- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

Hidden Gems in South Korea Top Undiscovered Stocks for August 2024

Reviewed by Simply Wall St

The South Korea stock market recently ended a three-day slide, with the KOSPI index closing just beneath the 2,690-point plateau. Despite mixed global forecasts and key inflation data on the horizon, small-cap stocks in South Korea continue to attract interest for their potential growth opportunities. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and innovation amidst broader market fluctuations. Here are three such hidden gems in South Korea worth considering for August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide, with a market cap of ₩1.21 trillion.

Operations: PSK HOLDINGS generates revenue primarily from the sale of semiconductor manufacturing and flat panel display equipment. The company's net profit margin is notable at 15.67%.

PSK Holdings, a small-cap player in South Korea, has shown impressive earnings growth of 40.8% over the past year, outpacing the Semiconductor industry’s -10.8%. The company is forecasted to continue this trend with an annual growth rate of 20.74%. A notable one-off gain of ₩26.4B impacted its financials for the year ending June 30, 2024. Despite a debt-to-equity ratio increase from 0% to 4.4% over five years, PSK remains profitable with no cash runway concerns and sufficient interest coverage on its payments.

- Navigate through the intricacies of PSK HOLDINGS with our comprehensive health report here.

Gain insights into PSK HOLDINGS' historical performance by reviewing our past performance report.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. develops, manufactures, and sells PCB automation equipment in South Korea and internationally, with a market cap of ₩521.58 billion.

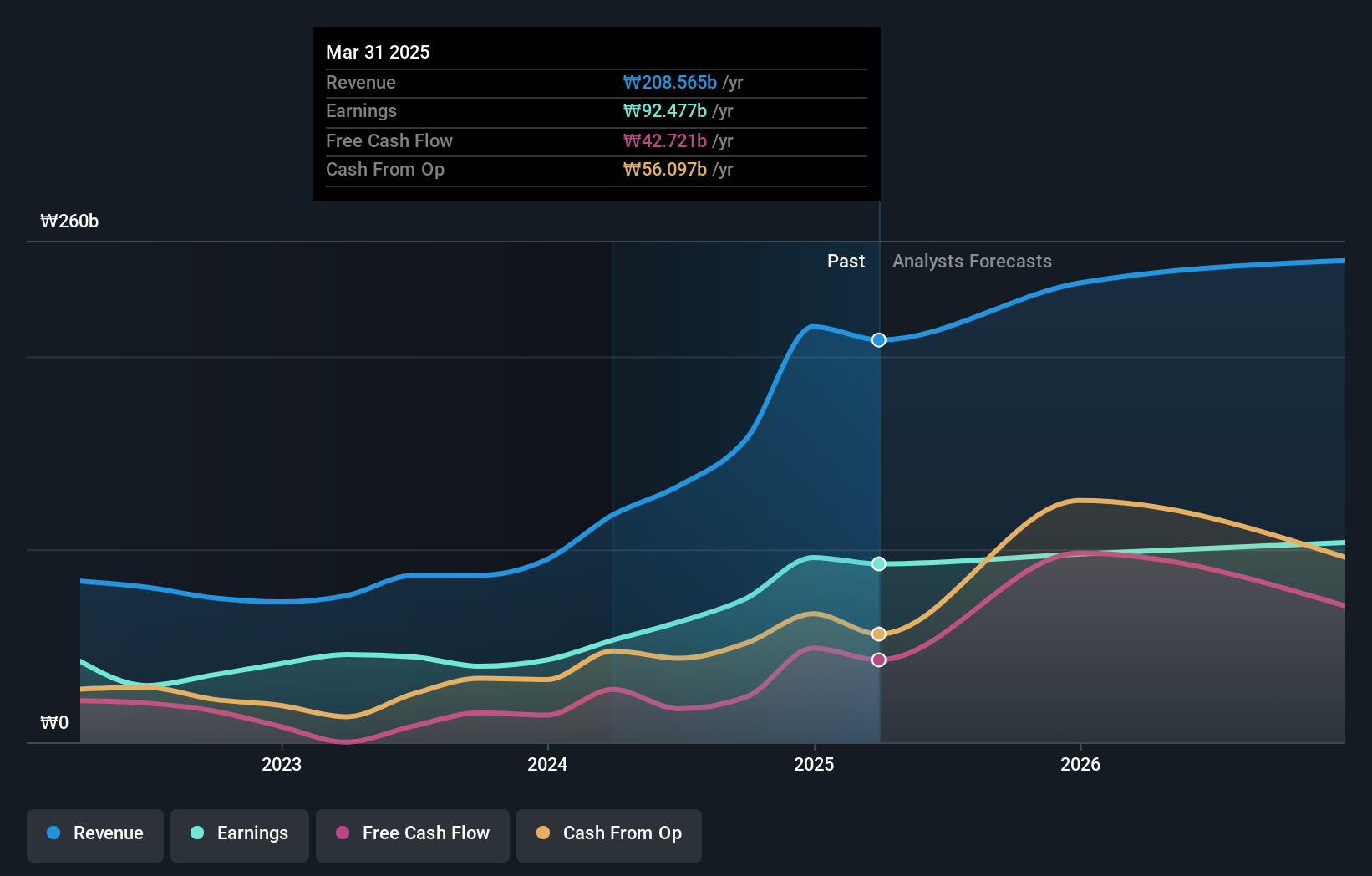

Operations: The primary revenue stream for Taesung Ltd. comes from manufacturing and selling PCB automation equipment, generating ₩45.68 billion. The company's gross profit margin is 35%.

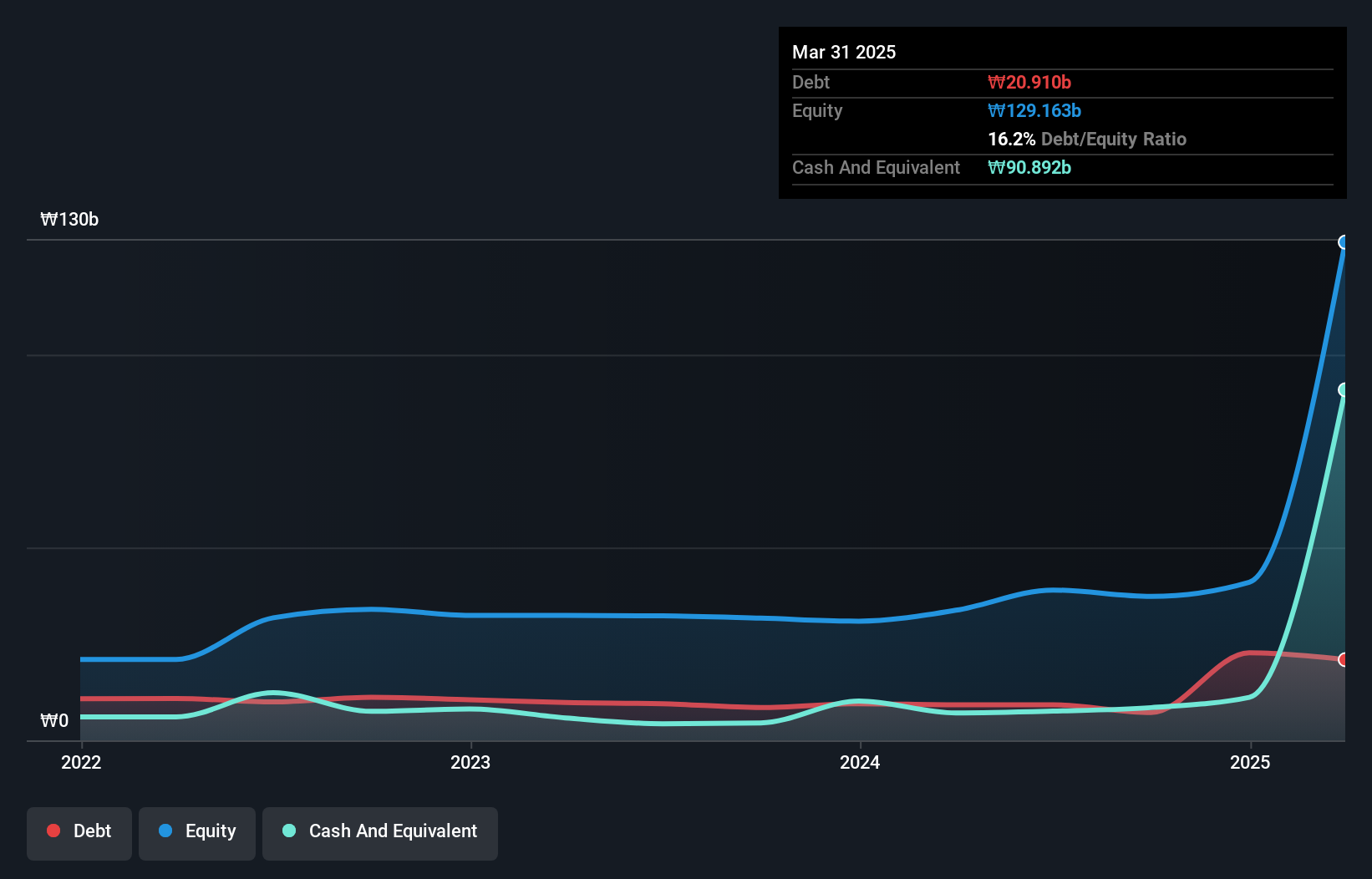

Taesung Ltd., a small-cap player in South Korea, has shown impressive earnings growth of 1482.3% over the past year, outpacing the semiconductor industry's -10.8%. The company repurchased shares in 2024, reflecting confidence in its future prospects. Despite high volatility in its share price over the past three months, Taesung's net debt to equity ratio stands at a satisfactory 4.2%, and interest payments on its debt are well covered by EBIT (17.5x coverage).

- Click here and access our complete health analysis report to understand the dynamics of TaesungLtd.

Examine TaesungLtd's past performance report to understand how it has performed in the past.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries, with a market cap of ₩1.65 billion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from the sale of storage batteries. The company's market cap stands at ₩1.65 billion.

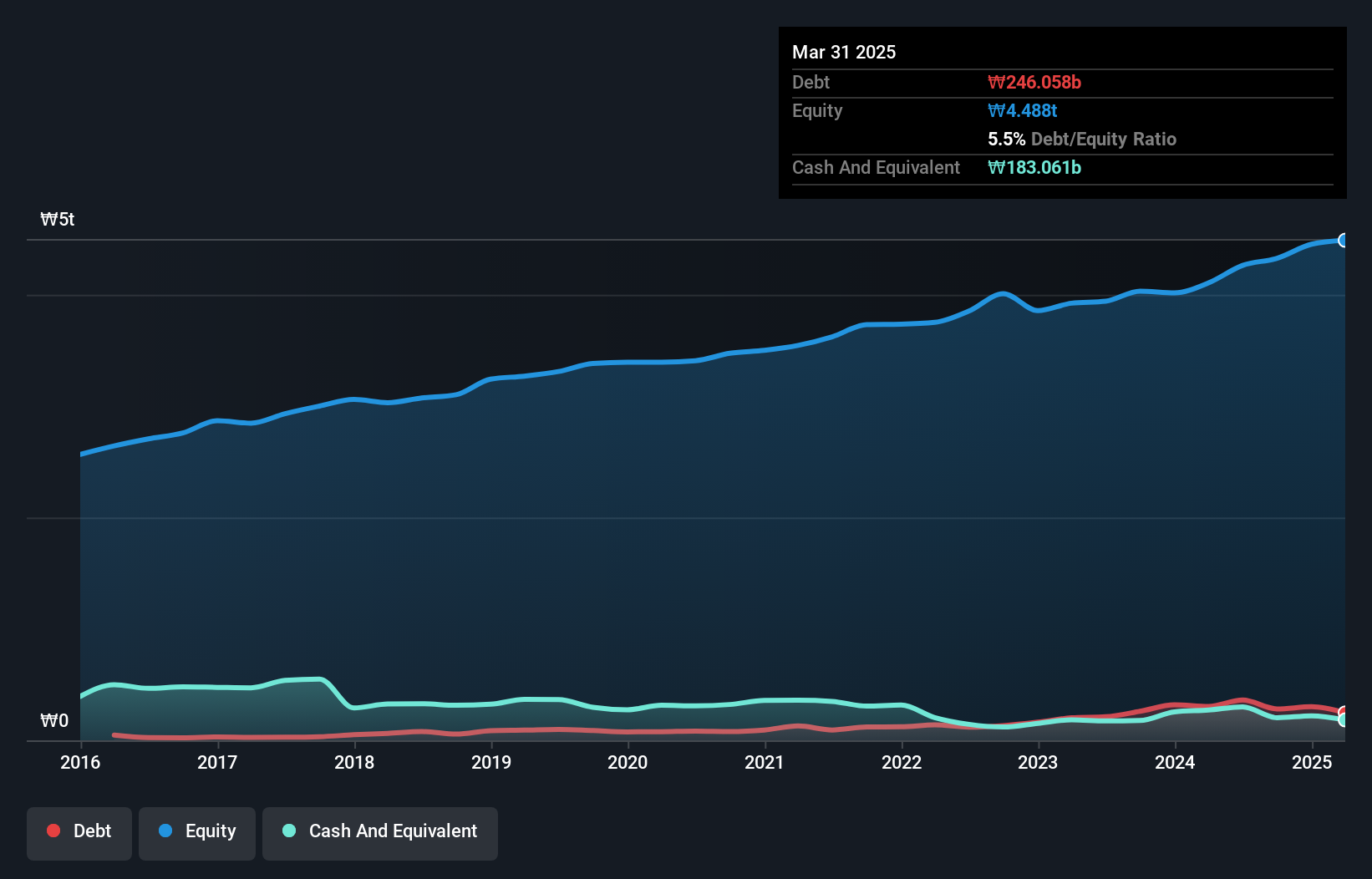

Hankook's recent performance has been impressive, with net income for Q2 2024 reaching KRW 108.48 million, up from KRW 36.32 million a year earlier. The company's debt to equity ratio rose from 3% to 8.5% over five years but remains satisfactory at a net debt to equity ratio of 1.4%. Trading at a P/E ratio of 4.8x compared to the KR market's average of 11.5x, Hankook appears undervalued relative to peers and industry standards.

- Click here to discover the nuances of Hankook with our detailed analytical health report.

Understand Hankook's track record by examining our Past report.

Summing It All Up

- Dive into all 197 of the KRX Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Excellent balance sheet with acceptable track record.