- South Korea

- /

- Basic Materials

- /

- KOSE:A300720

Undiscovered Gems in South Korea: Top Stocks for August 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, with a notable 11% gain in the Utilities sector. Despite overall market stagnation over the past year, earnings are forecast to grow by 29% annually. Identifying strong stocks in this environment involves looking for companies poised to capitalize on these growth opportunities while navigating current market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

| PaperCorea | 53.09% | 1.31% | 77.27% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries, with a market cap of ₩1.61 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from the sale of storage batteries. The company's market cap stands at ₩1.61 trillion.

Hankook's impressive earnings growth of 267% over the past year, significantly outpacing the Auto Components industry at 17.5%, highlights its strong performance. The company's net income for Q2 2024 was KRW 108.48 million, up from KRW 36.32 million a year ago, with basic earnings per share rising to KRW 1,145 from KRW 383. Trading at a price-to-earnings ratio of just 4.9x compared to the market's 11.5x, Hankook seems undervalued and offers high-quality earnings with EBIT covering interest payments by an impressive margin of 40x.

- Delve into the full analysis health report here for a deeper understanding of Hankook.

Examine Hankook's past performance report to understand how it has performed in the past.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai G.F. Holdings Co., Ltd. engages in the rental and investment businesses, with a market cap of ₩750.68 billion.

Operations: Hyundai G.F. Holdings Co., Ltd. generates revenue primarily through its rental and investment activities. The company has a market cap of ₩750.68 billion, reflecting its significant presence in these sectors.

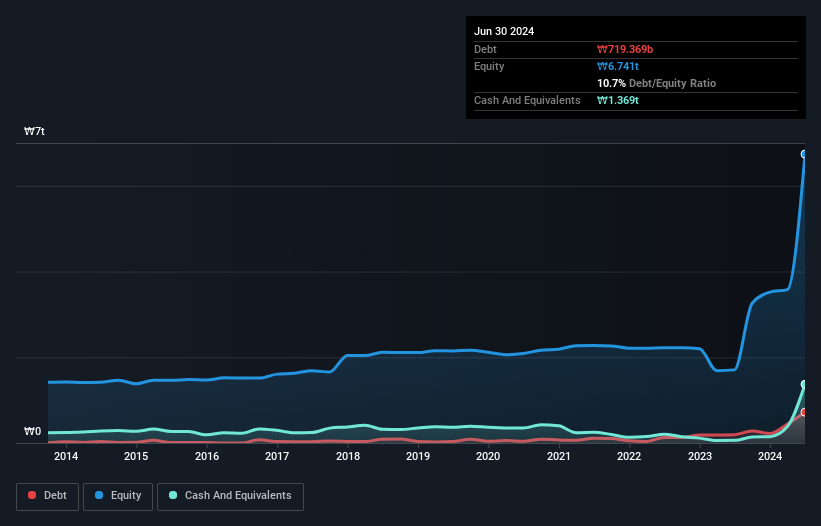

Hyundai G.F. Holdings, a small cap South Korean firm, has shown impressive earnings growth of 242291% over the past year, significantly outpacing its industry peers. Trading at 75.2% below its estimated fair value, it offers potential for value investors despite a debt to equity ratio increase from 1.6% to 10.7% over five years. The company remains profitable with no cash runway concerns and has more cash than total debt, although shareholders faced substantial dilution in the past year.

- Navigate through the intricacies of Hyundai G.F. Holdings with our comprehensive health report here.

Hanil Cement (KOSE:A300720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hanil Cement Co., Ltd. produces and sells cements, ready-mixed concretes, and admixtures with a market cap of ₩1.06 trillion.

Operations: Hanil Cement's primary revenue streams are derived from the production and sale of cements, ready-mixed concretes, and admixtures. The company has a market cap of ₩1.06 trillion.

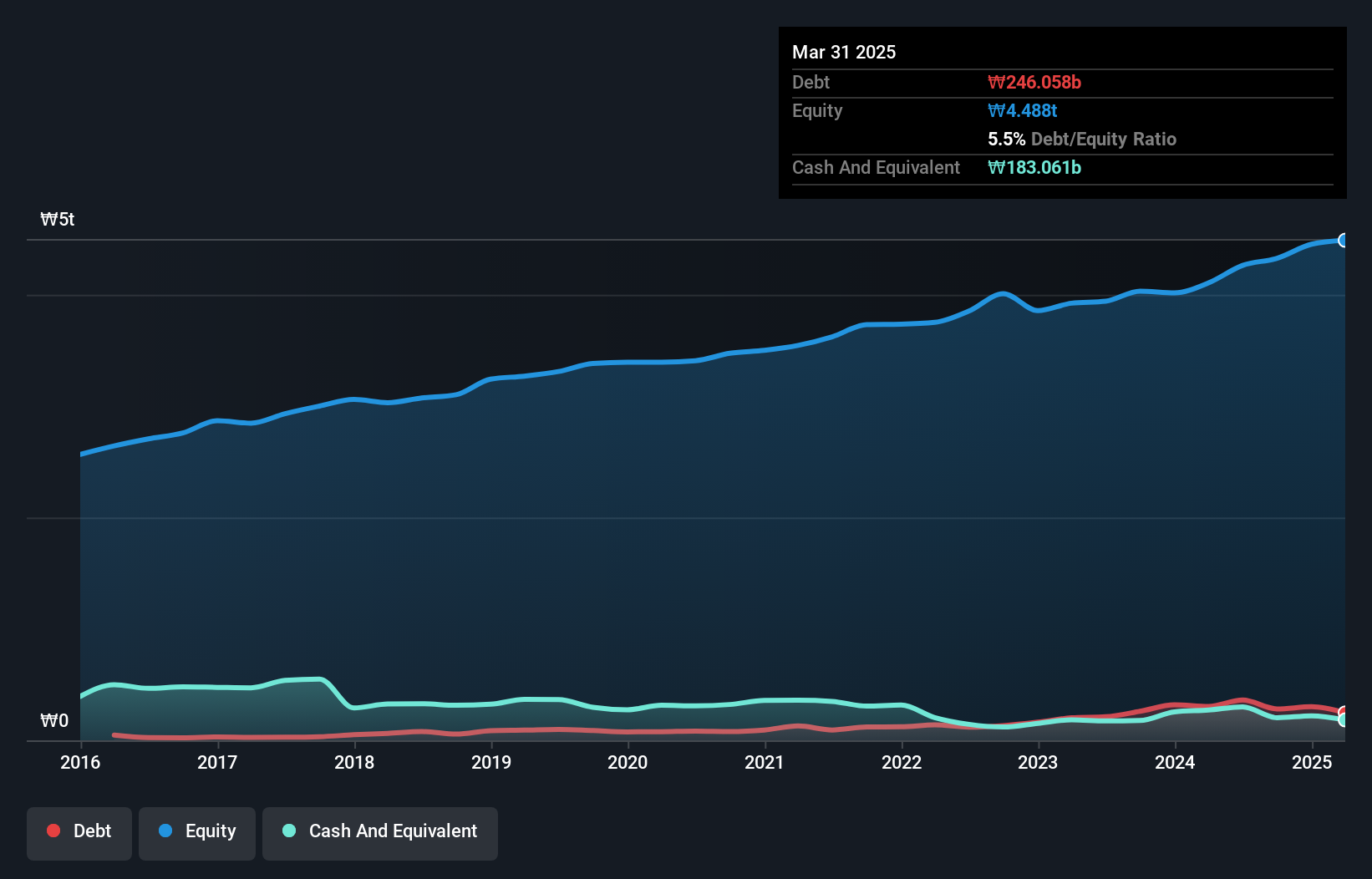

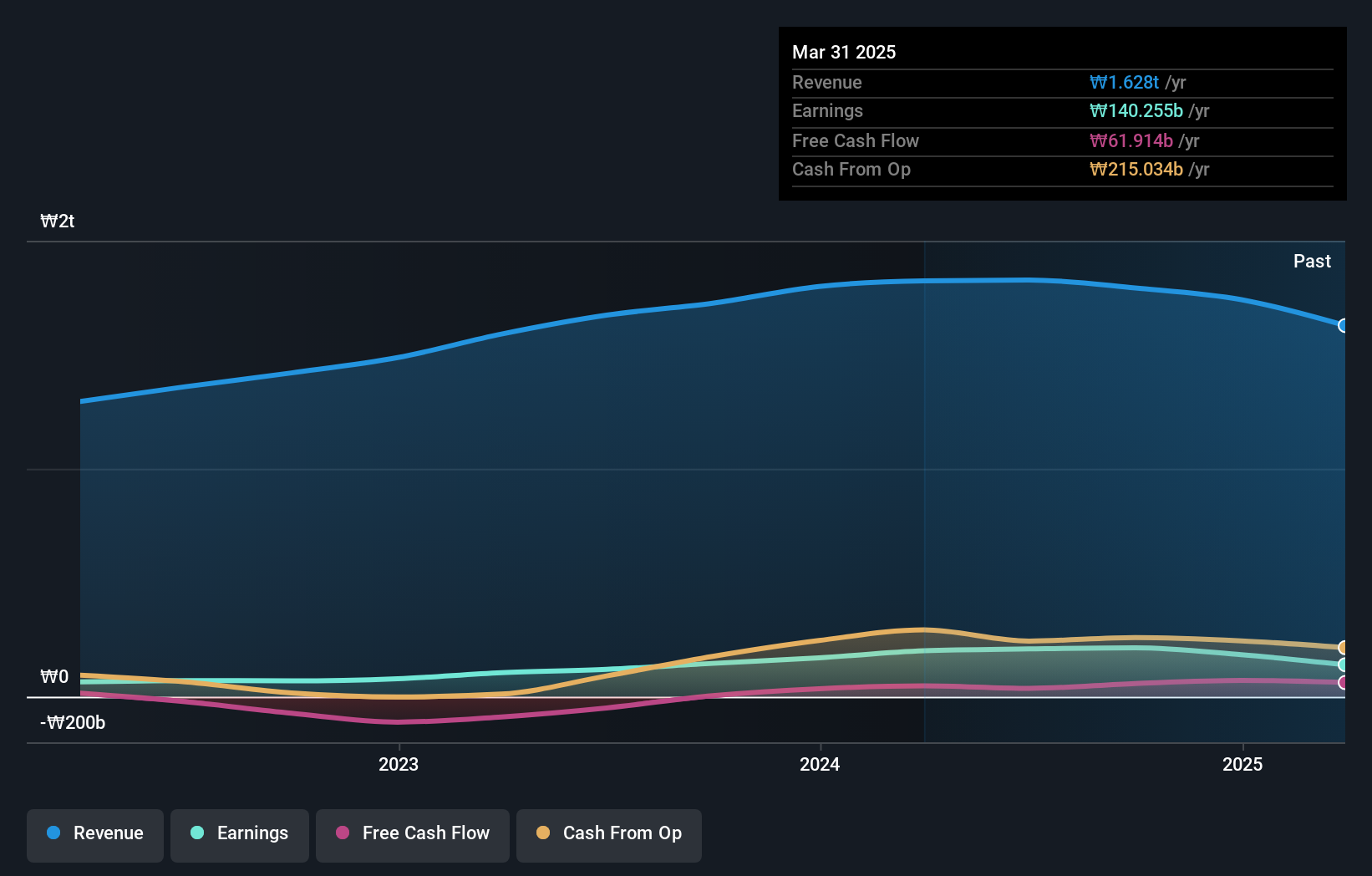

Hanil Cement has shown impressive earnings growth of 74.7% over the past year, outpacing the Basic Materials industry’s -2.6%. Trading at 12.9% below our fair value estimate, it offers good value for investors. The company's net debt to equity ratio stands at a satisfactory 23.7%, and its interest payments are well covered by EBIT with a coverage of 15.2x, indicating strong financial health and high-quality earnings potential in the future.

- Click to explore a detailed breakdown of our findings in Hanil Cement's health report.

Gain insights into Hanil Cement's past trends and performance with our Past report.

Make It Happen

- Discover the full array of 195 KRX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanil Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A300720

Hanil Cement

Produces and sells cements, ready-mixed concretes, and admixtures.

Solid track record with excellent balance sheet.