Stock Analysis

- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A023530

Lotte Shopping (KRX:023530 investor five-year losses grow to 57% as the stock sheds ₩175b this past week

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example the Lotte Shopping Co., Ltd. (KRX:023530) share price dropped 64% over five years. That's not a lot of fun for true believers. Even worse, it's down 11% in about a month, which isn't fun at all.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Lotte Shopping

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Lotte Shopping became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline. On top of that, revenue has declined by 4.3% per year over the half decade; that could be a red flag for some investors.

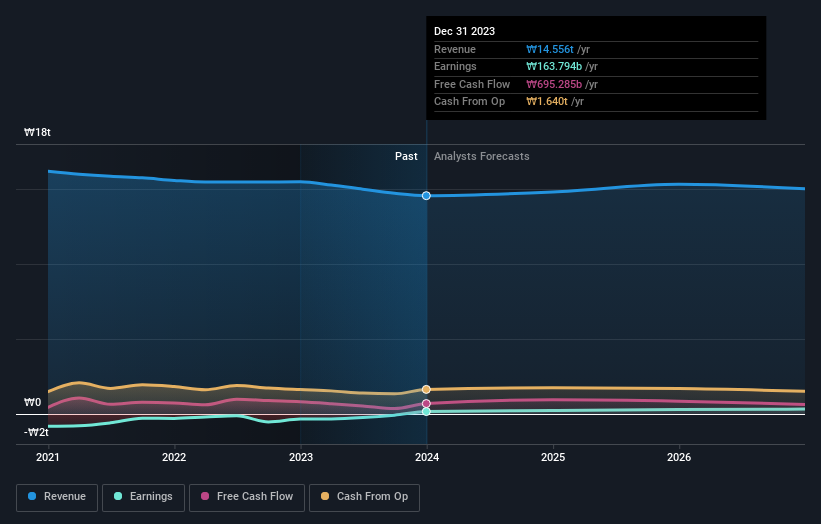

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Lotte Shopping is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Lotte Shopping stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Lotte Shopping's TSR for the last 5 years was -57%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 1.1% in the last year, Lotte Shopping shareholders lost 18% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Lotte Shopping better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Lotte Shopping (at least 1 which is significant) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Lotte Shopping is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A023530

Lotte Shopping

Lotte Shopping Co., Ltd. engages in the retail operations through department stores, outlet stores, discount stores, supermarkets, electronics specialty stores, home shopping, cultural stores, and E-commerce channels.

Undervalued average dividend payer.