Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

High Growth Tech Stocks In South Korea To Watch

Reviewed by Simply Wall St

The South Korea stock market has finished lower in three straight sessions, plunging more than 105 points or 4 percent along the way. The KOSPI now rests just above the 2,575-point plateau although it's due for support on Friday. In such a fluctuating market environment, identifying high growth tech stocks that can withstand volatility and capitalize on innovation becomes crucial for investors.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally, with a market cap of ₩1.16 trillion.

Operations: Wemade Co., Ltd. generates revenue primarily through the development and publishing of games both domestically and internationally. The company operates in a highly competitive industry, focusing on digital content creation for various gaming platforms.

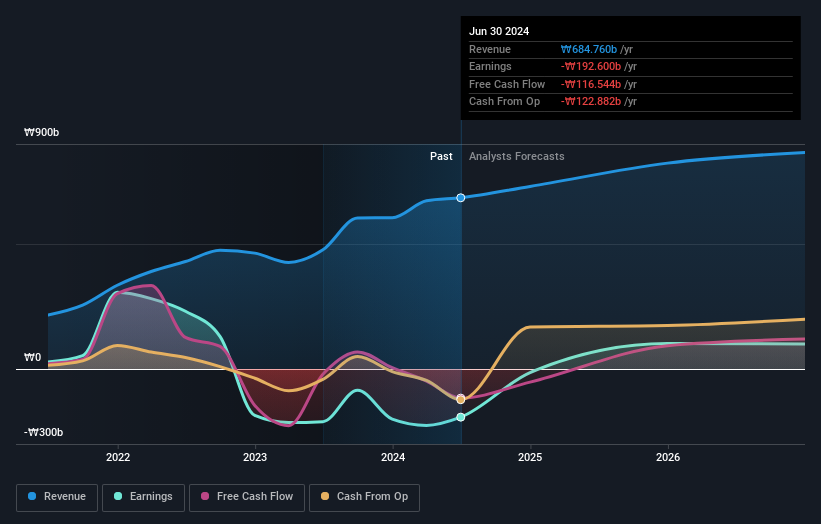

WemadeLtd., a South Korean tech company, is making significant strides in the blockchain gaming sector with its WEMIX ecosystem. Despite reporting a net loss of ₩51.60 billion for Q2 2024, the company's revenue saw a year-over-year increase to ₩332.70 billion, highlighting growth potential. Their focus on R&D is evident with considerable investment aimed at enhancing their blockchain solutions and gaming platforms. Revenue growth is forecasted at 9.5% annually, slightly below the market average of 10.6%, but earnings are expected to surge by 106.57% per year, indicating strong future prospects in this innovative space.

- Dive into the specifics of WemadeLtd here with our thorough health report.

Review our historical performance report to gain insights into WemadeLtd's's past performance.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation, with a market cap of ₩1.98 trillion, produces and sells elecfoils in Korea and internationally.

Operations: Lotte Energy Materials Corporation generates revenue primarily from its Manufacturing Sector, contributing ₩768.85 billion, and the Service Sector, adding ₩218.48 billion. The company focuses on the production and sale of elecfoils both domestically and internationally.

Lotte Energy Materials has shown robust growth in South Korea's tech sector, with a forecasted revenue increase of 16.3% per year, outpacing the market average of 10.6%. The company's earnings are expected to surge by 53.7% annually, reflecting strong future potential. Notably, Lotte Energy allocated ₩18 billion to R&D in the past year, underscoring its commitment to innovation and technological advancement. This strategic focus positions it well within the high-growth tech landscape despite recent industry shifts and challenges.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩971.86 billion.

Operations: Solum Co., Ltd. generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing ₩1.16 billion. The company operates in both domestic and international markets, focusing on power modules, digital tuners, and electronic shelf labels.

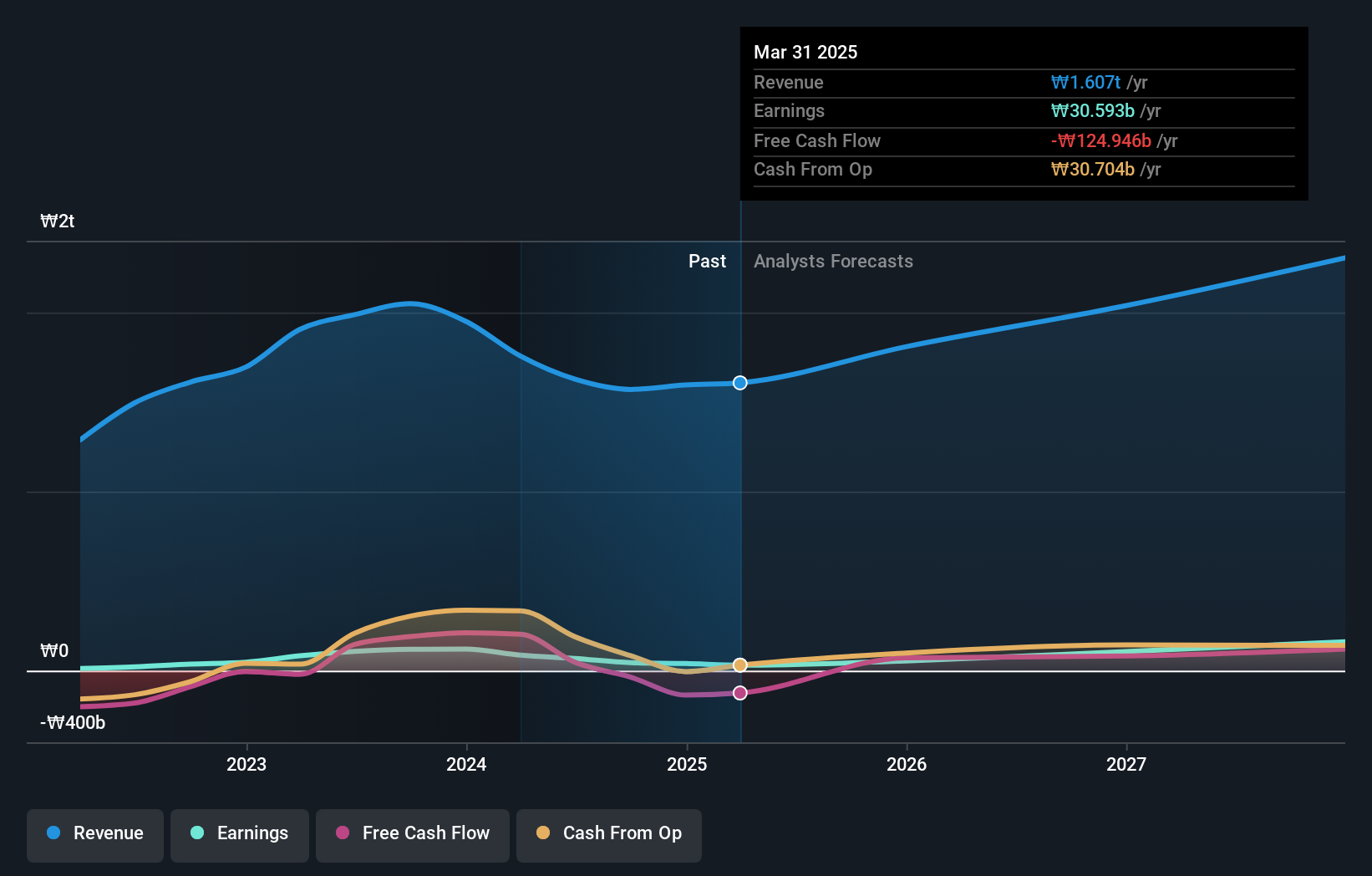

Solum's earnings are forecasted to grow at an impressive 36.3% annually, significantly outpacing the South Korean market average of 28.9%. The company's revenue is also expected to increase by 13.9% per year, surpassing the national average growth rate of 10.6%. Solum has committed ₩20 billion towards a share repurchase program aimed at enhancing shareholder value and stabilizing stock prices. This strategic move, combined with robust R&D investments, positions Solum well within South Korea's high-growth tech landscape despite recent industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Solum.

Gain insights into Solum's past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 48 KRX High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.