Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

Exploring High Growth Tech Stocks This November 2024

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes nearing record highs and smaller-cap stocks outperforming, investors are keenly observing how economic indicators like falling jobless claims and rising home sales influence broader market sentiment. In this environment, a good high-growth tech stock is often characterized by strong fundamentals, adaptability to macroeconomic shifts, and the ability to leverage technological advancements such as artificial intelligence to drive future growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.46% | 109.25% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1300 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company operating in South Korea, Japan, and internationally with a market cap of ₩906.94 billion.

Operations: YG Entertainment generates revenue primarily from its entertainment segment, amounting to ₩493.91 billion.

YG Entertainment, despite a challenging past with earnings declining by 82% last year, is poised for a robust recovery with expected earnings growth of 69.1% annually over the next three years. This forecast surpasses the broader Korean market's average of 28.8%, highlighting its potential rebound within the entertainment industry. Additionally, while its revenue growth projection stands at 17.2% per year, outpacing the market expectation of 9%, it remains under the high-growth threshold of 20%. The company also faces hurdles with a reduced net profit margin from last year's 13.2% to this year's modest 3.1%. Despite these challenges, YG Entertainment’s significant investment in R&D could innovate and drive future profitability in an industry where technological and creative advancements are crucial.

- Navigate through the intricacies of YG Entertainment with our comprehensive health report here.

Evaluate YG Entertainment's historical performance by accessing our past performance report.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baudroie, Inc. offers optimal IT solutions in Japan and has a market capitalization of ¥79.76 billion.

Operations: The company specializes in delivering IT solutions across Japan, focusing on various technology-driven services. With a market capitalization of ¥79.76 billion, its revenue streams are primarily derived from providing customized IT solutions to businesses. The financial structure emphasizes efficient cost management and strategic investment in technology development to enhance service offerings and client satisfaction.

BaudroieInc, recently added to the S&P Global BMI Index, demonstrates a robust growth trajectory with its revenue expected to surge by 30.1% annually. This performance is significantly ahead of the broader market's 4.2% growth rate. The company's commitment to innovation is evident from its R&D spending, which has consistently aligned with or exceeded industry norms, fostering developments that keep it at the forefront of technological advances. Moreover, BaudroieInc's earnings are set to rise by 28.4% per year, outpacing both its past performance and sector averages. These financial indicators suggest a strong upward momentum, underpinned by strategic market positioning and continuous investment in technology development.

- Delve into the full analysis health report here for a deeper understanding of baudroieinc.

Examine baudroieinc's past performance report to understand how it has performed in the past.

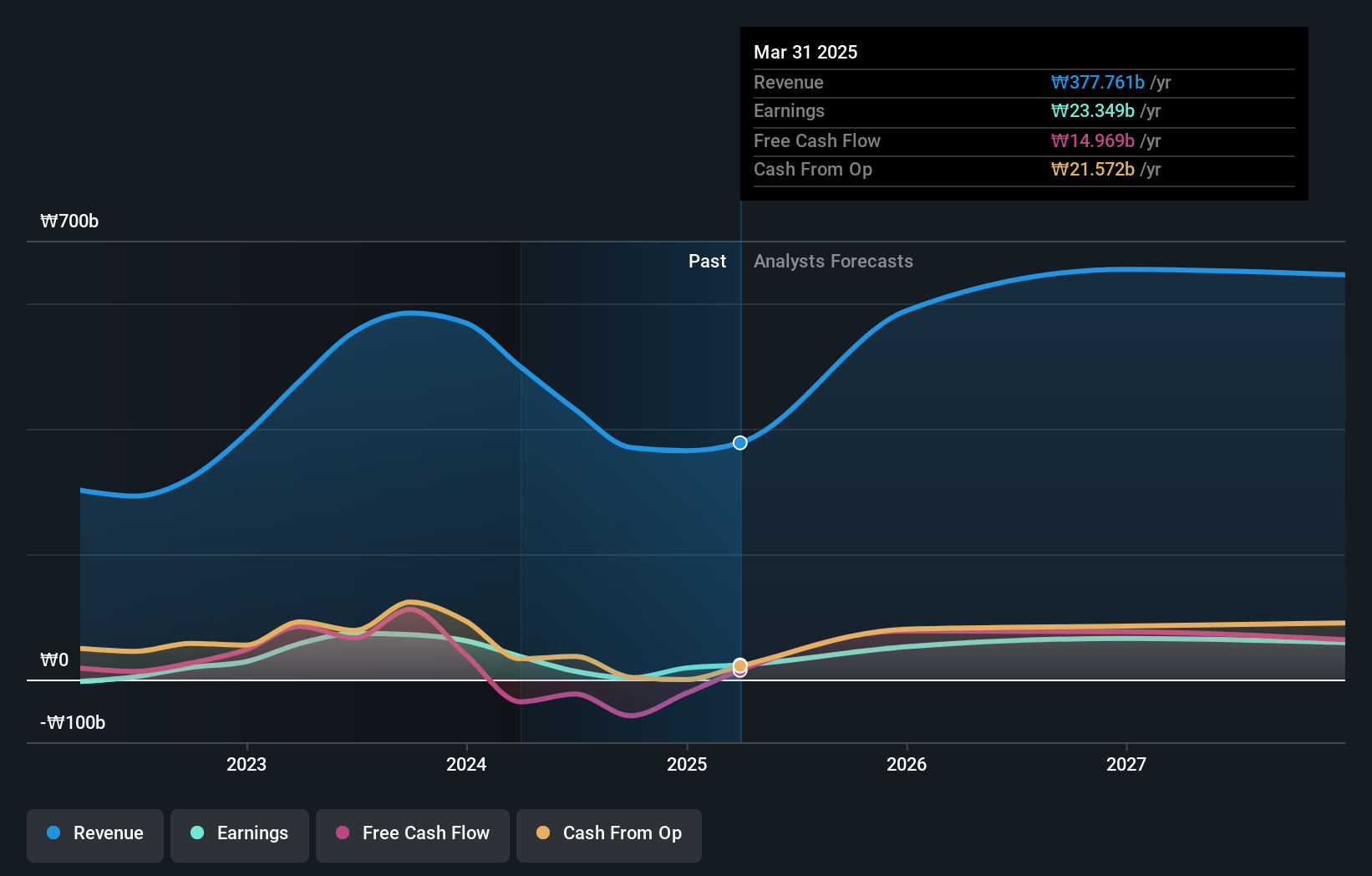

SEIKOH GIKEN (TSE:6834)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEIKOH GIKEN Co., Ltd. designs, manufactures, and sells optical components, lenses, and radio over fiber products both in Japan and internationally, with a market cap of ¥40.83 billion.

Operations: The company's revenue is primarily derived from two segments: Optical Products Related, generating ¥8.23 billion, and Precision Machine Related, contributing ¥8.78 billion. The Precision Machine segment slightly surpasses the Optical Products in revenue generation.

SEIKOH GIKEN stands out in the tech landscape with its impressive earnings growth of 67.8% over the past year, surpassing the electronic industry's average decline of 3.2%. This performance is bolstered by a forecasted annual revenue increase of 10.8%, which notably exceeds Japan's market growth rate of 4.2%. The company's commitment to innovation is highlighted by its strategic R&D investments, aligning with an anticipated profit surge at a robust rate of 25.1% annually—far outpacing the broader Japanese market's expectation of 7.9%. These figures not only reflect SEIKOH GIKEN’s strong market position but also underscore its potential to sustain significant growth amidst competitive pressures.

- Click to explore a detailed breakdown of our findings in SEIKOH GIKEN's health report.

Understand SEIKOH GIKEN's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 1300 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.