- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks to Watch in South Korea September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 1.0%, and over the past 12 months, it has remained flat overall; however, earnings are forecast to grow by 29% annually. In this environment, identifying high growth tech stocks that can capitalize on strong earnings forecasts is crucial for investors seeking potential opportunities.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Devsisters | 25.46% | 63.02% | ★★★★★★ |

| Park Systems | 23.49% | 35.59% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩16.95 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. The company's focus includes the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Alteogen's recent MFDS approval for Tergase®, a recombinant hyaluronidase with over 99% purity, highlights its innovative Hybrozyme™ Technology. The company forecasts earnings growth of 99.46% per year and revenue expansion at 64.2%, outpacing the market's 10.8%. Despite high volatility in share price, Alteogen is transitioning to a commercial-stage entity with promising applications in dermal fillers, eye surgery anesthetics, and orthopedics pain management.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Gain insights into ALTEOGEN's past trends and performance with our Past report.

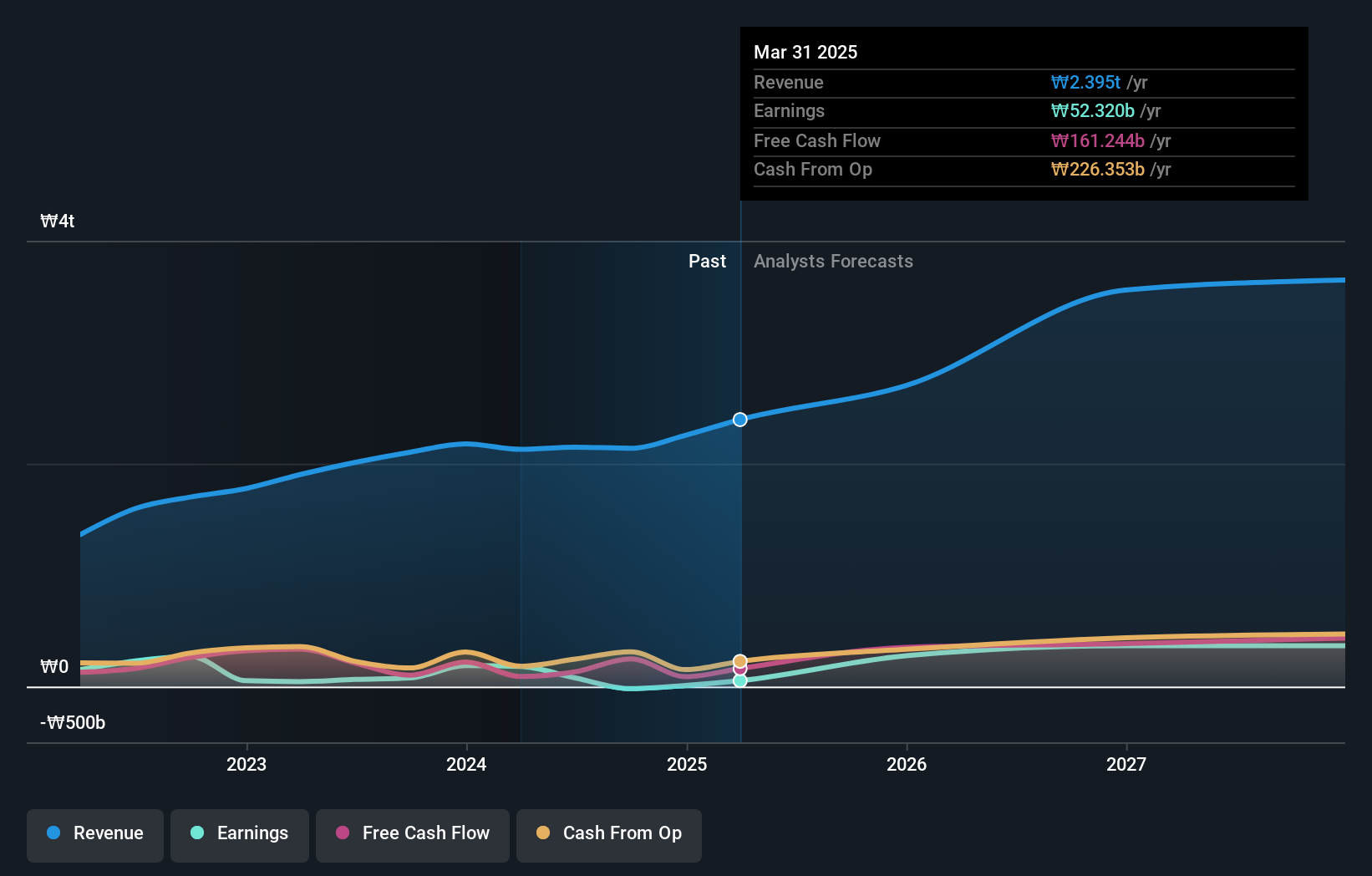

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, develops and produces protein-based drugs for oncology treatment in South Korea and has a market cap of ₩41.89 trillion.

Operations: The company generates revenue primarily from three segments: Chemical Drugs (₩507.02 million) and Bio Medical Supply (₩3.54 billion).

Celltrion's earnings are projected to grow at 59.4% annually, significantly outpacing the KR market's 29.1%. The company's revenue is expected to increase by 25.4% per year, surpassing the market average of 10.8%. Recent R&D investments have been substantial, with expenditures reaching ₩1.2 billion in the latest quarter, driving innovation such as SteQeyma®, an ustekinumab biosimilar approved for multiple chronic inflammatory diseases by the European Commission. Additionally, Celltrion repurchased 410,734 shares for ₩75.89 billion between June and August 2024, aiming to enhance shareholder value and stabilize stock prices.

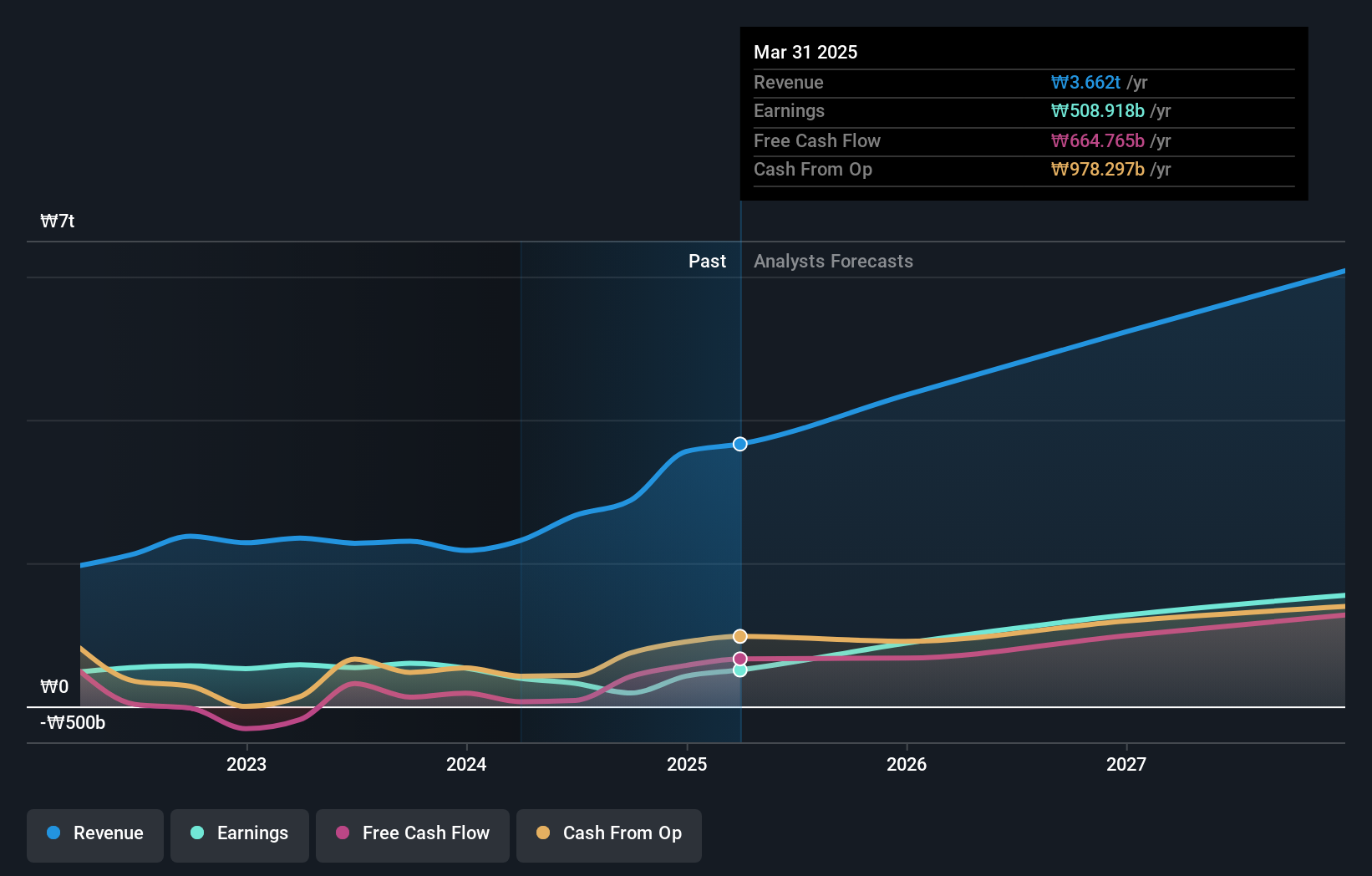

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩7.68 billion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label segment (₩1.28 billion), Platform segment (₩361.12 million), and Solution segment (₩1.24 billion). The company focuses on music production, publishing, and artist management while handling significant internal transactions amounting to -₩732.08 million.

HYBE's earnings are forecast to grow at 42.5% annually, outpacing the KR market's 29.1%, while revenue is expected to increase by 14.1% per year, surpassing the market average of 10.8%. Despite a large one-off loss of ₩189.4 billion impacting recent financials, HYBE reported Q2 sales of ₩640.46 million and net income of ₩14.59 million, reflecting resilience in its core business segments like music production and artist management. The company also announced a share repurchase program for up to 150,000 shares by September 27, aiming to stabilize stock prices amidst these growth projections.

- Unlock comprehensive insights into our analysis of HYBE stock in this health report.

Examine HYBE's past performance report to understand how it has performed in the past.

Where To Now?

- Unlock our comprehensive list of 49 KRX High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.