Stock Analysis

- South Korea

- /

- Entertainment

- /

- KOSDAQ:A101730

Wemade Max (KOSDAQ:101730) delivers shareholders splendid 29% CAGR over 3 years, surging 12% in the last week alone

Wemade Max Co., Ltd. (KOSDAQ:101730) shareholders might be concerned after seeing the share price drop 12% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. The share price marched upwards over that time, and is now 113% higher than it was. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

The past week has proven to be lucrative for Wemade Max investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Wemade Max

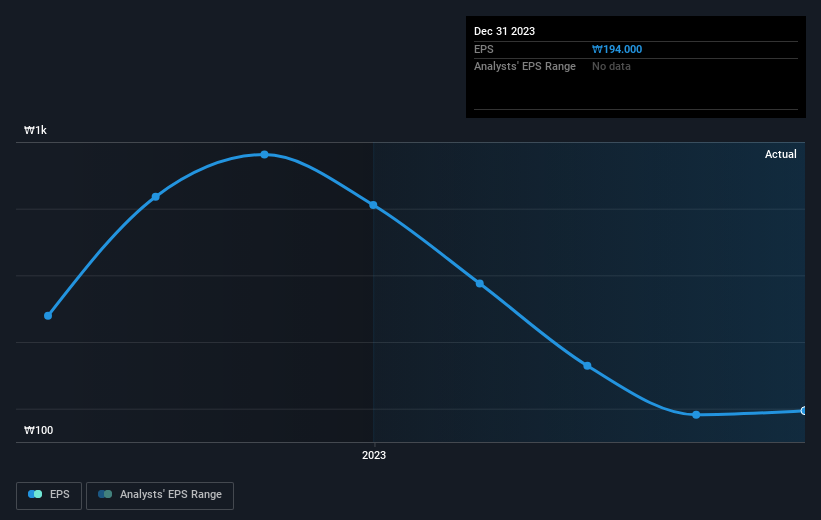

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Wemade Max became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Wemade Max's earnings, revenue and cash flow.

A Different Perspective

Investors in Wemade Max had a tough year, with a total loss of 30%, against a market gain of about 7.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 16%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Wemade Max better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Wemade Max you should be aware of.

But note: Wemade Max may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Wemade Max is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A101730

Flawless balance sheet with poor track record.