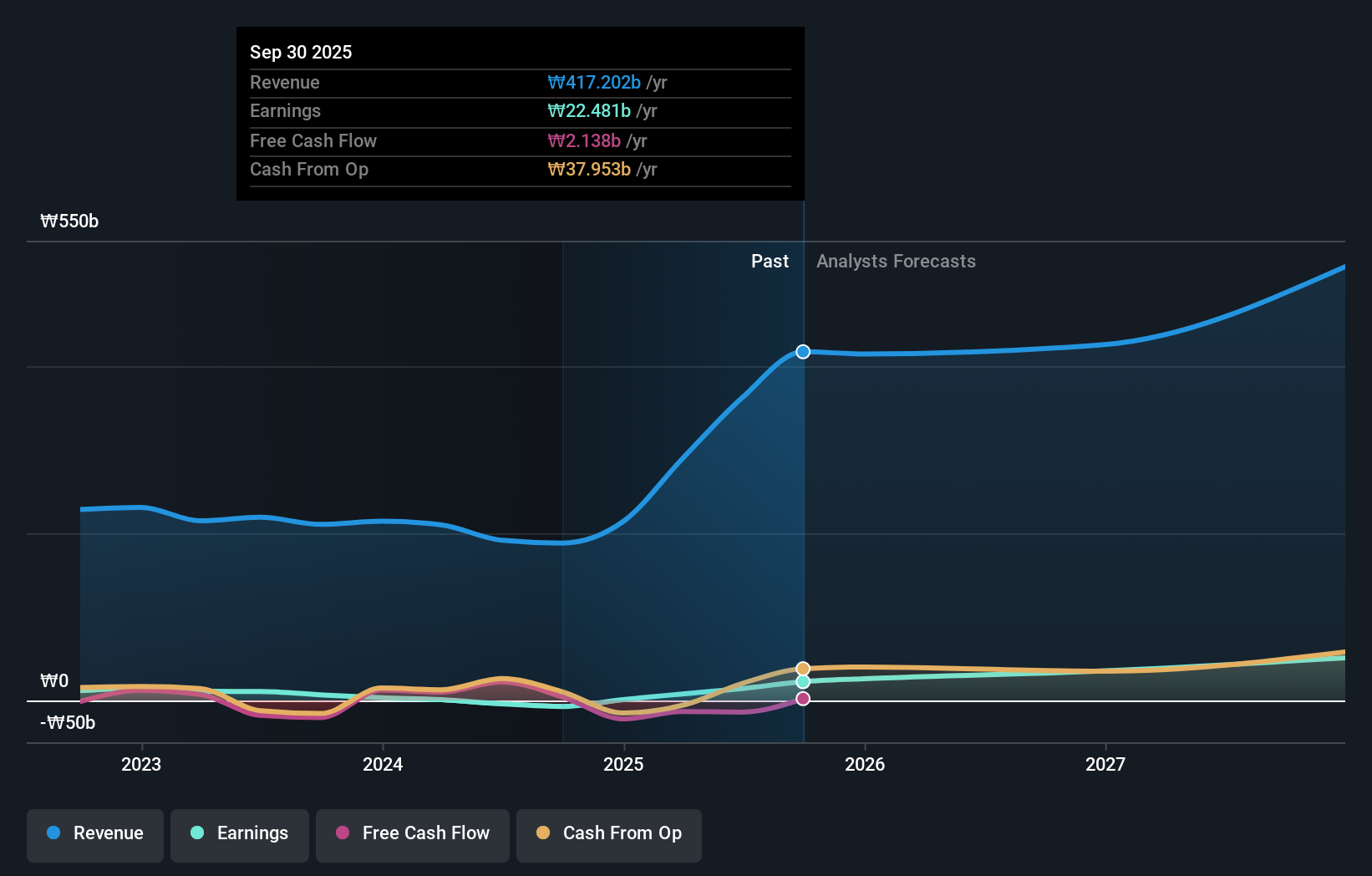

Operations: The company's revenue segments include ₩90.79 million from biotechnology.

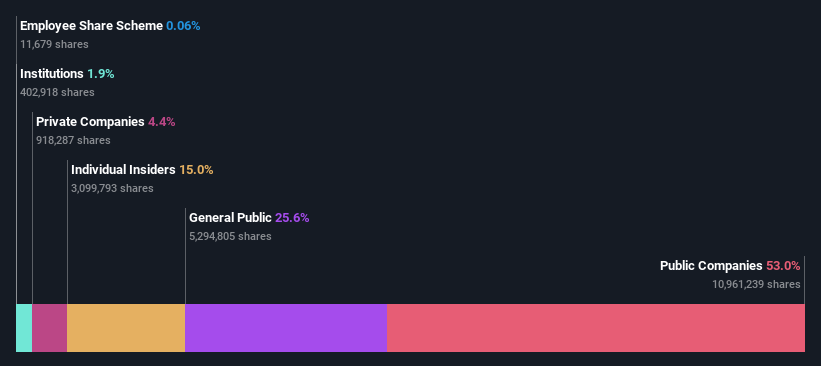

Insider Ownership: 26.6%

Revenue Growth Forecast: 64.2% p.a.

ALTEOGEN Inc. is expected to become profitable within the next three years, with revenue forecasted to grow 64.2% annually, significantly outpacing the South Korean market's growth rate of 10.7%. Despite recent shareholder dilution and high share price volatility, it trades at 75.7% below its estimated fair value. The recent approval of Tergase® by Korea’s MFDS marks a key milestone, leveraging its proprietary Hybrozyme™ Technology for superior product purity and broader applications in medical fields.

- Take a closer look at ALTEOGEN's potential here in our earnings growth report.

- The analysis detailed in our ALTEOGEN valuation report hints at an inflated share price compared to its estimated value.

D.I (KOSE:A003160)

Simply Wall St Growth Rating: ★★★★★★

Overview: D.I Corporation manufactures and supplies semiconductor inspection equipment in South Korea and internationally, with a market cap of ₩385.60 billion.

Operations: D.I Corporation's revenue segments include Electronic Parts (₩12.90 billion), Semiconductor Equipment (₩137.77 billion), Environmental Facilities (₩6.85 billion), Audio and Video Equipment (₩14.35 billion), and Secondary Battery Equipment (₩29.55 billion).

Insider Ownership: 32%

Revenue Growth Forecast: 46.4% p.a.

D.I Corporation is expected to become profitable within three years, with revenue growth forecasted at 46.4% annually, outpacing the South Korean market's 10.7%. Despite high share price volatility, a recent private placement of KRW 20 billion in convertible bonds indicates strong investor confidence and potential for substantial future growth. The bonds are fully convertible into shares, enhancing insider ownership and aligning management interests with shareholders.

- Dive into the specifics of D.I here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, D.I's share price might be too optimistic.

Where To Now?

- Explore the 90 names from our Fast Growing KRX Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.